Is Chancellor Precious Metals safe?

Business

License

Is Chancellor Precious Metals Safe or Scam?

Introduction

Chancellor Precious Metals is a Hong Kong-based forex and precious metals broker that has been operating since 2017. It positions itself as a trading platform for those interested in forex and precious metals, offering access to products like loco London gold and silver. As the forex market can be rife with scams and unreliable brokers, it is crucial for traders to conduct thorough evaluations before committing their funds. This article aims to provide a comprehensive analysis of Chancellor Precious Metals, focusing on its regulatory status, company background, trading conditions, customer safety, client experiences, platform performance, and overall risk assessment. The investigation is based on a review of multiple sources, including user complaints and expert evaluations, to determine whether Chancellor Precious Metals is a safe choice for traders or a potential scam.

Regulation and Legitimacy

The regulatory environment is a critical factor in assessing the safety of any trading platform. Brokers that are regulated by reputable authorities are generally considered safer, as they must adhere to strict guidelines designed to protect investors. Chancellor Precious Metals claims to be regulated by the Chinese Gold & Silver Exchange Society (CGSE), which is a recognized body in Hong Kong. However, the overall regulatory landscape for forex brokers in Hong Kong is often criticized for being less stringent than in other jurisdictions.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Chinese Gold & Silver Exchange Society (CGSE) | 064 | Hong Kong | Verified |

Despite its claimed regulation, there are concerns regarding the effectiveness of this oversight. Many users have reported issues such as difficulties in withdrawing funds and other operational challenges. The lack of a comprehensive regulatory framework raises questions about the true safety of trading with Chancellor Precious Metals. Therefore, while there is a regulatory claim, the actual enforcement and investor protection remain ambiguous, leading to skepticism about whether Chancellor Precious Metals is truly safe.

Company Background Investigation

Chancellor Precious Metals was established in 2017 and is based in Hong Kong. The firm operates under the auspices of CGSE, which adds a layer of legitimacy to its operations. However, the company's history is relatively short in comparison to many other brokers in the market. The ownership structure and management team are not widely publicized, which raises concerns about transparency.

The management team‘s expertise is crucial in understanding the broker's operational integrity. Unfortunately, detailed information about the management's professional background is not readily available, making it difficult to assess their qualifications. Transparency in operations, including clear information on the company’s ownership and management, is vital for building trust with potential clients. The absence of such disclosures may lead traders to question whether Chancellor Precious Metals is safe.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. Chancellor Precious Metals offers a variety of trading instruments, primarily focused on precious metals. However, the overall fee structure and trading costs are points of contention among users.

| Fee Type | Chancellor Precious Metals | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 0.05 USD | 0.2 USD |

| Commission Structure | 50 USD per lot | 30-60 USD per lot |

| Overnight Interest Range | 12 USD (long) / 2 USD (short) | 10 USD (long) / 2 USD (short) |

The commission structure appears to be on the higher end compared to the industry average, which could deter potential traders. Furthermore, the lack of transparency regarding additional fees may lead to unexpected costs. Traders are often advised to be cautious about brokers with unclear fee structures, as they can significantly impact profitability. Therefore, the trading conditions at Chancellor Precious Metals warrant careful consideration, raising questions about whether it is a safe trading environment.

Customer Funds Security

The safety of customer funds is paramount for any trading platform. Chancellor Precious Metals claims to implement various security measures, including fund segregation and investor protection policies. However, the effectiveness of these measures is questionable given the numerous complaints regarding withdrawal issues.

In assessing the broker's safety measures, it is essential to evaluate their policies on fund segregation and negative balance protection. Segregated accounts help ensure that client funds are kept separate from the broker's operational funds, providing a layer of security. However, the absence of clear information regarding these practices makes it difficult to ascertain the level of protection offered to clients.

Historically, there have been reports of clients struggling to withdraw their funds, which raises serious concerns about the broker's operational integrity. Such incidents can indicate potential risks associated with trading at Chancellor Precious Metals, leading to skepticism about whether it is indeed safe.

Customer Experience and Complaints

Client feedback serves as a valuable resource for evaluating a broker's reliability. Reviews and complaints about Chancellor Precious Metals reveal a pattern of negative experiences, particularly concerning withdrawal difficulties and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Delayed or no response |

| Misappropriation of Funds | Critical | No resolution provided |

| Customer Service Delays | Medium | Long wait times |

Many users have reported being unable to withdraw their funds or receiving inadequate responses from customer service. A few specific cases highlight the severity of these complaints, with one user alleging that they were defrauded and unable to access their investment. Such reports contribute to the perception that Chancellor Precious Metals may not be safe for traders, as unresolved complaints can indicate deeper systemic issues within the broker.

Platform and Execution

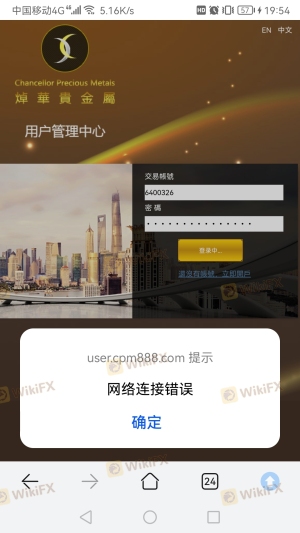

The trading platform provided by Chancellor Precious Metals is built on the popular MetaTrader 4 and 5 systems. While these platforms are known for their reliability and user-friendly interfaces, the overall performance and execution quality are critical for traders.

User reviews indicate mixed experiences regarding order execution, with some traders reporting slippage and delays. The quality of order execution can significantly affect trading outcomes, and any signs of manipulation or poor performance can be red flags for potential clients.

Overall, while the platform itself may be reputable, the execution quality raises concerns about whether Chancellor Precious Metals is a safe choice for traders who prioritize efficient trading experiences.

Risk Assessment

Using Chancellor Precious Metals involves several risks that potential clients should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of robust oversight raises concerns. |

| Operational Risk | High | Numerous complaints regarding withdrawals. |

| Transparency Risk | Medium | Limited information about management and operations. |

Given these risks, it is advisable for traders to approach Chancellor Precious Metals with caution. Implementing risk mitigation strategies, such as diversifying investments and setting limits on trading exposure, can help protect against potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Chancellor Precious Metals may not be the safest option for traders. The combination of regulatory concerns, negative customer experiences, and operational issues raises significant red flags. While the broker claims to be regulated, the effectiveness of this oversight is questionable, and the numerous complaints about withdrawal issues indicate potential risks.

For traders seeking a reliable trading environment, it may be prudent to consider alternative brokers with stronger regulatory frameworks and positive user reviews. Brokers with a proven track record of transparency and customer support are generally safer options. Ultimately, due diligence and careful evaluation of any trading platform are essential to ensure a secure trading experience.

Is Chancellor Precious Metals a scam, or is it legit?

The latest exposure and evaluation content of Chancellor Precious Metals brokers.

Chancellor Precious Metals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Chancellor Precious Metals latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.