Executive Summary

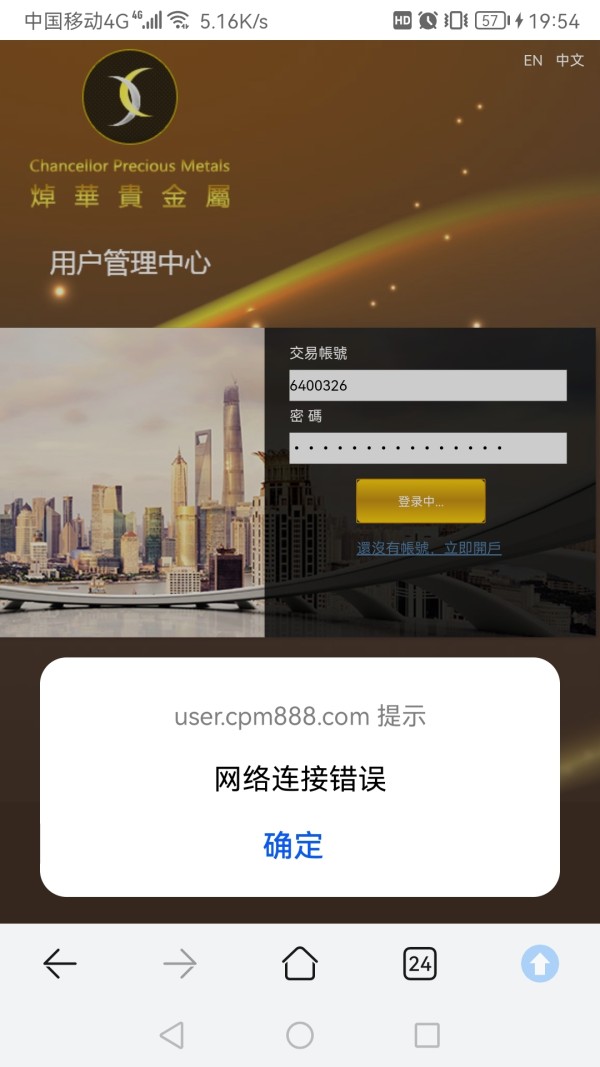

This comprehensive chancellor precious metals review reveals significant concerns about this Hong Kong-based trading company. Potential investors should be very careful before choosing this broker. Chancellor Precious Metals Limited was established in 2008 and operates under a "temporarily non-regulatory" status. This raises immediate red flags for traders seeking secure and compliant trading environments.

According to WikiFX reports, the broker has received a concerning user rating of 3 out of 10. Multiple complaints exist regarding customer fund misappropriation and fraudulent activities. The broker offers MT4 trading platform access with a minimum deposit requirement of $200. This positions itself toward traders willing to accept higher risk levels.

However, the lack of proper regulatory oversight creates serious problems. Combined with documented user complaints about fund withdrawal issues and alleged defrauding of customers, this makes the broker unsuitable for most retail traders. Our analysis indicates that Chancellor Precious Metals presents substantial risks that outweigh any potential benefits. This is particularly true given the availability of well-regulated alternatives in the competitive forex market.

Important Notice

Due to Chancellor Precious Metals' current regulatory status being classified as "temporarily non-regulatory" with regulated time of less than one year, investors must exercise extreme caution. The regulatory framework surrounding this entity remains incomplete and potentially unreliable. This creates significant uncertainty for client fund protection and dispute resolution mechanisms.

This review is based on comprehensive analysis of publicly available information, user feedback from multiple sources including WikiFX, and industry reports. Given the rapidly changing nature of regulatory environments and the documented concerns surrounding this broker, readers should verify all information independently. They should also consider seeking advice from qualified financial professionals before making any investment decisions.

Rating Framework

Broker Overview

Chancellor Precious Metals Limited first incorporated in 2008 in the Hong Kong Special Administrative Region. This marks over 15 years of operation in the financial services sector. Despite this relatively long operational history, the company operates as a trading company rather than a fully licensed financial services provider.

This significantly impacts its regulatory standing and client protection capabilities. The broker's business model focuses primarily on forex trading services. However, the scope and depth of these services remain limited compared to established industry leaders.

According to available company information, Chancellor Precious Metals positions itself within the competitive Hong Kong financial services market. The company leverages the region's strategic location and financial infrastructure. However, the company's current operational status raises questions about its commitment to regulatory compliance and client protection standards.

These standards are typically expected from reputable financial service providers. The broker's primary offering centers around forex trading through the MetaTrader 4 platform. It targets individual retail traders and potentially institutional clients.

The company maintains a physical presence in Hong Kong, with contact information including a dedicated hotline. However, comprehensive customer support infrastructure details remain unclear. This chancellor precious metals review reveals that while the broker has maintained operations for over a decade, its regulatory evolution has not kept pace with industry standards.

Regulatory Status

Chancellor Precious Metals currently operates under "temporarily non-regulatory" status. WikiFX data shows regulated time listed as less than one year. This regulatory classification represents a significant concern for potential clients.

It indicates the absence of comprehensive oversight from recognized financial authorities.

Minimum Deposit Requirements

The broker requires a minimum deposit of $200 to open trading accounts. This falls within reasonable ranges compared to industry standards. However, the lack of detailed account tier information makes it difficult to assess the full cost structure.

Available Assets

Chancellor Precious Metals primarily focuses on forex trading. Specific details about currency pairs, exotic options, and other tradable instruments are not comprehensively detailed in available documentation.

The broker provides access to the MetaTrader 4 platform. This remains a popular choice among retail forex traders. However, information about platform customization, additional tools, or proprietary features is limited.

Cost Structure

Critical information regarding spreads, commissions, overnight fees, and other trading costs is notably absent from available sources. This makes cost comparison with competitors challenging for potential clients.

Leverage Options

Specific leverage ratios and margin requirements are not detailed in the available information. This represents a significant information gap for traders evaluating risk management parameters.

Payment Methods

Details about deposit and withdrawal methods, processing times, and associated fees are not specified in current documentation. This is essential information for operational trading decisions.

Geographic Restrictions

Information about regional availability and restrictions for different jurisdictions is not clearly outlined in available sources.

This chancellor precious metals review highlights the concerning lack of transparency in key operational areas. Traders typically require this information for informed decision-making.

Account Conditions Analysis

The account conditions offered by Chancellor Precious Metals present a mixed picture with several concerning gaps in available information. With a minimum deposit requirement of $200, the broker positions itself as accessible to retail traders. However, this relatively low barrier to entry may also attract less experienced investors who might be more vulnerable to the risks associated with an inadequately regulated platform.

The absence of detailed information about different account types represents a significant transparency issue. Most reputable brokers offer tiered account structures with varying benefits, features, and requirements. The lack of such information makes it impossible for potential clients to understand what services and protections they might receive at different investment levels.

Account opening procedures and verification requirements are not clearly outlined in available documentation. This raises questions about the broker's compliance with international anti-money laundering and know-your-customer standards. These processes are typically well-documented by legitimate brokers as part of their regulatory compliance frameworks.

Special account features such as Islamic accounts, demo accounts, or professional trader classifications are not mentioned in available sources. This limitation suggests either a basic service offering or inadequate disclosure of available options. User feedback indicates dissatisfaction with account-related services, though specific details about account management issues are not comprehensively documented.

The scoring of 4/10 for account conditions reflects these transparency issues and the concerning regulatory status that undermines confidence in account protection measures. This chancellor precious metals review emphasizes that potential clients should seek detailed account documentation before considering any deposits.

Chancellor Precious Metals' tools and resources offering appears limited based on available information. It centers primarily around the MetaTrader 4 platform. While MT4 remains a respected trading platform with robust charting capabilities, technical indicators, and automated trading support, the broker's implementation and additional resource provision remain unclear.

The absence of detailed information about research resources, market analysis, economic calendars, or educational materials represents a significant limitation for traders. Most established brokers provide daily market commentary, technical analysis, fundamental research, and educational webinars to support their clients' trading decisions.

Automated trading capabilities through MT4's Expert Advisors functionality should theoretically be available. However, specific policies regarding algorithmic trading, VPS services, or strategy development resources are not documented. This lack of clarity creates uncertainty for traders who depend on automated systems.

Educational resources appear to be absent or inadequately promoted. This is particularly concerning given the broker's regulatory status. Reputable brokers typically invest heavily in client education as both a service differentiator and risk management tool, helping clients make more informed trading decisions.

The availability of mobile trading applications, web-based platforms, or additional trading tools beyond the standard MT4 offering is not clearly communicated. Modern traders expect multi-platform accessibility and comprehensive trading tool suites that adapt to different trading styles and market conditions.

User feedback suggests disappointment with the overall tool and resource provision. However, specific deficiencies are not detailed in available reviews. The 5/10 rating reflects the basic MT4 provision while acknowledging the significant gaps in comprehensive trading support resources.

Customer Service and Support Analysis

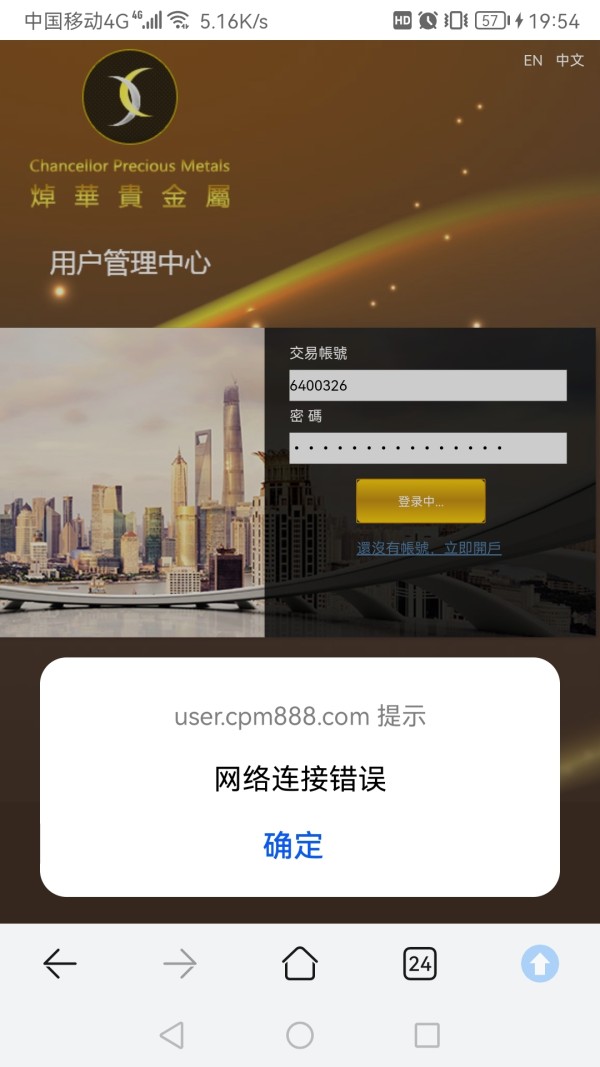

Customer service and support represent critical areas of concern for Chancellor Precious Metals. Available evidence suggests significant deficiencies in this essential business function. The broker provides a Hong Kong-based hotline as the primary contact method, though the availability of alternative communication channels such as live chat, email support, or comprehensive FAQ resources remains unclear.

Response times and service quality metrics are not documented. User feedback indicates substantial dissatisfaction with customer service experiences. According to WikiFX reports, clients have reported difficulties with fund withdrawals and communication with company representatives.

This suggests systematic customer service failures rather than isolated incidents.

The absence of clearly documented customer service hours, multilingual support options, or escalation procedures represents a significant operational weakness. Professional forex brokers typically maintain 24/5 customer support during market hours, with clear communication protocols and multiple contact options to accommodate diverse client needs.

User complaints documented on various platforms indicate more serious issues than typical service quality concerns. Reports include unresponsive customer service during critical situations involving fund access and account management. These reports suggest that customer service deficiencies may be symptomatic of broader operational and ethical issues within the organization.

The lack of transparent dispute resolution procedures or regulatory oversight mechanisms compounds customer service concerns. Clients may have limited recourse when standard service channels fail to resolve issues satisfactorily. Professional brokers typically provide clear escalation paths and maintain relationships with regulatory bodies or ombudsman services for dispute resolution.

The 3/10 rating for customer service reflects these documented deficiencies and the concerning pattern of user complaints. These suggest systematic rather than occasional service failures.

Trading Experience Analysis

The trading experience offered by Chancellor Precious Metals presents several areas of concern that significantly impact the overall client experience. While the broker provides access to the MetaTrader 4 platform, which offers solid basic functionality for forex trading, the lack of detailed information about execution quality, slippage rates, and order processing creates uncertainty about actual trading conditions.

Platform stability and performance metrics are not documented or independently verified. User feedback suggests issues with overall trading experience quality. The absence of specific data about average execution speeds, requote rates, or slippage statistics makes it difficult for traders to assess whether the platform can meet their performance requirements.

This is particularly true for scalping or high-frequency trading strategies.

Order execution quality represents a critical factor in trading success. Yet Chancellor Precious Metals provides no transparent information about their execution model, liquidity providers, or order routing procedures. Professional brokers typically disclose whether they operate as market makers, use electronic communication networks, or employ straight-through processing models.

The availability of advanced order types, partial fills, or sophisticated risk management tools through the MT4 platform is not clearly documented. While MT4 supports various order types natively, broker-specific implementations can vary significantly in terms of functionality and reliability.

Mobile trading capabilities and cross-platform synchronization are essential for modern traders. However, specific details about mobile app quality, feature parity, or performance are not available in current documentation. User reports suggest general dissatisfaction with the trading experience, though specific technical issues are not comprehensively detailed.

This chancellor precious metals review assigns a 4/10 rating for trading experience. This reflects concerns about transparency and documented user dissatisfaction while acknowledging the basic MT4 platform provision.

Trust and Safety Analysis

Trust and safety represent the most critical areas of concern regarding Chancellor Precious Metals. Multiple factors contribute to a very poor assessment in this essential category. The broker's "temporarily non-regulatory" status immediately raises significant red flags about client protection, fund segregation, and dispute resolution mechanisms.

These are fundamental to safe trading environments.

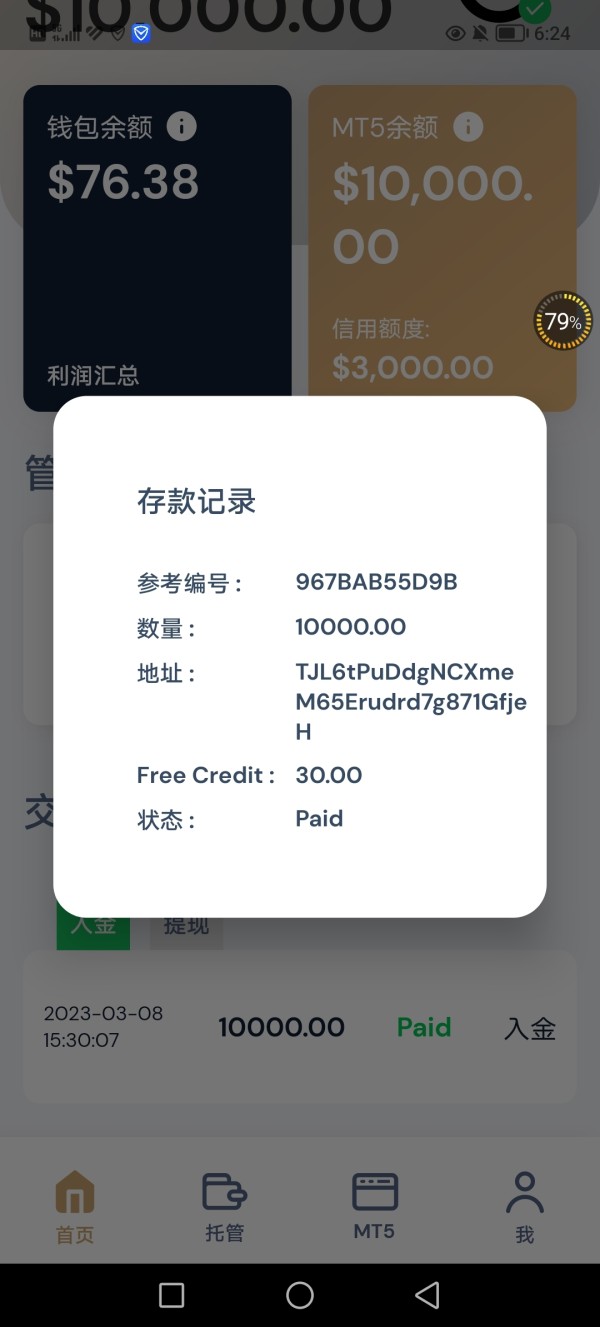

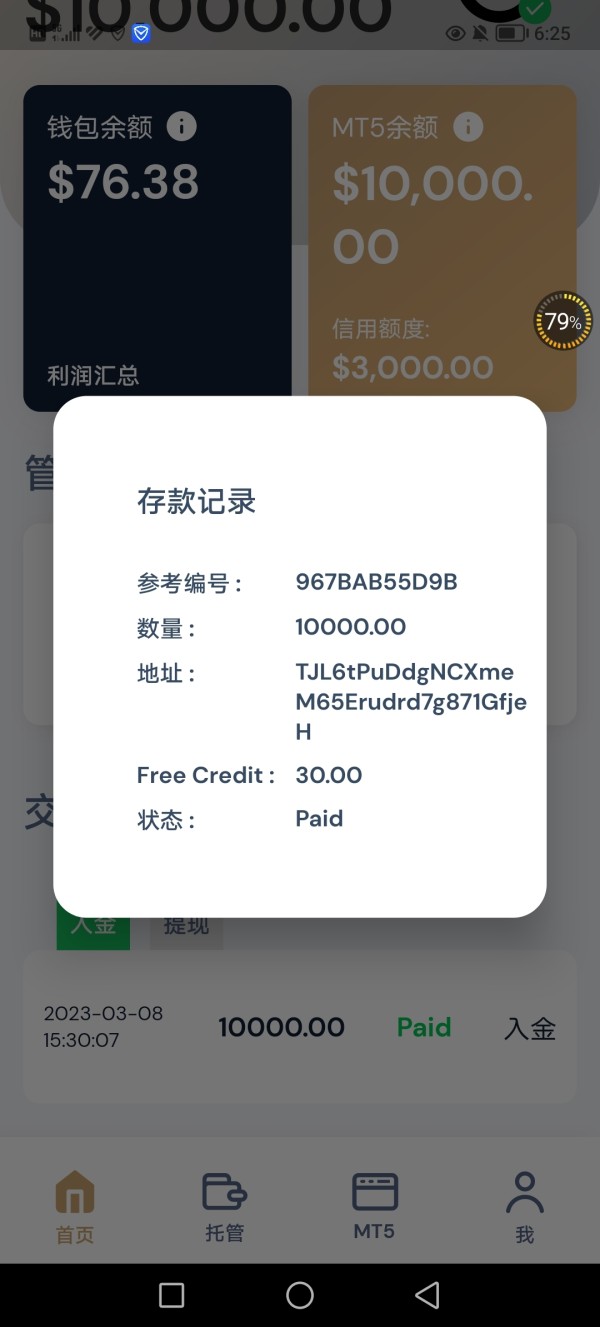

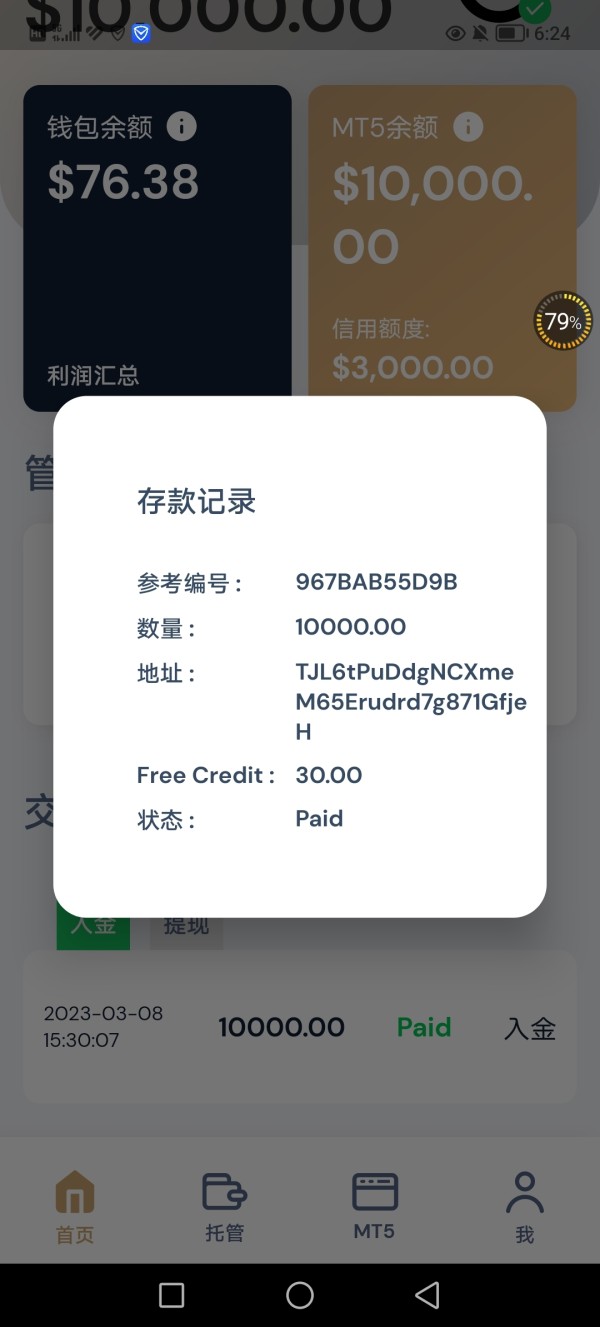

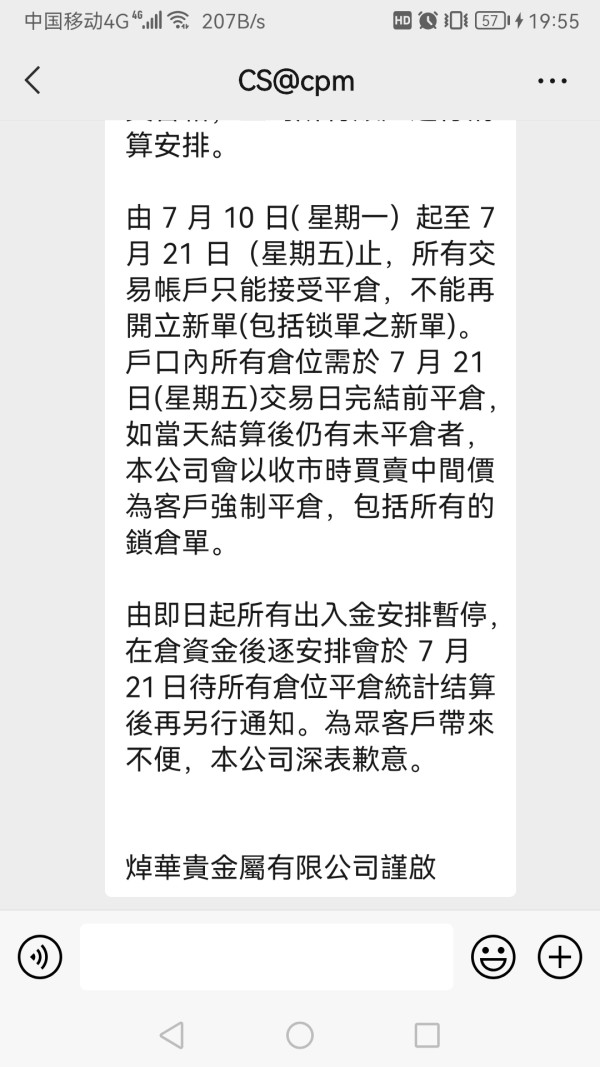

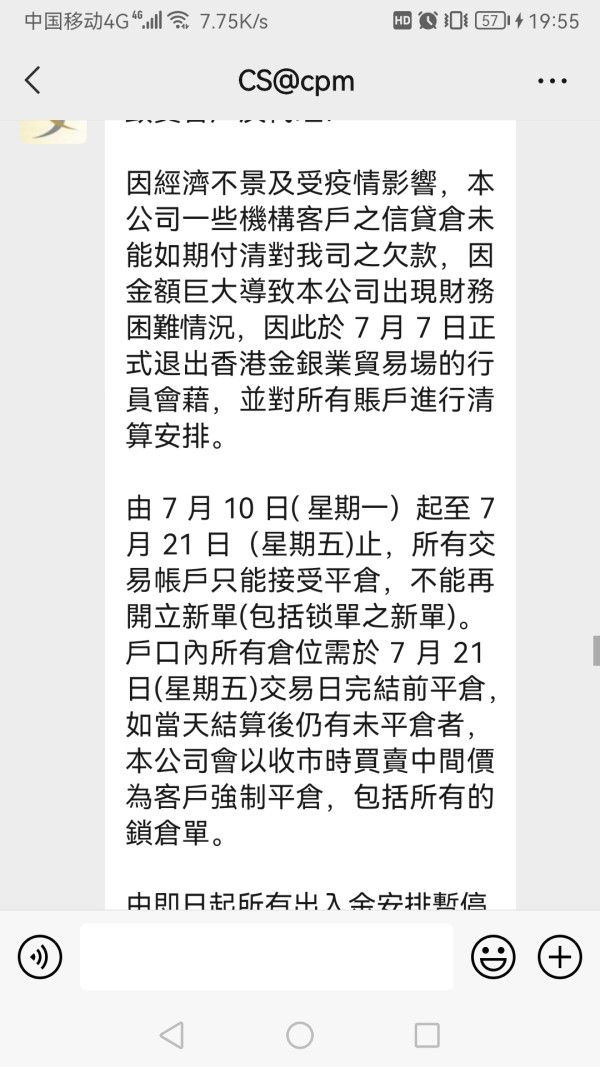

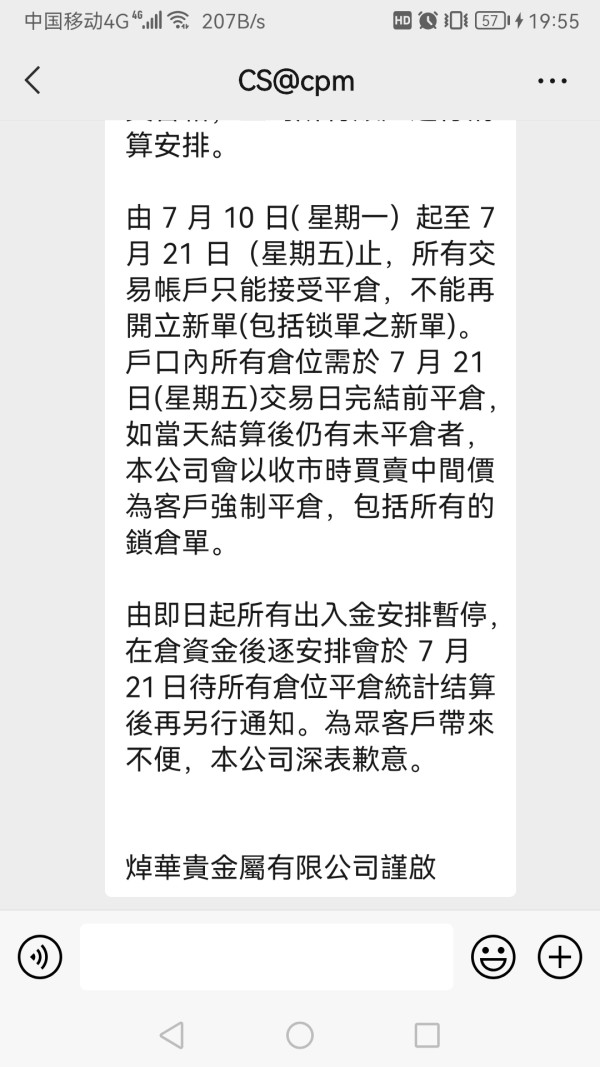

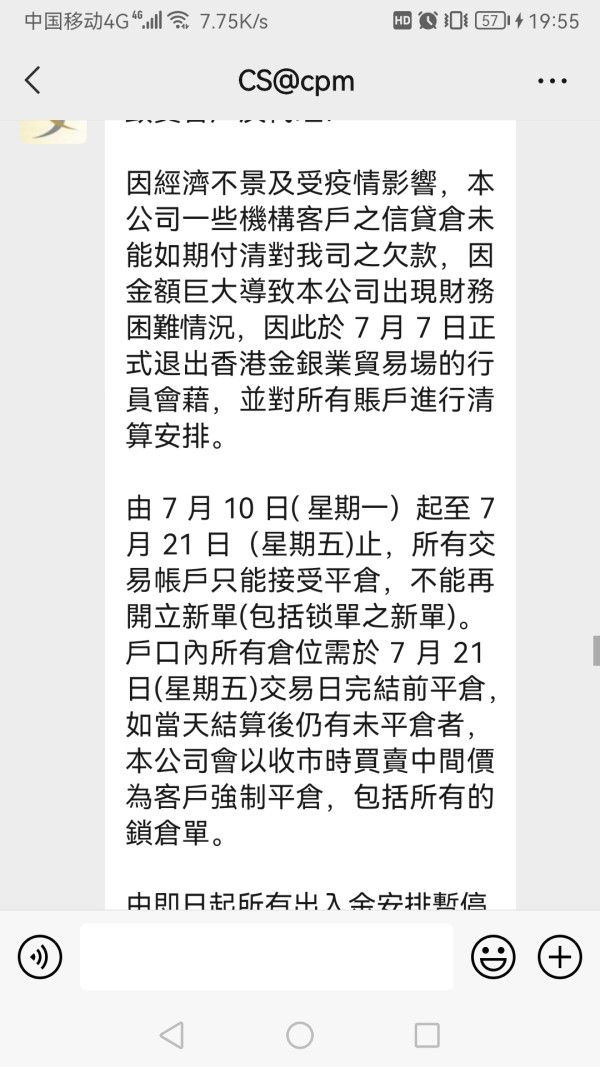

According to WikiFX reports, Chancellor Precious Metals faces serious allegations including customer fund misappropriation and fraudulent activities. These represent the most severe type of concerns that can affect a financial services provider. These allegations, combined with the lack of proper regulatory oversight, create an extremely high-risk environment for potential clients.

Fund safety measures such as segregated client accounts, deposit insurance, or third-party custody arrangements are not documented or verified by regulatory authorities. Professional brokers typically maintain client funds in segregated accounts with established banks and provide clear documentation about fund protection measures. This appears to be absent in this case.

The company's transparency regarding financial statements, ownership structure, or operational procedures is severely limited. Reputable brokers typically provide comprehensive disclosure about their corporate structure, financial backing, and operational procedures. This is part of building client trust and meeting regulatory requirements.

Industry reputation and third-party verification sources consistently raise concerns about Chancellor Precious Metals' operational integrity. The documented user complaints and allegations of misconduct create a pattern of concern that extends beyond typical business disputes or isolated incidents.

The absence of regulatory oversight means that clients have limited recourse through official complaints procedures, arbitration services, or compensation schemes. These are typically available with properly regulated brokers. This lack of protection mechanisms significantly amplifies the risks associated with engaging this broker's services.

User Experience Analysis

User experience with Chancellor Precious Metals receives consistently negative feedback across multiple evaluation criteria. An overall user rating of 3/10 according to WikiFX data reflects widespread dissatisfaction among clients. This low satisfaction score indicates systematic issues that affect the majority of users rather than isolated problems affecting a small minority.

The overall user satisfaction metrics suggest significant problems with core business functions including account management, trading execution, customer service, and most critically, fund security and withdrawal processes. User reports consistently highlight difficulties with accessing their own funds. This represents the most serious type of operational failure for any financial services provider.

Interface design and platform usability, while based on the familiar MT4 framework, appear to suffer from implementation issues or additional complications that negatively impact user experience. The standard MT4 platform typically receives positive user feedback. This suggests that broker-specific factors may be degrading the expected user experience.

Registration and account verification processes are not well-documented. User feedback suggests complications or delays in these essential onboarding procedures. Professional brokers typically streamline these processes while maintaining compliance standards, creating efficient user experiences that build confidence from initial contact.

Fund operation experiences represent the most critical area of user concern. Documented reports exist of withdrawal difficulties and fund access issues. These reports go beyond typical processing delays and suggest more serious operational or ethical problems that directly impact users' financial security.

Common user complaints focus on communication difficulties, unresponsive customer service, and most seriously, problems accessing deposited funds. These issues create a pattern of concern that suggests systematic operational failures rather than occasional service issues.

The user demographic appears to include traders who may not have been fully informed about the risks associated with dealing with an inadequately regulated broker. This highlights the importance of due diligence in broker selection processes.

Conclusion

This comprehensive chancellor precious metals review reveals a broker that presents substantial risks and uncertainties that far outweigh any potential benefits for most traders. With a "temporarily non-regulatory" status, documented user complaints regarding fund misappropriation, and an overall user rating of just 3/10, Chancellor Precious Metals fails to meet the basic standards expected from professional forex brokers.

The broker is particularly unsuitable for traders with low risk tolerance, beginners seeking educational support, or anyone prioritizing fund security and regulatory protection. While the $200 minimum deposit and MT4 platform access might appear attractive, these modest advantages are overshadowed by serious concerns about operational integrity and client protection.

The main advantages include basic MT4 platform access and relatively low entry requirements. However, these are significantly outweighed by critical disadvantages including lack of proper regulation, documented user complaints about fund access, poor customer service ratings, and absence of comprehensive trading resources. For traders seeking reliable, secure, and professionally managed trading environments, numerous well-regulated alternatives offer superior protection and service quality.