Cloud-Deck FX 2025 Review: Everything You Need to Know

Executive Summary

This cloud-deck fx review looks at a broker that has created mixed reactions from traders. Cloud-Deck FX says it is an online investment platform that offers forex and multi-asset trading with maximum leverage up to 1:500. Our analysis shows big concerns about the broker's regulatory status and safety credentials.

The platform claims Stock Group Limited operates it, registered in the United Kingdom, yet it operates under Vanuatu Financial Services Commission regulation. This regulatory setup raises questions about investor protection standards. Multiple asset classes are available including forex, futures, indices, precious metals, energy, and stocks, targeting experienced traders who want high-leverage trading opportunities.

Available reports show Cloud-Deck FX has faced fraud complaints and scam allegations, which future clients should carefully consider. The broker appears to serve traders with some market experience, especially those seeking high-leverage trading opportunities. However, the presence of negative feedback and regulatory concerns suggests that potential investors should be very careful before putting funds into this platform.

Important Notice

Regional Entity Differences: Cloud-Deck FX claims operation through Stock Group Limited registered in the United Kingdom, but actual regulatory oversight falls under the Vanuatu Financial Services Commission. This creates potential differences in legal protection and safety standards compared to major financial jurisdictions. Traders should understand that Vanuatu regulation typically offers less strict investor protection compared to tier-one regulatory frameworks.

Review Methodology: This evaluation is mainly based on publicly available information and user feedback collected from various sources. Due to limited transparency from the broker, some information gaps exist, and future clients should do additional research before making investment decisions.

Rating Framework

Broker Overview

Cloud-Deck FX operates as an online investment platform focusing on forex and multi-asset trading services. The company claims Stock Group Limited manages it, which is registered in the United Kingdom, though the actual regulatory oversight appears to fall under different jurisdiction. The broker positions itself in the competitive online trading space, offering access to multiple financial markets with emphasis on high-leverage trading opportunities.

The platform's business model centers on providing retail traders access to various financial instruments including foreign exchange, commodities, and equity indices. However, the establishment date and detailed company background information remain unclear in available public materials. The broker's operational structure and corporate history lack transparency, which raises questions about its long-term stability and commitment to client service.

Available information shows Cloud-Deck FX operates under Vanuatu Financial Services Commission regulation rather than UK oversight despite claims of UK incorporation. The broker offers trading across six major asset categories: forex pairs, futures contracts, market indices, precious metals, energy commodities, and individual stocks. This cloud-deck fx review notes that while the asset variety appears comprehensive, the regulatory framework raises significant concerns about investor protection standards.

Regulatory Status: Cloud-Deck FX operates under Vanuatu Financial Services Commission oversight, though specific license numbers are not clearly disclosed in available materials. This regulatory jurisdiction typically provides less strict investor protection compared to major financial centers.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available sources, creating uncertainty about funding convenience and processing times.

Minimum Deposit Requirements: Available materials do not specify minimum deposit amounts, making it difficult for potential clients to assess entry requirements.

Bonuses and Promotions: No information about bonus offerings or promotional programs is available in current sources.

Tradeable Assets: The platform offers six asset categories including forex currencies, futures contracts, market indices, precious metals, energy commodities, and individual stocks, providing reasonable market diversification.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not detailed in available materials, limiting cost comparison opportunities.

Leverage Ratios: Maximum leverage reaches 1:500, which represents high-risk trading conditions suitable only for experienced traders.

Platform Options: Specific trading platform information is not detailed in available sources.

Geographic Restrictions: Regional availability limitations are not specified in current materials.

Customer Support Languages: Available customer service languages are not detailed in accessible information.

This cloud-deck fx review emphasizes that the lack of detailed operational information represents a significant transparency concern for potential clients.

Account Conditions Analysis

The account structure and conditions offered by Cloud-Deck FX remain largely unclear based on available information. Specific account types, their respective features, and associated benefits are not detailed in accessible materials. This lack of transparency makes it difficult for potential clients to understand what services they would receive and how different account tiers might serve varying trading needs.

Minimum deposit requirements are not specified in available sources, creating uncertainty about the financial commitment required to begin trading. The absence of clear deposit information also makes it challenging to compare Cloud-Deck FX with other brokers in the market. Additionally, the account opening process, required documentation, and verification procedures are not detailed in public materials.

Special account features such as Islamic accounts for Muslim traders, demo accounts for practice trading, or managed account services are not mentioned in available information. The broker's approach to account management, including any tiered service levels based on deposit amounts or trading volumes, remains unclear.

This cloud-deck fx review notes that the lack of detailed account information represents a significant concern for transparency and client communication. Future traders typically require clear understanding of account conditions before making investment decisions, and the absence of this information suggests poor client communication standards.

Available information does not provide specific details about Cloud-Deck FX's trading tools and analytical resources. The quality and variety of trading instruments, charting capabilities, and market analysis tools remain unclear based on accessible materials. This lack of information makes it difficult to assess whether the platform provides adequate tools for informed trading decisions.

Research and analysis resources, including market commentary, economic calendars, and technical analysis tools, are not detailed in available sources. Educational resources such as trading guides, webinars, or market tutorials are also not mentioned, which could indicate limited support for trader development and skill building.

Automated trading support, including expert advisors, algorithmic trading capabilities, or copy trading services, is not specified in accessible information. These features have become standard expectations in modern trading platforms, and their absence or unclear availability represents a potential limitation.

The platform's technological infrastructure, including mobile trading capabilities, API access for advanced traders, and integration with third-party tools, remains undocumented in available materials. This information gap makes it challenging to evaluate the platform's suitability for different trading styles and technical requirements.

Customer Service and Support Analysis

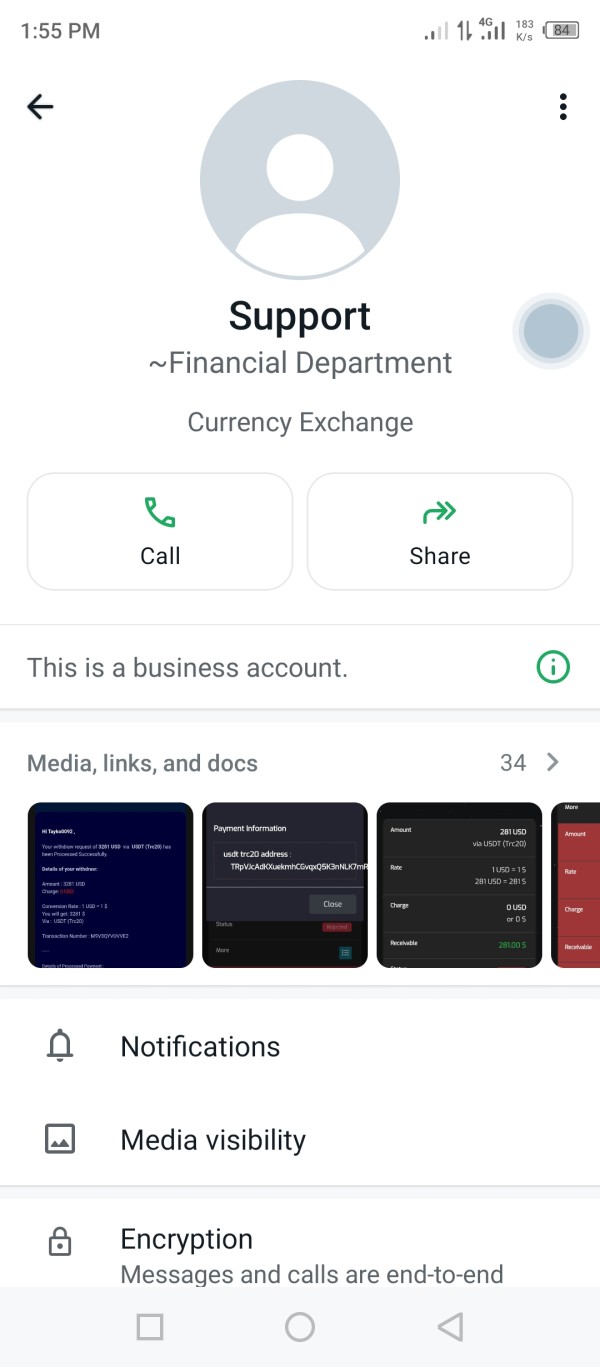

Customer service quality and availability information for Cloud-Deck FX is not detailed in accessible sources. Available communication channels, including phone, email, live chat, or other contact methods, are not specified, creating uncertainty about how clients can reach support when needed.

Response times for customer inquiries and the overall quality of support services remain unclear based on available information. The absence of specific customer service metrics or user testimonials about support experiences makes it difficult to assess the broker's commitment to client assistance.

Multi-language support capabilities are not mentioned in available materials, which could limit accessibility for international clients. Customer service hours and availability across different time zones are also not specified, potentially creating challenges for traders in various geographic locations.

Problem resolution processes, escalation procedures, and the broker's approach to handling client complaints are not detailed in accessible information. Given the fraud complaints mentioned in various sources, the quality of customer service becomes particularly important for addressing client concerns and maintaining trust.

Trading Experience Analysis

Platform stability and execution quality information for Cloud-Deck FX is not available in accessible sources. Order execution speed, slippage rates, and overall platform performance metrics are not detailed, making it difficult to assess the technical quality of the trading environment.

The user interface design, platform functionality, and ease of navigation are not described in available materials. Mobile trading capabilities, which have become essential for modern traders, are also not specified, creating uncertainty about trading flexibility and accessibility.

Trading environment features such as one-click trading, advanced order types, and risk management tools are not detailed in accessible information. The platform's ability to handle high-frequency trading or scalping strategies remains unclear based on available sources.

Real-time data quality, chart functionality, and market depth information are not specified in current materials. These technical aspects significantly impact trading effectiveness and decision-making capabilities, yet their quality and availability remain uncertain for Cloud-Deck FX users.

Trust and Safety Analysis

Cloud-Deck FX operates under Vanuatu Financial Services Commission regulation, which typically provides less comprehensive investor protection compared to tier-one regulatory frameworks. The regulatory status raises concerns about fund safety and dispute resolution mechanisms available to clients.

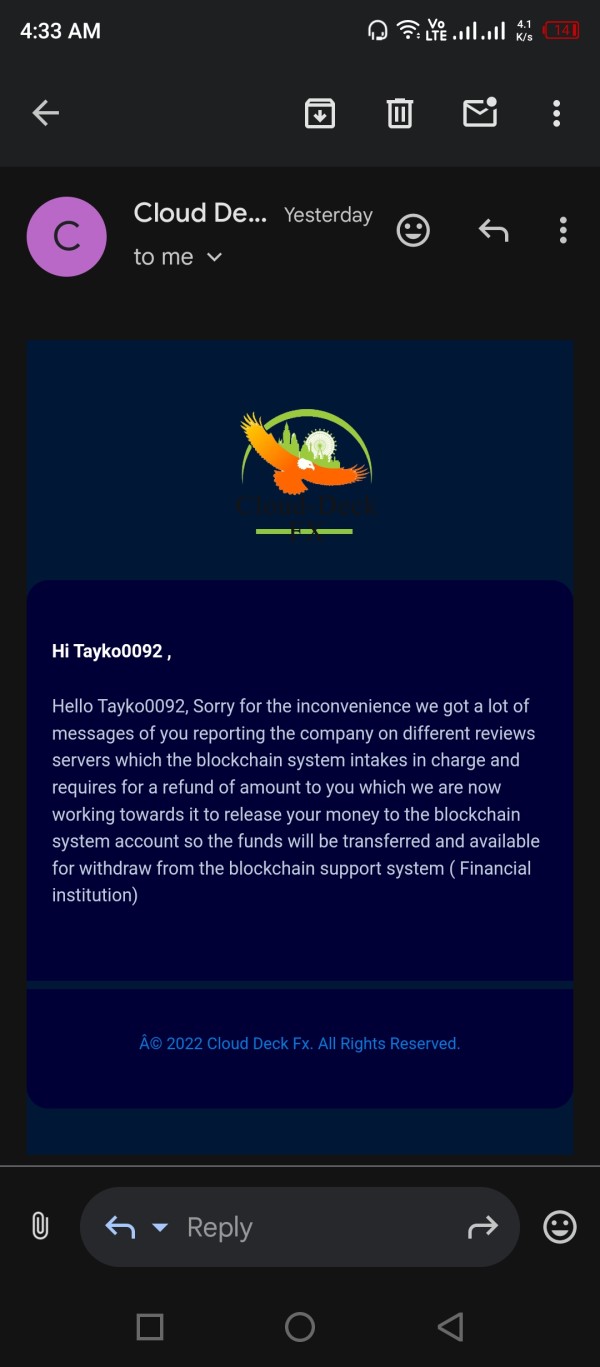

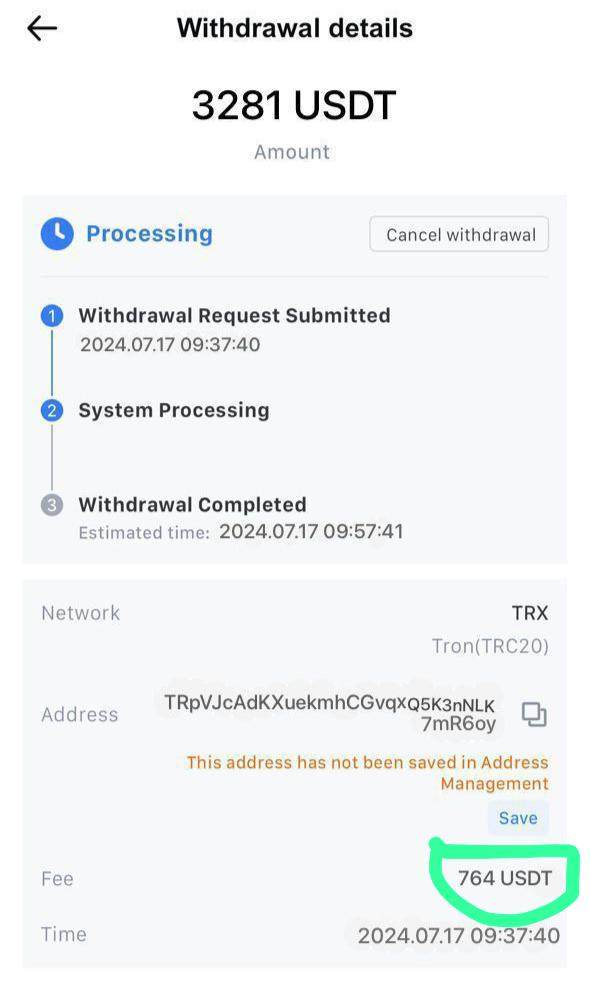

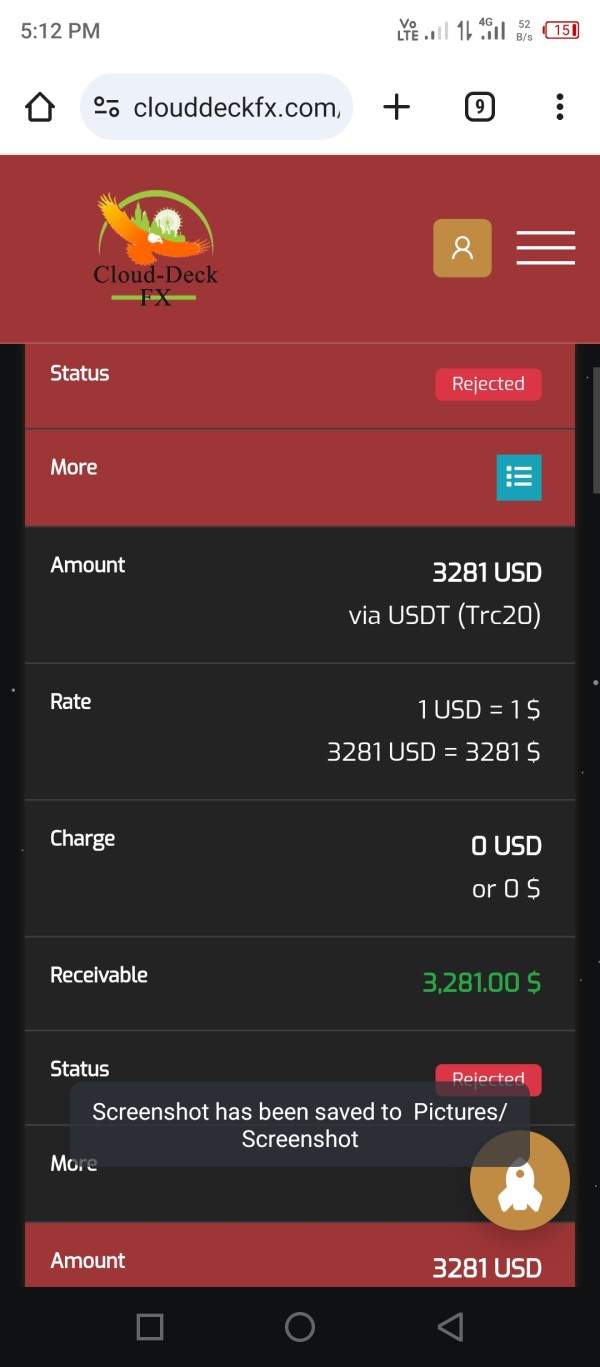

Fraud complaints and scam allegations have been reported regarding Cloud-Deck FX, significantly impacting the broker's reputation and trustworthiness. These negative reports suggest potential issues with business practices, fund handling, or client treatment that future investors should carefully consider.

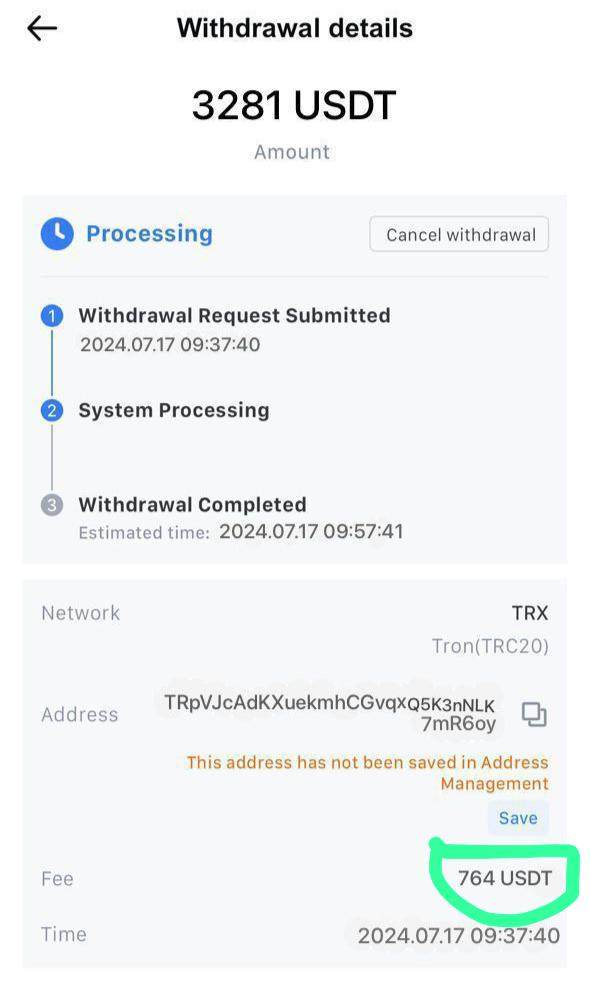

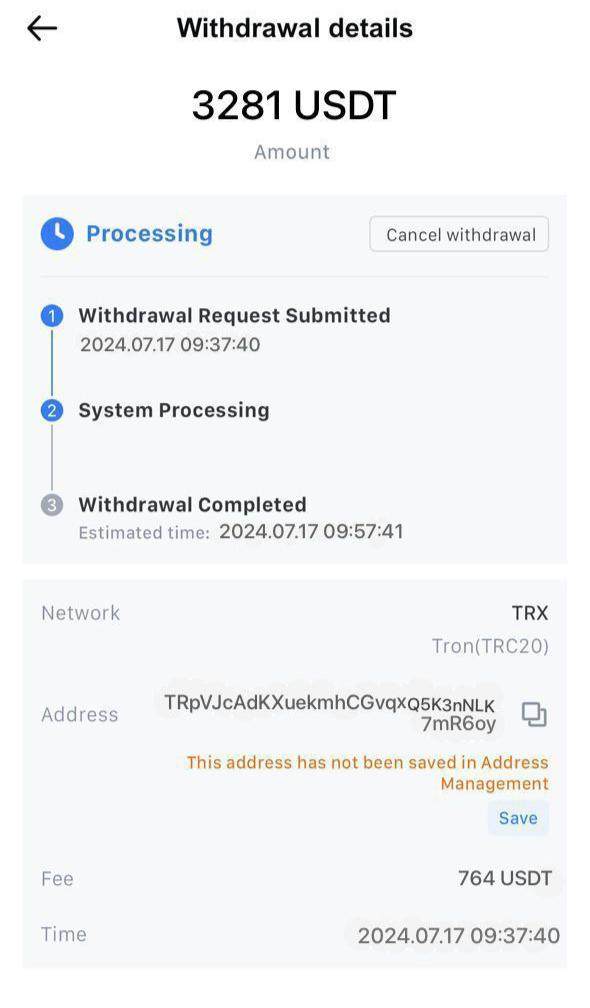

Specific fund safety measures such as segregated client accounts, deposit insurance, or negative balance protection are not detailed in available materials. The absence of clear safety protocols creates uncertainty about how client funds are protected and what recourse exists in case of problems.

Company transparency regarding ownership, financial statements, and operational details appears limited based on available information. The lack of comprehensive disclosure about company structure and financial health represents a significant concern for potential clients evaluating the broker's stability and reliability.

This cloud-deck fx review emphasizes that the combination of regulatory concerns and fraud allegations creates substantial trust issues that require careful consideration by future clients.

User Experience Analysis

Overall user satisfaction information for Cloud-Deck FX is limited in available sources, though existing reports suggest mixed experiences with notable negative feedback. The presence of fraud complaints indicates that some users have encountered serious problems with the broker's services.

Interface design and platform usability details are not specified in accessible materials, making it difficult to assess how user-friendly the trading environment might be. Registration and account verification processes are also not detailed, creating uncertainty about the onboarding experience for new clients.

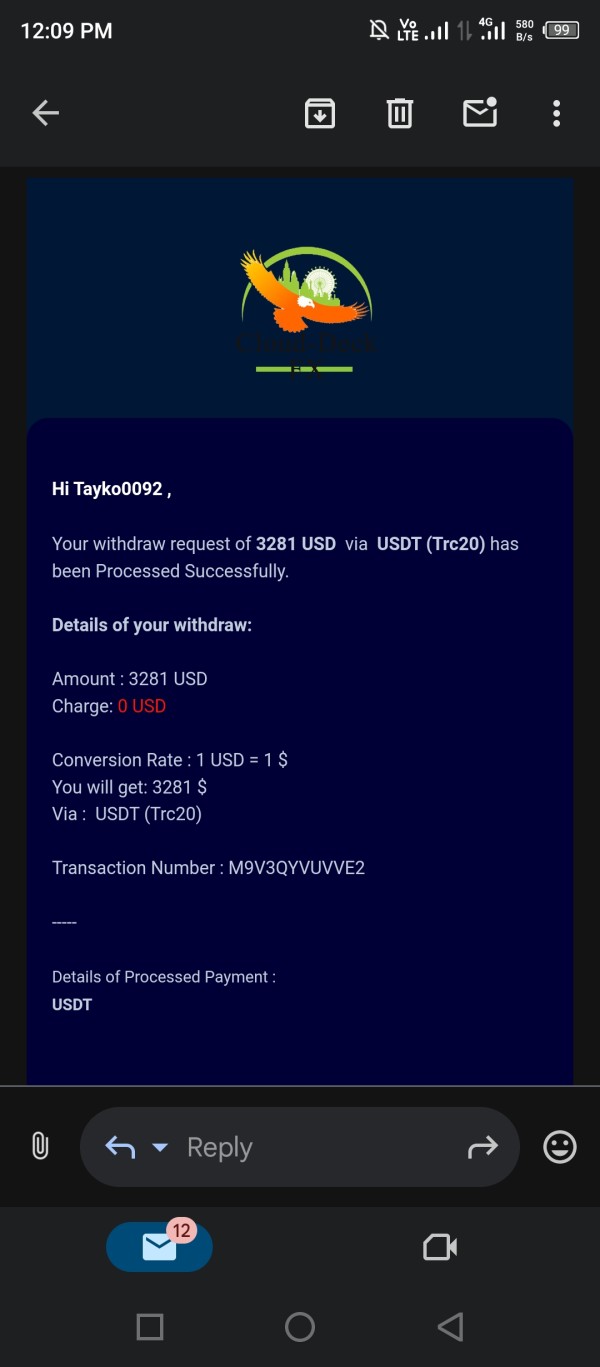

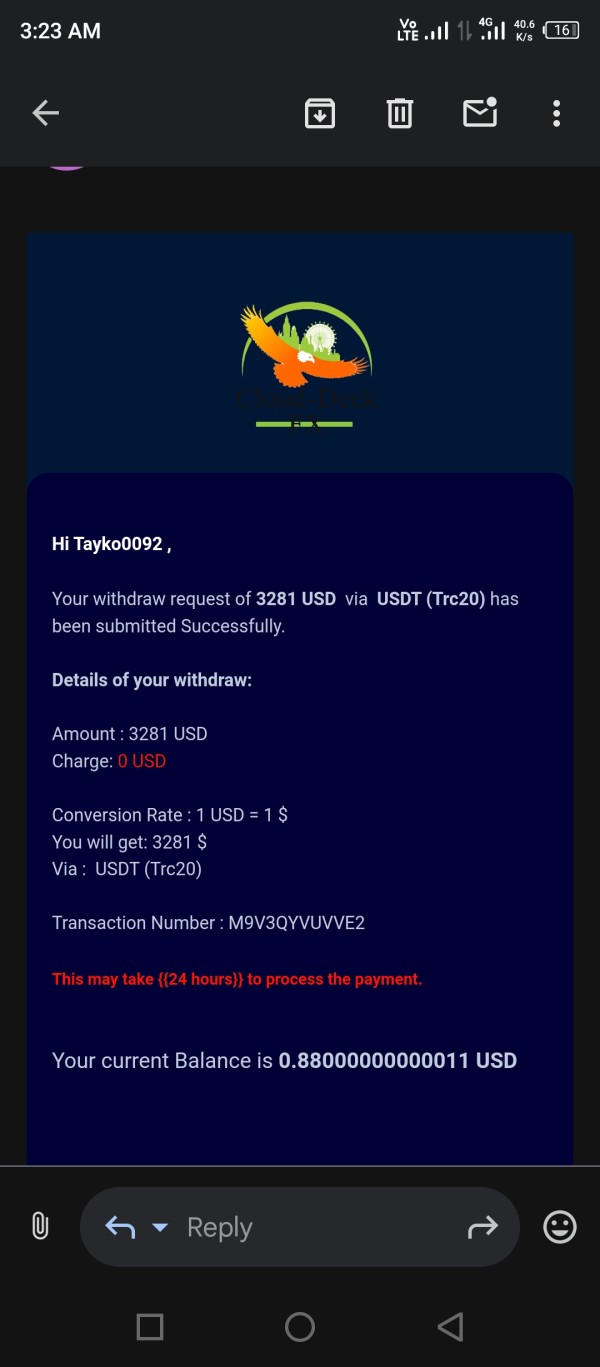

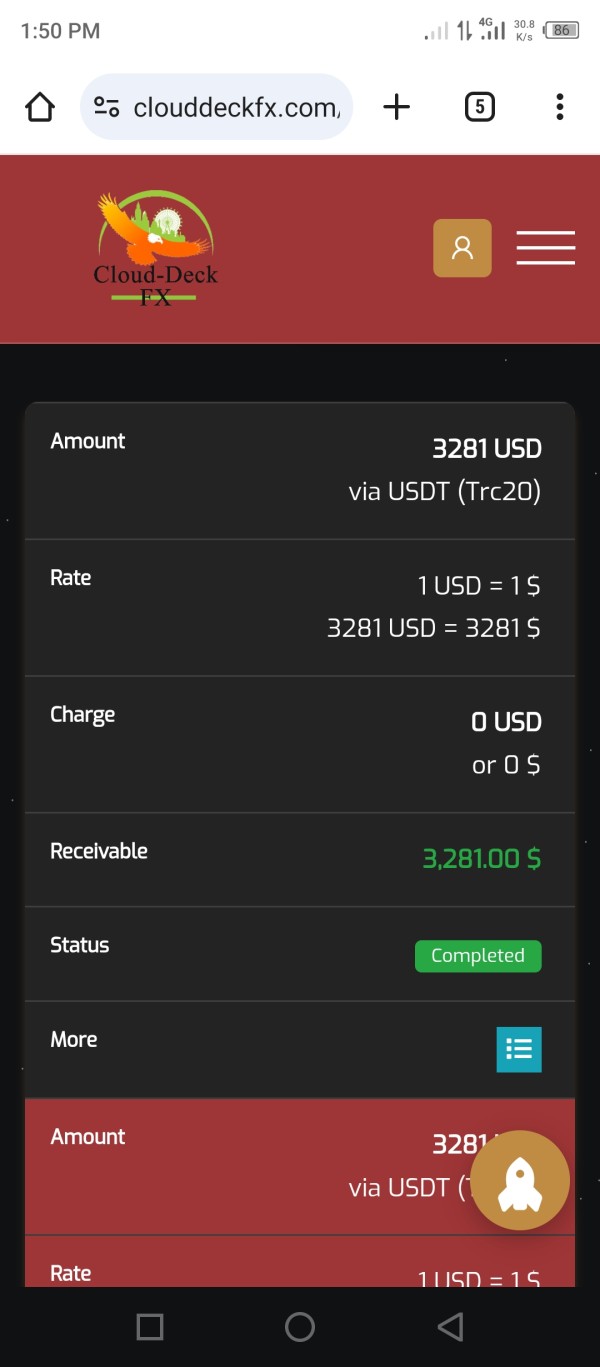

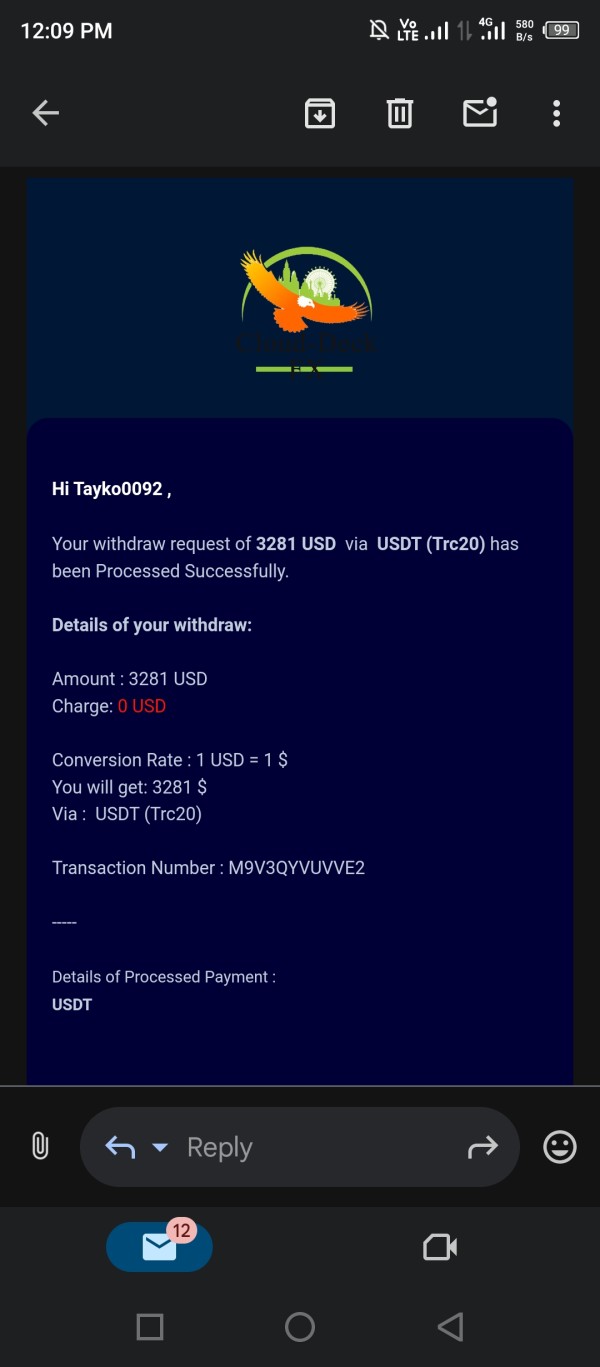

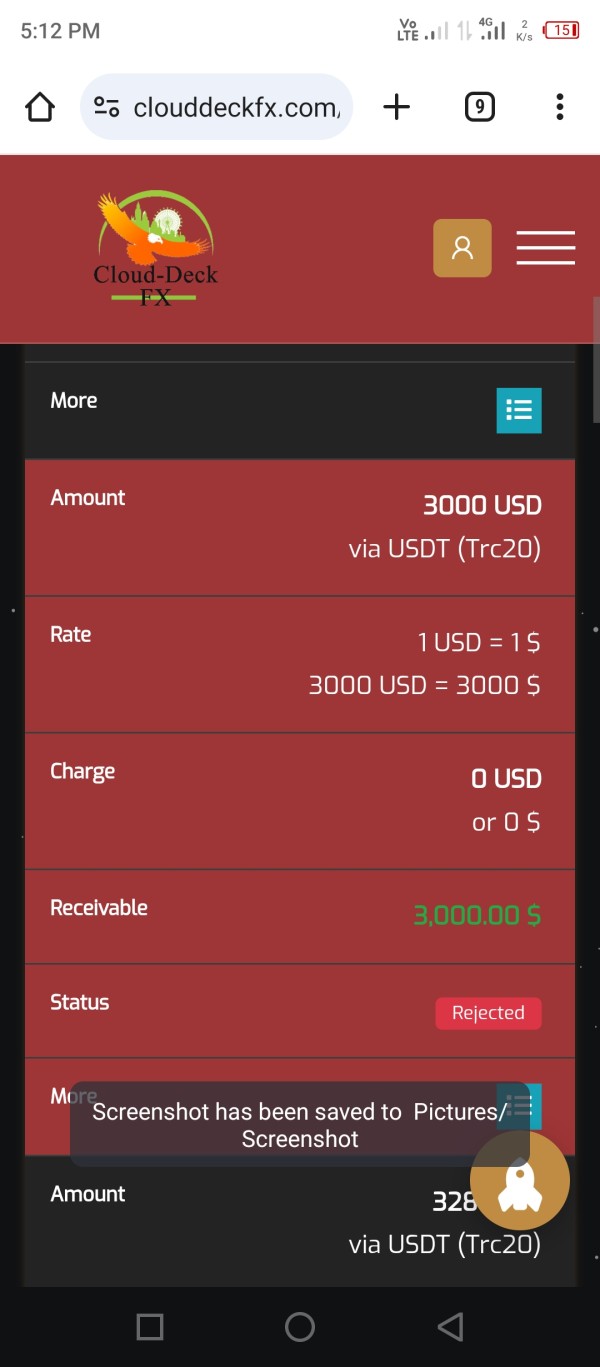

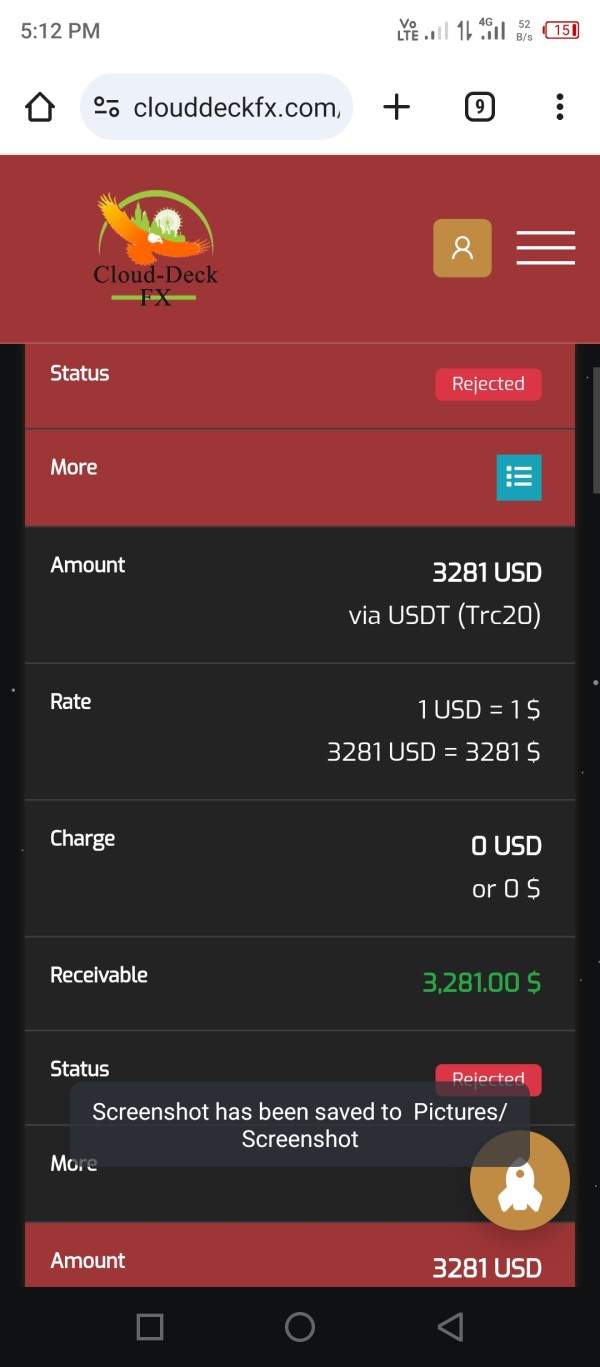

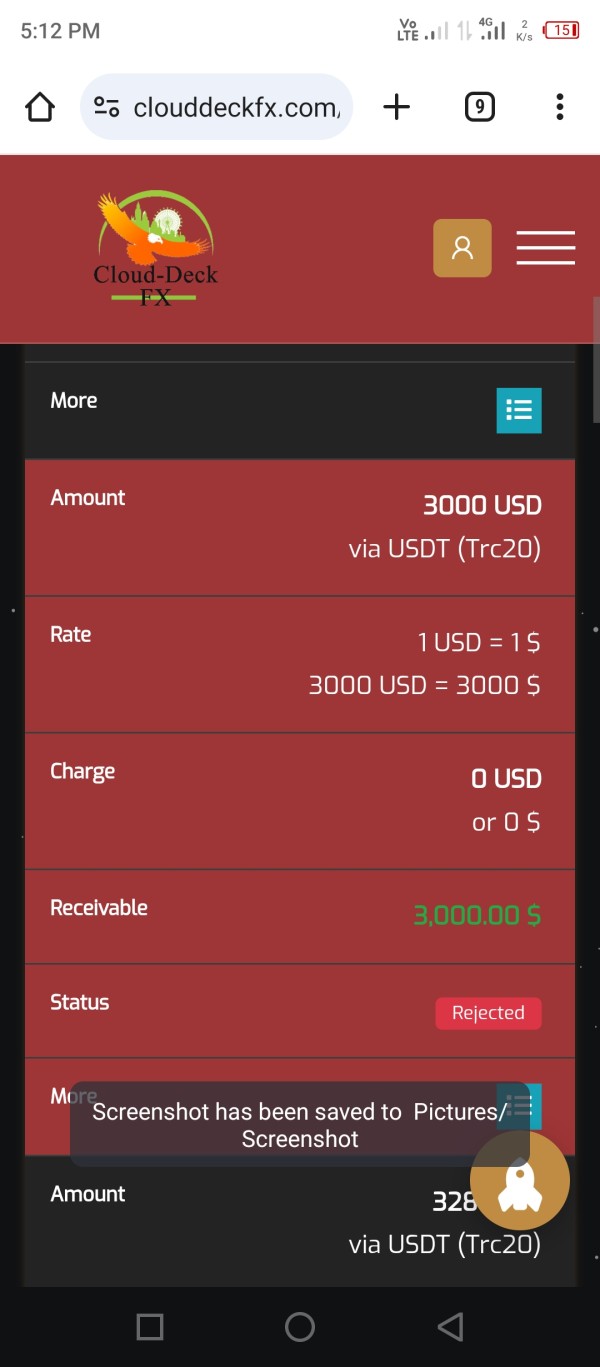

Fund management experiences, including deposit and withdrawal processes, are not well-documented in available sources. Given the importance of smooth financial transactions in trading, the lack of clear information about these processes represents a significant concern.

Common user complaints appear to center around fraud allegations and trust issues rather than specific platform functionality problems. However, the limited availability of detailed user feedback makes it difficult to identify specific areas of concern or satisfaction.

The broker appears to target experienced traders, particularly those interested in high-leverage trading opportunities. However, the risk profile and regulatory concerns suggest that even experienced traders should exercise significant caution when considering this platform.

Conclusion

This cloud-deck fx review reveals significant concerns about Cloud-Deck FX that potential clients should carefully consider. While the broker offers high leverage up to 1:500 and access to multiple asset classes, the regulatory framework under Vanuatu Financial Services Commission and the presence of fraud complaints create substantial trust issues.

The broker may be more suitable for experienced traders who understand high-risk trading environments, but even seasoned professionals should exercise extreme caution given the regulatory and safety concerns. The lack of transparency in operational details, account conditions, and platform features further compounds the risk assessment challenges.

The main advantages include high leverage options and diversified asset offerings, while significant disadvantages include unclear regulatory protection, fraud allegations, and limited transparency about operational details. Based on available information, future clients should conduct extensive additional research and consider alternative brokers with stronger regulatory credentials before making investment decisions.