Clair Capital Review 1

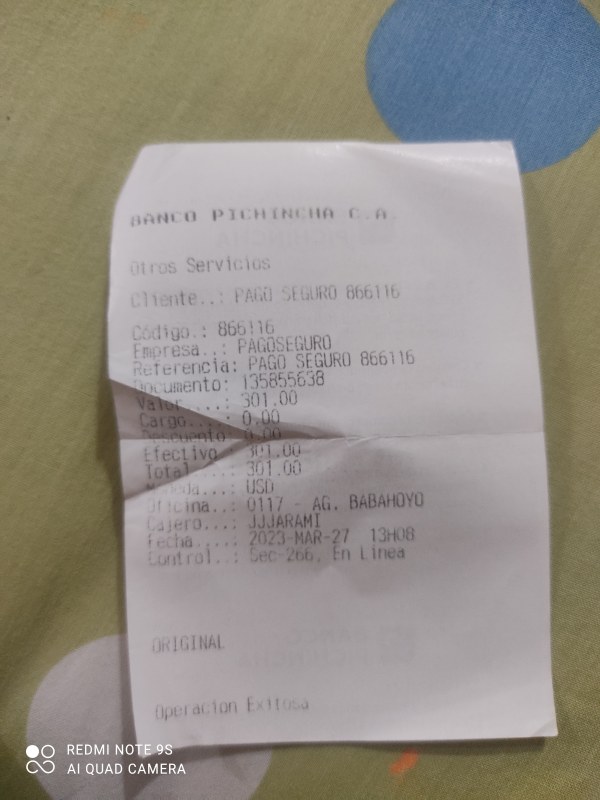

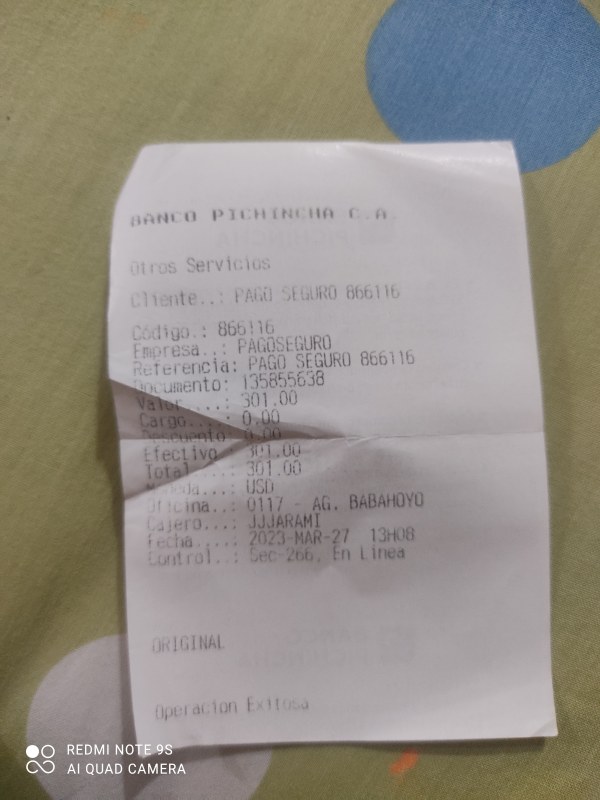

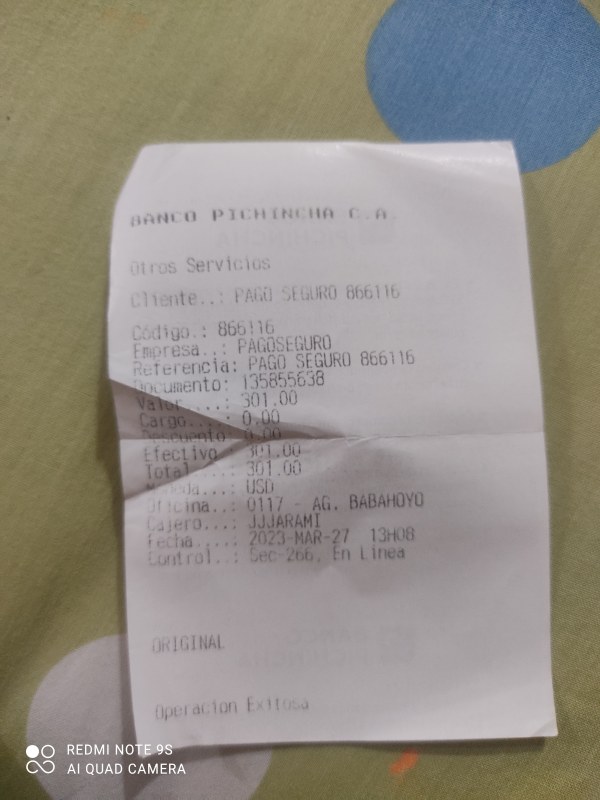

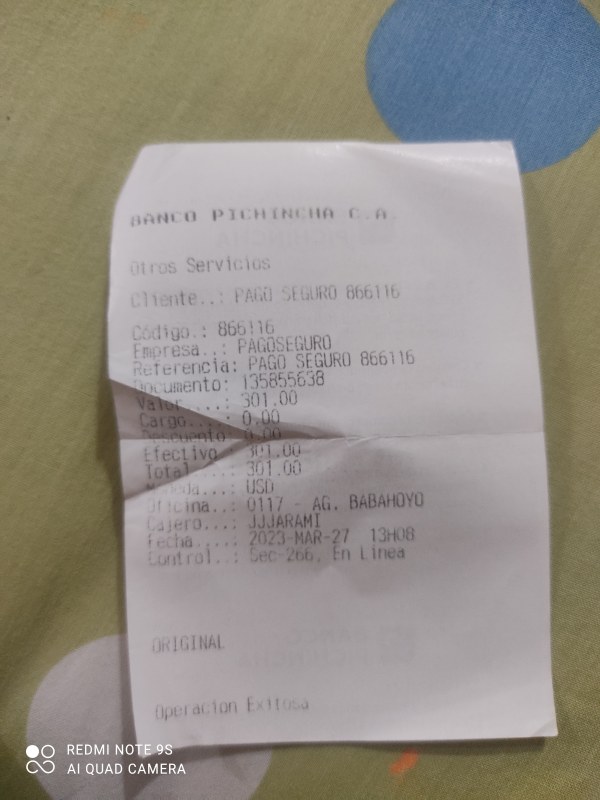

My balance with earnings USD 4543, MY MANAGER'S NAME IS DANIEL SANTINO DIPRIETO

Clair Capital Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

My balance with earnings USD 4543, MY MANAGER'S NAME IS DANIEL SANTINO DIPRIETO

This Clair Capital review shows a complete analysis of a broker that has raised major red flags in the financial industry. Our research and user feedback reveal that Clair Capital appears to be unreliable and potentially fraudulent, posing serious risks to traders and investors. Spain's National Securities Market Commission has officially added the broker to their warning list for providing investment services without proper authorization.

Key concerns include no regulatory oversight, missing licensing information, and very negative user experiences. Many sources have flagged Clair Capital as a scam operation. Users report problems withdrawing funds and poor customer service quality. The broker claims to operate from the UK while being registered in Saint Vincent and the Grenadines, which raises more questions about its legitimacy and transparency.

This review uses publicly available information and user feedback from various sources. Traders should know that Clair Capital operates across different areas with unclear regulatory status. The broker is registered in Saint Vincent and the Grenadines but claims to provide services in the UK without proper authorization from UK financial authorities.

Our assessment uses official regulatory warnings, user testimonials, and industry reports. Given the major warning signs and lack of transparency, potential investors should exercise extreme caution and consider alternative, properly regulated brokers for their trading activities.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 2/10 | Poor |

| Tools and Resources | 3/10 | Poor |

| Customer Service | 2/10 | Poor |

| Trading Experience | 2/10 | Poor |

| Trust and Security | 1/10 | Very Poor |

| User Experience | 2/10 | Poor |

| Overall Rating | 2/10 | Very Poor |

Clair Capital presents itself as a financial services provider offering trading opportunities in various markets. The broker's background and operational history remain largely hidden. The company is registered in Saint Vincent and the Grenadines, a place known for its lenient regulatory environment, while claiming to serve clients in the UK and other European markets without proper authorization from relevant financial authorities.

The broker's business model focuses on attracting retail traders through online marketing but lacks the basic regulatory framework that legitimate brokers maintain. Clair Capital claims to provide access to financial markets through their ClairTrader platform. However, specific details about trading conditions, available instruments, and operational procedures remain undisclosed.

This Clair Capital review reveals that the broker fails to meet basic industry standards for transparency and regulatory compliance. The absence of clear information about company leadership, operational history, and financial backing raises serious concerns about the broker's legitimacy and ability to provide reliable trading services to clients.

Regulatory Status: Spain's National Securities Market Commission has officially added Clair Capital to their warning list for operating without proper authorization. The broker lacks licensing from any reputable financial regulatory authority.

Deposit and Withdrawal Methods: The broker does not disclose specific information about available payment methods in their materials, which is another red flag for potential clients.

Minimum Deposit Requirements: Clair Capital has not published clear information about minimum deposit amounts or account opening requirements.

Promotional Offers: No information about bonuses or promotional campaigns is available in the reviewed materials.

Available Trading Assets: The broker does not clearly disclose specific details about tradeable instruments and asset classes.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains undisclosed. This makes it impossible for traders to assess the true cost of trading with this broker.

Leverage Ratios: Information about maximum leverage offerings is not available in the reviewed materials.

Platform Options: The broker claims to offer the ClairTrader platform. However, specific features and capabilities are not detailed.

Geographic Restrictions: Specific information about service availability by region is not clearly stated.

Customer Support Languages: The reviewed materials do not specify available support languages.

The account conditions offered by Clair Capital remain largely mysterious due to the broker's failure to provide transparent information about its services. This Clair Capital review found no clear details about different account types, their respective features, or the requirements for opening and maintaining trading accounts. This lack of transparency is particularly concerning for potential traders who need to understand the terms and conditions before committing their funds.

The absence of published minimum deposit requirements makes it impossible for traders to plan their investment strategy effectively. Legitimate brokers typically offer clear information about account tiers, minimum funding requirements, and the benefits associated with different account levels. Clair Capital's failure to provide such basic information suggests either poor business practices or intentional hiding of terms that might be unfavorable to clients.

User feedback indicates that the account opening process, when it functions at all, lacks the professional standards expected from legitimate financial service providers. Reports suggest that clients who do manage to deposit funds often encounter significant difficulties when attempting to access their accounts or execute trades. The overall account management experience appears to be substandard and unreliable.

The trading tools and resources offered by Clair Capital appear to be severely limited based on available information. While the broker claims to provide access to the ClairTrader platform, specific details about its functionality, features, and reliability are not disclosed. This lack of transparency about trading tools is particularly problematic for traders who rely on sophisticated analysis and execution capabilities.

Research and analytical resources, which are essential components of any serious trading operation, appear to be absent or inadequately developed. Legitimate brokers typically provide market analysis, economic calendars, news feeds, and educational materials to support their clients' trading decisions. The absence of such resources suggests that Clair Capital may not be equipped to provide comprehensive trading support.

Educational resources and training materials, which are crucial for novice traders, are not mentioned in available information about the broker. This gap in service offering further undermines the broker's credibility and suggests a lack of commitment to client success and development. The absence of automated trading support and third-party platform integration also limits the broker's appeal to more sophisticated traders.

Customer service quality at Clair Capital appears to be significantly below industry standards based on user feedback and available information. Reports from users consistently describe poor responsiveness, inadequate problem-solving capabilities, and general lack of professional support. This pattern of poor customer service is particularly concerning given the complex nature of financial trading and the need for reliable support when issues arise.

The availability of customer support channels and their operational hours are not clearly disclosed, which creates additional uncertainty for potential clients. Legitimate brokers typically provide multiple contact methods including phone, email, live chat, and sometimes social media support. The lack of clear information about support availability suggests that Clair Capital may not maintain adequate customer service infrastructure.

Response times for customer inquiries appear to be excessive based on user reports, with some clients indicating that their concerns were never adequately addressed. The quality of support provided, when available, seems to lack the expertise and authority necessary to resolve trading-related issues effectively. This poor service quality contributes to the overall negative assessment of the broker's reliability and professionalism.

The trading experience provided by Clair Capital has been consistently described as unreliable and problematic by users who have attempted to use their services. Reports indicate significant issues with platform stability, order execution, and overall system reliability. These fundamental problems make it extremely difficult for traders to execute their strategies effectively or manage their risk appropriately.

Platform performance appears to be a major concern, with users reporting system crashes, delayed order execution, and difficulty accessing their trading accounts. Such technical issues can result in significant financial losses for traders, particularly in volatile market conditions where timing is crucial. The unreliable nature of the trading infrastructure raises serious questions about the broker's technical capabilities and commitment to providing professional services.

The overall trading environment described by users suggests a lack of proper market connectivity and professional-grade trading infrastructure. This Clair Capital review found that users consistently describe their trading experience as frustrating and potentially dangerous to their financial well-being. The combination of technical issues and poor support creates an environment that is unsuitable for serious trading activities.

Trust and security represent the most critical concerns regarding Clair Capital, with multiple red flags indicating potential fraudulent activity. The broker's inclusion on the CNMV warning list for operating without authorization represents a clear regulatory violation that should concern any potential client. This official warning from a respected European financial regulator carries significant weight and suggests serious compliance issues.

The complete absence of regulatory oversight from any reputable financial authority creates an environment where client funds lack basic protections. Legitimate brokers operate under strict regulatory frameworks that include segregated client accounts, compensation schemes, and regular audits. Clair Capital's regulatory status provides none of these protections, leaving clients vulnerable to potential fund misappropriation.

Company transparency is virtually non-existent, with critical information about corporate structure, leadership, and financial backing remaining undisclosed. This lack of transparency, combined with the regulatory warnings and negative user feedback, creates a pattern consistent with fraudulent operations. The broker's industry reputation has been severely damaged by multiple sources identifying it as a scam operation.

Overall user satisfaction with Clair Capital appears to be extremely low based on available feedback and reviews. Users consistently report negative experiences ranging from technical difficulties to complete inability to withdraw funds. This pattern of poor user experience spans multiple aspects of the broker's operations and suggests systematic problems rather than isolated incidents.

The user interface and platform usability, while not extensively detailed in available materials, appear to be problematic based on user complaints about system functionality. Legitimate trading platforms should provide intuitive navigation, reliable execution, and comprehensive account management tools. The negative feedback suggests that Clair Capital's platform fails to meet these basic requirements.

Fund management represents perhaps the most serious area of user concern, with multiple reports of withdrawal difficulties and potential fund retention. These issues strike at the heart of the broker-client relationship and represent the most serious form of service failure. The consistent nature of these complaints across different users suggests systematic problems with the broker's fund management practices.

This comprehensive Clair Capital review reveals a broker that poses significant risks to potential clients and fails to meet basic industry standards for safety, reliability, and professionalism. The combination of regulatory warnings, lack of transparency, poor user feedback, and absence of proper licensing creates a clear pattern of red flags that should concern any potential investor.

Clair Capital cannot be recommended to any type of trader or investor due to the substantial risks involved. The broker's inclusion on official warning lists, combined with consistent negative user experiences, suggests that engaging with this entity could result in financial loss and frustration.

The primary disadvantages include complete lack of regulatory oversight, poor customer service, unreliable trading infrastructure, and potential difficulties with fund withdrawal. No significant advantages were identified that would offset these serious concerns. Traders seeking reliable forex and CFD services should consider properly regulated alternatives that offer transparent operations, client fund protection, and professional service standards.

FX Broker Capital Trading Markets Review