Uniq Markets 2025 Review: Everything You Need to Know

Executive Summary

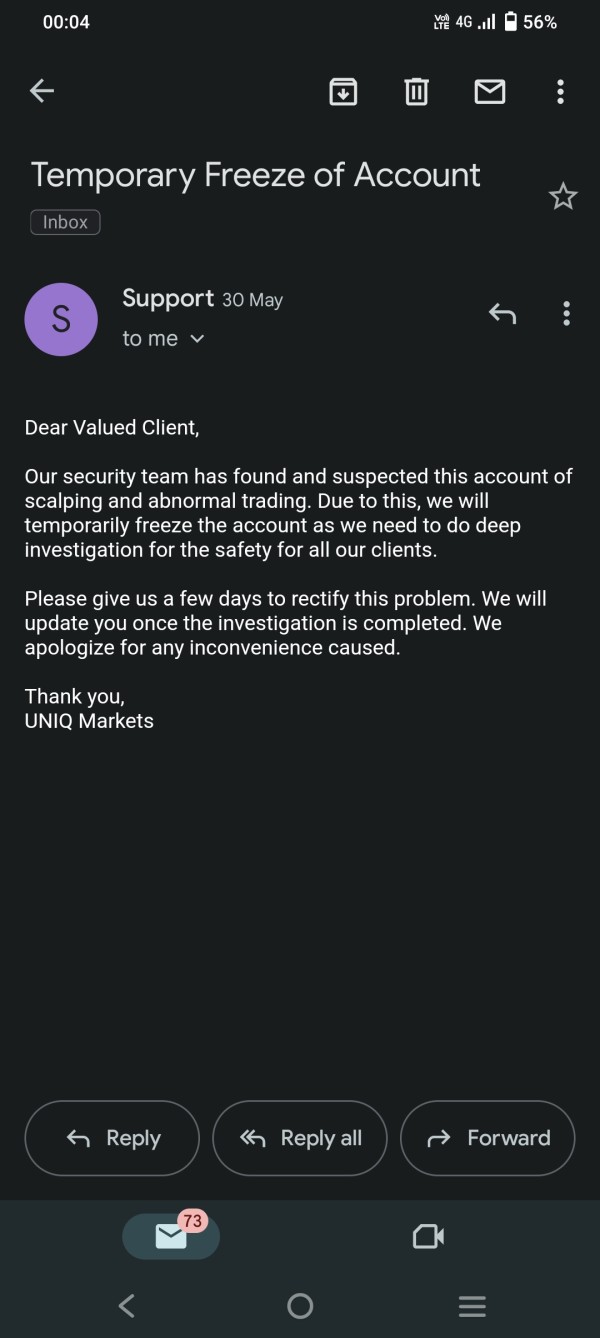

This comprehensive uniq markets review reveals concerning findings about the broker's legitimacy and safety. Uniq Markets has been identified as a potential scam platform operating without proper regulatory oversight. Multiple industry sources and user reports indicate that this offshore broker lacks legitimate forex licensing. The platform poses significant risks to traders' funds.

Based on available evidence, Uniq Markets exhibits numerous warning signs typical of fraudulent trading platforms. Users have expressed serious concerns about the broker's safety, transparency, and overall trustworthiness. The platform's lack of regulatory compliance and absence of verifiable company information raise immediate red flags for potential clients. These issues make the platform unsuitable for serious trading.

This broker appears to target traders who may be less aware of regulatory requirements and safety protocols in forex trading. However, traders with low risk tolerance should exercise extreme caution and consider regulated alternatives instead. The overwhelming negative feedback and industry warnings strongly suggest that Uniq Markets does not meet the standards expected from legitimate forex brokers in 2025. Professional traders consistently avoid platforms with such poor reputations.

Important Notice

Regional Entity Differences: Uniq Markets operates as an offshore broker and may not be regulated in any major financial jurisdiction. The lack of regulatory oversight means that trader protections and compensation schemes typically available with licensed brokers are not applicable. This review is based on available user feedback, industry analysis, and publicly accessible information. Limited transparency from the broker may create information gaps.

Rating Framework

Broker Overview

Uniq Markets presents itself as a trading platform. Specific information about its establishment date and company background remains notably absent from available sources. According to industry reports from ForexBrokerz and other review platforms, Uniq Markets operates as an offshore broker without clear regulatory backing or transparent corporate structure. This lack of transparency raises immediate concerns about the platform's legitimacy.

The broker's business model appears to follow the typical offshore approach. The platform operates in jurisdictions with minimal regulatory oversight. This setup allows the platform to avoid the stringent requirements imposed by major financial regulators such as the FCA, ASIC, or CySEC. However, this also means that traders have limited recourse in case of disputes or fund recovery issues.

Regarding trading infrastructure, specific details about the trading platform, available asset classes, and execution model are not clearly documented in available sources. This lack of transparency is itself a significant concern. Legitimate brokers typically provide comprehensive information about their trading environment, technology partnerships, and market access arrangements. The absence of such fundamental information in this uniq markets review highlights the platform's questionable legitimacy.

Regulatory Status: Uniq Markets operates as an offshore entity without apparent regulation from recognized financial authorities. No valid forex license has been identified in connection with this broker.

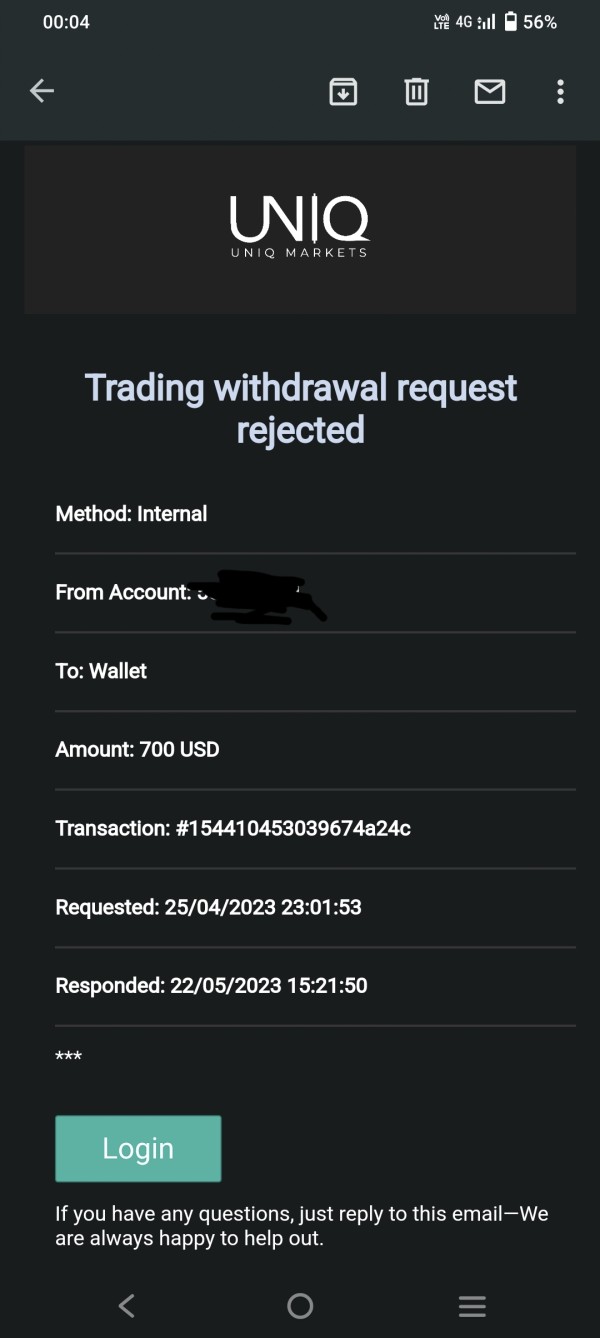

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal options is not detailed in available sources. This raises concerns about fund management transparency.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with Uniq Markets is not specified in available documentation.

Bonus and Promotions: No information about promotional offers or bonus structures has been identified in the available sources.

Tradeable Assets: Details about available trading instruments and asset classes are not clearly specified in the reviewed materials.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not available in the sources reviewed for this uniq markets review.

Leverage Ratios: The maximum leverage offered by Uniq Markets is not specified in available documentation.

Platform Options: Information about trading platforms and software options is not detailed in the available sources.

Geographic Restrictions: Specific regional limitations are not clearly outlined in available materials.

Customer Support Languages: The range of supported languages for customer service is not specified.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions offered by Uniq Markets receive an extremely poor rating due to the complete lack of transparency regarding account types, features, and requirements. Available sources do not provide any specific information about different account tiers, minimum deposit requirements, or special account features that might be available to traders. This absence of basic information creates serious concerns about the platform's legitimacy.

The absence of clear information about account opening procedures is particularly concerning. Legitimate brokers typically provide detailed explanations of their account structures, verification processes, and the documentation required for different account types. The fact that such basic information is not readily available suggests either poor business practices or intentional obfuscation. Professional traders expect transparency in account management procedures.

User feedback consistently indicates that account conditions are not transparent. This creates additional risks for potential clients. Unlike regulated brokers who must clearly disclose their terms and conditions, Uniq Markets appears to operate without such transparency requirements. This uniq markets review finds that the broker's approach to account management falls far short of industry standards and regulatory expectations.

Uniq Markets receives the lowest possible rating for tools and resources due to the complete absence of information about trading tools, research capabilities, educational materials, or analytical resources. This represents a critical deficiency that significantly impacts the trading experience and trader development opportunities. Professional traders require comprehensive analytical tools to make informed decisions.

Professional forex brokers typically provide comprehensive suites of trading tools including technical analysis software, economic calendars, market research reports, and educational resources. The lack of any documented tools or resources suggests that Uniq Markets either does not offer such services or deliberately conceals information about their availability. This absence of essential trading infrastructure is unacceptable for serious trading activities.

User feedback consistently indicates extremely low satisfaction with the tools and resources provided by the platform. Industry experts have noted the absence of essential trading infrastructure that traders expect from legitimate brokers. This deficiency not only affects trading performance but also raises questions about the platform's commitment to supporting trader success and education. The lack of educational resources particularly impacts new traders who need guidance.

Customer Service and Support Analysis

Customer service and support capabilities at Uniq Markets receive a poor rating based on consistently negative user feedback and the absence of clear information about support channels and availability. Users have reported inadequate response times and poor problem-resolution capabilities, which are critical issues for any trading platform. Effective customer support is essential for addressing urgent trading issues.

The lack of detailed information about customer service channels, operating hours, and multilingual support options is concerning. Legitimate brokers typically provide multiple contact methods including phone, email, live chat, and comprehensive FAQ sections. The absence of such information suggests limited commitment to customer support infrastructure. Professional traders require reliable support when technical issues arise.

User reports consistently indicate dissatisfaction with the quality and responsiveness of customer service. Many users have expressed frustration with the platform's ability to address concerns and resolve issues effectively. This poor service quality, combined with the lack of regulatory oversight, creates additional risks for traders who may need assistance with account or trading issues. The combination of poor support and regulatory absence leaves traders particularly vulnerable.

Trading Experience Analysis

The trading experience offered by Uniq Markets receives a poor rating due to user concerns about platform stability, execution quality, and overall trading environment. Users have expressed significant worries about the safety and reliability of the trading infrastructure, which are fundamental requirements for any forex broker. Stable platform performance is essential for successful trading activities.

Available information does not include specific details about platform stability, execution speeds, or order processing quality. This lack of transparency about core trading functionality is itself a red flag, as legitimate brokers typically provide detailed information about their execution model, technology infrastructure, and performance metrics. Professional traders require detailed performance data to evaluate platform suitability.

User feedback consistently indicates disappointment with the overall trading experience. Users cite concerns about platform reliability and execution quality. The absence of mobile trading information and platform feature details further undermines confidence in the broker's technological capabilities. This uniq markets review finds that the trading experience falls significantly below industry standards and trader expectations.

Trustworthiness Analysis

Uniq Markets receives the lowest possible trustworthiness rating due to multiple warning signs and the absence of regulatory oversight. The platform has been identified by industry sources as a potential scam, with users expressing serious concerns about fund safety and platform legitimacy. Trust is fundamental to any successful broker-client relationship.

The lack of regulatory licenses from recognized financial authorities is a critical trust issue. Legitimate forex brokers operate under strict regulatory frameworks that provide trader protections, fund segregation requirements, and dispute resolution mechanisms. The absence of such oversight leaves traders without essential protections and recourse options. Regulatory compliance is non-negotiable for legitimate trading platforms.

Industry reports consistently warn about the risks associated with Uniq Markets. User feedback overwhelmingly indicates low trust levels. The combination of regulatory absence, negative industry assessments, and poor user experiences creates a compelling case against trusting this platform with trading funds. Third-party evaluations consistently identify significant risks associated with this broker.

User Experience Analysis

The overall user experience with Uniq Markets receives a poor rating based on consistently negative feedback across multiple aspects of platform interaction. User satisfaction levels are extremely low, with complaints focusing primarily on safety concerns, lack of transparency, and poor service quality. Positive user experience is essential for sustained trading success.

Available information does not include details about interface design, ease of use, or registration processes. These are fundamental aspects of user experience. The absence of such basic information suggests either poor platform development or intentional concealment of platform capabilities and limitations. Professional platforms prioritize user-friendly design and clear processes.

User feedback consistently indicates dissatisfaction with fund management experiences and overall platform interaction. The concentration of complaints around safety and transparency issues reflects broader concerns about the platform's legitimacy and operational standards. Based on user profiles and feedback patterns, this platform is not recommended for traders with low risk tolerance or those seeking reliable trading environments. The negative feedback patterns are consistent across multiple review sources.

Conclusion

This comprehensive uniq markets review concludes that Uniq Markets represents a high-risk offshore broker that fails to meet basic industry standards for safety, transparency, and regulatory compliance. The platform has been identified as a potential scam by multiple industry sources, with users consistently reporting negative experiences and safety concerns. Professional traders should avoid this platform entirely.

The broker is not recommended for any trader profile, particularly those with low risk tolerance who prioritize fund safety and regulatory protection. The numerous warning signs, including lack of regulatory oversight, absence of transparent information, and overwhelmingly negative user feedback, make Uniq Markets unsuitable for serious forex trading activities. Traders should seek regulated alternatives that provide proper protection and transparency.

The primary disadvantages include extremely poor safety ratings, lack of user trust, absence of regulatory protection, and inadequate customer support. No significant advantages have been identified that would offset these substantial risks and deficiencies.