Ifdc 2025 Review: Everything You Need to Know

In this comprehensive review of Ifdc, we delve into the broker's offerings, user experiences, and expert opinions. Overall, Ifdc has garnered mixed reviews, with concerns raised about its regulatory status and customer service. However, it does offer a wide range of trading instruments and utilizes popular trading platforms like MT4, which may appeal to certain traders.

Note: It is crucial to be aware of the different entities operating under the Ifdc name across various jurisdictions. This review aims for fairness and accuracy by consolidating insights from multiple sources.

Rating Overview

We assess brokers based on their offerings, user feedback, and expert analyses.

Broker Overview

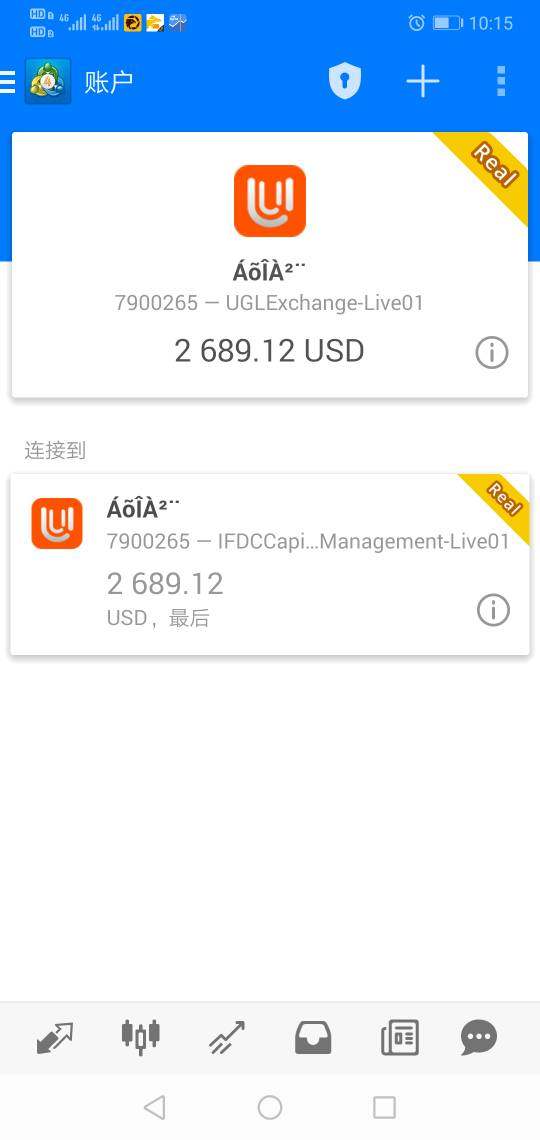

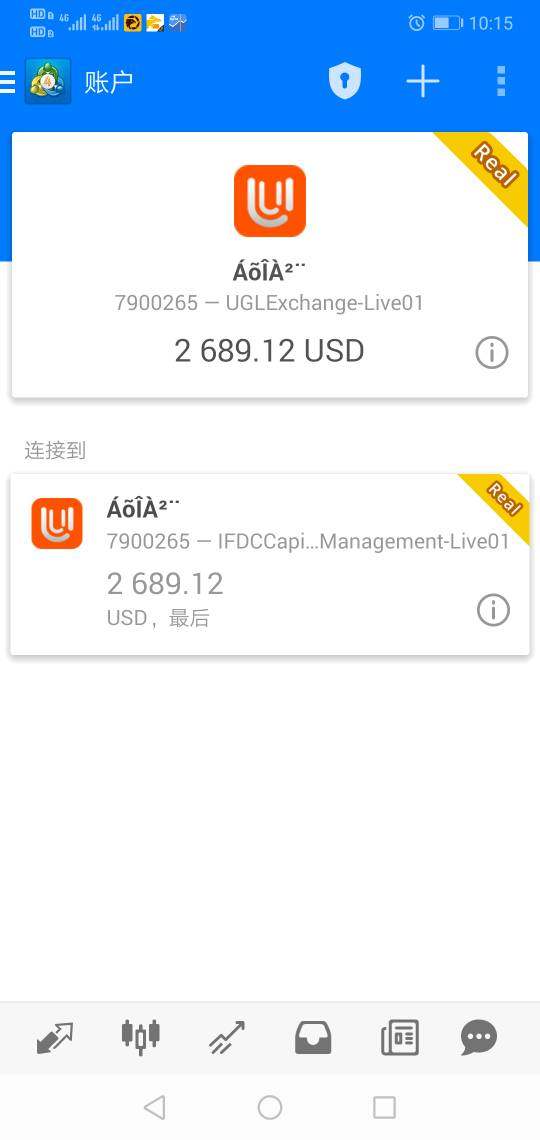

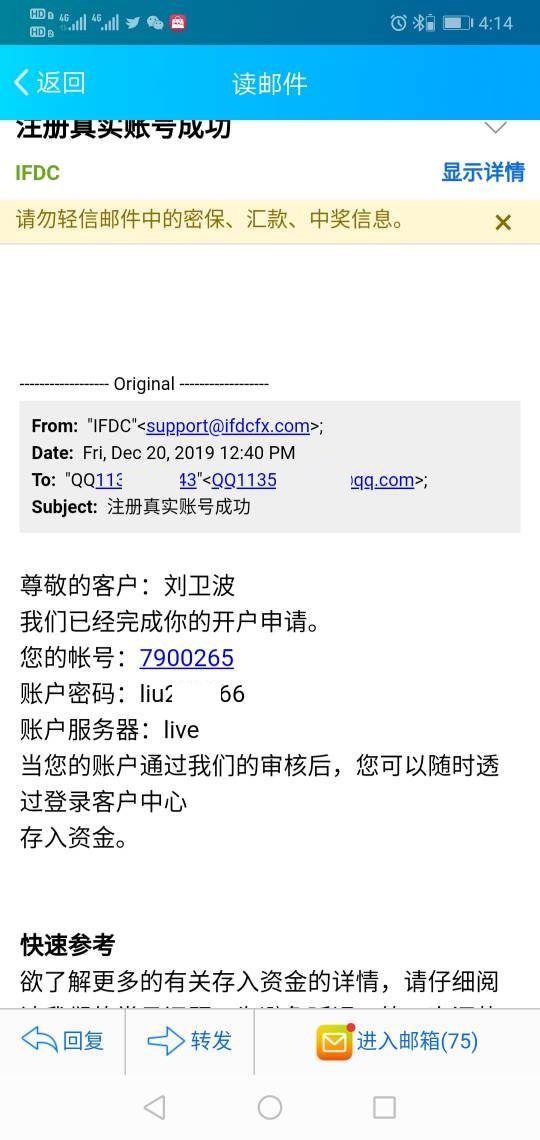

Founded in 2019, Ifdc operates under the name Ifdc Capital Management LLC, claiming to provide trading services in forex, commodities, and cryptocurrencies. The broker promotes the widely used MT4 trading platform, available on desktop and mobile devices. However, it has faced scrutiny regarding its regulatory status, as it claims to hold a license from the National Futures Association (NFA) but operates beyond its scope, raising concerns about its legitimacy.

Ifdc offers a variety of trading instruments, including forex pairs, commodities, and cryptocurrencies, but lacks clear information about its regulatory oversight. This lack of transparency may deter potential investors.

Detailed Insights

Regulatory Regions

Ifdc claims to operate under the NFA, but multiple sources indicate that it is unauthorized and lacks stringent regulation. This raises significant red flags for potential investors who prioritize safety and regulatory compliance. Given the broker's questionable regulatory status, traders should conduct thorough due diligence before engaging with Ifdc.

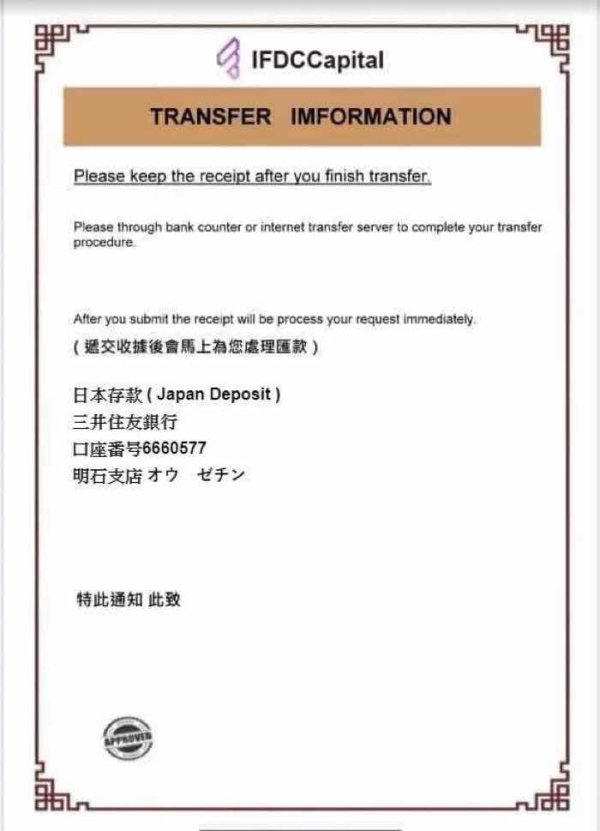

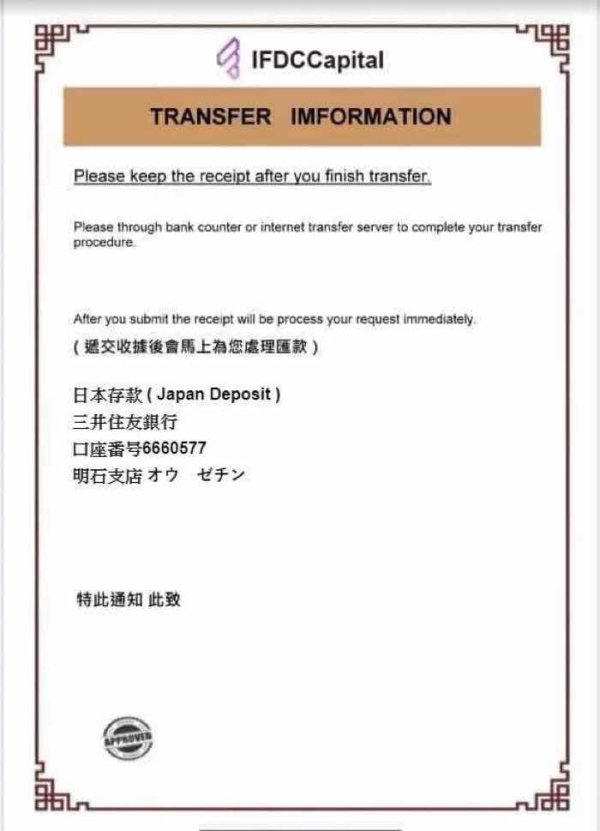

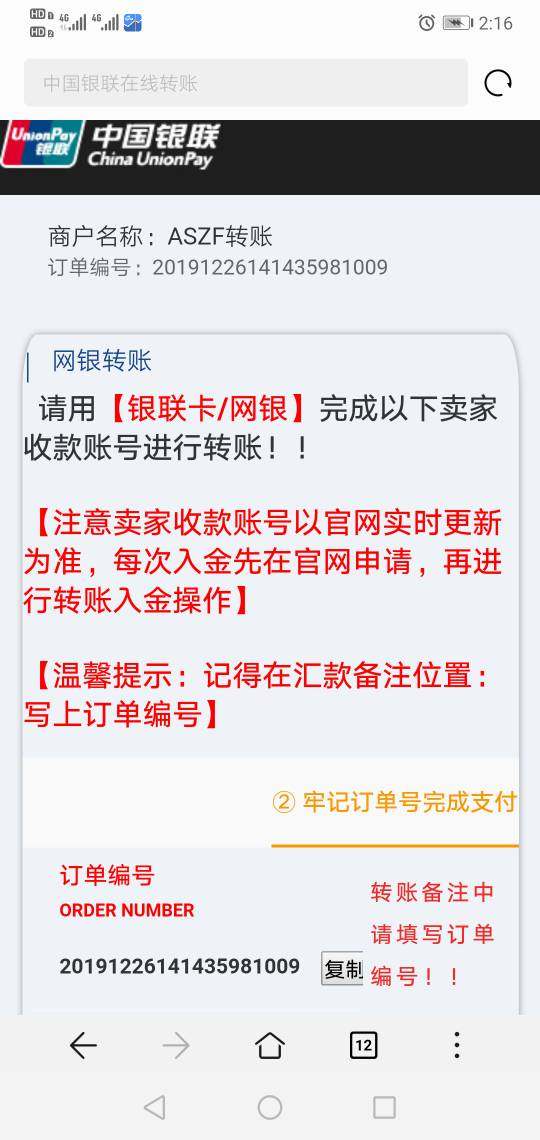

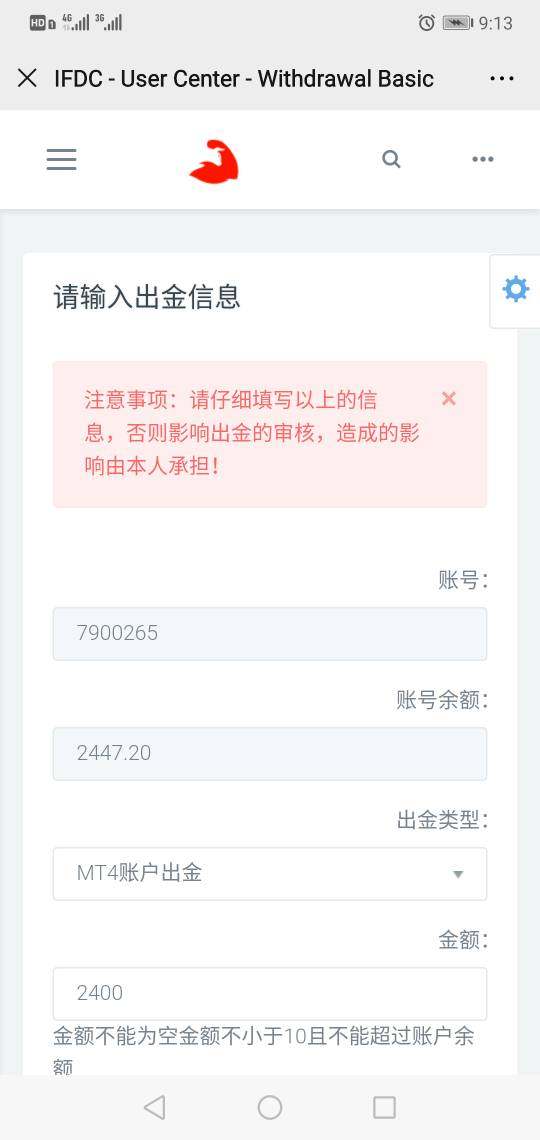

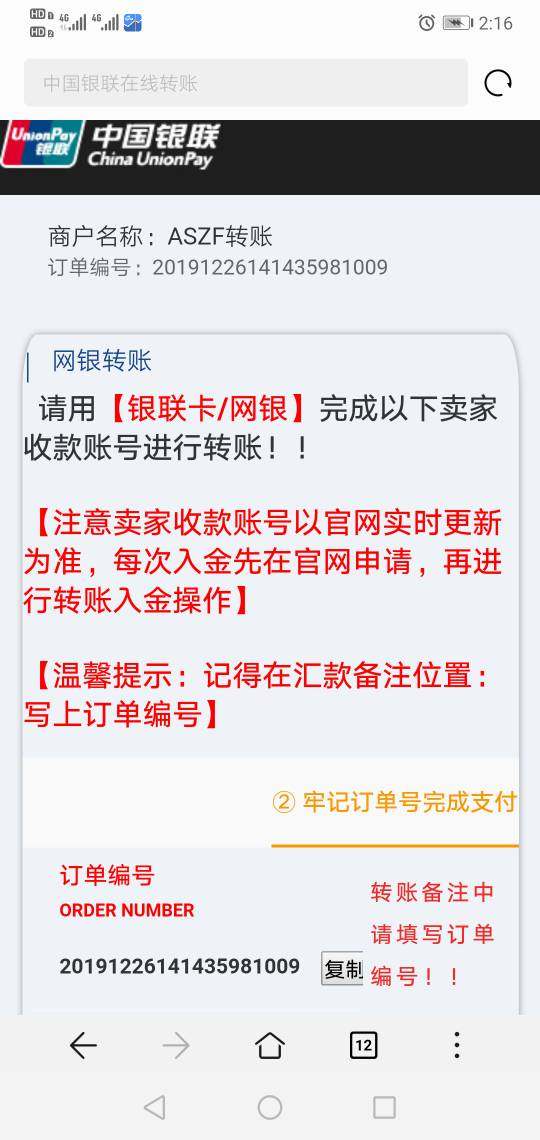

Deposit/Withdrawal Currencies and Methods

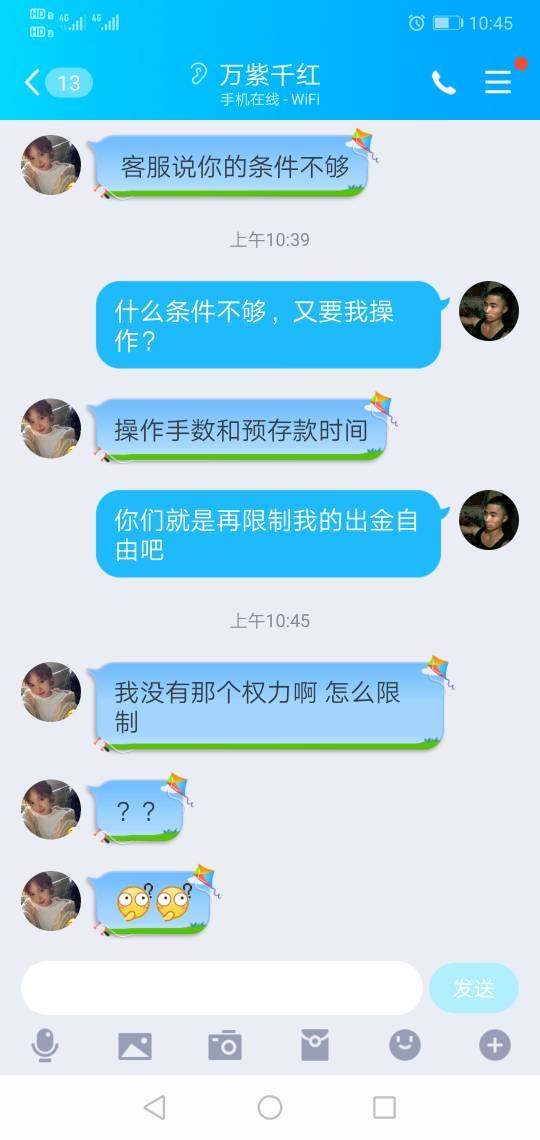

There is limited information available regarding the deposit and withdrawal methods accepted by Ifdc. The broker does not provide clear details on minimum deposit requirements, which can be a deterrent for new traders. Additionally, the absence of information regarding withdrawal times and fees further complicates the user experience.

Minimum Deposit

Information regarding the minimum deposit for opening an account with Ifdc is unclear. Several reviews indicate that the lack of transparency in this area could be a significant drawback, especially for novice traders looking to start with a small investment.

Ifdc does not seem to offer any substantial bonuses or promotions, which is a common practice among many brokers to attract new clients. The absence of such incentives may limit its appeal, especially when compared to competitors who provide attractive promotional offers.

Tradable Asset Classes

Ifdc claims to offer a wide range of tradable instruments, including forex, commodities, and cryptocurrencies. However, the lack of clarity regarding specific assets and trading conditions raises concerns about the broker's credibility and the quality of its offerings.

Costs (Spreads, Fees, Commissions)

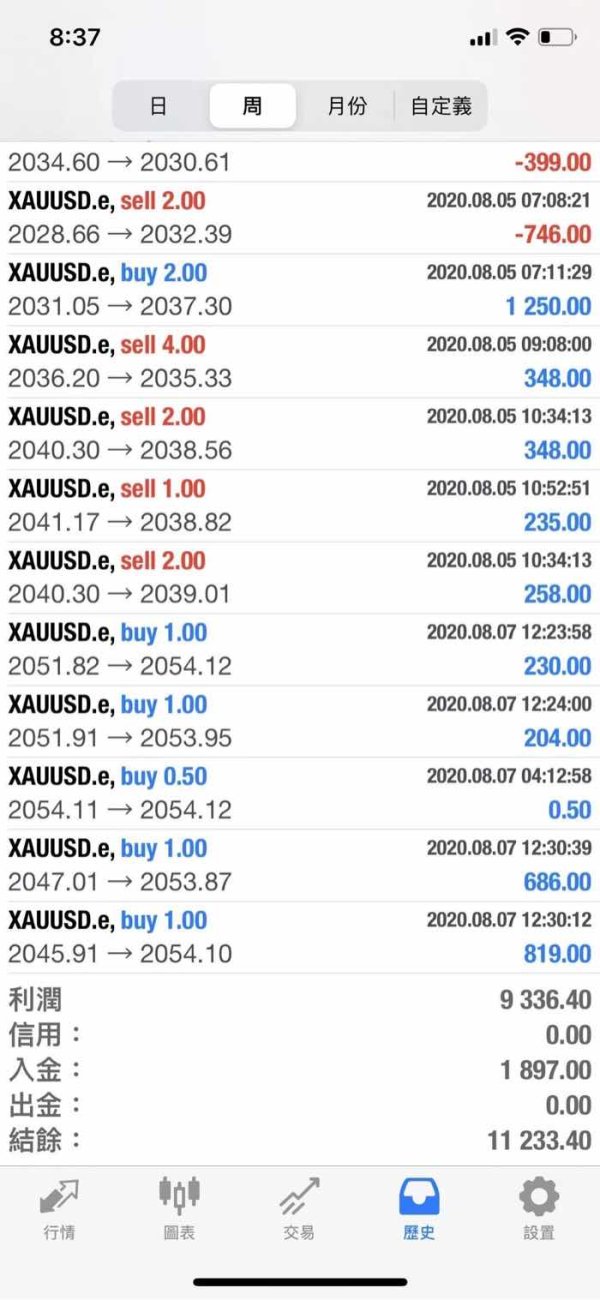

The information available on Ifdc's spreads, fees, and commissions is inconsistent. Some reviews mention that the broker offers floating spreads, but specific details are sparse. Additionally, the absence of clear commission structures can lead to confusion for potential traders.

Leverage

Ifdc reportedly offers leverage up to 1:500, which is considered high and often associated with increased risk. While high leverage can amplify profits, it can also lead to significant losses, especially for inexperienced traders.

Ifdc primarily utilizes the MT4 platform, which is popular among traders for its user-friendly interface and advanced charting tools. However, the absence of newer platforms like MT5 may limit the broker's appeal to more advanced traders looking for additional features.

Restricted Areas

Ifdc does not clearly specify the regions where it operates or any restrictions on trading. This lack of transparency could pose risks for traders in certain jurisdictions, as they may unknowingly engage with an unregulated entity.

Available Customer Support Languages

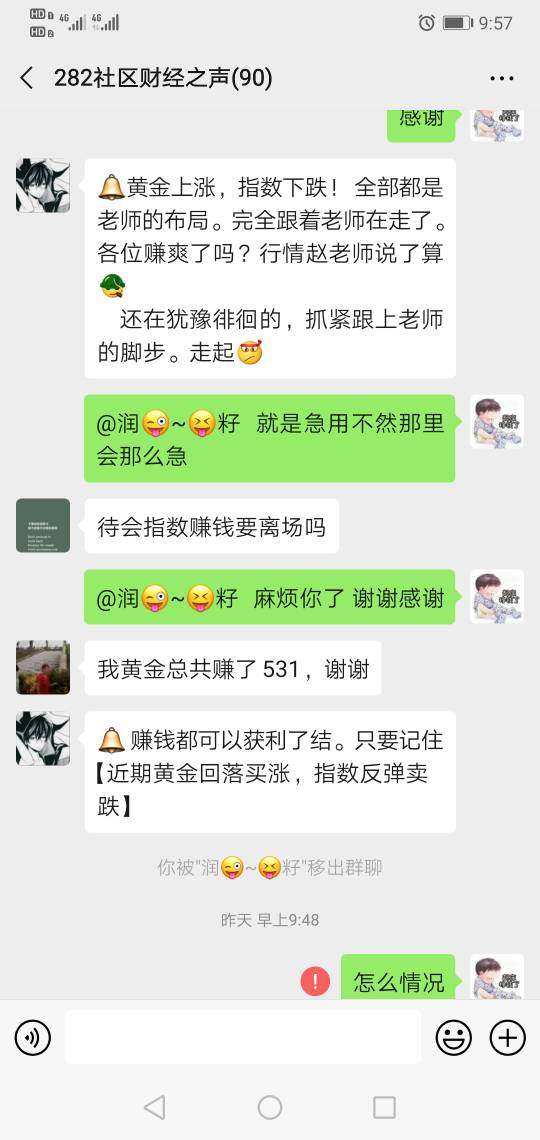

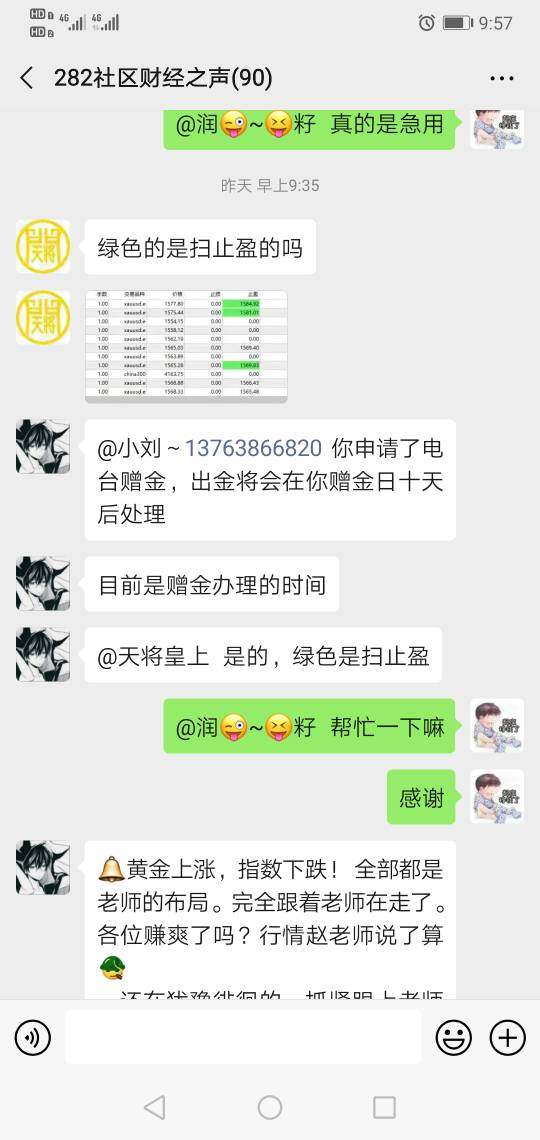

Customer support options at Ifdc appear limited, with reports indicating long response times and inadequate support for users facing issues. This can be a significant drawback for traders who require timely assistance, especially during volatile market conditions.

Rating Recap

Detailed Breakdown

-

Account Conditions (3.5/10): Ifdc lacks transparency regarding its account types and minimum deposits, leading to confusion for potential clients.

Tools and Resources (6.0/10): The availability of the MT4 platform provides traders with essential tools for analysis and execution, but the lack of newer platforms may limit its appeal.

Customer Service and Support (4.0/10): Reports of long response times and inadequate support raise concerns about the broker's commitment to customer service.

Trading Setup (Experience) (5.0/10): While the trading experience on MT4 is generally positive, the absence of clarity on spreads and commissions can lead to dissatisfaction.

Trust Level (2.0/10): Ifdc's questionable regulatory status and lack of transparency significantly impact its trustworthiness.

User Experience (4.5/10): User experiences vary, with some traders appreciating the platform's features while others express concerns about support and transparency.

In conclusion, Ifdc appears to be a broker with potential but is marred by significant concerns regarding its regulatory status and customer support. Traders should exercise caution and consider these factors when deciding whether to engage with Ifdc. Always prioritize safety and conduct thorough research before investing.