Fxrevenues 2025 Review: Everything You Need to Know

In the ever-evolving landscape of online trading, Fxrevenues has emerged as a notable player since its inception in 2022. However, a comprehensive analysis of user experiences and expert opinions reveals a mixed bag of reviews. While some users praise its customer support and quick transactions, others raise serious concerns about the broker's regulatory status and transparency. This review aims to dissect the various aspects of Fxrevenues to provide a clearer picture for potential traders.

Note: It is crucial to recognize that Fxrevenues operates under different entities across regions, which may impact the level of service and regulatory compliance. This review aims to present a balanced view based on available information and user feedback.

Ratings Overview

How We Rated the Broker: Our ratings are based on a thorough analysis of user reviews, expert opinions, and factual data regarding the broker's offerings.

Broker Overview

Fxrevenues is a trading brand operated by VHNX Ltd, registered in Saint Vincent and the Grenadines. It offers a proprietary trading platform, which is not based on popular platforms like MT4 or MT5, potentially limiting user familiarity. The broker provides access to a diverse range of assets, including forex, commodities, indices, stocks, and cryptocurrencies. However, it lacks a regulatory license from reputable authorities, raising concerns about its legitimacy and safety for traders.

Detailed Breakdown

Regulatory Status

Fxrevenues operates without oversight from major regulatory bodies, which is a significant red flag. The New Zealand Financial Markets Authority (NZ FMA) issued warnings against the broker, stating it is not authorized to provide intermediary services for derivatives trading. Similar warnings have been echoed by the Ontario Securities Commission (OSC) in Canada and the UK's Financial Conduct Authority (FCA). This lack of regulation makes it difficult for traders to feel secure in their investments.

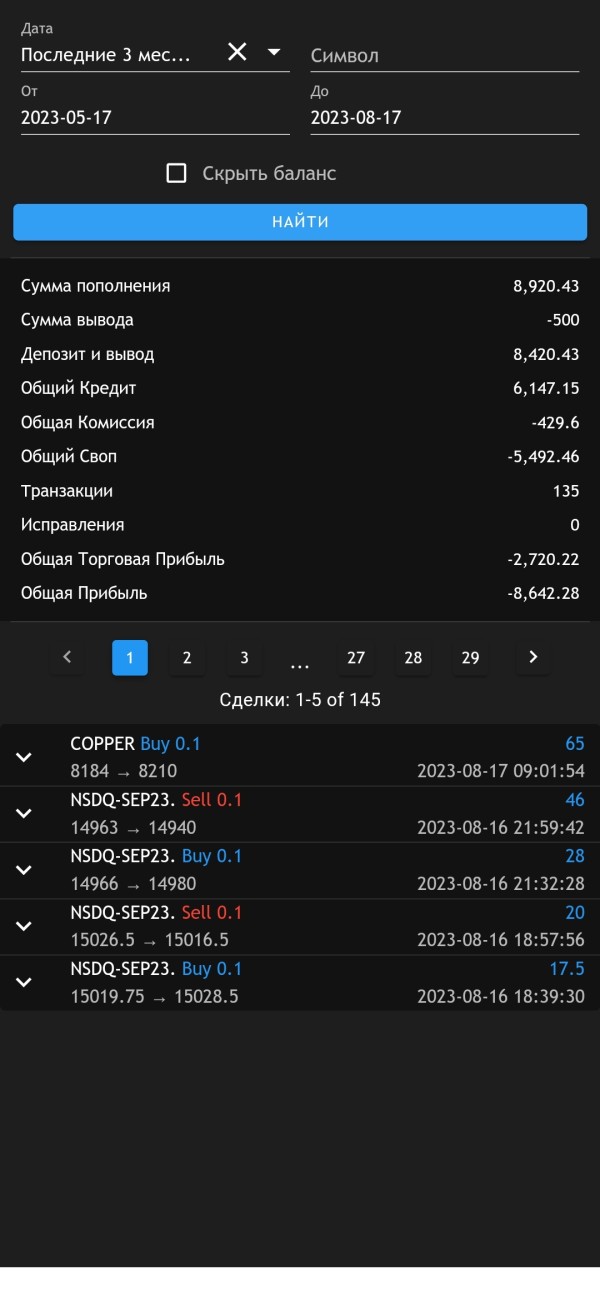

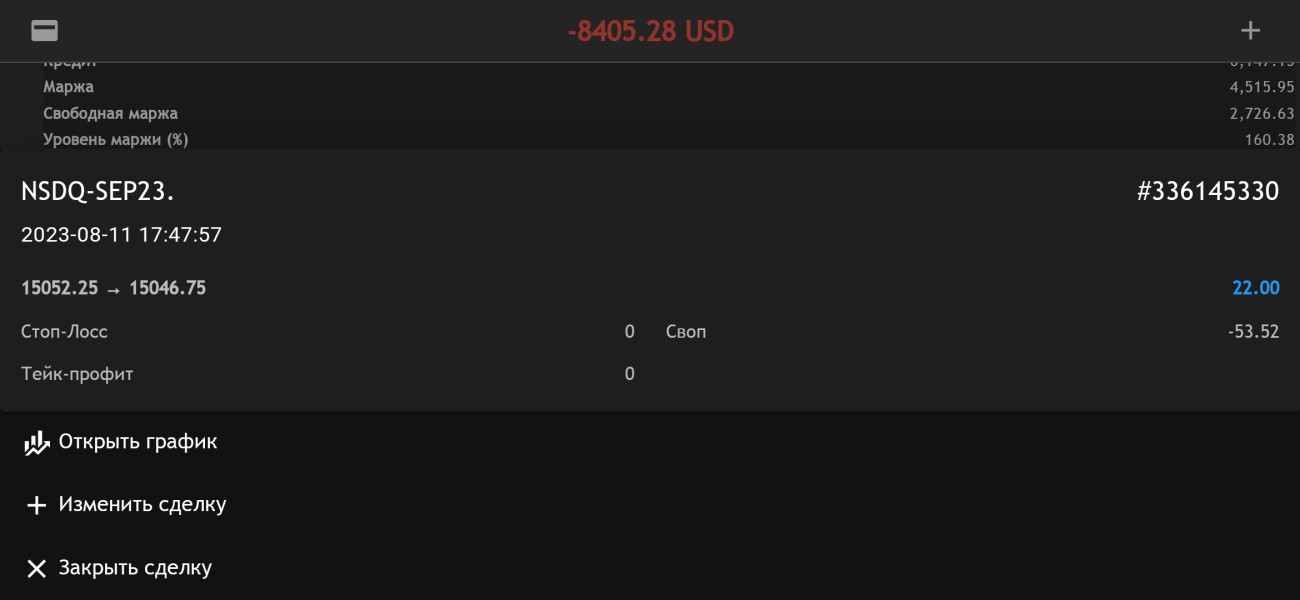

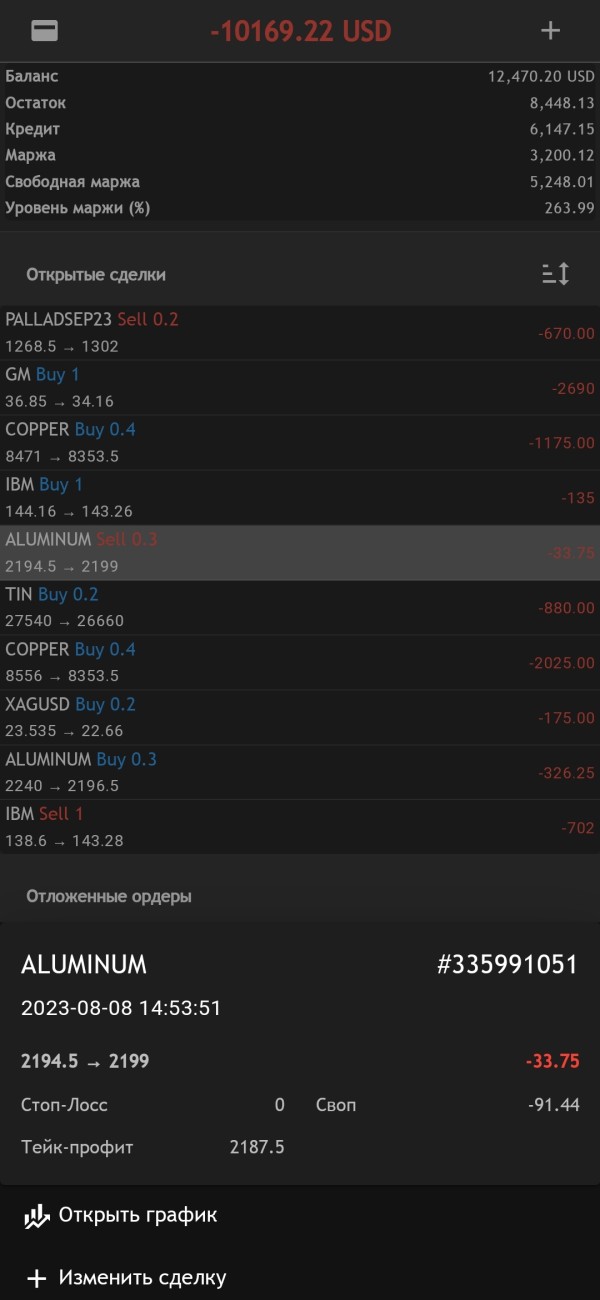

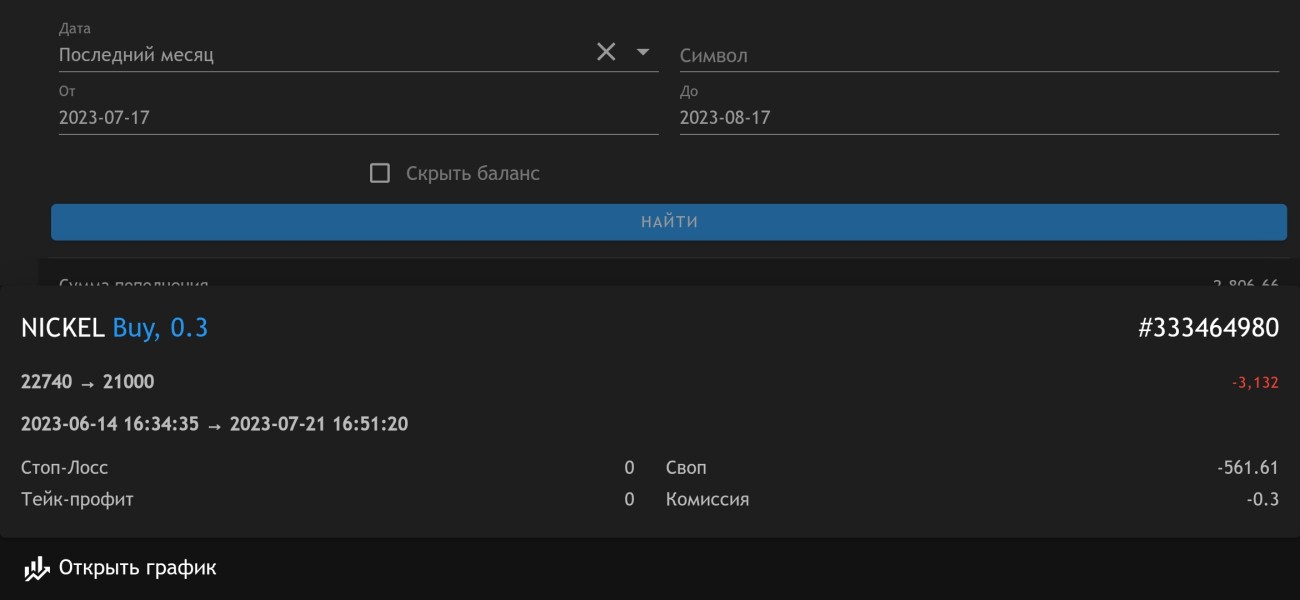

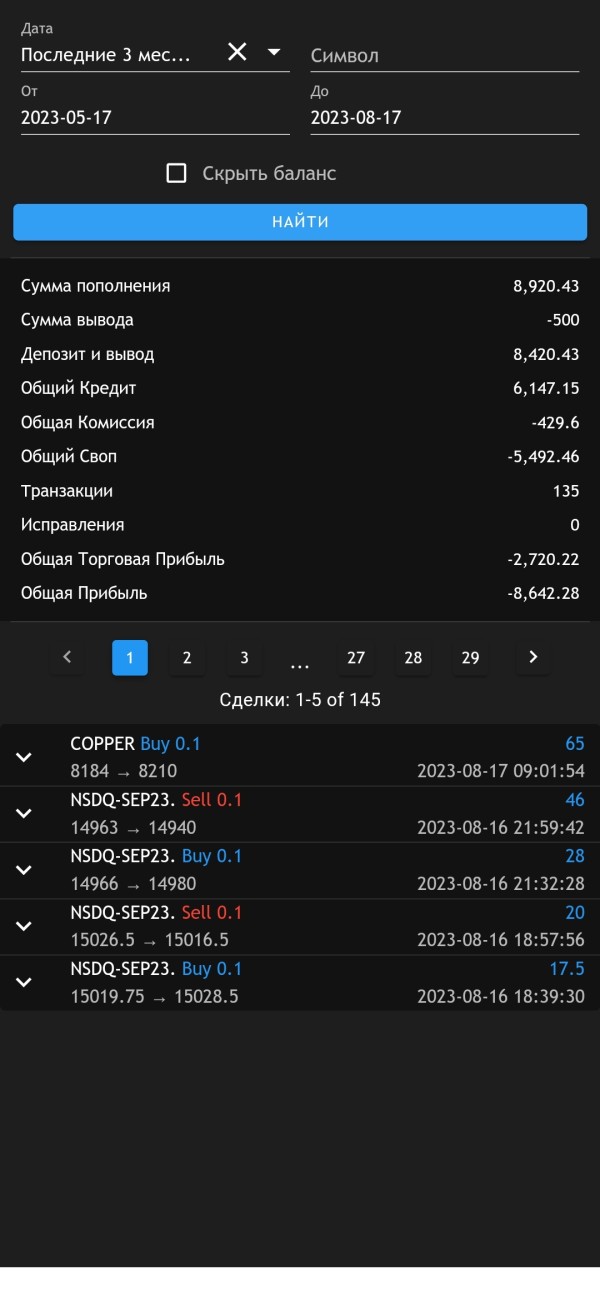

Deposit and Withdrawal Options

Fxrevenues allows deposits through various methods, including credit/debit cards, bank transfers, and cryptocurrencies. The minimum deposit required to open an account is $250, which is relatively high compared to many reputable brokers. Withdrawals are processed within five business days, but the lack of clarity regarding withdrawal fees and methods raises concerns.

Minimum Deposit

The minimum deposit requirement of $250 is considered high, especially for a broker that lacks a solid regulatory framework. Many established brokers allow for lower initial deposits, making it easier for novice traders to enter the market.

Fxrevenues does not prominently advertise any bonuses or promotions, which may appeal to some traders looking for straightforward trading experiences without hidden conditions. However, the absence of promotional offers could also indicate a lack of competitive edge in attracting new clients.

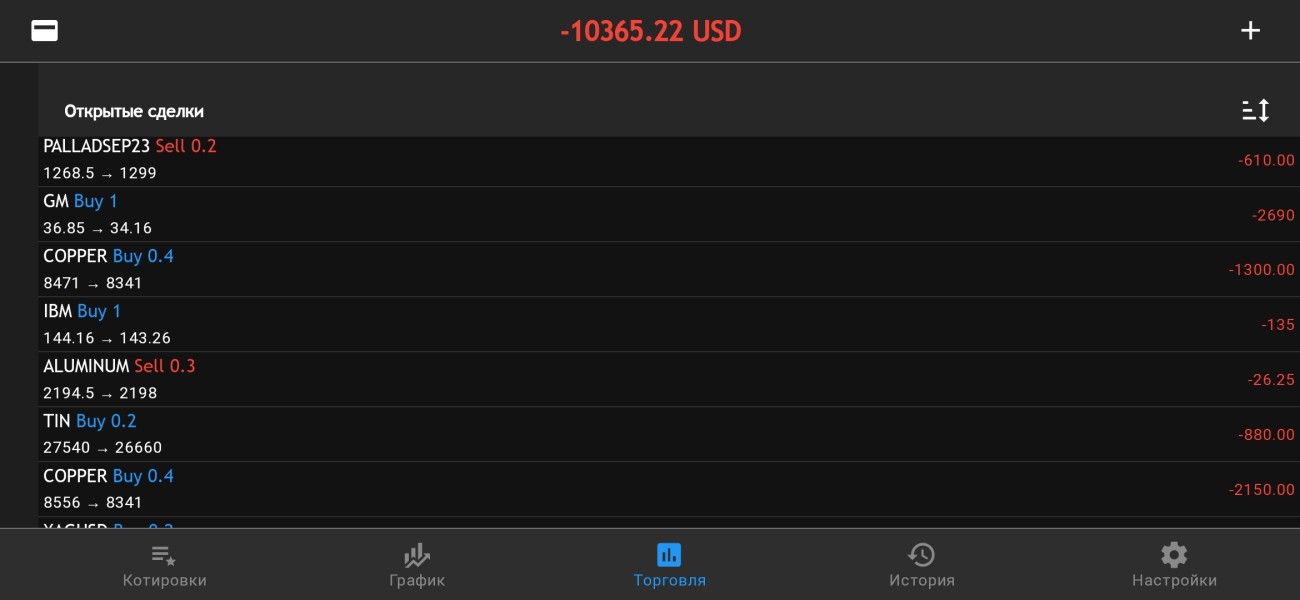

Tradable Asset Classes

Fxrevenues offers a broad spectrum of tradable assets, including over 90 currency pairs, various commodities, indices, stocks, and a limited selection of cryptocurrencies. While this diversity is appealing, the execution quality and spreads remain unclear, leading to uncertainty regarding trading costs.

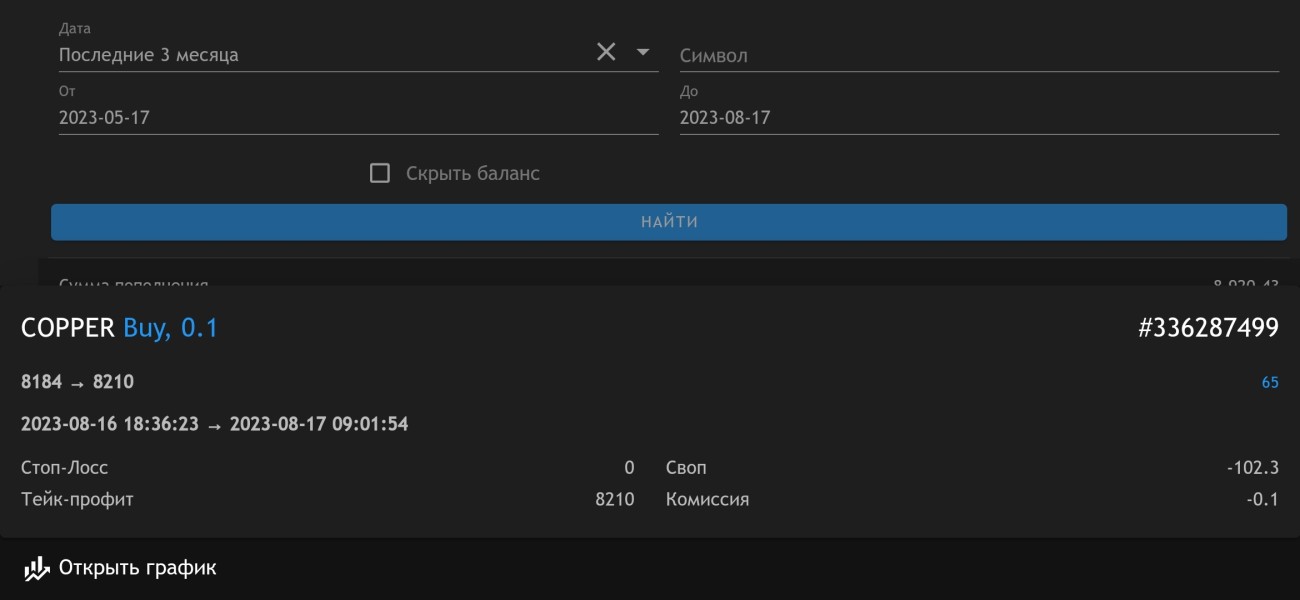

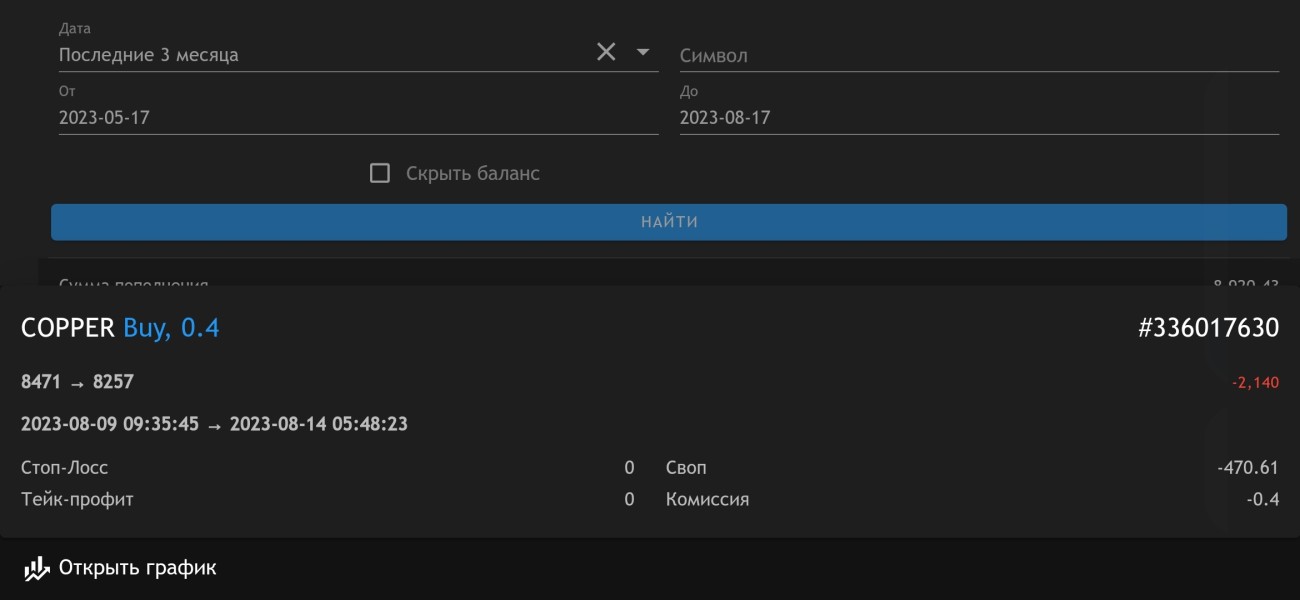

Costs (Spreads, Fees, Commissions)

The broker claims to offer zero commissions, but the actual trading costs, including spreads, are not clearly disclosed. This lack of transparency can be problematic, as hidden charges may apply, particularly in volatile market conditions. Traders should be cautious and inquire directly with customer support for detailed fee structures.

Leverage

Fxrevenues offers leverage up to 1:200, which can amplify both potential gains and losses. While high leverage can be enticing, it poses significant risks, especially for inexperienced traders who may not fully understand the implications.

The broker utilizes its proprietary trading platform, which is accessible via web and mobile applications. However, the absence of well-known platforms like MT4 or MT5 may deter some traders who prefer familiar interfaces.

Restricted Regions

Fxrevenues does not allow traders from the United States to open accounts, which is a common practice among brokers that lack regulatory approval in major markets.

Available Customer Service Languages

Customer support is available in English, and the broker claims to offer 24/5 support. However, user reviews indicate mixed experiences with the responsiveness and effectiveness of customer service.

Repeated Ratings Overview

Detailed Breakdown of Ratings

Account Conditions

While Fxrevenues offers multiple account types, the minimum deposit requirement of $250 is a barrier for many potential traders. The lack of a demo account further complicates the onboarding process, making it challenging for new traders to familiarize themselves with the platform.

The broker provides various analytical tools, such as economic calendars and market news, which can be beneficial for traders. However, the educational resources are limited, and many users express a desire for more comprehensive training materials.

Customer Service and Support

User reviews highlight that the customer support team is generally responsive and helpful, which is a positive aspect for traders needing assistance. However, some reports indicate that the quality of support can vary significantly.

Trading Experience

The trading experience on Fxrevenues is hampered by the lack of transparency regarding spreads and execution quality. User feedback suggests that while the platform is user-friendly, it does not meet the standards set by more established brokers.

Trustworthiness

The absence of regulatory oversight and the mixed reviews regarding user experiences contribute to a low trust rating for Fxrevenues. Traders are advised to exercise caution when dealing with this broker.

User Experience

The overall user experience is somewhat positive due to the platform's intuitive design. However, the lack of a demo account and limited transparency regarding trading costs detracts from the overall impression.

In conclusion, while Fxrevenues presents itself as a promising broker with a variety of offerings, the concerns regarding its regulatory status, transparency, and user experiences cannot be overlooked. Potential traders should conduct thorough research and consider safer alternatives before committing their funds to this broker.