Is Cloud-deck fx safe?

Business

License

Is Cloud-Deck FX A Scam?

Introduction

Cloud-Deck FX is a relatively new player in the forex trading market, positioning itself as a platform that offers various trading options for investors looking to diversify their portfolios. However, as the forex market continues to attract both seasoned traders and newcomers, the necessity for thorough scrutiny of trading platforms has never been more critical. Many traders have fallen victim to scams and unregulated brokers, leading to significant financial losses. Thus, it is essential to evaluate the credibility of Cloud-Deck FX carefully. This article employs a comprehensive investigative approach, analyzing the broker's regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk assessment to determine whether Cloud-Deck FX is safe or a potential scam.

Regulation and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. A regulated broker is subject to oversight by financial authorities, which ensures compliance with legal guidelines, protects investor interests, and maintains transparency. Unfortunately, Cloud-Deck FX lacks sufficient regulatory oversight, raising serious concerns.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation implies that Cloud-Deck FX operates without the necessary oversight, allowing it to engage in questionable practices without fear of repercussions. This lack of accountability leaves traders vulnerable, as they have no recourse in case of fraudulent activity. Historical compliance records play a crucial role in assessing the legitimacy of a broker. In this case, the lack of verifiable regulatory credentials for Cloud-Deck FX indicates that it does not meet the standards expected of a trustworthy trading platform. Therefore, potential investors should exercise extreme caution when considering this broker, as the lack of regulation is a significant red flag.

Company Background Investigation

Cloud-Deck FX was established in 2023, making it a relatively new entity in the forex trading landscape. The company claims to operate from the United Kingdom, but the lack of regulatory affiliation raises questions about its legitimacy. Understanding the ownership structure and the management team's background is vital for assessing a broker's credibility. Unfortunately, detailed information about the management team and their professional experience is scarce, which adds to the uncertainty surrounding the company.

A transparent company should disclose its ownership and operational methods, but Cloud-Deck FX appears to lack this level of transparency. The absence of clear information regarding its management and ownership structure raises concerns about its legitimacy and reliability. Without a well-defined framework for accountability, investors may find themselves exposed to significant risks. Therefore, the opaque nature of Cloud-Deck FX's operations warrants caution among potential investors.

Trading Conditions Analysis

When evaluating whether Cloud-Deck FX is safe, it is essential to analyze its trading conditions and fee structures. A transparent broker should provide clear information about trading costs, including spreads and commissions. However, many users have reported hidden fees and unclear policies associated with withdrawals and trading.

| Fee Type | Cloud-Deck FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of specific information about trading costs raises concerns about potential hidden fees that could significantly impact a trader's profitability. Furthermore, any unusual or problematic fee structures could indicate underlying issues with the broker's practices. Traders should always be vigilant and conduct thorough research before committing to any trading platform. The absence of clarity in Cloud-Deck FX's fee structure may be a cause for concern, suggesting that potential investors should seek alternative options that offer more transparent trading conditions.

Customer Funds Security

The safety of customer funds is a critical aspect of any brokerage. A reliable broker should implement robust measures to protect client funds, including segregated accounts and investor protection schemes. Unfortunately, there is limited information available regarding Cloud-Deck FX's customer funds security measures.

The absence of clear policies on fund segregation and negative balance protection raises significant concerns about the safety of investor capital. Without proper safeguards, traders may find themselves at risk of losing their investments without any means of recourse. Moreover, any historical incidents involving fund security issues could further exacerbate the risks associated with this broker. Therefore, potential investors must be cautious and consider these factors when evaluating whether Cloud-Deck FX is safe for their trading activities.

Customer Experience and Complaints

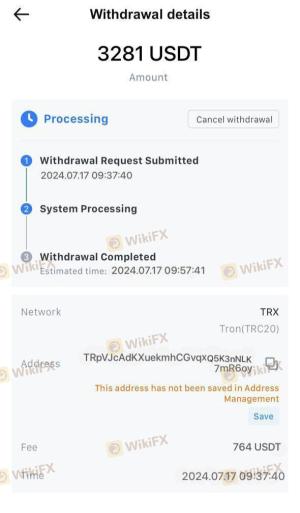

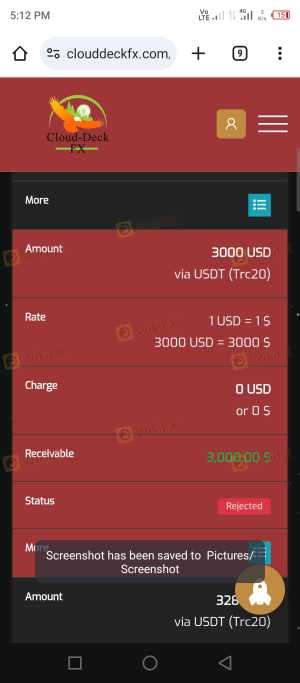

User feedback is invaluable in assessing a broker's reliability. A thorough analysis of customer experiences can reveal common complaints and the company's responsiveness to issues. Unfortunately, Cloud-Deck FX has received numerous negative reviews, particularly regarding withdrawal difficulties and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Customer Support | High | Poor |

Common complaints include unexplained delays in processing withdrawals, unexpected fees, and a lack of communication from customer support. These issues not only frustrate users but also raise significant red flags regarding the broker's operational integrity. For instance, one user reported being unable to withdraw funds after repeated requests, which highlights a concerning trend among users of Cloud-Deck FX. Such complaints should not be taken lightly, as they may indicate deeper issues within the broker's operations. Therefore, potential investors should consider these factors when determining whether Cloud-Deck FX is a scam or a legitimate trading platform.

Platform and Execution

The trading platform's performance is another critical factor in assessing a broker's reliability. A robust and user-friendly trading platform should provide seamless execution, minimal slippage, and a stable trading environment. However, user reviews indicate that Cloud-Deck FX's platform may not meet these expectations.

Reports of order execution issues, including high slippage and rejected orders, raise concerns about the platform's reliability. If traders experience frequent execution problems, it could significantly impact their trading performance and profitability. Additionally, any signs of platform manipulation should be thoroughly investigated, as they can indicate unethical practices. Therefore, potential investors should approach Cloud-Deck FX with caution, as the reported issues with its trading platform may suggest that it is not a safe option for trading.

Risk Assessment

Using Cloud-Deck FX presents various risks that potential investors should be aware of. The lack of regulation, combined with numerous negative user experiences, raises serious concerns about the broker's overall reliability.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for hidden fees and withdrawal issues |

| Operational Risk | Medium | Platform execution issues and slippage |

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with Cloud-Deck FX. Seeking alternative brokers with established regulatory oversight and positive user experiences may be a prudent course of action.

Conclusion and Recommendations

In conclusion, the evidence suggests that Cloud-Deck FX is not safe for traders. The lack of regulatory oversight, numerous negative user experiences, and concerns regarding customer funds security raise significant red flags. Traders should exercise extreme caution and consider alternative options that offer more transparency and reliability.

For those seeking trustworthy trading platforms, consider established brokers regulated by reputable financial authorities, such as the FCA or ASIC. These brokers typically provide enhanced investor protection, transparent trading conditions, and a more reliable trading environment. Ultimately, safeguarding your investments should be the top priority when choosing a forex broker, and avoiding platforms like Cloud-Deck FX is a wise decision.

Is Cloud-deck fx a scam, or is it legit?

The latest exposure and evaluation content of Cloud-deck fx brokers.

Cloud-deck fx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Cloud-deck fx latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.