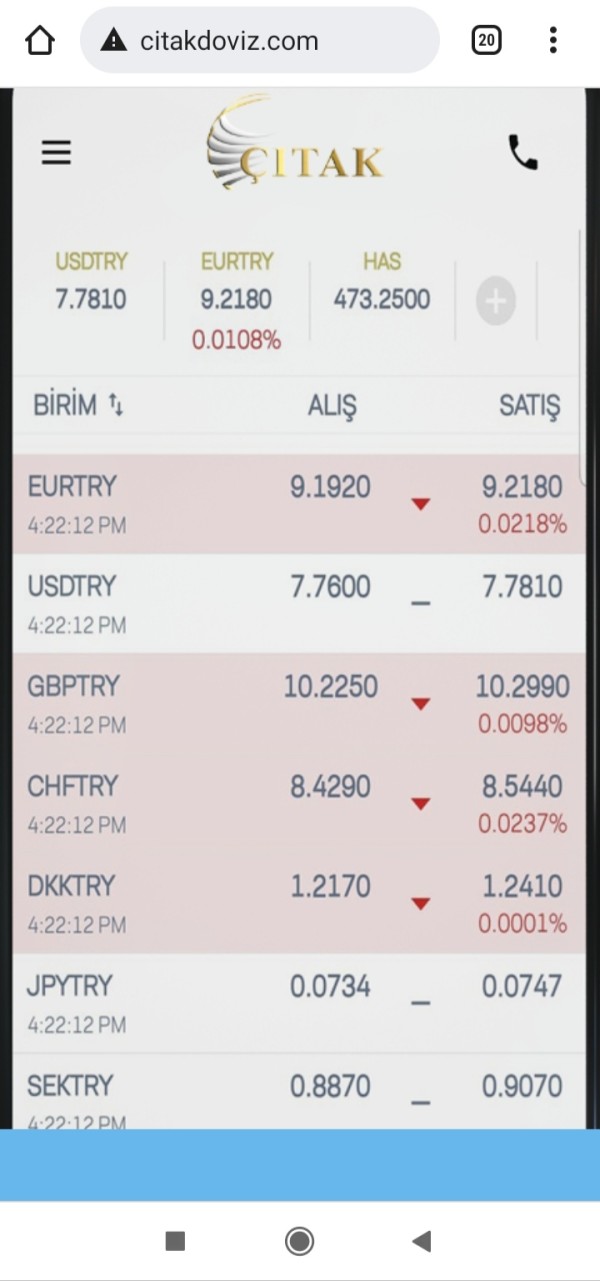

ÇITAK Review 1

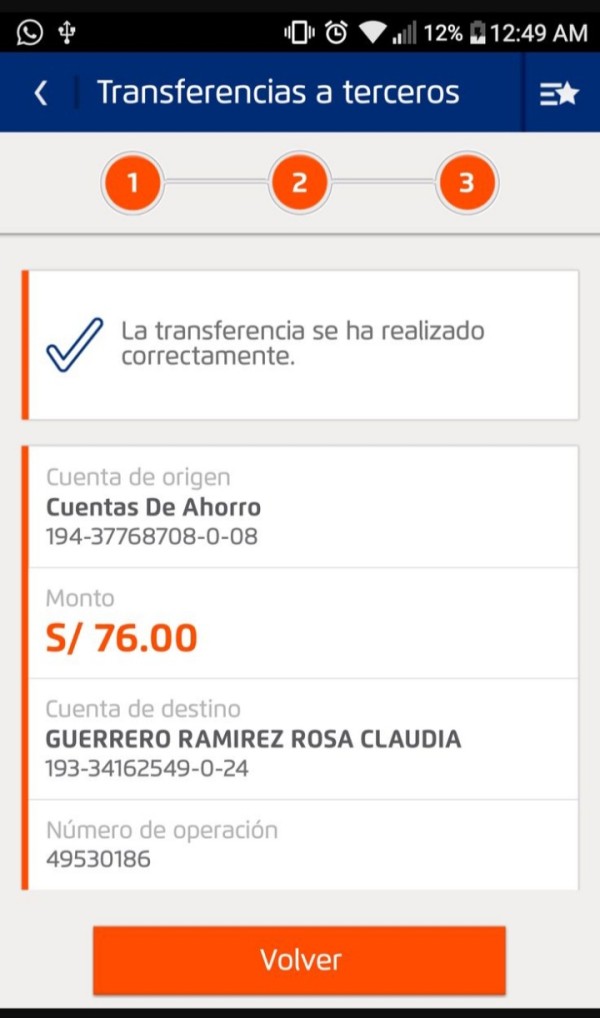

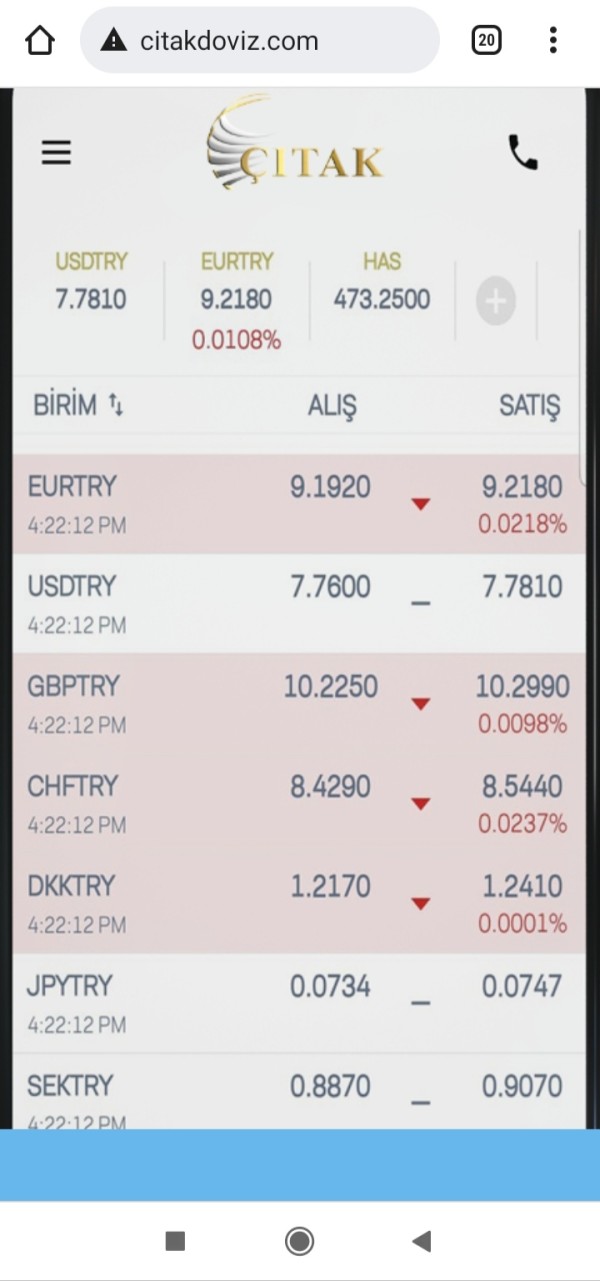

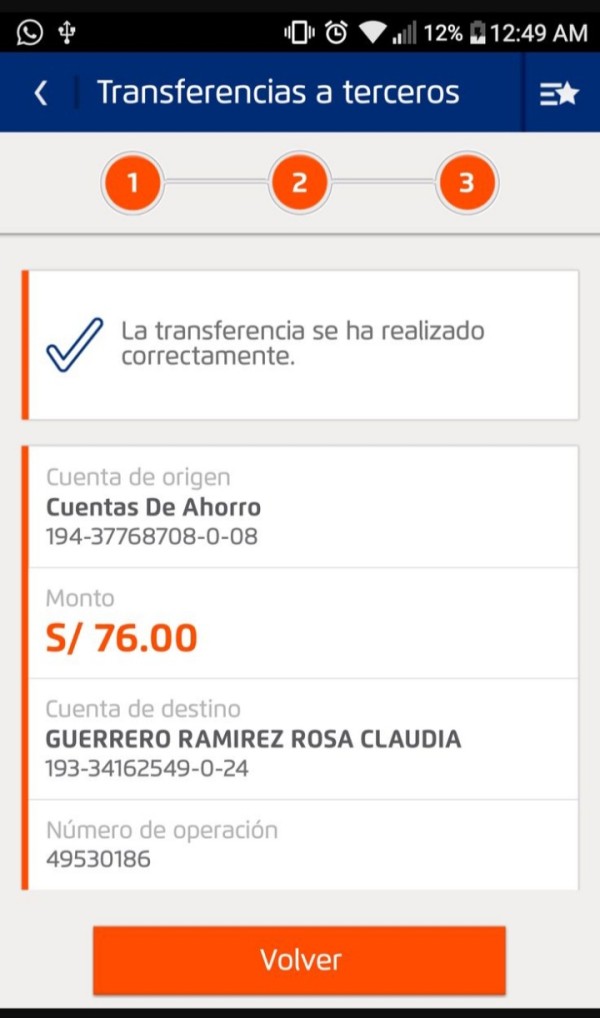

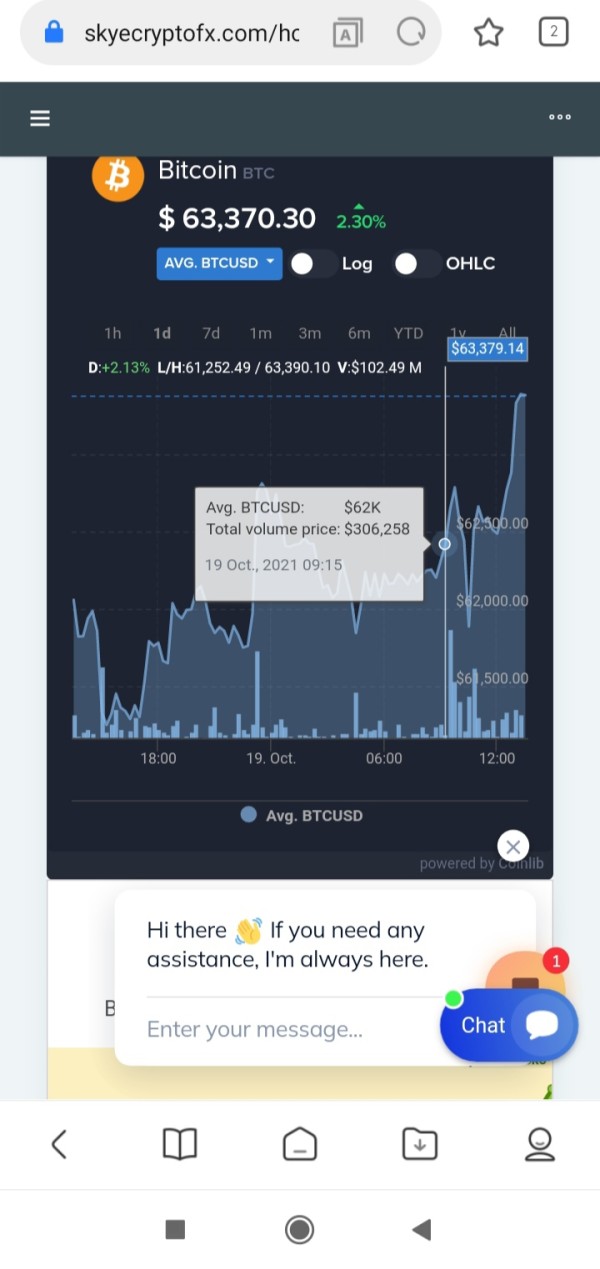

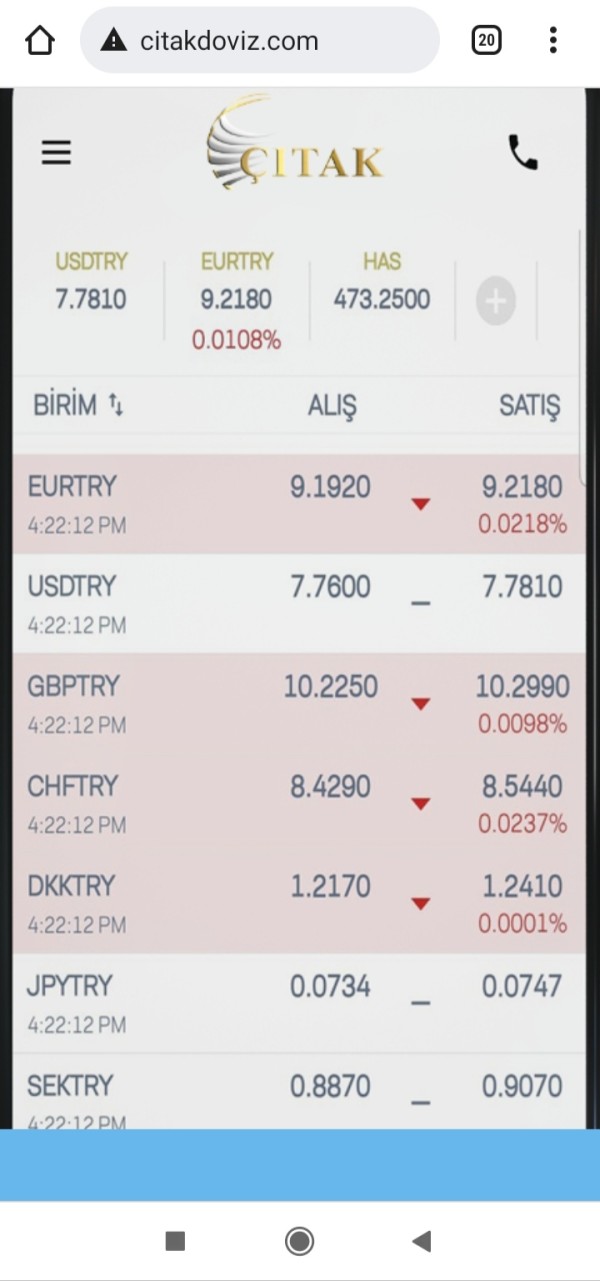

The operator manipulated the market and made it different from the real market. All the investment in my account was gone. They hided my investment of $76. I wanted to get a respond.

ÇITAK Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

The operator manipulated the market and made it different from the real market. All the investment in my account was gone. They hided my investment of $76. I wanted to get a respond.

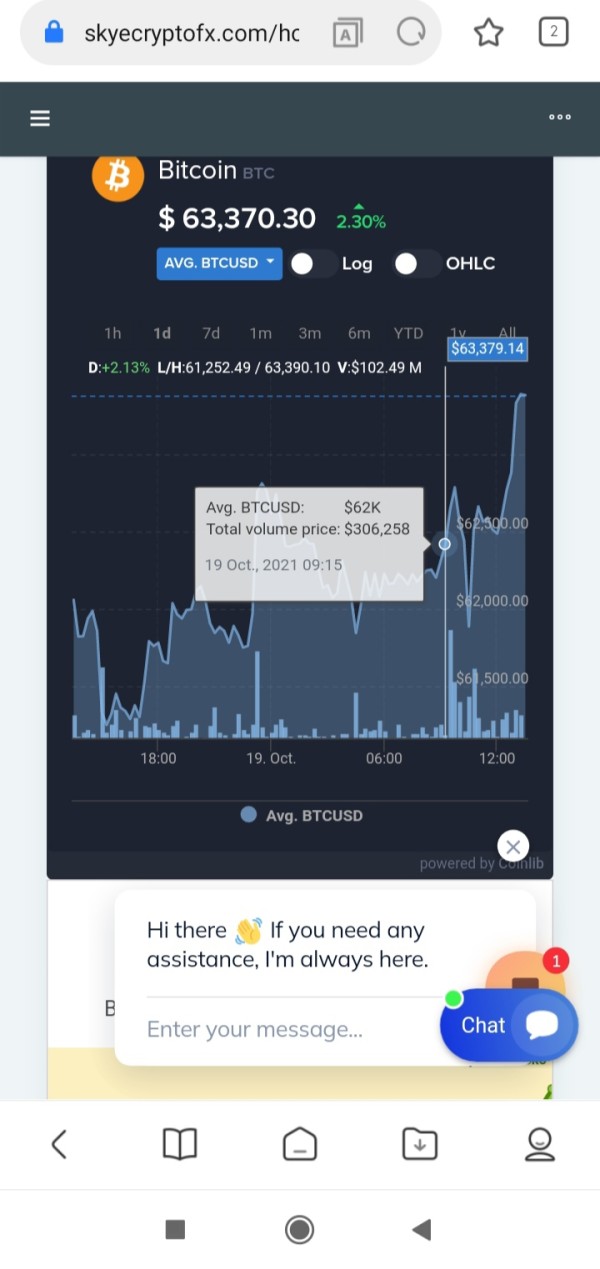

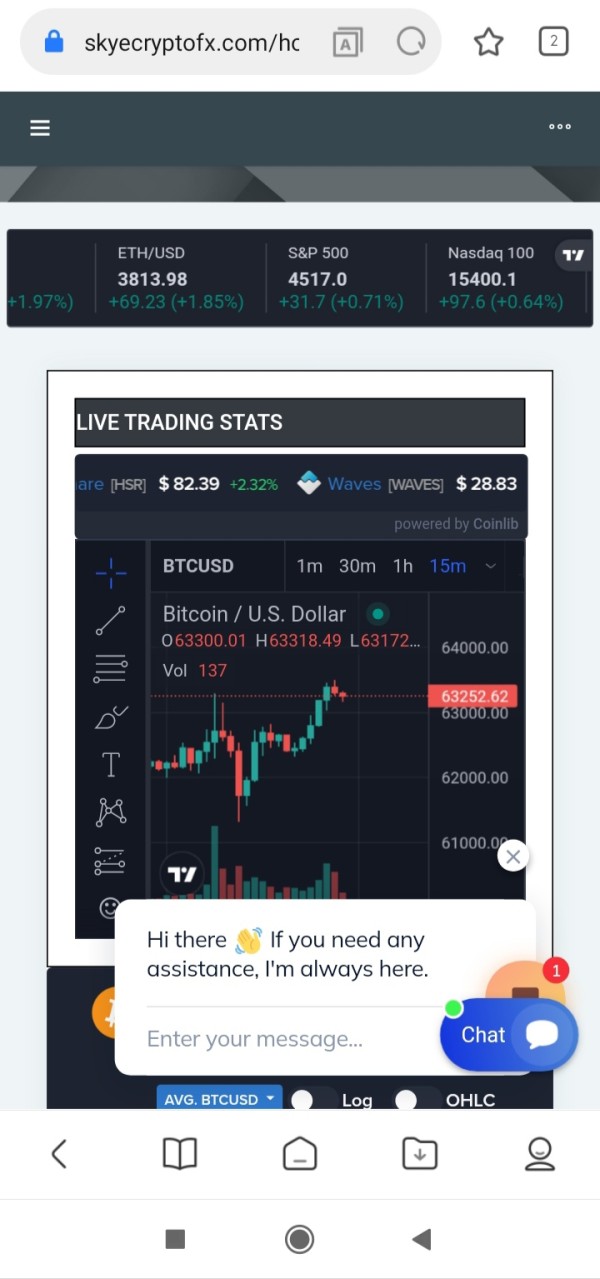

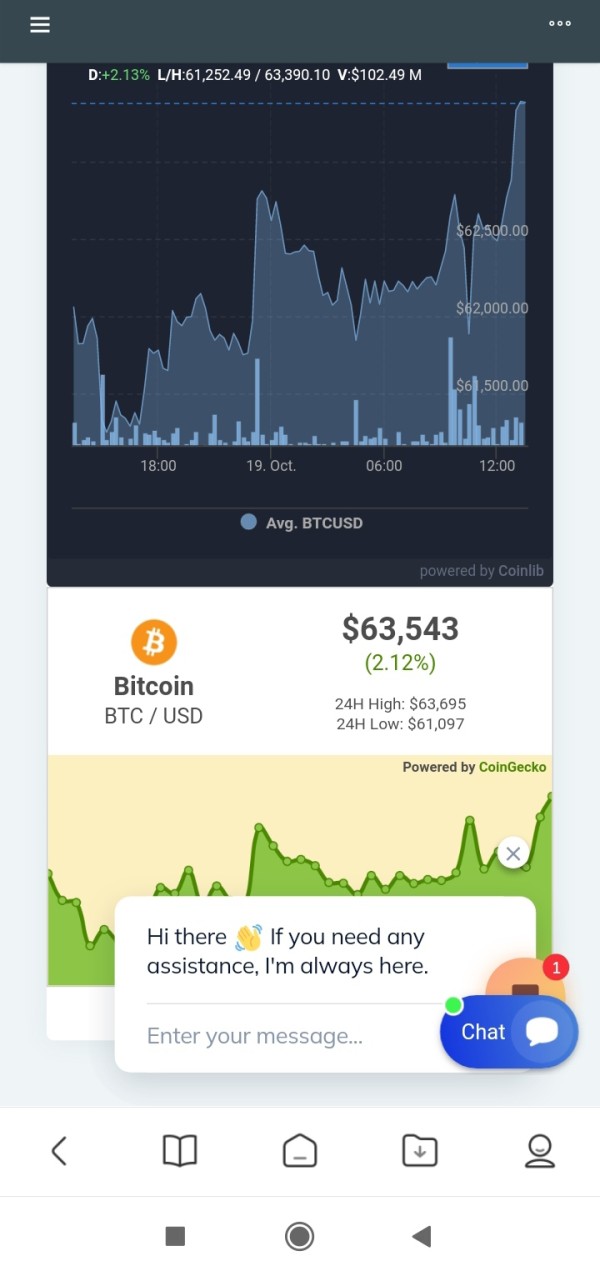

This Citak review shows concerning findings about a trading platform that has raised red flags among potential investors. Based on user feedback and market analysis, Citak appears to present major risks to traders, especially those seeking reliable and transparent trading services. The platform has been linked to potential fraudulent activities, as shown in various user reports mentioning the "Citidel Investment App" which may be connected to questionable business practices.

Our evaluation shows that while some trading entities with similar names operate in legitimate financial markets, the specific platform under review lacks transparency and regulatory clarity that professional traders require. The absence of clear regulatory information, combined with negative user experiences, makes this platform unsuitable for risk-averse investors. Traders considering this platform should exercise extreme caution and thoroughly verify all regulatory credentials before engaging with any services.

Important Notice

This review is based on available user feedback and publicly accessible information. Due to limited official documentation from the platform itself, our assessment relies heavily on user experiences and market reports. Potential users should note that information regarding regulatory status, trading conditions, and operational transparency remains unclear from available sources. Our evaluation methodology incorporates user testimonials, industry standards comparison, and available market data to provide an objective assessment of the platform's suitability for different trader profiles.

| Evaluation Criteria | Score | Rating Basis |

|---|---|---|

| Account Conditions | 3/10 | No specific account information available in sources |

| Tools and Resources | 2/10 | Limited information on trading tools and educational resources |

| Customer Service | 2/10 | No detailed customer service information provided |

| Trading Experience | 3/10 | Insufficient data on platform performance and user experience |

| Trust and Reliability | 2/10 | User reports indicate potential fraud risks |

| User Experience | 2/10 | Negative feedback from user evaluations |

According to available information, entities with similar naming conventions operate in the financial services sector. However, the specific platform under review lacks clear operational transparency. Citibrokers Inc, located in San Francisco, California, represents one such entity with 2-10 employees operating from 400 Treat Ave Suite H. This Citak review focuses on a platform that appears to be separate from established financial institutions, raising questions about its legitimacy and operational scope.

The platform's business model remains unclear from available sources. No specific information has been provided about trading instruments, execution methods, or client service approaches. Unlike established brokers that offer comprehensive multi-platform DMA execution, clearing, and settlement services across various asset classes, the platform under review lacks detailed operational information. This absence of transparency contrasts sharply with industry standards where reputable brokers provide extensive documentation about their services, regulatory compliance, and operational procedures.

Regulatory Status: Specific regulatory information remains unavailable in accessible sources. This presents a significant concern for potential users seeking regulated trading environments.

Deposit and Withdrawal Methods: No information regarding funding options or withdrawal procedures has been identified in available materials.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in accessible documentation.

Promotional Offers: No details about bonuses or promotional campaigns are available from reviewed sources.

Trading Assets: Information about available trading instruments and asset classes remains unspecified in current materials.

Cost Structure: Fee schedules, spreads, and commission structures are not detailed in available information. This makes cost comparison impossible.

Leverage Options: Leverage ratios and margin requirements are not specified in accessible sources.

Platform Options: Trading platform types and technological infrastructure details are not provided in available materials.

Geographic Restrictions: Regional availability and restrictions are not clearly outlined in reviewed sources.

Customer Support Languages: Multi-language support availability remains unspecified in current documentation.

This Citak review highlights the concerning lack of essential information that professional traders require when selecting a trading platform.

The evaluation of account conditions reveals significant information gaps that raise serious concerns about platform transparency. Account types and their respective features remain unspecified in available documentation. This contrasts sharply with industry standards where reputable brokers provide detailed breakdowns of different account tiers, their benefits, and associated requirements. Professional trading platforms typically offer multiple account categories designed for different trader profiles, from beginners to institutional clients.

Minimum deposit requirements are not disclosed in accessible sources. This makes it impossible for potential clients to assess affordability or compare costs with established competitors. The lack of financial transparency represents a significant red flag, as legitimate brokers typically provide clear pricing structures to help traders make informed decisions. The absence of information about account opening procedures, verification requirements, and documentation needs further compounds these concerns.

Special account features such as Islamic accounts, demo accounts, or institutional services are not mentioned in available materials. Established brokers routinely offer these specialized services to accommodate diverse client needs and regulatory requirements. The platform's failure to address these standard offerings suggests either limited service scope or inadequate communication of available features.

This Citak review emphasizes that the lack of clear account condition information makes it extremely difficult for traders to assess whether the platform meets their specific trading requirements and risk tolerance levels.

The assessment of trading tools and resources reveals a concerning absence of information that professional traders rely upon for informed decision-making. Trading tools variety and quality cannot be evaluated based on available sources. No specific information about charting capabilities, technical indicators, or analytical instruments has been provided. Reputable trading platforms typically showcase their technological capabilities and analytical tools as key differentiators in competitive markets.

Research and analysis resources appear to be unspecified in accessible documentation. This represents a significant limitation for traders who depend on market insights, economic calendars, and professional analysis to guide their trading decisions. Established brokers routinely provide comprehensive research departments, third-party analysis, and market commentary to support client trading activities.

Educational resources and training materials are not mentioned in available sources. This suggests either their absence or poor communication of available learning opportunities. Professional platforms typically invest heavily in trader education through webinars, tutorials, market analysis, and educational content designed to improve client trading skills and market understanding.

Automated trading support and algorithmic trading capabilities remain unaddressed in current materials. This limits assessment of the platform's suitability for sophisticated trading strategies. Modern trading environments increasingly support automated systems, expert advisors, and algorithmic trading approaches that many professional traders consider essential.

The absence of detailed information about these critical platform components raises questions about the platform's commitment to providing professional-grade trading services and supporting client success through comprehensive tools and educational resources.

Customer service evaluation reveals significant information gaps that prevent proper assessment of support quality and availability. Customer service channels and accessibility options are not specified in available documentation. This makes it impossible to determine how clients can contact support teams or resolve trading-related issues. Professional brokers typically provide multiple communication channels including phone, email, live chat, and dedicated account management for different client tiers.

Response times and service quality metrics remain unmeasured in accessible sources. This represents a critical information gap for traders who may require urgent assistance during volatile market conditions. Established trading platforms routinely publish service level agreements and response time commitments to demonstrate their dedication to client support.

Multi-language support capabilities are unspecified in current materials. This potentially limits accessibility for international traders who prefer communication in their native languages. Reputable global brokers typically offer support in multiple languages to serve diverse client bases effectively.

Customer service hours and availability schedules are not mentioned in available information. This makes it unclear whether support aligns with global trading hours or specific regional requirements. Professional platforms usually provide extended support hours that correspond with major trading sessions across different time zones.

The lack of customer service information raises concerns about the platform's ability to provide adequate support for traders who may encounter technical issues, account problems, or require assistance with trading procedures. This information gap represents a significant risk factor for potential clients who value reliable customer support as an essential component of their trading experience.

The evaluation of trading experience reveals substantial information deficiencies that prevent comprehensive assessment of platform performance and user satisfaction. Platform stability and execution speed cannot be verified from available sources. No user feedback or performance metrics have been documented regarding system reliability during peak trading hours or volatile market conditions. Professional trading platforms typically provide execution statistics and uptime guarantees to demonstrate their technological reliability.

Order execution quality and slippage performance remain unspecified in accessible documentation. This represents a critical gap for traders who prioritize precise order fulfillment and minimal execution delays. Established brokers routinely publish execution quality reports and transparency metrics to demonstrate their commitment to fair trading practices.

Platform functionality and feature completeness cannot be assessed based on current information. This makes it impossible to determine whether the platform provides essential trading tools such as advanced order types, risk management features, and portfolio analysis capabilities. Modern trading environments typically offer comprehensive functionality designed to support various trading strategies and risk management approaches.

Mobile trading experience and application quality are not addressed in available materials. Mobile trading represents an increasingly important component of modern trading infrastructure. Professional platforms invest significantly in mobile technology to ensure traders can manage positions and monitor markets regardless of their location.

This Citak review emphasizes that the absence of detailed trading experience information makes it extremely difficult for potential users to assess whether the platform can meet their performance expectations and trading requirements. The lack of user testimonials and performance data represents a significant concern for traders seeking reliable trading environments.

Trust assessment reveals the most concerning aspects of this platform evaluation, with multiple indicators suggesting significant reliability issues. Regulatory credentials and licensing information remain unverified in available sources. This represents a fundamental concern for traders seeking regulated trading environments. Legitimate brokers typically prominently display their regulatory licenses, supervisory authorities, and compliance frameworks to demonstrate their commitment to regulatory oversight.

Fund security measures and client protection protocols are unspecified in accessible documentation. This raises serious questions about asset safety and segregation practices. Professional brokers routinely detail their client fund protection measures, including segregated accounts, deposit insurance, and regulatory capital requirements designed to protect client assets.

Corporate transparency and operational disclosure appear limited based on available information. There are insufficient details about company ownership, financial backing, and operational history. Established financial institutions typically provide comprehensive corporate information, annual reports, and regulatory filings that enable clients to assess institutional stability.

Industry reputation and third-party verification cannot be confirmed from current sources. No independent ratings, regulatory actions, or industry recognition have been documented. Reputable brokers typically accumulate industry awards, regulatory commendations, and third-party certifications that validate their operational standards and client service quality.

Negative incident handling and user complaint resolution appear problematic based on available user feedback suggesting potential fraudulent activities associated with related platforms. The presence of fraud warnings and negative user experiences represents a significant red flag that potential clients should carefully consider before engaging with the platform.

User experience evaluation reveals predominantly negative feedback and concerning user reports that significantly impact the platform's overall assessment. Overall user satisfaction appears compromised based on available feedback suggesting potential fraudulent activities and operational concerns. Unlike established brokers that typically maintain positive user communities and testimonial databases, this platform appears to generate negative user experiences.

Interface design and usability cannot be properly assessed due to limited information about platform accessibility and user interface quality. Professional trading platforms typically invest heavily in user experience design, ensuring intuitive navigation, customizable layouts, and efficient workflow management for traders of varying experience levels.

Registration and verification processes remain unclear from available sources. This makes it difficult to assess onboarding efficiency and account setup convenience. Established brokers typically streamline these processes while maintaining necessary compliance requirements and security protocols.

Funding operation experiences are not documented in accessible materials. This prevents assessment of deposit and withdrawal convenience, processing times, and associated costs. Professional platforms usually provide detailed information about funding options and processing procedures to ensure client convenience.

Common user complaints appear to focus on legitimacy concerns based on available feedback suggesting potential fraud risks and operational transparency issues. This pattern of negative feedback contrasts sharply with reputable brokers that typically maintain positive user relationships and transparent communication practices.

The concentration of negative feedback and fraud-related concerns suggests that this platform may not provide the reliable, professional trading environment that serious traders require for successful trading activities.

This comprehensive Citak review reveals significant concerns that make the platform unsuitable for most traders, particularly those prioritizing safety, transparency, and regulatory compliance. The evaluation highlights numerous red flags including lack of regulatory clarity, absence of essential operational information, and user reports suggesting potential fraudulent activities.

The platform is not recommended for risk-averse investors or traders seeking regulated, transparent trading environments. The absence of clear regulatory credentials, combined with negative user feedback and operational opacity, creates an unacceptable risk profile for professional trading activities.

Primary disadvantages include potential fraud risks, lack of transparency, insufficient operational disclosure, and concerning user experiences. These factors collectively suggest that traders would be better served by established, regulated brokers that provide comprehensive operational transparency, regulatory oversight, and positive user experiences essential for successful trading activities.

FX Broker Capital Trading Markets Review