Is UNIQ Markets safe?

Business

License

Is Uniq Markets Safe or a Scam?

Introduction

Uniq Markets is a forex broker that has emerged in the trading landscape, positioning itself as a platform for traders seeking opportunities in the foreign exchange market. With a focus on providing various trading instruments and conditions, it aims to attract both novice and experienced traders. However, the need for caution in evaluating forex brokers cannot be overstated. The forex market is rife with unregulated entities, and traders risk losing their investments to scams if they do not conduct thorough due diligence. This article investigates the legitimacy of Uniq Markets by analyzing its regulatory status, company background, trading conditions, and customer experiences.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its safety and reliability. Uniq Markets claims to operate under the jurisdiction of Mauritius but lacks any licenses from reputable financial regulatory authorities such as the Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC). This absence of regulation raises significant red flags regarding the broker's legitimacy and the protection of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Mauritius | Unverified |

The lack of regulatory oversight means that Uniq Markets is not subject to the same standards and protections that regulated brokers must adhere to, such as maintaining segregated accounts for client funds and providing investor compensation schemes. This absence of regulation is a critical consideration for traders evaluating whether Uniq Markets is safe.

Company Background Investigation

Uniq Markets is operated by a company called Uniq Group of Companies Limited, which presents a vague corporate identity with little transparency. Established in 2022, the broker's history is short and lacks any significant milestones that would enhance its credibility. Moreover, there is minimal information available regarding the ownership structure or the management team's qualifications.

The lack of transparency about the company's operations and ownership can be concerning for potential investors. A reputable broker typically provides detailed information about its management team, including their professional backgrounds and experiences in the financial sector. Unfortunately, Uniq Markets does not offer such insights, which further complicates the assessment of whether Uniq Markets is safe for trading.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. Uniq Markets advertises competitive trading conditions, including low spreads and high leverage. However, the actual trading environment may differ significantly from what is presented on their website.

| Fee Type | Uniq Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.06 pips | 0.6 - 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not Specified | Varies |

While the advertised spread of 0.06 pips is attractive, it is crucial to approach these claims with skepticism, especially given the broker's unregulated status. Additionally, the absence of a clear commission structure and overnight interest information raises concerns about hidden fees that could affect trading profitability. Such opacity is a common tactic employed by unregulated brokers to lure in unsuspecting traders, making it vital to question whether Uniq Markets is safe.

Client Funds Security

The safety of client funds is paramount when choosing a broker. Uniq Markets does not provide sufficient information regarding its security measures for client funds. The absence of segregated accounts and investor protection schemes means that traders' funds could be at risk in the event of financial difficulties faced by the broker.

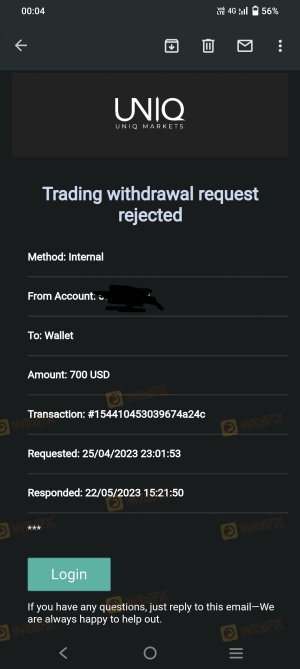

Moreover, without regulatory oversight, there is no guarantee that the broker will adhere to industry standards for fund protection. Historical issues with fund security, such as withdrawal problems or account freezes, have been reported by users, further highlighting the potential risks associated with trading with Uniq Markets. Therefore, it is essential to consider the implications of these factors when assessing whether Uniq Markets is safe.

Customer Experience and Complaints

Customer feedback is a valuable resource for understanding a broker's reputation and reliability. Reviews of Uniq Markets reveal a pattern of dissatisfaction among users, with common complaints including withdrawal difficulties, slow customer service, and misleading advertising practices.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Slow |

| Misleading Claims | High | Unresponsive |

For instance, several users have reported that their withdrawal requests were either delayed or denied altogether, with the company providing vague explanations. Such experiences indicate a concerning trend that suggests a lack of accountability and responsiveness from Uniq Markets. This raises significant questions about the broker's commitment to customer satisfaction and whether Uniq Markets is safe for traders.

Platform and Trade Execution

The trading platform is another critical aspect of the trading experience. Uniq Markets claims to offer the popular MetaTrader 4 platform, known for its robust features and user-friendly interface. However, users have reported issues with platform stability and execution quality, including slippage and order rejections.

The quality of order execution is vital for traders, as delays or rejections can result in missed opportunities or unexpected losses. If there are signs of platform manipulation or technical glitches, it could further undermine the broker's credibility. Hence, potential investors should carefully assess whether Uniq Markets is safe based on the platform's performance.

Risk Assessment

Engaging with Uniq Markets involves inherent risks, particularly due to its unregulated status. The lack of oversight means that traders have limited recourse in the event of disputes or malpractices.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No oversight |

| Fund Security | High | No segregation |

| Customer Support | Medium | Poor responsiveness |

To mitigate these risks, traders should consider using well-regulated brokers with established reputations. Conducting thorough research, reading reviews, and seeking advice from experienced traders can also help in making informed decisions about trading platforms. Therefore, it is crucial to weigh the risks associated with Uniq Markets when considering if Uniq Markets is safe.

Conclusion and Recommendations

In conclusion, the investigation into Uniq Markets reveals several concerning factors that suggest it may not be a safe trading environment. The absence of regulatory oversight, lack of transparency, and negative customer feedback raise significant red flags. Based on the evidence presented, it is advisable for traders to exercise extreme caution when considering engagement with Uniq Markets.

For those seeking reliable trading options, it is recommended to explore well-regulated brokers with proven track records. Brokers that are licensed by reputable authorities provide essential safeguards for client funds and transparency in operations, making them a safer choice for traders. In light of the findings, it is clear that Uniq Markets is not safe for trading, and potential investors should proceed with caution.

Is UNIQ Markets a scam, or is it legit?

The latest exposure and evaluation content of UNIQ Markets brokers.

UNIQ Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

UNIQ Markets latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.