Is FxLive Traders safe?

Business

License

Is Fxlive Traders A Scam?

Introduction

Fxlive Traders positions itself as a global trading platform that offers various financial instruments, including forex and CFDs. In an increasingly crowded market, it is crucial for traders to carefully evaluate the legitimacy and reliability of brokers before committing their funds. This is especially true in the forex market, where unregulated brokers can pose significant risks to investors. In this article, we will conduct a thorough investigation into Fxlive Traders, examining its regulatory status, company background, trading conditions, customer experience, and overall risks involved. Our assessment is based on a review of multiple sources, including regulatory databases, user reviews, and expert opinions.

Regulation and Legitimacy

Understanding the regulatory landscape is vital for assessing whether Fxlive Traders is safe. A broker's regulatory status can significantly impact the security of client funds and the overall trustworthiness of the trading environment. Fxlive Traders is currently not regulated by any tier-one financial authority, which raises serious concerns about its legitimacy and operational practices.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulation from reputable authorities such as the FCA in the UK, ASIC in Australia, or the CFTC in the USA indicates that Fxlive Traders operates in a high-risk environment. Regulatory bodies enforce strict compliance measures to protect investors, including capital requirements, regular audits, and transparency in operations. Without such oversight, traders may find themselves vulnerable to fraudulent activities and mismanagement of funds.

Company Background Investigation

Fxlive Traders has a vague company profile, with limited information available about its history, ownership structure, and management team. The broker claims to be based in Detroit, Texas, but fails to provide substantial details about its founding or operational history. This lack of transparency can be a red flag for potential investors.

The management team behind Fxlive Traders is not publicly disclosed, which raises further concerns regarding accountability and expertise. A reputable brokerage typically provides information about its team, including their qualifications and experience in the financial sector. The absence of this information can lead to skepticism about the broker's intentions and operational integrity.

Overall, the lack of transparency and verifiable information about Fxlive Traders contributes to the perception that it may not be a safe trading option for investors.

Trading Conditions Analysis

When evaluating whether Fxlive Traders is safe, it's essential to analyze its trading conditions, including fees and spreads. The broker claims to offer competitive trading conditions, but the specifics remain unclear.

| Fee Type | Fxlive Traders | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | 15% on profits | 0-0.5% |

| Overnight Interest Range | N/A | Varies |

Fxlive Traders charges a service fee of 15% on total profits, which is significantly higher than the industry average. This fee structure can substantially erode traders' profits and may be indicative of a broker that prioritizes its revenue over the interests of its clients. Additionally, the lack of clear information regarding spreads and overnight interest rates raises concerns about the overall trading costs and transparency.

Client Funds Safety

The safety of client funds is paramount when considering whether Fxlive Traders is safe. The broker does not provide detailed information about its security measures, such as fund segregation, investor protection schemes, or negative balance protection policies.

In regulated environments, brokers are often required to keep client funds in segregated accounts, ensuring that traders' money is not used for operational expenses. Without such protections, clients of Fxlive Traders may find their investments at risk in the event of financial instability or operational mismanagement.

There have been no reported incidents of fund mismanagement or security breaches associated with Fxlive Traders, but the lack of regulatory oversight means that traders have limited recourse if issues arise.

Customer Experience and Complaints

Customer feedback is a critical component in assessing the reliability of any broker. An analysis of reviews and complaints regarding Fxlive Traders reveals a pattern of dissatisfaction among users.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Average |

| High Fees | High | Poor |

Common complaints include difficulties in withdrawing funds, lack of transparency regarding fees, and high service charges. Many users report frustration with the withdrawal process, often citing delays and additional fees that were not clearly communicated upfront. The company's response to these complaints has been generally poor, indicating a lack of commitment to customer service.

Two notable cases illustrate these issues: one user reported being unable to withdraw their funds despite multiple requests, while another mentioned hidden fees that significantly reduced their profits. Such experiences contribute to the perception that Fxlive Traders may not be a safe broker to engage with.

Platform and Trade Execution

The trading platform offered by Fxlive Traders is a crucial aspect of the user experience. Evaluating its performance, stability, and user interface is essential in determining whether Fxlive Traders is safe for trading.

The broker provides a web-based platform that claims to offer real-time execution and a variety of trading tools. However, there are concerns regarding the platform's reliability, with some users reporting issues such as slippage and order rejections. These problems can significantly impact trading performance and lead to losses.

Furthermore, the lack of advanced features commonly found in established trading platforms raises questions about the broker's commitment to providing a competitive trading environment.

Risk Assessment

In assessing the overall risk of trading with Fxlive Traders, several factors must be considered.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation from reputable bodies. |

| Financial Risk | High | High fees and unclear trading costs. |

| Operational Risk | Medium | Issues with platform stability. |

| Customer Service Risk | High | Poor response to complaints. |

The overall risk of using Fxlive Traders is high, primarily due to its lack of regulation, high fees, and customer service issues. Traders should exercise caution and consider these risks before engaging with the platform. To mitigate these risks, it is advisable to conduct thorough research and possibly seek alternative brokers with better regulatory oversight and customer service records.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fxlive Traders may not be a safe option for traders. The lack of regulation, combined with high fees and numerous customer complaints, raises significant red flags. While the broker may offer appealing trading conditions on the surface, the underlying risks are substantial.

Traders should be particularly cautious if they are considering investing with Fxlive Traders. It is advisable to explore alternative brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction. Some recommended alternatives include brokers like IG, OANDA, or Forex.com, which provide a safer trading environment and better customer support.

In summary, while Fxlive Traders may present itself as a viable trading option, the potential risks involved warrant serious consideration. Traders should prioritize safety and regulatory compliance when selecting a broker to ensure the protection of their investments.

Is FxLive Traders a scam, or is it legit?

The latest exposure and evaluation content of FxLive Traders brokers.

FxLive Traders Similar Brokers Safe

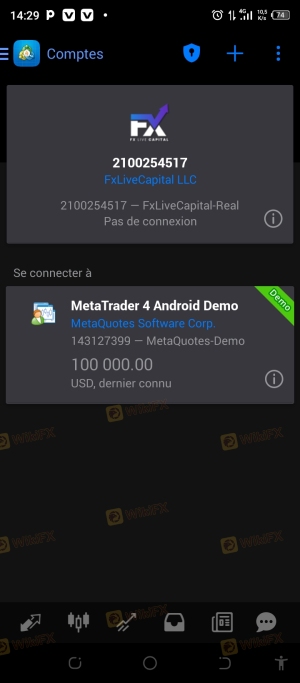

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FxLive Traders latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.