Dbfx 2025 Review: Everything You Need to Know

In this comprehensive review of Dbfx, we explore the broker's offerings, user experiences, and expert opinions. Overall, Dbfx has received mixed feedback, with some users praising its platform and customer support, while others express concerns regarding its regulatory status and withdrawal processes.

Note: It's essential to consider that Dbfx operates under different entities across regions, which may affect the trading experience and regulatory protections available to users.

Rating Overview

We assess brokers based on user feedback, expert reviews, and factual data.

Broker Overview

Founded in 2006, Dbfx is a forex broker that has garnered attention for its association with Deutsche Bank, which enhances its liquidity and credibility. The platform primarily utilizes MetaTrader 4 (MT4) for trading, offering access to a variety of financial instruments, including forex, commodities, and cryptocurrencies. However, it is crucial to note that Dbfx operates under the regulatory framework of the Vanuatu Financial Services Commission (VFSC), which has raised concerns among users regarding its reliability and investor protection.

Detailed Review

Regulatory Geographies

Dbfx operates in several regions but is primarily regulated by the VFSC. While this regulatory body allows for some oversight, it is often criticized for its lax standards compared to more stringent regulators like the FCA or CySEC. This lack of robust regulation has led to skepticism about the safety of funds held with Dbfx.

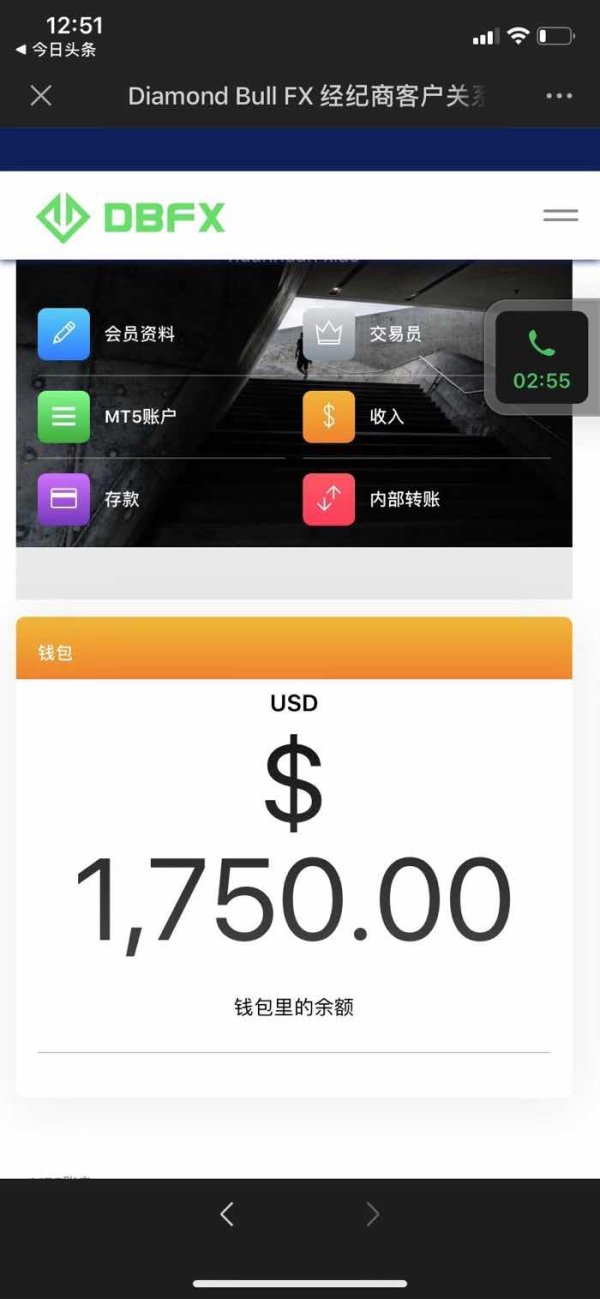

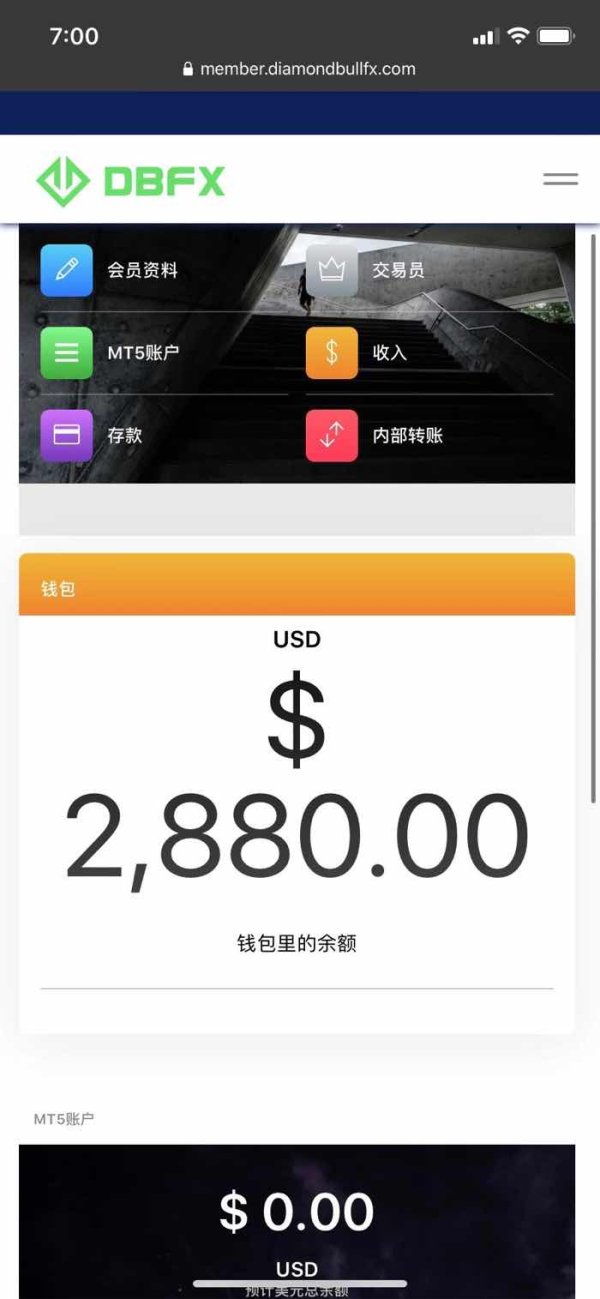

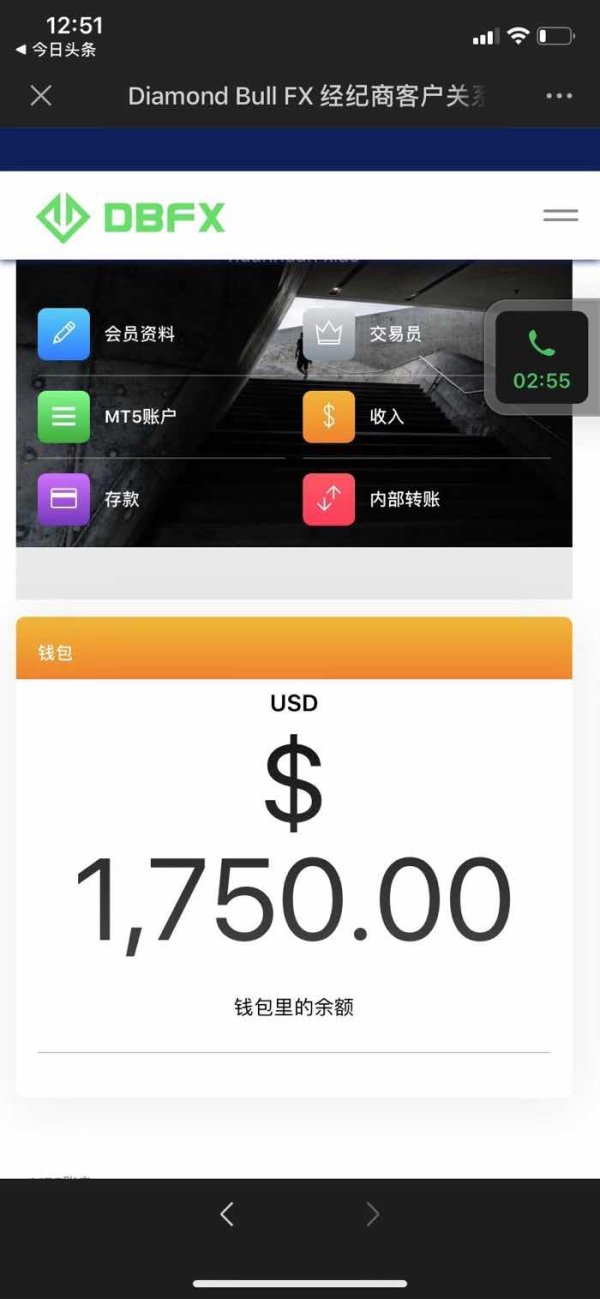

Deposit/Withdrawal Currencies & Cryptocurrencies

Dbfx supports a limited number of base currencies, predominantly USD, EUR, and GBP. Additionally, it allows for cryptocurrency trading, although the specifics about which cryptocurrencies are available are not extensively detailed in the reviews.

Minimum Deposit

The minimum deposit to open a Dbfx trading account is set at $200, making it relatively accessible for new traders. However, some reviews highlight that higher-tier accounts require significantly larger minimum deposits, which may deter casual traders.

Dbfx does not appear to offer any significant bonuses or promotions, which is a common practice among many brokers to attract new clients. This could be a disadvantage for those looking for additional incentives to start trading.

Tradable Asset Classes

Dbfx provides a range of tradable asset classes, including forex pairs, commodities, and cryptocurrencies. However, the selection of stocks and ETFs is limited, which may not meet the needs of all traders.

Costs (Spreads, Fees, Commissions)

The trading costs associated with Dbfx are reportedly competitive, with spreads starting around 1-2 pips for major currency pairs. However, users have reported that the withdrawal fees can vary depending on the chosen method, which may add to the overall trading costs.

Leverage

Dbfx offers leverage up to 100:1, which is lower than many competitors that provide leverage ratios of up to 500:1. While lower leverage can reduce risk, many traders prefer having the option for higher leverage to maximize their trading potential.

Dbfx primarily utilizes the MT4 platform, which is well-regarded for its user-friendly interface and extensive trading tools. However, the lack of a web-based platform may pose a challenge for traders who prefer not to download software.

Restricted Areas

Dbfx is not available to traders in certain jurisdictions, including the United States and some EU countries, which may limit its accessibility for potential clients.

Available Customer Service Languages

Dbfx offers customer support primarily in English, which may be a limitation for non-English speaking users. However, the broker does provide multiple channels for support, including email and live chat.

Repeated Rating Overview

Detailed Breakdown of Ratings

- Account Conditions (5/10): While the minimum deposit is accessible, the higher-tier accounts may deter new traders. The lack of a mini account option is a significant drawback.

- Tools and Resources (6/10): Dbfx offers a decent range of educational resources, but they may not be as extensive as those offered by competitors.

- Customer Service and Support (7/10): Users have reported positive experiences with customer support, noting responsiveness and helpfulness.

- Trading Setup (Experience) (6/10): The MT4 platform provides a solid trading experience, but the absence of a web-based option could be limiting for some users.

- Trustworthiness (4/10): The regulatory status of Dbfx raises concerns, with many users expressing skepticism about the safety of their funds.

- User Experience (5/10): Overall user feedback is mixed, with some praising the platform while others highlight issues with withdrawals and regulatory transparency.

- Additional Features (6/10): While Dbfx offers a reasonable range of features, the lack of promotions and bonuses may be a disadvantage for some traders.

In conclusion, the Dbfx review indicates that while the broker has some strengths, particularly in customer service and platform usability, there are significant concerns regarding its regulatory status and withdrawal processes. Traders should weigh these factors carefully before deciding to engage with Dbfx.