DDT 2025 Review: Everything You Need to Know

Executive Summary

This DDT review gives traders and investors a complete analysis of DDT as a financial entity in 2025. DDT appears to be connected with various financial contexts, including dividend distribution tax implications and potential brokerage activities, based on available information. Our research shows significant information gaps about DDT's specific operations as a trading platform or financial service provider.

The limited data suggests that DDT may operate in multiple financial sectors. Concrete details about trading conditions, platform functionality, and regulatory compliance remain unclear though. This DDT review shows that potential users should exercise caution due to the lack of transparent information about the company's core services, regulatory status, and operational framework.

Without comprehensive data on trading conditions, customer support infrastructure, or regulatory oversight, it's challenging to provide a definitive recommendation for any specific trader demographic. It's important to note that this evaluation is based on limited publicly available information, and significant data gaps exist regarding DDT's operations across different jurisdictions.

Important Notice

Regulatory frameworks and operational standards may vary considerably between regions. Potential users should verify current regulatory status and service availability in their specific location. The assessment methodology used in this review relies on available documentation and industry sources, though comprehensive empirical data remains limited.

Traders should conduct additional due diligence before engaging with any financial services associated with DDT.

Rating Framework

Based on available information, here are our ratings across six key dimensions:

Broker Overview

DDT's presence in the financial sector appears to span multiple contexts. Establishing a clear operational profile proves challenging due to limited available documentation though. The entity's background, establishment date, and primary business model remain unclear from publicly accessible sources.

Without concrete information about founding dates, corporate structure, or primary operational focus, it's difficult to provide a comprehensive company overview. The available information suggests potential involvement in various financial activities, though specific details about trading platform infrastructure, asset coverage, or primary business operations are not clearly documented. This DDT review reveals that the entity's regulatory framework, supervisory oversight, and compliance standards require further clarification for potential users seeking transparent operational information.

Regulatory Jurisdiction

Available sources do not provide clear information about DDT's regulatory jurisdiction or supervisory authorities. The lack of transparent regulatory disclosure raises questions about compliance oversight and consumer protection measures.

Deposit and Withdrawal Methods

Specific information about funding methods, processing times, and associated fees is not available in the source materials reviewed for this analysis.

Minimum Deposit Requirements

Concrete data regarding minimum deposit thresholds for different account types has not been identified in available documentation.

Information about promotional offers, bonus structures, or incentive programs is not detailed in accessible sources.

Tradeable Assets

The range of financial instruments, asset classes, and markets available through DDT's platform remains unclear from available documentation.

Cost Structure

Detailed information about spreads, commissions, overnight fees, and other trading costs is not comprehensively available in source materials.

Leverage Ratios

Specific leverage offerings and margin requirements are not detailed in the information sources reviewed.

Technical specifications, platform features, and software options are not clearly documented in available materials.

Regional Restrictions

Geographic limitations and service availability by jurisdiction are not specified in accessible sources.

Customer Support Languages

Multi-language support capabilities and communication channels are not detailed in available documentation.

This DDT review highlights the significant information gaps that potential users should consider when evaluating the service provider.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of DDT's account conditions proves challenging due to the absence of detailed information about account types, opening procedures, and specific features. Without access to comprehensive documentation about minimum deposit requirements, account tiers, or special account options such as Islamic accounts, it's difficult to assess the competitiveness of their offerings. Industry standards typically expect brokers to provide multiple account types catering to different trader profiles, from beginners to professional traders.

However, the lack of available information about DDT's account structure raises concerns about transparency and customer clarity. Professional traders generally require detailed specifications about account features, while beginners need clear guidance about entry-level options. The absence of user feedback regarding account opening experiences, verification processes, or account management tools further complicates this DDT review.

Standard industry practice involves providing detailed account information, including features, limitations, and associated costs, which appears to be lacking in DDT's case.

Assessing DDT's trading tools and educational resources presents significant challenges due to limited available information. Modern traders expect comprehensive analytical tools, real-time market data, and educational resources to support their trading decisions. However, specific details about DDT's tool offerings remain unclear from available sources.

Industry-leading brokers typically provide advanced charting packages, technical indicators, economic calendars, and market analysis tools. Educational resources usually include webinars, tutorials, market commentary, and trading guides. The absence of detailed information about these essential components raises questions about DDT's commitment to trader support and development.

Automated trading support, API access, and third-party tool integration are increasingly important for serious traders. Without clear documentation about these capabilities, potential users cannot adequately assess whether DDT's platform meets their technical requirements and trading strategies.

Customer Service and Support Analysis

Evaluating DDT's customer service infrastructure proves difficult due to the lack of available information about support channels, response times, and service quality. Effective customer support typically includes multiple communication channels such as live chat, email, and phone support, operating during extended hours to accommodate global trading schedules. Professional traders require prompt technical support, especially during volatile market conditions when platform issues can result in significant losses.

The absence of detailed information about DDT's support capabilities, including multilingual options and technical expertise levels, creates uncertainty about service reliability. User feedback and testimonials about customer service experiences are not available in the reviewed sources, making it impossible to assess actual service quality or problem resolution effectiveness. This lack of transparency regarding customer support infrastructure represents a significant concern for potential users requiring reliable assistance.

Trading Experience Analysis

The assessment of DDT's trading experience relies heavily on platform performance metrics, execution quality, and user interface design, none of which are adequately documented in available sources. Modern trading platforms require fast execution speeds, minimal slippage, and stable connectivity to provide competitive trading conditions. Order execution quality, including fill rates and price improvement statistics, are crucial factors for active traders.

However, specific performance data about DDT's execution capabilities is not available for analysis. Mobile trading functionality has become essential for contemporary traders, yet details about DDT's mobile platform features and performance remain unclear. The overall trading environment, including platform stability during market volatility and system uptime statistics, cannot be properly evaluated due to insufficient data.

This DDT review reveals significant gaps in available information that would typically inform trading experience assessments.

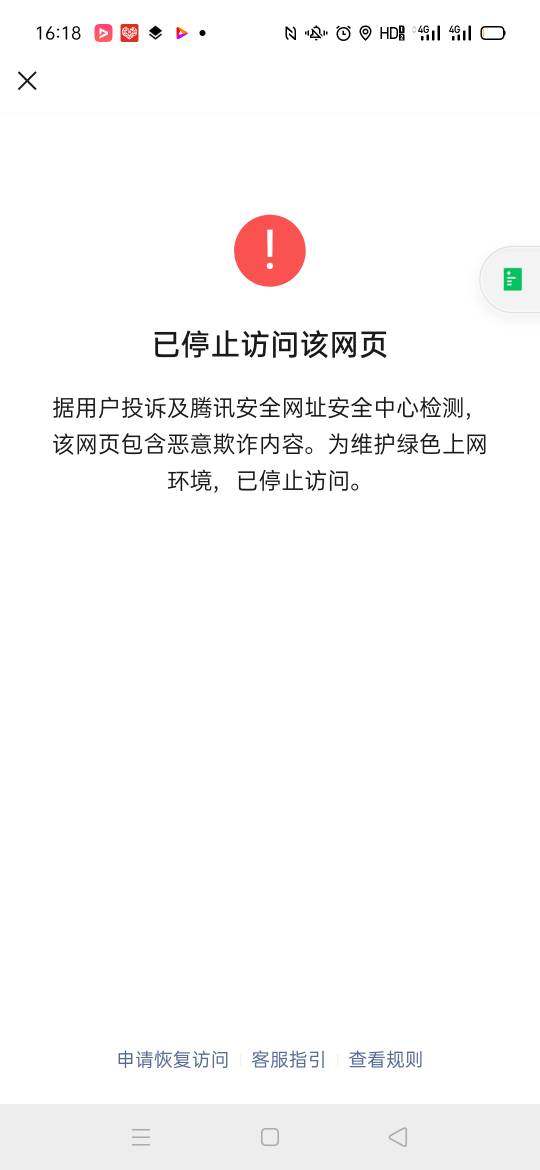

Trust and Regulation Analysis

Trust evaluation requires comprehensive information about regulatory oversight, financial safeguards, and corporate transparency, areas where DDT's documentation appears limited. Regulatory compliance with recognized financial authorities provides essential consumer protections and operational standards that serious traders require. Client fund segregation, deposit insurance, and negative balance protection are fundamental safety measures that reputable brokers implement.

However, specific information about DDT's financial safeguards and risk management procedures is not available in reviewed sources. Corporate transparency, including company ownership, financial statements, and regulatory filings, contributes to overall trustworthiness assessments. The limited availability of such information about DDT raises questions about transparency and accountability standards that potential users should carefully consider.

User Experience Analysis

Comprehensive user experience evaluation requires detailed information about interface design, registration processes, and overall platform usability, which remains limited for DDT. User satisfaction typically depends on intuitive platform design, efficient account management tools, and streamlined operational procedures. The registration and verification process significantly impacts initial user experience, yet specific details about DDT's onboarding procedures are not available for review.

Funding and withdrawal experiences, including processing times and fee structures, are crucial for user satisfaction but lack adequate documentation. Common user complaints and satisfaction metrics would typically inform this analysis, but such feedback is not available in the reviewed sources. Without comprehensive user experience data, it's challenging to provide meaningful insights about DDT's service quality from the end-user perspective.

Conclusion

This comprehensive DDT review reveals significant information gaps that prevent a definitive assessment of the service provider's capabilities and suitability for different trader types. The lack of transparent information about core operational aspects, regulatory compliance, and user experiences raises important concerns for potential users. Without adequate documentation about trading conditions, platform features, and regulatory oversight, it's difficult to recommend DDT to any specific trader demographic.

The absence of user feedback and performance data further complicates the evaluation process, suggesting that potential users should exercise considerable caution and conduct additional due diligence before engaging with DDT's services.