Hantec Markets 2025 Review: Everything You Need to Know

Executive Summary

Hantec Markets is a regulated forex and CFD broker. The company has received mostly positive feedback from users, especially for quick customer service and fast trade execution. Established in 1990, this broker has more than thirty years of experience in the industry, giving traders access to over 2,650 trading instruments across many different types of investments including forex, stocks, commodities, cryptocurrencies, and ETFs.

The platform works with both MT4 and MT5 trading systems. This makes it good for all kinds of traders, from beginners to experts. Hantec Markets focuses on clear trading conditions and follows regulatory rules, though we need to check the specific regulatory details more carefully.

The broker says it's perfect for traders who want reliable service and many different trading choices in today's changing financial markets. This hantec markets review shows a broker that combines old-style forex trading with new technology features. However, people thinking about using this broker should look at both the good points and the problems before they decide.

Important Notice

This review knows that different regional offices of Hantec Markets may have different rules and trading conditions based on where users live. Traders should check the specific rules and terms that apply to their area before they open an account.

The review you're reading uses information that anyone can find and feedback from users collected from many sources. We try hard to give complete and correct reviews, but we suggest that people thinking about using this broker do their own research and carefully read all terms and conditions before they start trading with Hantec Markets.

Rating Framework

Broker Overview

Hantec Markets has become an important company in forex and CFD trading since it started in 1990. With more than thirty years in the market, the company has built a good reputation for giving reliable trading services to many different clients.

The broker runs a business focused on providing CFD and forex trading services while staying committed to being honest and reliable in its trading environment. The company has been around for a long time in the very competitive forex market, which shows it can change and grow with new market conditions and rules.

Hantec Markets has positioned itself as a broker that understands both traditional trading methods and modern technology needs. This makes it easy to use for traders with different levels of experience and different trading preferences. The broker supports both MT4 and MT5 trading platforms, giving traders access to standard industry trading technology.

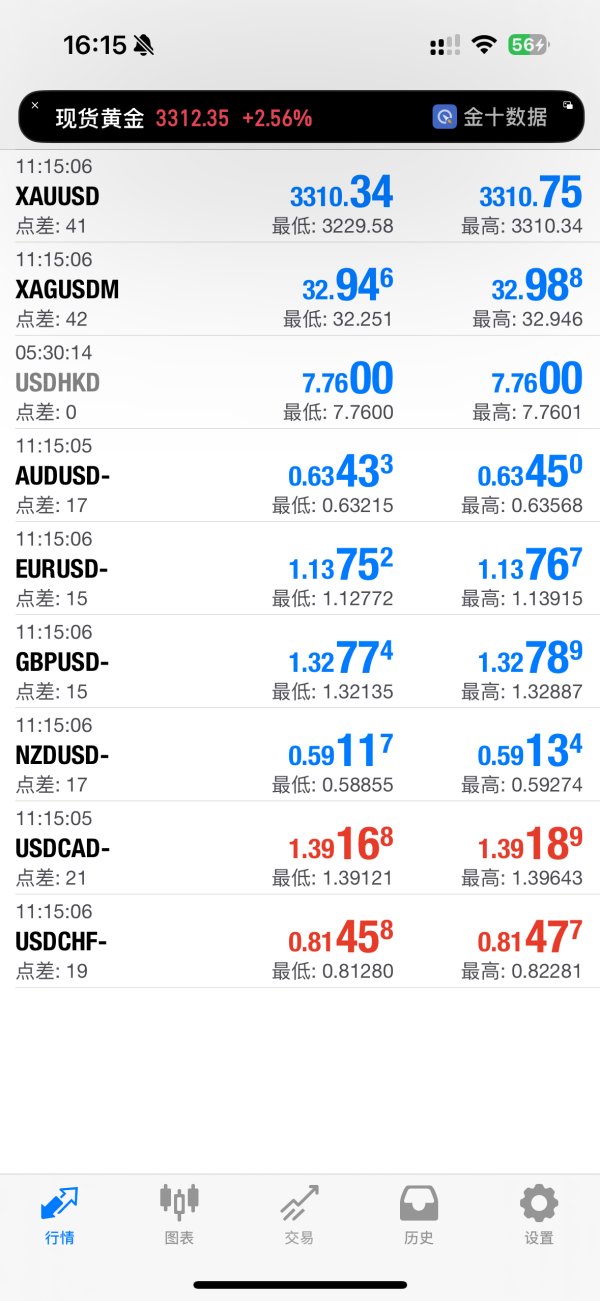

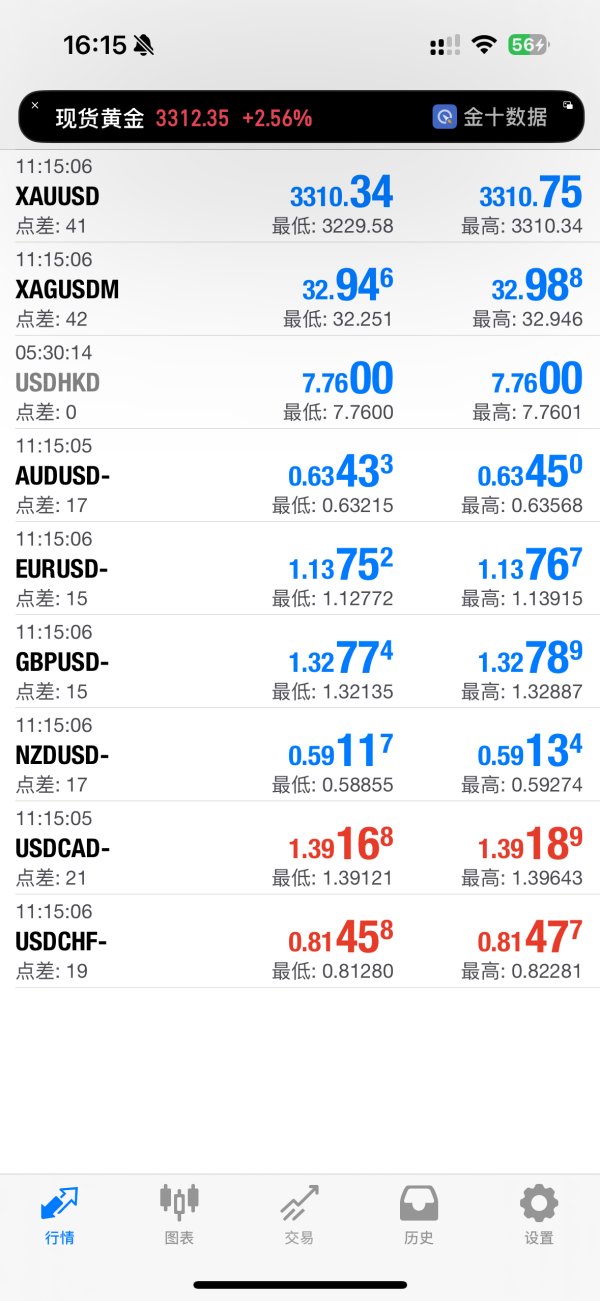

The broker offers a huge range of assets you can trade, including forex pairs, individual stocks, commodities, cryptocurrencies, and ETFs, with more than 2,650 different instruments total. While the company says it follows regulatory rules, specific details about regulatory bodies and license numbers need more checking for complete honesty.

This hantec markets review shows that the broker helps traders who want a complete trading environment with many different asset options and an established market presence.

Regulatory Jurisdiction: Hantec Markets says it operates under regulatory oversight, though specific regulatory authorities and license numbers are not detailed in currently available information.

Deposit and Withdrawal Methods: Information about specific funding methods and withdrawal procedures is not detailed in available sources.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in current available documentation.

Bonus and Promotional Offers: Details about promotional offers or bonus programs are not specified in available sources.

Tradeable Assets: The broker gives access to over 2,650 trading instruments covering forex currency pairs, individual stocks, commodities, cryptocurrencies, and exchange-traded funds (ETFs). This offers significant variety for different trading strategies.

Cost Structure: While the broker says it offers competitive spreads, specific spread ranges and commission structures are not detailed in available information.

The lack of detailed pricing information may require direct contact with the broker. Leverage Ratios: Specific leverage offerings are not mentioned in currently available sources.

Platform Options: Hantec Markets supports both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. This gives traders access to industry-standard trading technology.

Regional Restrictions: Information about geographical limitations or restricted countries is not specified in available sources.

Customer Support Languages: Specific language support options are not detailed in current documentation.

This hantec markets review section shows the need for potential clients to ask for additional information directly from the broker about specific terms and conditions.

Detailed Rating Analysis

Account Conditions Analysis

Looking at Hantec Markets' account conditions is challenging because there's limited public information about specific account types and their features. Available sources don't give detailed information about the variety of account options, minimum deposit requirements, or special account features that might be available to different types of traders.

User feedback suggests that potential clients should carefully look at the advantages and disadvantages before opening an account. This may mean there's some complexity in the account opening process or terms that need careful consideration.

This recommendation from existing users shows how important it is to understand all account conditions before committing to the platform. Without specific information about account types, minimum deposits, or account opening procedures, it becomes hard to see how Hantec Markets compares to other brokers in terms of accessibility and account flexibility.

The absence of detailed account information in public sources may require potential clients to talk directly with the broker's representatives to understand the full scope of available options. The lack of clear account information in this hantec markets review suggests that interested traders should focus on getting comprehensive account details during their first conversations with the broker.

Hantec Markets shows significant strength in its trading tools and resources by providing access to over 2,650 different trading instruments. This huge selection covers multiple asset classes, making it suitable for traders using diverse trading strategies and those seeking to spread their investments across different market sectors.

The wide range of available instruments includes traditional forex currency pairs, individual stocks from various global markets, commodities ranging from precious metals to energy products, cryptocurrencies reflecting the growing digital asset market, and ETFs providing exposure to broader market indices. This variety puts Hantec Markets in a good position for traders who prefer to manage multiple asset types within a single trading platform.

However, available sources don't give specific details about research and analysis resources, educational materials, or automated trading support that might complement the extensive instrument selection. The absence of information about analytical tools, market research, or educational resources represents a gap in understanding the full scope of trader support services.

User feedback generally shows satisfaction with the diversity of available trading instruments, though the lack of detailed information about additional resources and tools limits a complete assessment of this category. The platform's support for both MT4 and MT5 suggests that traders have access to the analytical and automated trading capabilities built into these platforms.

Customer Service and Support Analysis

Customer service represents one of Hantec Markets' notable strengths based on available user feedback. Reviews consistently highlight how responsive the customer service team is, with users reporting quick response times to their questions and support requests.

This positive feedback about service responsiveness suggests that the broker makes client communication and support a priority. The quality of customer service appears to meet user expectations, with feedback showing that support staff are helpful in addressing client concerns and questions.

However, available sources don't give specific details about the various customer service channels available, such as phone support, live chat, email support, or any specialized support for different account types. Information about multilingual support capabilities and customer service operating hours is not detailed in current sources, which could be important factors for international clients operating in different time zones.

The absence of specific details about service structure and availability represents an area where potential clients may need to make direct inquiries. Despite the lack of detailed information about service structure and availability, the consistent positive feedback about responsiveness suggests that Hantec Markets maintains a customer-focused approach to client support, which is reflected in user satisfaction with service quality.

Trading Experience Analysis

User feedback about trading experience with Hantec Markets shows positive performance in trade execution speed, with clients reporting fast execution of their trading orders. This feedback suggests that the broker's trading infrastructure can handle orders efficiently, which is crucial for traders who need quick market entry and exit capabilities.

The platform's support for both MT4 and MT5 gives traders access to comprehensive trading functionality, including advanced charting tools, technical indicators, and automated trading capabilities. These platforms are industry standards and offer robust features for both manual and algorithmic trading approaches.

While user feedback mentions competitive spreads, specific spread ranges and execution statistics are not detailed in available sources. The absence of concrete performance data such as average execution speeds, slippage statistics, or requote frequencies limits the ability to provide a comprehensive technical assessment of the trading environment.

Available information doesn't include details about mobile trading experience, which has become increasingly important for traders who need to manage positions while away from their primary trading stations. The lack of specific information about mobile platform capabilities and performance represents a gap in understanding the complete trading experience offered by Hantec Markets.

Trust and Reliability Analysis

Looking at Hantec Markets' trustworthiness presents certain challenges due to limited specific information about regulatory credentials and safety measures. While the broker claims to operate under regulatory oversight, specific regulatory authorities, license numbers, and compliance details are not clearly detailed in available public sources.

The company's establishment in 1990 and continued operation for over three decades suggests a level of stability and market acceptance. However, this longevity alone doesn't substitute for transparent regulatory information.

The absence of specific regulatory details makes it difficult to verify the exact nature and extent of oversight under which the broker operates. Information about client fund protection measures, segregation of client funds, or participation in compensation schemes is not detailed in available sources.

These factors are typically crucial for assessing the safety of client deposits and the broker's commitment to client protection standards. The lack of detailed information about the company's corporate structure, ownership, or any significant regulatory actions or industry recognition limits the ability to provide a comprehensive trust assessment.

Potential clients may need to request specific regulatory and safety information directly from the broker to make informed decisions about fund safety and regulatory protection.

User Experience Analysis

Overall user satisfaction with Hantec Markets appears to be generally positive, though feedback suggests a mixed experience that includes both satisfied clients and those who recommend careful analysis before proceeding. Some users have provided 5-star ratings, indicating high satisfaction levels, while others advise potential clients to thoroughly analyze both advantages and disadvantages before opening accounts.

The user experience appears to be particularly positive regarding the diversity of available trading instruments and the responsiveness of customer service. However, the recommendation from some users to carefully analyze pros and cons suggests that there may be aspects of the service that don't meet all user expectations or that require careful consideration.

Available sources don't give specific information about the user interface design, ease of navigation, or the overall aesthetic and functional design of the trading platforms. Similarly, details about the registration and verification process, account funding procedures, or common user complaints are not detailed in current sources.

The broker appears to attract traders who value diverse trading opportunities and appreciate responsive customer service, though the mixed nature of feedback suggests that user experience may vary depending on individual trading needs and expectations. The absence of detailed user journey information limits the ability to assess the complete user experience comprehensively.

Conclusion

This hantec markets review reveals a broker with over three decades of industry experience that shows particular strengths in instrument diversity and customer service responsiveness. With access to more than 2,650 trading instruments and support for both MT4 and MT5 platforms, Hantec Markets positions itself as a good option for traders seeking variety and established trading technology.

The broker appears most suitable for traders who want diverse trading opportunities and value responsive customer support. The extensive range of available instruments makes it particularly appealing for those who prefer to manage multiple asset types within a single trading environment.

However, the assessment reveals significant information gaps regarding regulatory specifics, account conditions, and detailed cost structures. Potential clients should focus on getting comprehensive information about regulatory credentials, specific trading costs, and account terms before making final decisions.

While user feedback generally supports the broker's service quality, the recommendation to carefully analyze advantages and disadvantages before proceeding should be followed by all prospective clients.