Altura 2025 Review: Everything You Need to Know

Executive Summary

Altura Markets presents itself as a comprehensive brokerage firm offering multiple trading and research services across various financial markets. This altura review reveals a company with mixed profiles based on available information and user feedback. Some sources indicate positive user satisfaction particularly in product quality areas, but the lack of transparent regulatory information raises important considerations for potential traders.

The company operates support units across major financial centers including Paris, London, and Chicago. They provide 24-hour service coverage throughout the week. According to Altura Markets' official communications, they specialize in trading, electronic trading, troubleshooting, event resolution, training, and research services, though specific details regarding trading conditions, account types, and regulatory compliance remain notably absent from available public information.

User feedback from various sources shows generally positive experiences, particularly regarding product quality and customer service responsiveness. The company appears to position itself toward investors seeking diversified trading opportunities. However, the lack of detailed regulatory disclosure may limit its appeal to more risk-conscious traders who prioritize transparent oversight.

Important Notice

Cross-Regional Entity Differences: Altura Markets operates across multiple financial centers including Paris, London, and Chicago, but specific regulatory information for each jurisdiction has not been clearly disclosed in available materials. Potential investors should exercise caution and conduct independent verification of regulatory status before engaging with the platform.

Review Methodology: This evaluation is based on publicly available information, user feedback, and official company communications. It does not include direct testing of actual trading conditions or platform performance. Readers should conduct their own due diligence before making investment decisions.

Rating Framework

Broker Overview

Altura Markets positions itself as a specialized brokerage company providing comprehensive trading, electronic trading, troubleshooting, event resolution, training, and research services. According to information from Crunchbase and the company's official website, the firm focuses on serving clients who require complex order execution and market monitoring services, which allows traders to concentrate their energy on generating trading ideas and alpha in their portfolios.

The company emphasizes its in-depth knowledge and experience in equities and equity markets. This suggests a particular strength in stock trading services. Their business model appears to center around providing sophisticated execution capabilities for complex orders and scenarios between different products and markets, indicating a focus on more advanced trading strategies rather than basic retail services.

Altura Markets operates through state-of-the-art trading platforms designed to execute client transactions across various products and markets. The firm's infrastructure includes support units strategically located in Paris, London, and Chicago. This enables comprehensive coverage across major trading sessions. This altura review notes that their 24-hour service commitment, available every day of the week, represents a significant operational commitment to client support across global time zones.

The company's approach suggests targeting institutional or sophisticated retail clients who require complex order execution capabilities and continuous market monitoring. However, specific details regarding the types of trading platforms used, asset classes offered, and regulatory oversight remain notably absent from publicly available information.

Regulatory Regions: Specific regulatory information has not been disclosed in available materials, despite the company's operations across multiple major financial centers.

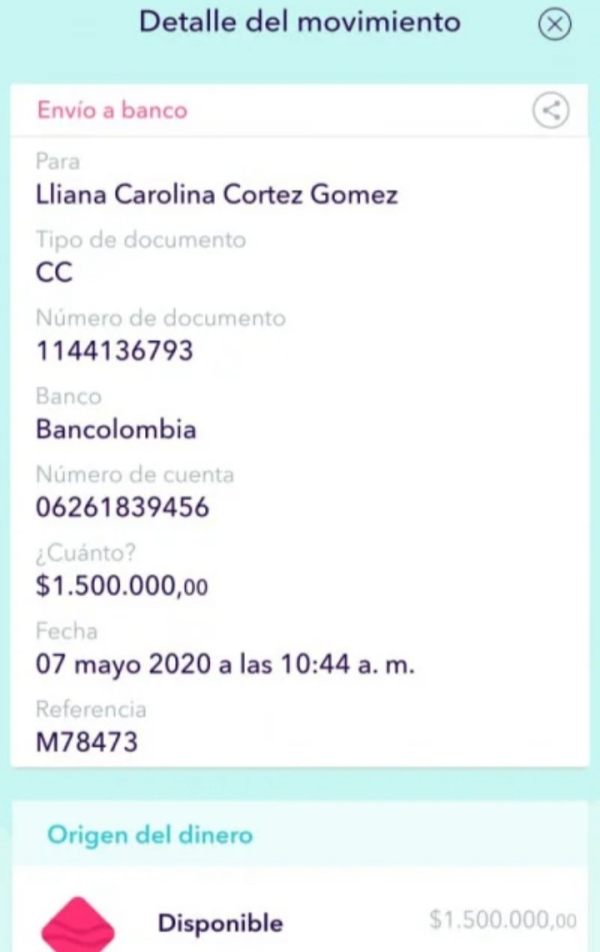

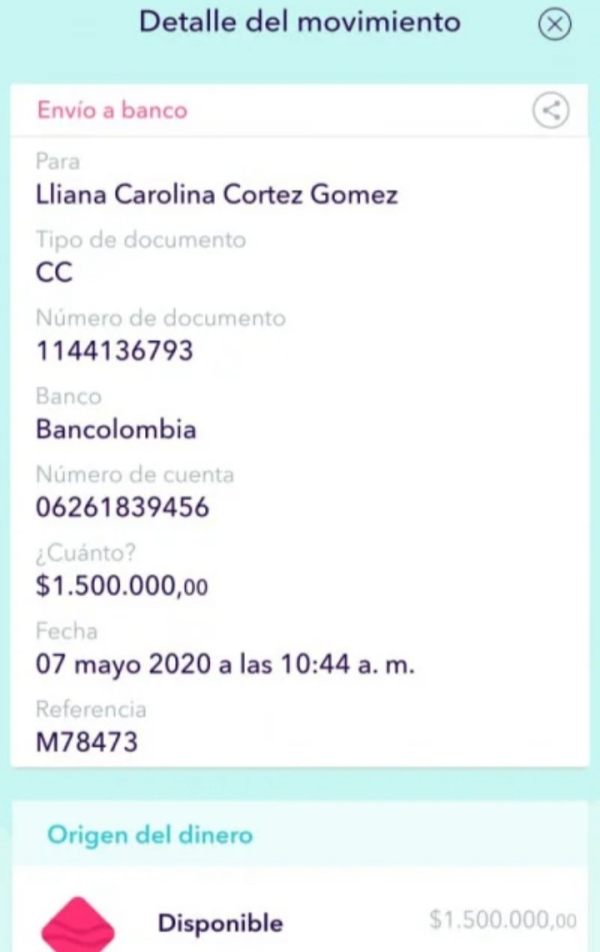

Deposit and Withdrawal Methods: Detailed information about funding options and withdrawal procedures is not specified in current available sources.

Minimum Deposit Requirements: Specific minimum deposit amounts have not been disclosed in accessible company information.

Bonuses and Promotions: No specific promotional offers or bonus structures are mentioned in available materials.

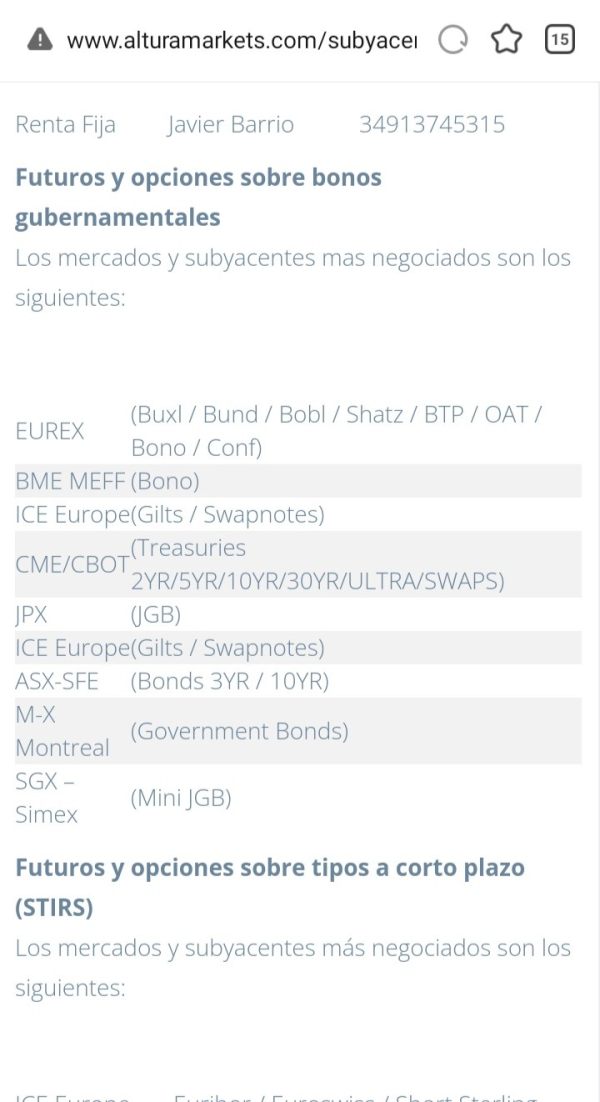

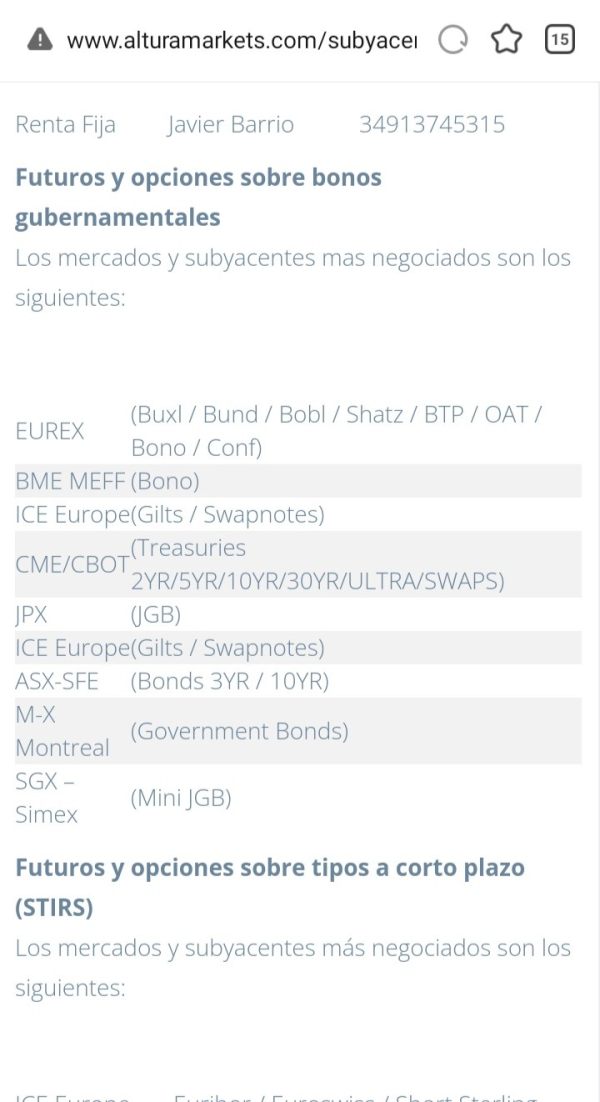

Tradeable Assets: While the company mentions expertise in equities and equity markets, comprehensive asset class listings are not provided in current sources.

Cost Structure: Detailed fee schedules, commission structures, and trading costs are not specified in available information. This represents a significant transparency gap for potential clients.

Leverage Ratios: Specific leverage offerings and risk management parameters are not detailed in accessible materials.

Platform Options: Although the company mentions using "state of the art trading platforms," specific platform names and features are not disclosed.

Regional Restrictions: Geographic limitations or restricted territories are not specified in available information.

Customer Service Languages: Multilingual support capabilities are not detailed in current sources.

This altura review identifies significant information gaps that potential clients should address through direct contact with the company before making trading decisions.

Detailed Rating Analysis

Account Conditions Analysis

The analysis of Altura Markets' account conditions faces substantial limitations due to insufficient publicly available information. Current sources do not provide details regarding account types, minimum deposit requirements, or account opening procedures. This lack of transparency represents a significant concern for potential traders who typically require clear information about account structures before committing to a brokerage relationship.

Without specific information about account tiers, benefits, or special features such as Islamic accounts, it becomes challenging for traders to assess whether Altura Markets meets their specific trading requirements. The absence of clearly defined account opening procedures also raises questions about the company's onboarding process and client verification requirements.

Industry standard practice typically involves transparent disclosure of account conditions, including minimum deposits, maintenance requirements, and any special account features. The lack of such information in this altura review suggests potential clients would need to engage directly with the company to obtain these fundamental details.

Professional traders and institutions often require detailed account specifications to ensure compliance with their own operational and regulatory requirements. The absence of this information may limit Altura Markets' appeal to more sophisticated market participants who prioritize transparency in their broker selection process.

Available information provides limited insight into Altura Markets' trading tools and resources portfolio. While the company mentions offering trading, electronic trading, troubleshooting, event resolution, training, and research services, specific details about the quality and scope of these tools remain undisclosed in publicly accessible materials.

The mention of "state of the art trading platforms" suggests the company invests in technology infrastructure. However, without specific platform names, features, or capabilities, it's difficult to assess the actual quality of their trading environment. Research and analysis resources, which are crucial for informed trading decisions, are mentioned as part of their service offering but lack detailed descriptions.

Educational resources and training services are indicated as part of their portfolio, which could be valuable for traders seeking to enhance their skills. However, the format, quality, and accessibility of these educational materials are not specified in current sources.

Automated trading support and algorithmic trading capabilities, increasingly important in modern trading environments, are not explicitly addressed in available information. This represents another area where potential clients would need to seek clarification directly from the company.

Customer Service and Support Analysis

Customer service represents one of the stronger aspects highlighted in available information about Altura Markets. The company's commitment to 24-hour service coverage, supported by units in Paris, London, and Chicago, demonstrates a significant operational investment in client support across global time zones.

The strategic positioning of support centers across major financial hubs suggests the company understands the international nature of trading markets. They recognize the need for continuous support availability. User feedback indicators suggest positive experiences with the company's customer service quality, though specific response time metrics and detailed service quality assessments are not available in current sources.

The company's emphasis on troubleshooting and event resolution services suggests a proactive approach to client support beyond basic inquiry handling. However, important details such as available communication channels, multilingual support capabilities, and specific service level agreements remain undisclosed. Professional traders often require guaranteed response times and dedicated support channels, information that would need to be verified directly with the company.

Trading Experience Analysis

The assessment of Altura Markets' trading experience faces significant limitations due to insufficient detailed information in available sources. While the company emphasizes its capability to execute complex orders and scenarios between different products and markets, specific performance metrics, platform stability data, and execution quality statistics are not provided.

The mention of "state of the art trading platforms" suggests investment in technology infrastructure. However, without specific platform names, features, or performance benchmarks, it's challenging to evaluate the actual trading experience quality. Order execution speed, slippage rates, and platform uptime statistics, which are crucial factors for active traders, remain undisclosed.

Mobile trading capabilities, increasingly important for modern traders who require flexibility and mobility, are not specifically addressed in available information. This represents a significant gap given the growing importance of mobile trading solutions in the contemporary trading landscape.

The company's focus on complex order execution suggests capabilities beyond basic market orders, potentially including advanced order types and algorithmic execution. However, without detailed specifications, traders cannot assess whether these capabilities meet their specific trading strategy requirements. This altura review emphasizes the need for direct platform demonstration or trial access to properly evaluate trading experience quality.

Trust and Regulation Analysis

The trust and regulation assessment reveals significant concerns regarding transparency and regulatory disclosure. Despite Altura Markets' operations across major financial centers including Paris, London, and Chicago, specific regulatory licenses, oversight bodies, and compliance frameworks are not clearly disclosed in available public information.

Regulatory compliance represents a fundamental aspect of broker evaluation, particularly for traders prioritizing capital protection and legal recourse options. The absence of clear regulatory information makes it difficult for potential clients to assess the level of protection and oversight governing their trading relationship with the company.

Fund safety measures, segregation policies, and investor protection schemes, which are typically highlighted by regulated brokers, are not detailed in accessible materials. This lack of transparency regarding client fund protection represents a significant concern for risk-conscious traders.

The company's reputation and standing within the financial industry cannot be adequately assessed without access to regulatory records, compliance history, and third-party verification of their operational legitimacy. Professional traders and institutions typically require comprehensive regulatory verification before establishing trading relationships.

User Experience Analysis

User experience evaluation is constrained by limited specific feedback and detailed user journey information in available sources. While some indicators suggest positive user satisfaction, particularly regarding product quality and service responsiveness, comprehensive user experience metrics remain unavailable.

Interface design and platform usability, crucial factors for trading efficiency and user satisfaction, are not specifically addressed in current information. The registration and verification process, which forms users' first impression of the service, lacks detailed description in accessible materials.

Funding operations experience, including deposit and withdrawal processes, processing times, and user satisfaction with financial transactions, are not detailed in available sources. These operational aspects significantly impact overall user experience and trading convenience.

Common user complaints and areas for improvement, typically valuable insights for potential clients, are not systematically documented in current sources. The absence of balanced user feedback, including both positive experiences and areas of concern, limits the ability to provide comprehensive user experience assessment.

The company appears to target traders seeking diversified trading opportunities and complex execution capabilities. However, specific user personas and satisfaction metrics for different trader types remain undisclosed. This information gap makes it challenging for potential clients to determine alignment with their specific trading requirements and experience expectations.

Conclusion

This altura review reveals a brokerage company with both promising aspects and significant transparency concerns. Altura Markets demonstrates operational commitment through its 24-hour support coverage across major financial centers and appears to offer sophisticated trading capabilities for complex order execution. User feedback indicators suggest positive experiences with customer service and product quality.

However, the substantial lack of detailed information regarding regulatory oversight, trading conditions, account structures, and platform specifications represents a significant limitation for potential clients. The absence of clear regulatory disclosure, in particular, may concern traders who prioritize transparency and regulatory protection.

Altura Markets appears most suitable for sophisticated traders and institutions willing to conduct extensive due diligence and direct engagement with the company to obtain necessary operational details. The company's strengths in customer service and complex execution capabilities may appeal to traders with specific advanced requirements. Meanwhile, the transparency gaps may deter more risk-averse market participants seeking comprehensive upfront disclosure.