Is DDT safe?

Business

License

Is DDT Safe or Scam?

Introduction

DDT, short for Digital Dream Technology, is a forex broker that positions itself in the global trading market, primarily focusing on forex instruments. As the financial landscape continues to evolve, traders are increasingly aware of the importance of selecting a reputable broker. The foreign exchange market is fraught with risks, and the presence of unregulated or poorly regulated brokers can lead to significant financial losses. Therefore, it is crucial for traders to carefully evaluate the legitimacy and safety of any brokerage before committing their funds. This article aims to provide a comprehensive analysis of DDT's safety and reliability by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

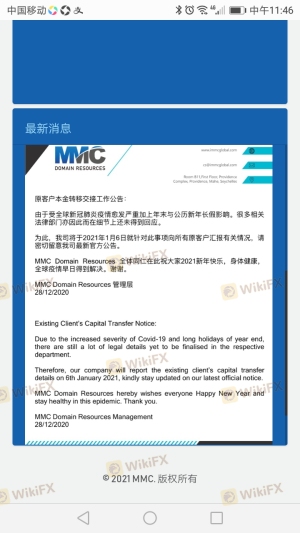

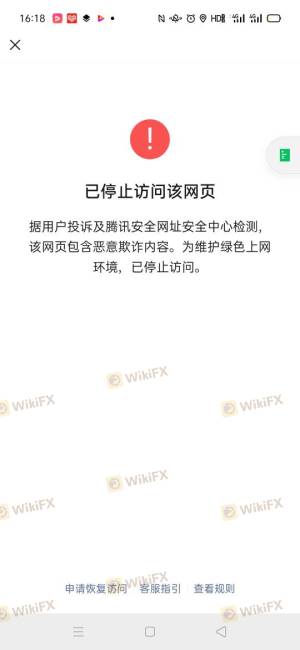

When it comes to trading, regulatory oversight is a critical factor that can significantly impact a broker's credibility. DDT's regulatory status raises several concerns. According to various sources, including WikiFX, DDT operates without proper regulation, which is a significant red flag for potential traders. The broker's license from the Financial Service Providers Register (license number 548927) has been revoked, and it lacks authorization from any recognized financial authority. This lack of regulatory oversight means that there are no guarantees for traders regarding the safety of their funds or the integrity of the trading practices employed by DDT.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 548927 | New Zealand | Revoked |

The absence of a regulatory framework not only increases the risks associated with trading but also diminishes the broker's accountability. A well-regulated broker is typically subject to stringent compliance standards, which can help protect traders from fraud and malpractice. In DDT's case, the lack of oversight means that traders may have limited recourse if issues arise, making it essential to consider whether DDT is safe for trading.

Company Background Investigation

Understanding a broker's history and ownership structure is vital for assessing its reliability. DDT claims to have been established for over five years, with its operations reportedly based in Ukraine. However, the lack of transparency surrounding its ownership and management team is concerning. While the company presents itself as a legitimate brokerage, the absence of detailed information about its founders or key executives raises questions about its operational integrity.

The management team's background and expertise play a crucial role in determining the broker's reliability. A team with a solid track record in finance and trading can inspire confidence among traders. Unfortunately, DDT has not provided sufficient information to evaluate the qualifications and experience of its management team. This lack of transparency may indicate that the broker is not fully committed to maintaining a trustworthy reputation.

Furthermore, the absence of clear company disclosures and operational history makes it challenging for potential clients to gauge DDT's credibility. In an industry where trust is paramount, such opacity can be a significant deterrent for traders seeking a secure trading environment. Therefore, when evaluating whether DDT is safe, the lack of transparency becomes a critical factor.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, are essential components that traders must consider. DDT advertises competitive spreads starting from 0.3 pips for major currency pairs, which can be attractive to traders looking for cost-effective trading options. However, the absence of transparent information regarding commissions and other potential fees raises concerns about the overall cost structure.

| Fee Type | DDT | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.3 pips | From 0.1 pips |

| Commission Model | Not disclosed | Varies significantly |

| Overnight Interest Range | Not disclosed | Varies significantly |

The lack of clarity regarding commissions and other fees can lead to unexpected costs for traders, potentially impacting their profitability. Furthermore, the absence of detailed information about overnight interest rates (swap rates) can be particularly concerning for traders who engage in longer-term positions. Without clear guidelines on these costs, traders may find themselves facing unfavorable trading conditions.

Additionally, the lack of transparency regarding the trading platform also raises questions. DDT claims to offer the widely-used MetaTrader 4 platform, but without clear information on execution quality, slippage, and order rejection rates, traders cannot adequately assess whether DDT is safe for their trading activities.

Customer Fund Security

The safety of customer funds is paramount when assessing a broker's reliability. DDT's approach to fund security raises significant concerns. The broker does not provide detailed information about its policies regarding fund segregation, investor protection, or negative balance protection. In the absence of these critical safety measures, traders may be at risk of losing their funds in the event of financial difficulties faced by the broker.

A reputable broker typically segregates client funds from its operational funds, ensuring that traders' money is protected in case of insolvency. Additionally, many regulated brokers offer investor protection schemes that provide a safety net for clients. However, DDT's lack of transparency regarding these measures leaves traders vulnerable.

Historically, there have been numerous complaints regarding DDT's inability to facilitate withdrawals, which further emphasizes the need for traders to be cautious. The absence of a robust fund security framework and the history of withdrawal issues raise significant flags about whether DDT is safe for trading.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Unfortunately, DDT has received a considerable number of complaints, with many users reporting difficulties in withdrawing their funds. According to WikiFX, there have been at least 28 documented complaints related to withdrawal issues, scams, and fraud.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/no response |

| Fraud Allegations | High | No clarification |

| Account Access | Medium | Limited support |

The most common complaints revolve around the inability to withdraw funds, which is a serious concern for any trader. For instance, one user reported being unable to withdraw funds for an extended period, citing various excuses from the broker. Such experiences not only undermine trust but also indicate potential operational issues within DDT.

The company's response to these complaints has been criticized as inadequate, with many users expressing frustration over the lack of timely support. This pattern of complaints and poor customer service raises significant doubts about whether DDT is a safe choice for traders.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. DDT claims to offer the MetaTrader 4 platform, which is widely recognized for its user-friendly interface and advanced analytical tools. However, there is limited information available regarding the platform's stability, execution quality, and any potential slippage issues.

Traders need to be aware of order execution quality, as poor execution can lead to slippage and increased trading costs. Unfortunately, without transparent data on execution speeds and rejection rates, it is difficult to ascertain whether DDT provides a reliable trading environment. Moreover, any signs of platform manipulation or unfair trading practices can further jeopardize traders' interests.

Risk Assessment

Using DDT as a trading platform presents several risks that potential traders should carefully consider. The following risk assessment summarizes key risk areas associated with DDT:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Fund Security | High | Lack of transparency regarding fund protection. |

| Customer Support | Medium | Numerous complaints and inadequate responses. |

| Trading Conditions | Medium | Unclear fee structures and potential hidden costs. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with better regulatory oversight and customer support. Engaging with a broker that has a proven track record of reliability can significantly reduce exposure to these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that DDT presents several significant risks and concerns that traders should carefully weigh. The lack of regulation, numerous complaints regarding withdrawal issues, and insufficient transparency raise serious doubts about whether DDT is safe for trading.

Traders are advised to exercise extreme caution and consider alternative, well-regulated brokers that offer robust customer support and transparent trading conditions. Some recommended alternatives include brokers with strong regulatory credentials, such as Forex.com, OANDA, or IG, which provide a more secure trading environment and better protection for client funds.

In summary, while DDT may appeal to some traders due to its trading conditions, the potential risks associated with trading with an unregulated broker far outweigh any potential benefits. Therefore, it is crucial for traders to prioritize their financial safety and select brokers that adhere to strict regulatory standards.

Is DDT a scam, or is it legit?

The latest exposure and evaluation content of DDT brokers.

DDT Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DDT latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.