Is DSG safe?

Business

License

Is DSG Safe or Scam?

Introduction

DSG, also known as DSG Financial Services Limited, positions itself as a player in the forex market, offering various trading services to clients globally. However, the influx of new traders in the forex market necessitates a cautious approach to selecting a broker. Traders must be vigilant, as the landscape is filled with both reputable firms and potential scams. This article aims to provide an objective assessment of whether DSG is a safe trading platform or if it exhibits characteristics of a scam. Our investigation is based on a thorough analysis of regulatory status, company background, trading conditions, client experiences, and overall risk factors.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its legitimacy. A regulated broker is typically subject to oversight by financial authorities, which helps to ensure fair practices and protect client funds. In the case of DSG, it is important to note that the broker operates without any recognized regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation is a red flag. It means that clients may not have access to legal recourse in case of disputes or financial losses. Furthermore, operating without regulatory oversight raises concerns about the broker's credibility and the safety of client funds. Historically, unregulated brokers have been associated with numerous complaints regarding fund mismanagement and withdrawal issues. Therefore, one must question: Is DSG safe? Given the lack of regulation, the answer leans towards caution.

Company Background Investigation

DSG Financial Services Limited, the entity behind the DSG brand, is registered in Hong Kong. The company's history appears limited, and it lacks the extensive track record that many reputable brokers possess. The ownership structure is not transparent, and there is little publicly available information regarding the management team. This lack of transparency raises concerns about the broker's accountability and reliability.

The management teams qualifications and experience are critical indicators of a broker's trustworthiness. However, DSG's website does not provide sufficient details about its leadership, which is a significant drawback. A broker that fails to disclose information about its management may not prioritize transparency, leading to potential issues in client trust and confidence. Therefore, when evaluating whether DSG is safe, the opaque nature of its operations is concerning.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders. DSG claims to provide competitive trading conditions, including low spreads and various account types. However, a thorough examination reveals a lack of clarity regarding fees and commissions.

| Fee Type | DSG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | $5.00 per lot |

| Overnight Interest Range | N/A | Varies widely |

The absence of specific details regarding spreads and commissions raises questions about the broker's fee structure. Traders should be wary of vague or undisclosed fees, as they can significantly impact profitability. Additionally, if DSG imposes hidden fees or charges that are not standard in the industry, it could further indicate that the broker is not operating in good faith. Thus, potential clients should carefully consider whether DSG is safe for their trading activities.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. DSG's approach to fund security is questionable, as it lacks regulatory oversight that typically mandates fund segregation and investor protection measures. Without these safeguards, clients may find themselves at risk of losing their investments without any means of recovery.

DSG does not provide clear information about its policies regarding fund segregation or negative balance protection. This lack of transparency is alarming, especially in light of reports from clients who have experienced difficulties in withdrawing their funds. Historical complaints about withdrawal issues suggest that clients may face significant hurdles when trying to access their capital. Therefore, when evaluating the safety of trading with DSG, potential clients should consider these risks seriously. The question remains: Is DSG safe? Based on the available information, it appears that client funds may not be adequately protected.

Customer Experience and Complaints

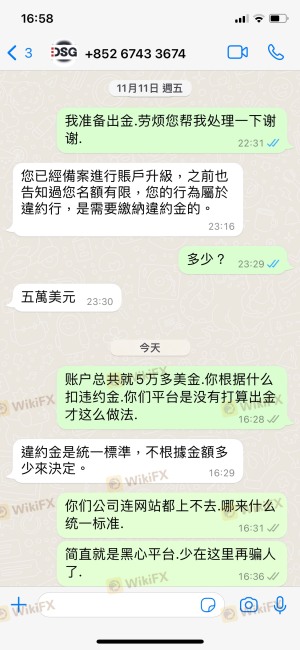

Client feedback is a valuable source of information when assessing a broker's reliability. Reports from current and former clients of DSG indicate a pattern of dissatisfaction, particularly regarding withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Average |

| Misleading Information | High | Poor |

Common complaints include an inability to withdraw funds and a lack of communication from the support team. For instance, several clients have reported that their requests for withdrawals were either ignored or met with unreasonable delays. This poor response to client concerns is a significant indicator of a broker's reliability. If a broker cannot provide timely support, it raises questions about their commitment to customer service and ethical practices. Thus, the evidence suggests that DSG may not be safe, as it fails to address critical client issues adequately.

Platform and Trade Execution

The trading platform is another essential aspect to consider when evaluating a broker. DSG claims to offer a user-friendly trading environment, but there is limited information available regarding the platform's performance and reliability. Traders have reported issues with order execution, including slippage and rejections.

A broker's ability to execute trades efficiently is crucial for successful trading. If clients experience frequent slippage or rejected orders, it can severely impact their trading outcomes. Furthermore, any signs of platform manipulation, such as artificially widening spreads during volatile market conditions, can indicate unethical practices. Therefore, potential clients must assess whether DSG is safe based on the platform's performance and execution quality.

Risk Assessment

Evaluating the risks associated with trading with DSG is vital for potential clients. The absence of regulation, combined with client complaints and withdrawal issues, presents a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of fund segregation |

| Customer Service Risk | Medium | Poor response to complaints |

| Trading Execution Risk | High | Reports of slippage and rejections |

Given these risk factors, potential clients should exercise extreme caution when considering trading with DSG. Traders are advised to conduct thorough research and consider alternative, regulated brokers to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that DSG may not be a safe broker for forex trading. The lack of regulatory oversight, combined with numerous client complaints and insufficient transparency, raises significant red flags. Traders should be wary of investing with DSG and should consider seeking alternative brokers that offer regulatory protection and a proven track record of customer satisfaction.

For those still interested in trading, it is advisable to look for regulated brokers with positive reviews and a transparent operational framework. Some reputable alternatives include brokers regulated by authorities such as the FCA or ASIC, which provide a safer trading environment. Always prioritize safety and due diligence when selecting a trading partner in the forex market.

Is DSG a scam, or is it legit?

The latest exposure and evaluation content of DSG brokers.

DSG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DSG latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.