Cpih 2025 Review: Everything You Need to Know

Executive Summary

This Cpih review shows a challenging assessment of a broker where critical information remains largely unavailable through standard research channels. Unlike established forex brokers with extensive documentation and user feedback, Cpih operates with limited public visibility regarding its trading conditions, regulatory status, and platform offerings. The available information primarily relates to economic data indices rather than forex brokerage services. This creates significant gaps in our evaluation process.

The broker's positioning within the competitive forex landscape remains unclear. Specific details about account types, trading platforms, spreads, and commission structures are not readily accessible. Without substantial user reviews or industry recognition, determining the target demographic for Cpih's services proves difficult. This lack of transparency raises questions about the broker's market presence and operational approach. It makes challenging for potential traders to make informed decisions based on concrete evidence.

Important Notice

This evaluation is based on limited publicly available information about Cpih as a forex broker. The assessment methodology acknowledges significant information gaps regarding regulatory compliance, trading conditions, and user experiences. Different regional entities may operate under varying regulatory frameworks, though specific jurisdictional details remain unclear. Readers should conduct independent verification of all broker claims and regulatory status before making any trading decisions.

Rating Framework

Broker Overview

Cpih presents as a forex broker with minimal publicly available information regarding its establishment date, corporate background, or operational history. The company's founding details remain undisclosed in accessible sources. This includes the year of inception and key management personnel. Without clear documentation of the business model, potential clients face uncertainty about the fundamental structure of their trading environment.

The broker's approach to client acquisition and retention strategies appears limited. No visible marketing presence or educational initiatives commonly associated with established forex brokers can be found. This absence of promotional activity or thought leadership content suggests either a very selective client approach or limited market engagement.

Trading platform specifications and supported asset classes for Cpih remain largely undocumented in available sources. The specific trading software cannot be confirmed through standard research channels. Similarly, the range of tradeable instruments lacks clear documentation. This includes major and minor currency pairs, commodities, indices, or cryptocurrency offerings. Regulatory oversight details are not readily verifiable through public regulatory databases or broker disclosure statements.

Regulatory Jurisdictions: Specific regulatory information for Cpih is not available in accessible sources. This makes it difficult to verify licensing status or compliance frameworks.

Deposit and Withdrawal Methods: Payment processing options and supported funding methods remain undocumented in available materials.

Minimum Deposit Requirements: Entry-level funding requirements are not specified in accessible broker information.

Bonus and Promotions: Current promotional offers or incentive programs are not detailed in available sources.

Tradeable Assets: The specific range of instruments available for trading lacks clear documentation in accessible materials.

Cost Structure: Spread configurations, commission rates, overnight financing charges, and other trading costs are not specified in available information. This makes cost comparison with competitors impossible.

Leverage Ratios: Maximum leverage offerings for different asset classes remain undocumented.

Platform Options: Available trading software and mobile applications are not clearly specified in accessible sources.

Geographic Restrictions: Service availability by region and any jurisdictional limitations are not detailed in available materials.

Customer Support Languages: Multilingual support capabilities and communication options remain unspecified in this Cpih review.

Account Conditions Analysis

The evaluation of Cpih's account conditions faces significant limitations due to the absence of detailed information about account structures and trading terms. Standard broker documentation typically includes multiple account tiers with varying features, minimum deposit requirements, and exclusive benefits for higher-tier clients. However, Cpih's account offerings remain undocumented in accessible sources.

Minimum deposit requirements cannot be verified through available information. Most established brokers clearly communicate entry-level funding requirements, ranging from $10 to $10,000 depending on account types. Without this fundamental information, potential clients cannot assess the broker's accessibility or target market positioning.

Account opening procedures and verification requirements also lack documentation. The typical KYC process, document requirements, and approval timeframes remain unclear. Special account features such as Islamic accounts for Muslim traders, corporate accounts for institutional clients, or demo accounts for practice trading are not mentioned in available sources.

The absence of user feedback regarding account management experiences further compounds the evaluation challenges. Client testimonials about account setup efficiency, funding processes, and account-related customer service are not available through standard research channels. This makes it impossible to assess real-world account condition performance in this Cpih review.

Cpih's trading tools and analytical resources cannot be adequately assessed due to limited available information about the broker's platform offerings and educational materials. Most competitive forex brokers provide comprehensive analytical suites including technical indicators, charting tools, economic calendars, and market research reports. However, specific details about Cpih's tool portfolio remain undocumented in accessible sources.

Research capabilities are not clearly outlined in available materials. This includes fundamental analysis resources, market commentary, and expert insights. The absence of educational content such as webinars, trading guides, or market analysis publications suggests either limited resource allocation to client education or poor visibility of existing offerings.

Automated trading support cannot be verified through available information. This includes Expert Advisor compatibility, copy trading services, or algorithmic trading tools. These features have become increasingly important for modern forex traders seeking to optimize their trading strategies and risk management approaches.

Third-party integrations with popular analytical platforms or social trading networks also remain unspecified. The lack of information about mobile trading applications, their functionality, and user interface quality further limits the assessment of Cpih's technological offerings and trader support infrastructure.

Customer Service and Support Analysis

Customer service evaluation for Cpih encounters significant obstacles due to the absence of detailed information about support channels, response times, and service quality metrics. Effective customer support typically includes multiple communication channels such as live chat, telephone support, email assistance, and comprehensive FAQ sections. However, Cpih's specific support infrastructure remains undocumented in accessible sources.

Response time performance cannot be assessed without user feedback or official service level agreements. Most reputable brokers provide 24/5 or 24/7 support during market hours, but Cpih's availability schedule is not clearly specified in available materials. Multilingual support capabilities are not detailed in accessible information.

The quality of support staff training, their trading knowledge, and problem-resolution effectiveness cannot be evaluated without client testimonials or independent service reviews. Technical support for platform issues, account problems, or trading disputes also lacks documentation. The escalation procedures for complex issues and the availability of dedicated account managers for premium clients remain unclear. This limits the assessment of overall service quality and client satisfaction potential.

Trading Experience Analysis

The trading experience evaluation for Cpih faces substantial limitations due to insufficient information about platform performance, execution quality, and user interface design. Platform stability cannot be assessed without user reports or independent testing data. Most professional traders prioritize reliable order execution and minimal downtime, but Cpih's performance metrics remain undocumented.

Order execution speed and slippage rates lack verification through available sources. The absence of execution statistics or third-party performance audits makes it impossible to compare Cpih's execution quality with industry standards or competitor offerings. Trading environment features such as one-click trading, advanced order types, risk management tools, and customizable interfaces are not clearly documented in accessible materials.

Mobile trading capabilities cannot be evaluated without specific information about app functionality and user experience design. Market depth information, real-time pricing accuracy, and spread consistency during different market sessions also remain unverified. The lack of user testimonials about actual trading experiences, platform reliability during news events, and overall satisfaction levels significantly limits the comprehensive assessment of Cpih's trading environment in this Cpih review.

Trust Factor Analysis

Trust assessment for Cpih presents significant challenges due to limited transparency regarding regulatory compliance, corporate structure, and operational history. Regulatory licensing cannot be verified through accessible regulatory databases or official documentation. Most trustworthy brokers maintain clear regulatory disclosure and provide license numbers for verification.

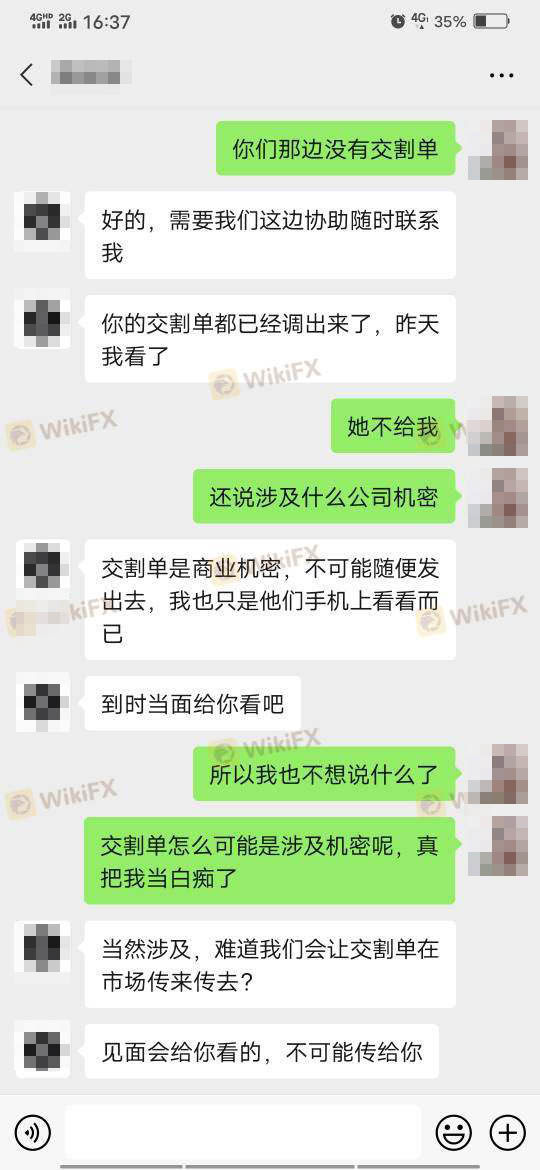

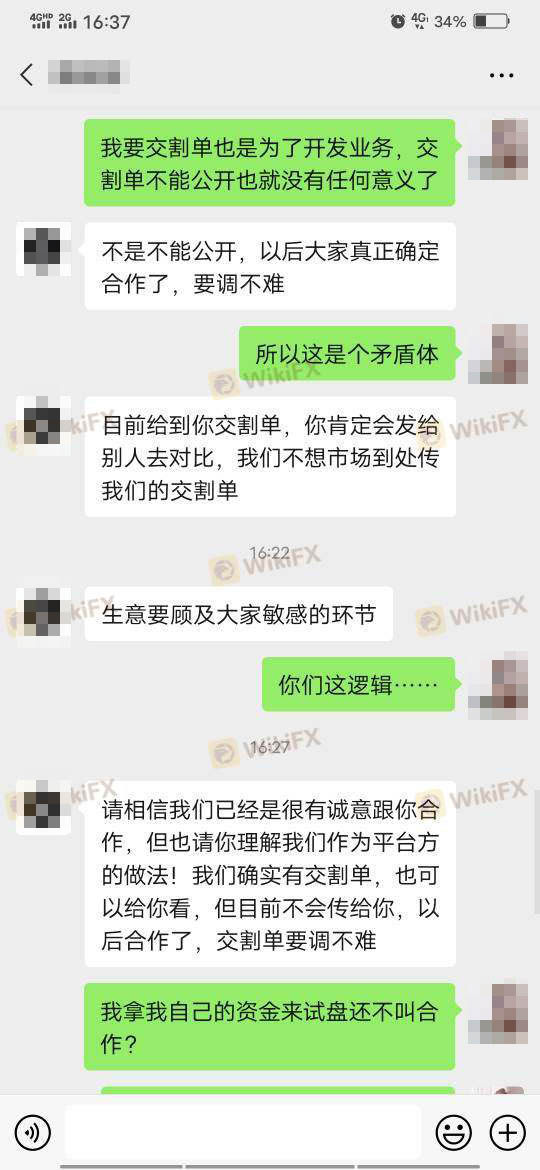

Fund security measures are not detailed in available sources. This includes client money segregation, deposit insurance coverage, and banking relationships. The absence of information about auditing practices, financial reporting, or third-party security certifications raises questions about operational transparency and client asset protection protocols.

Corporate governance information remains largely undocumented. This includes company ownership, management team backgrounds, and business history. Industry recognition through awards, certifications, or professional association memberships cannot be verified through standard research channels.

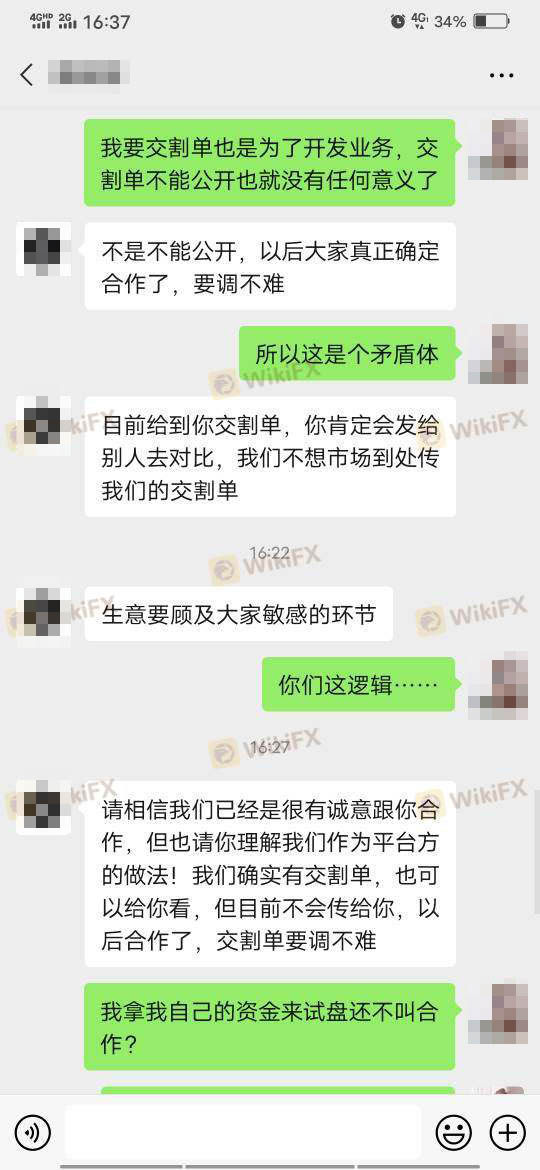

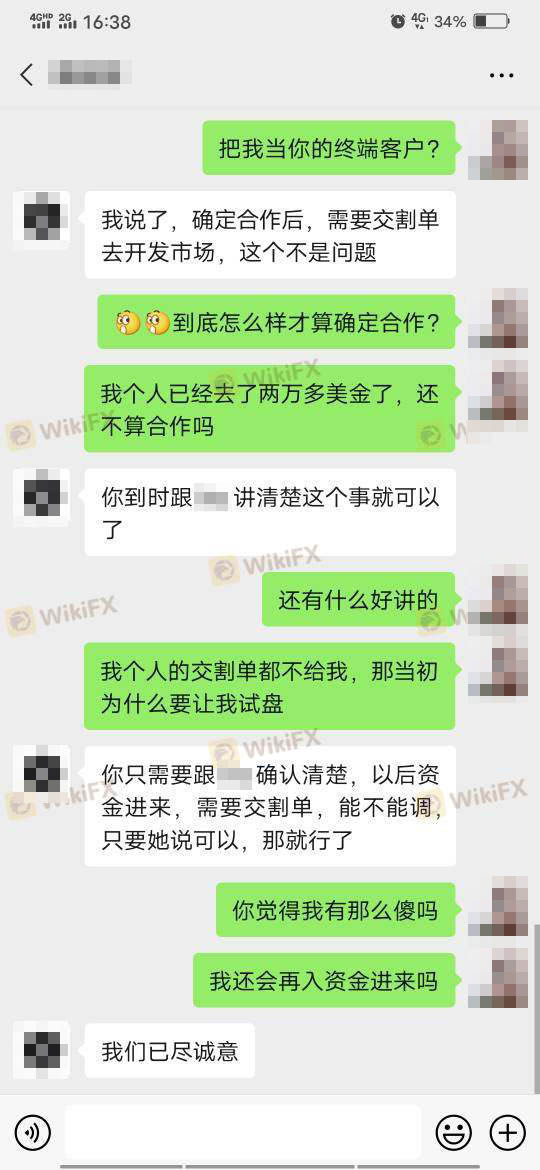

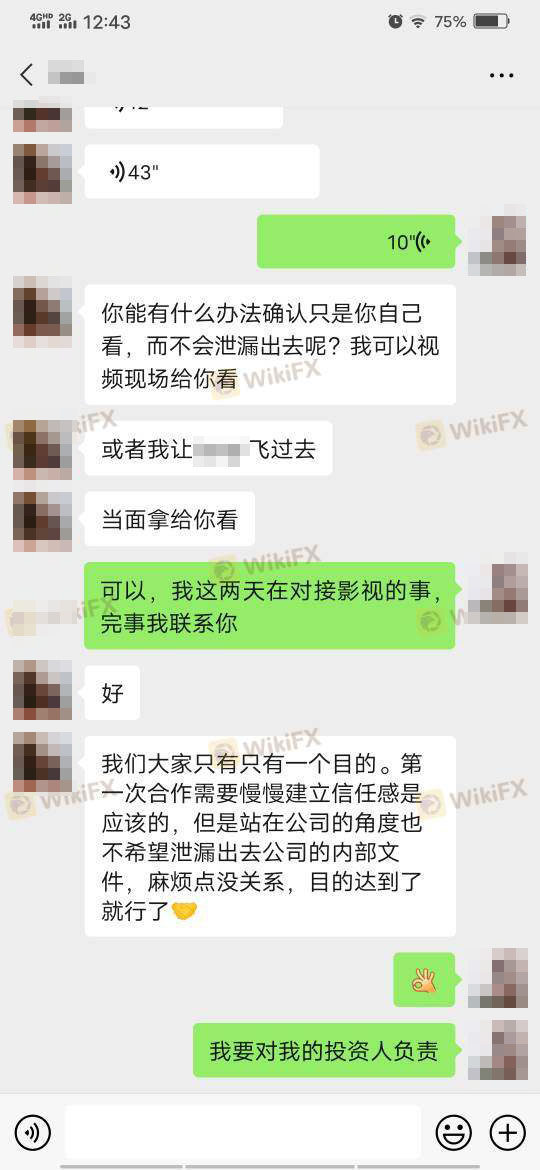

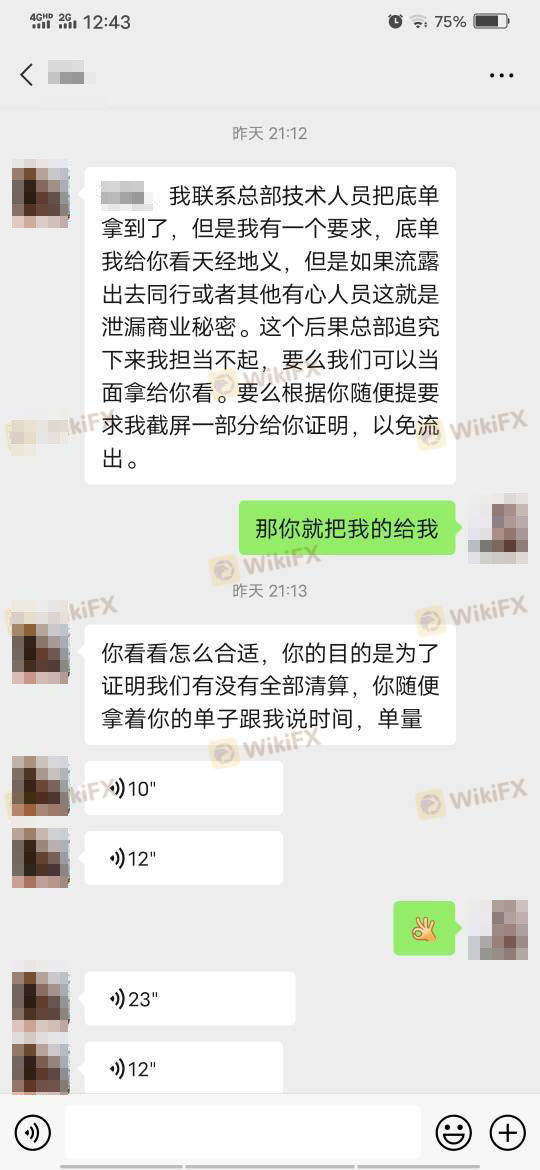

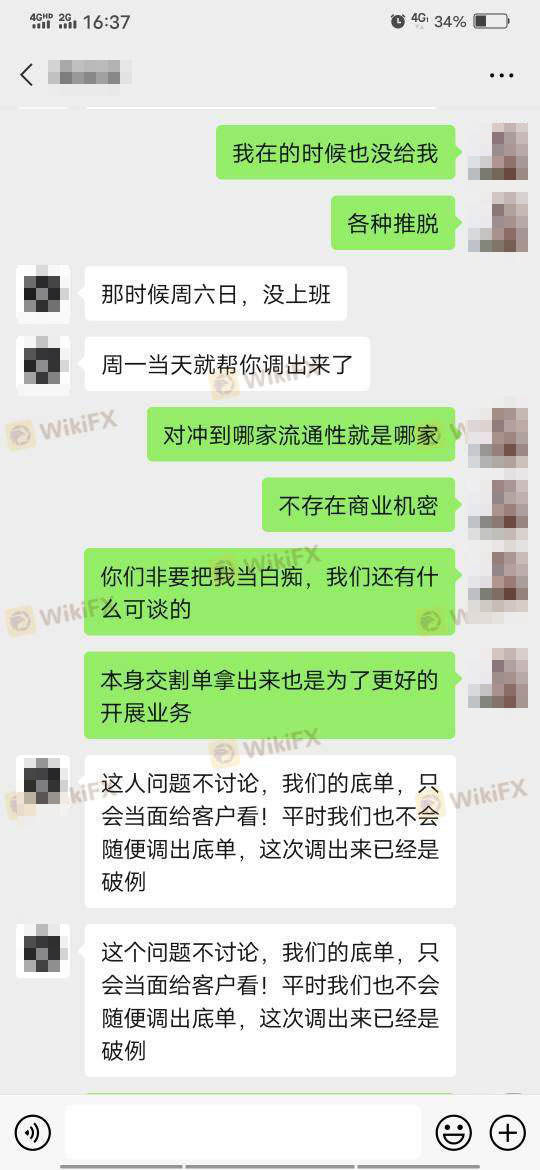

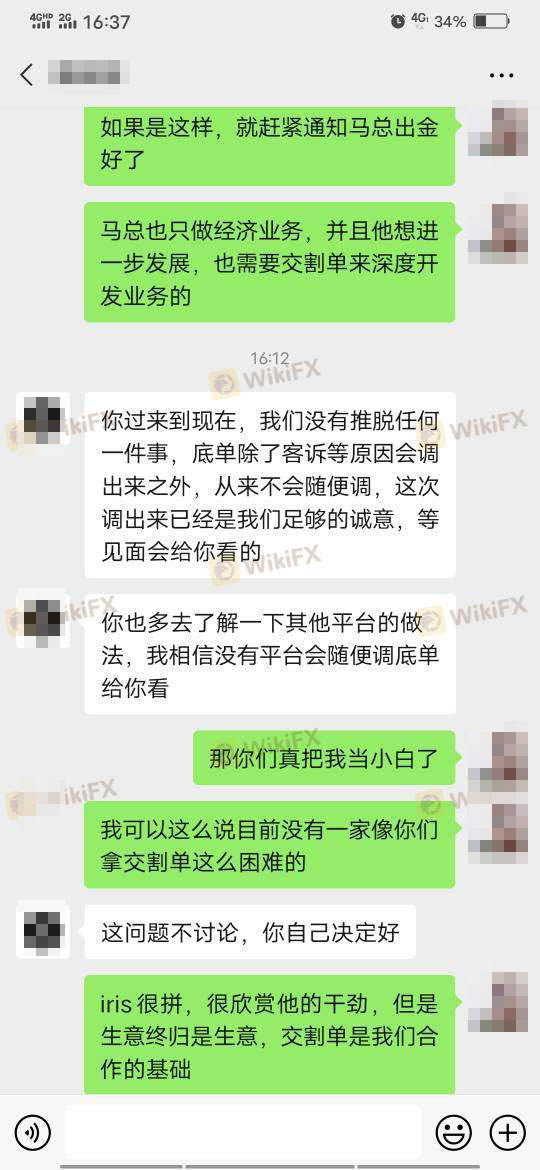

The lack of transparency regarding negative incidents, regulatory actions, or dispute resolution procedures further complicates trust evaluation. Without access to regulatory warnings, client complaints, or resolution statistics, potential traders cannot adequately assess the broker's reliability and ethical business practices.

User Experience Analysis

User experience assessment for Cpih encounters substantial limitations due to the absence of comprehensive user feedback and interface documentation. Overall user satisfaction metrics are not available through standard research channels. This lack of user-generated content makes it impossible to gauge real-world client experiences and satisfaction levels.

Interface design quality, navigation efficiency, and platform usability cannot be evaluated without access to demo accounts or user interface screenshots. Most modern brokers prioritize intuitive design and user-friendly interfaces, but Cpih's approach to user experience design remains unclear from available information. Registration and account verification processes lack detailed documentation about efficiency, required documentation, and approval timeframes.

The onboarding experience cannot be assessed without user feedback. This includes educational support for new traders and platform orientation. Common user complaints, technical issues, or service limitations are not documented in accessible sources. This prevents identification of potential problem areas or areas for improvement. The absence of user community features, social trading elements, or client feedback mechanisms further limits the comprehensive evaluation of overall user experience quality.

Conclusion

This Cpih review reveals significant information gaps that prevent a comprehensive evaluation of the broker's services and reliability. The absence of detailed information about regulatory status, trading conditions, platform features, and user experiences creates substantial uncertainty for potential clients. Without access to fundamental broker details such as licensing information, cost structures, and customer feedback, making informed trading decisions becomes extremely challenging.

The limited transparency and minimal public presence suggest that Cpih may not be positioned as a mainstream retail forex broker. Alternatively, it may operate with a very selective client approach. Potential traders should exercise extreme caution and conduct thorough independent verification before considering any engagement with this broker.