Is FxRevenues safe?

Pros

Cons

Is Fxrevenues A Scam?

Introduction

Fxrevenues is a relatively new player in the forex market, launched in 2022 and operating under the brand of VHNX Ltd, which is registered in Saint Vincent and the Grenadines. As traders explore various platforms for their trading activities, Fxrevenues has garnered attention for its promises of competitive trading conditions and a wide array of financial instruments. However, with the rise of online trading, the need for traders to meticulously evaluate the legitimacy and safety of forex brokers has never been more critical. The potential for scams and fraudulent activities in this sector necessitates a cautious approach. This article aims to provide a comprehensive analysis of whether Fxrevenues is a safe trading platform or a potential scam. The evaluation is based on a thorough investigation of its regulatory status, company background, trading conditions, customer experiences, and risk assessment.

Regulation and Legitimacy

Regulation plays a vital role in ensuring that forex brokers adhere to specific standards that protect traders' interests. Unfortunately, Fxrevenues lacks oversight from reputable regulatory authorities, which raises significant concerns about its legitimacy. The absence of regulation means that traders have limited recourse in the event of disputes or fraudulent activities.

Core Regulatory Information

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Saint Vincent and the Grenadines | Unverified |

The lack of a license from a recognized financial authority such as the FCA (UK), ASIC (Australia), or the SEC (USA) is alarming. Regulatory bodies ensure that brokers maintain transparency, segregate client funds, and adhere to strict operational guidelines. The New Zealand Financial Markets Authority (NZ FMA) has issued warnings against Fxrevenues, stating that it is unauthorized to provide intermediary services for derivatives trading. Similar warnings have been issued by the Ontario Securities Commission (OSC) and the UKs Financial Conduct Authority (FCA). This history of regulatory scrutiny further casts doubt on the broker's compliance and operational integrity.

Company Background Investigation

Fxrevenues is operated by VHNX Ltd, a company that claims to be based in Saint Vincent and the Grenadines. However, the lack of transparency regarding its ownership structure and management team raises eyebrows. The broker's website does not provide detailed information about its founding members or their qualifications, which is a significant red flag for potential investors.

The company's operational history is relatively short, having been established in 2022. A brief operational history combined with the absence of regulatory oversight suggests that Fxrevenues may not have the experience or credibility that traders typically seek in a forex broker. Transparency is essential for building trust, and the lack of information regarding the management team and their professional backgrounds only adds to the skepticism surrounding this broker.

Trading Conditions Analysis

Fxrevenues presents itself as a broker with competitive trading conditions, including a minimum deposit requirement of $250 and leverage of up to 1:200. However, the fee structure lacks clarity, which is often a tactic used by less reputable brokers to obscure hidden costs.

Core Trading Costs Comparison

| Fee Type | Fxrevenues | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0-2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Variable | Varies |

While Fxrevenues claims to offer zero commission trading, the spreads can be significantly wider than industry averages, which can eat into traders' profits. Furthermore, the absence of clear information regarding overnight interest rates and other potential fees raises concerns about unexpected costs that could arise during trading. Traders should approach such vague fee structures with caution, as they can often lead to greater financial loss.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. Fxrevenues states that it employs various security measures, including segregated accounts and negative balance protection. However, the lack of regulatory oversight raises questions about the effectiveness of these measures.

Security Measures Assessment

-

Segregated Accounts: Fxrevenues claims to keep client funds separate from its operational funds, which is a standard practice designed to protect traders' investments. However, without regulatory scrutiny, there is no guarantee that these accounts are maintained as promised.

Investor Protection: There is no information available regarding any investor compensation schemes that would provide a safety net for traders in case of broker insolvency.

Negative Balance Protection: This policy ensures that traders cannot lose more than their deposited funds, which is a positive aspect. However, the effectiveness of this protection is questionable without a regulatory framework to enforce it.

Given the broker's history of warnings from regulatory bodies and the lack of transparency regarding its fund security measures, traders should exercise extreme caution when considering Fxrevenues as a trading platform.

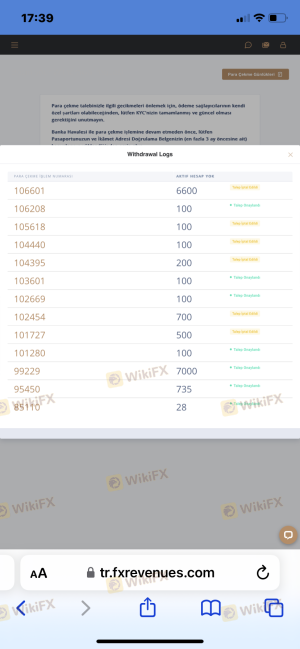

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating a broker's reliability. Reviews of Fxrevenues reveal a mixed bag of experiences, with several users reporting issues related to fund withdrawals and customer support.

Common Complaint Patterns

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or Ignored |

| High Spreads | Medium | Limited Explanation |

| Customer Support Quality | High | Unresponsive |

Many users have reported difficulties withdrawing their funds, with some claiming that their requests were ignored or delayed indefinitely. Additionally, complaints about high spreads and poor customer support have been prevalent, indicating systemic issues within the broker's operations.

For instance, one user reported that after depositing the minimum required amount, they faced relentless pressure to invest more, only to find their account balance inexplicably reduced. Such experiences highlight the potential risks associated with trading through Fxrevenues and suggest a pattern of practices that could be considered predatory.

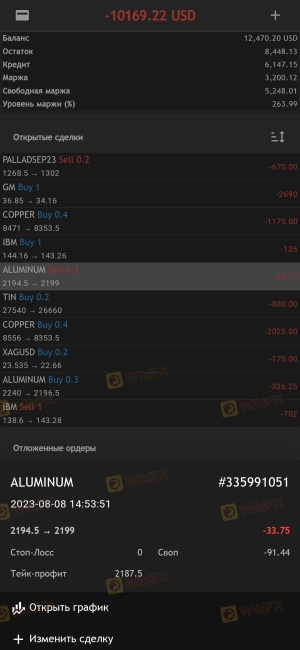

Platform and Trade Execution

The performance of a trading platform is vital for a trader's success. Fxrevenues offers a proprietary trading platform that lacks the reputation and reliability of established platforms like MetaTrader 4 or 5.

The platform's stability, execution quality, and responsiveness are critical factors that can impact trading outcomes. Users have reported issues with order execution, including slippage and rejected orders during volatile market conditions.

Risk Assessment

Engaging with Fxrevenues presents several risks that potential traders should be aware of.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No reputable oversight |

| Fund Security | High | Lack of investor protection |

| Trading Conditions | Medium | Vague fee structures |

| Customer Support | High | Poor response rates |

Given the high-risk levels associated with regulatory compliance and fund security, traders should be cautious. It is advisable to conduct thorough research and consider alternative brokers with stronger regulatory frameworks and customer protection policies.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fxrevenues raises significant red flags regarding its legitimacy and safety. The lack of regulatory oversight, combined with numerous complaints about withdrawal issues and poor customer support, indicates that traders should be extremely cautious when considering this broker.

For traders seeking reliable and trustworthy forex trading platforms, it is advisable to consider brokers that are regulated by top-tier authorities, such as the FCA, ASIC, or SEC. These brokers typically offer greater transparency, better customer protection, and a more secure trading environment.

In summary, is Fxrevenues safe? The overwhelming consensus points to a lack of safety and reliability, making it a platform that traders should approach with caution.

Is FxRevenues a scam, or is it legit?

The latest exposure and evaluation content of FxRevenues brokers.

FxRevenues Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FxRevenues latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.