Capitalix 2025 Review: Everything You Need to Know

Summary

This comprehensive Capitalix review examines a forex broker that has generated significant attention in the trading community. However, this attention is not always for positive reasons. Established as an online trading platform, Capitalix claims to have won recognition from Global Brands Magazine as the fastest growing forex broker in the GCC region. The broker has been flagged for suspicious review activity across multiple review platforms. This raises concerns about its credibility.

According to available data, Capitalix maintains a rating of 2 stars based on 600 reviews. Only 27% of reviewers recommend the platform. The broker offers trading services across multiple asset classes including forex, cryptocurrencies, and other financial instruments. Some users report positive experiences with the broker's expert team and customer support, but the overwhelming majority of feedback suggests significant issues with the platform's operations and trustworthiness.

This Capitalix review aims to provide traders with an objective analysis of the broker's services. We examine both the claimed achievements and the substantial negative feedback from the trading community.

Important Notice

Regional Variations: Capitalix's operations and regulatory status may vary across different jurisdictions. Traders should verify the specific regulatory framework applicable in their region before engaging with the platform.

Review Methodology: This evaluation is based on publicly available information, user feedback from multiple review platforms, and industry reports. Given that Capitalix has been flagged for suspicious review activity, particular attention has been paid to verified user experiences and independent sources.

Rating Framework

Broker Overview

Capitalix positions itself as an award-winning online trading platform. The company allegedly received recognition from Global Brands Magazine as the fastest growing forex broker in the GCC region. The company claims to provide comprehensive trading services across multiple asset classes, targeting both retail and institutional clients seeking exposure to global financial markets.

Despite these claims, the broker's actual performance tells a different story. With a 2-star rating based on 600 reviews and only 27% of users recommending the platform, Capitalix faces significant credibility challenges. The broker has been flagged across multiple review platforms for suspicious review activity. This suggests potential manipulation of user feedback to artificially inflate ratings.

The platform offers trading in forex pairs, cryptocurrencies, and other financial instruments. However, specific details about account types, minimum deposits, and trading conditions remain limited in publicly available information. This lack of transparency adds to the concerns surrounding the broker's operations and regulatory compliance.

Regulatory Status: Specific regulatory information for Capitalix is not clearly disclosed in available public materials. This raises immediate red flags for potential traders.

Deposit and Withdrawal Methods: Information regarding specific deposit and withdrawal options is not detailed in available sources. This creates uncertainty about fund management procedures.

Minimum Deposit Requirements: Specific minimum deposit requirements are not clearly stated in available documentation.

Bonuses and Promotions: Details about promotional offers and bonus structures are not available in current public information.

Trading Assets: The platform offers forex trading, cryptocurrency trading, and access to other financial instruments. However, the complete asset list is not comprehensively detailed.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not available in current documentation.

Leverage Ratios: Leverage information is not specified in available materials.

Platform Options: Details about specific trading platforms offered by Capitalix are not clearly outlined in accessible sources.

Geographic Restrictions: Information about regional restrictions is not detailed in available documentation.

Customer Support Languages: Specific language support information is not provided in current materials.

This Capitalix review reveals significant gaps in publicly available information. This itself is a concerning factor for potential traders.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by Capitalix present several concerns for potential traders. Based on available information, the broker does not provide clear details about account types, minimum deposit requirements, or specific account features. This lack of transparency immediately raises red flags about the platform's legitimacy and professional standards.

User feedback suggests that account opening processes may not meet industry standards. Several reviewers report difficulties in understanding terms and conditions. The absence of detailed information about Islamic accounts, professional trading accounts, or other specialized account types indicates a limited service offering compared to established brokers in the market.

The 2-star rating from 600 reviews, with only 27% recommending the platform, strongly suggests that account conditions do not meet trader expectations. Many users report issues with account management and unclear fee structures. This contributes to the poor overall rating in this category.

This Capitalix review finds that the broker's account conditions fall significantly below industry standards. This is primarily due to lack of transparency and negative user experiences.

Capitalix's offering of trading tools and resources appears limited based on available information and user feedback. The platform does not provide comprehensive details about analytical tools, research resources, or educational materials that are typically expected from professional forex brokers.

User reviews indicate a significant lack of quality trading tools and market analysis resources. The absence of detailed information about charting capabilities, technical indicators, or fundamental analysis tools suggests that the platform may not adequately serve serious traders who require sophisticated analytical capabilities.

Educational resources, which are crucial for trader development, are not prominently featured or detailed in available materials. This gap in educational support is particularly concerning for novice traders who rely on broker-provided learning materials to develop their trading skills.

The limited information available about automated trading support, API access, or third-party tool integration further diminishes the platform's appeal to experienced traders. These traders require advanced functionality.

Customer Service and Support Analysis (5/10)

Customer service represents one of the few areas where Capitalix receives mixed rather than purely negative feedback. Some users report positive experiences with the broker's expert team. This suggests that when support is available, it can be helpful. However, the overall customer service experience appears inconsistent and problematic.

The platform's customer service channels and availability are not clearly detailed in public information. This makes it difficult for potential clients to understand how to access support when needed. Response times and service quality appear to vary significantly based on user reports, with some praising the expert team while others report difficulties in reaching support staff.

Language support options are not clearly specified. This could be problematic for international traders seeking assistance in their native languages. The lack of transparency about customer service hours and available communication channels adds to the uncertainty surrounding support quality.

While some positive feedback exists regarding expert team assistance, the overall customer service rating remains average. This is due to inconsistent experiences and limited transparency about support procedures.

Trading Experience Analysis (3/10)

The trading experience offered by Capitalix appears to be significantly below industry standards based on user feedback and available information. With only 27% of 600 reviewers recommending the platform, the trading experience clearly fails to meet user expectations across multiple dimensions.

Platform stability and execution quality are major concerns raised by users. Reports suggest issues with order execution, potential slippage problems, and inconsistent platform performance that can significantly impact trading results. These technical issues are particularly problematic for active traders who require reliable execution and minimal downtime.

The lack of detailed information about trading platforms, mobile applications, and advanced trading features suggests limited functionality compared to established brokers. Users report difficulties with platform navigation and limited customization options. This can hinder effective trading strategies.

Market access and instrument availability, while including forex and cryptocurrencies, may be limited compared to more comprehensive brokers. The absence of detailed specifications about trading conditions, execution models, and market depth information further compounds the poor trading experience.

This Capitalix review finds that the trading experience falls well short of professional standards. These are the standards expected in the forex industry.

Trustworthiness Analysis (2/10)

Trustworthiness represents the most significant concern with Capitalix, earning the lowest rating in this comprehensive review. The broker has been flagged for suspicious review activity across multiple platforms. This immediately calls into question the authenticity of positive feedback and the company's business practices.

Regulatory information is notably absent or unclear in available documentation. This is a major red flag for any financial services provider. Legitimate forex brokers typically provide clear regulatory information, license numbers, and compliance details, none of which are readily available for Capitalix.

The dramatic discrepancy between claimed awards and actual user experiences suggests potential misrepresentation of achievements and market position. Capitalix claims to be the fastest growing forex broker in GCC, yet has a 2-star rating with 73% negative feedback. This disconnect between marketing claims and user reality significantly undermines credibility.

Fund safety measures, segregation of client funds, and insurance protections are not clearly detailed. This creates uncertainty about client asset protection. The absence of transparent information about company ownership, financial backing, and operational procedures further erodes trust.

Industry reputation suffers from widespread negative feedback and flagged review activity. This makes Capitalix one of the more problematic brokers in terms of trustworthiness.

User Experience Analysis (3/10)

Overall user experience with Capitalix is predominantly negative, as evidenced by the 2-star rating and low recommendation percentage. User feedback reveals significant issues across multiple aspects of the platform experience. These range from initial registration through ongoing trading activities.

Interface design and platform usability appear to be problematic based on user reports. Traders report difficulties navigating the platform and accessing essential features. This suggests poor user interface design and limited user experience optimization. The absence of detailed platform screenshots or feature descriptions in marketing materials may indicate a lack of confidence in the platform's visual appeal.

Registration and account verification processes receive criticism from users. Users report unclear procedures and potential delays in account activation. These issues create immediate friction for new users and set a negative tone for the overall relationship with the broker.

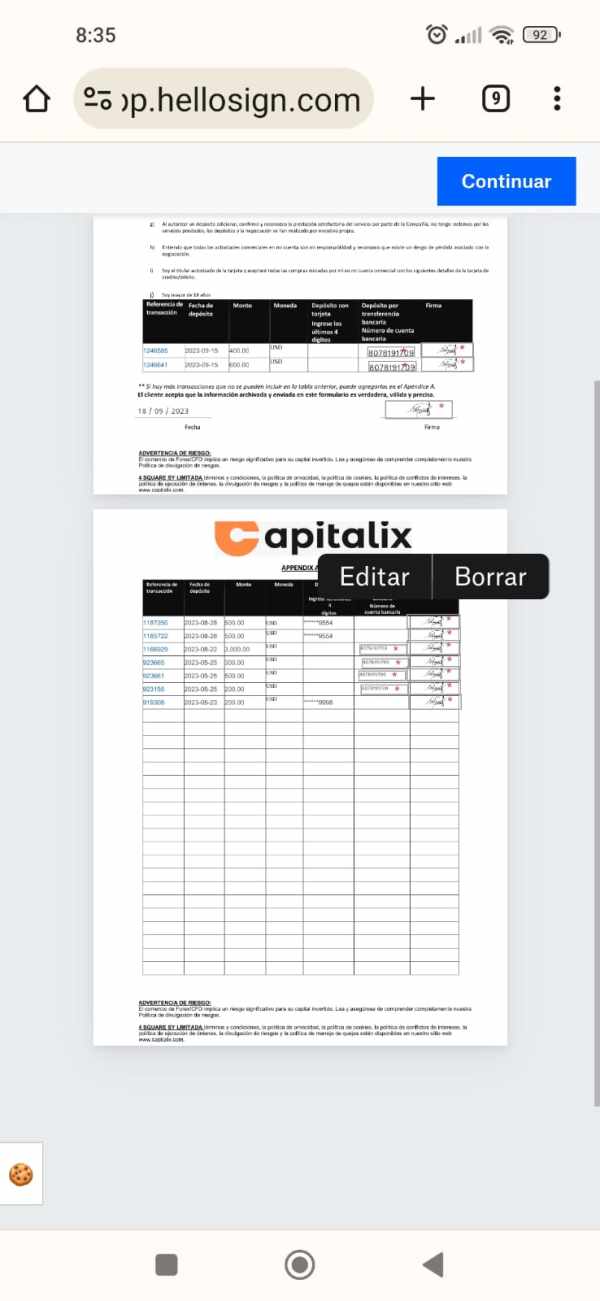

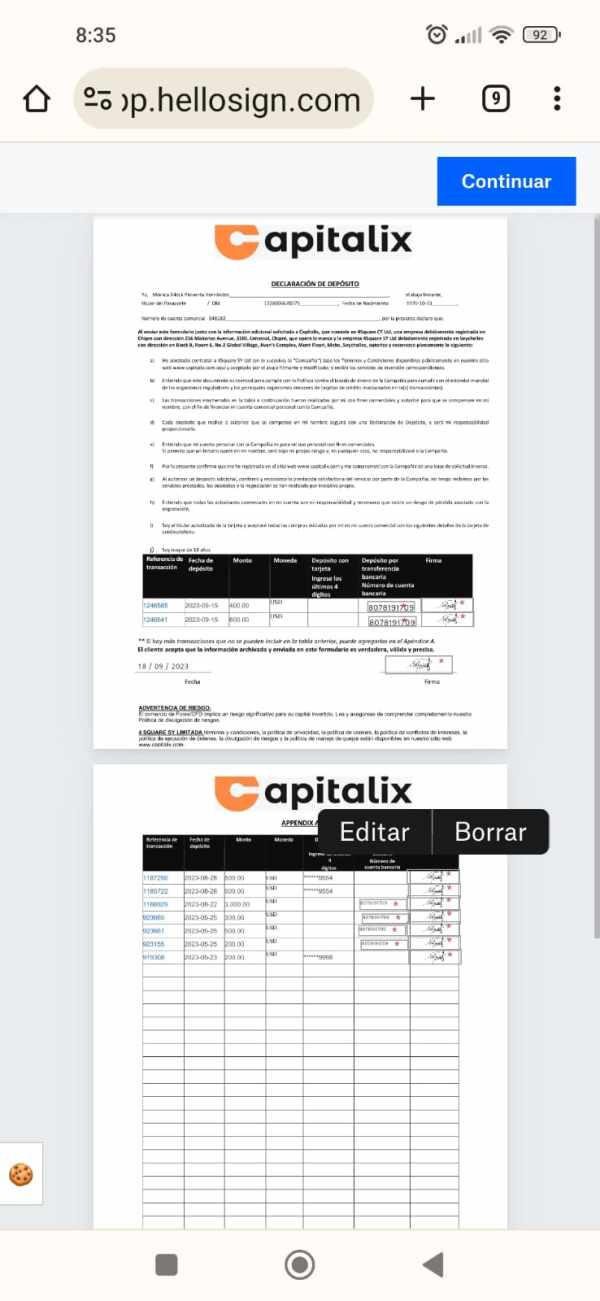

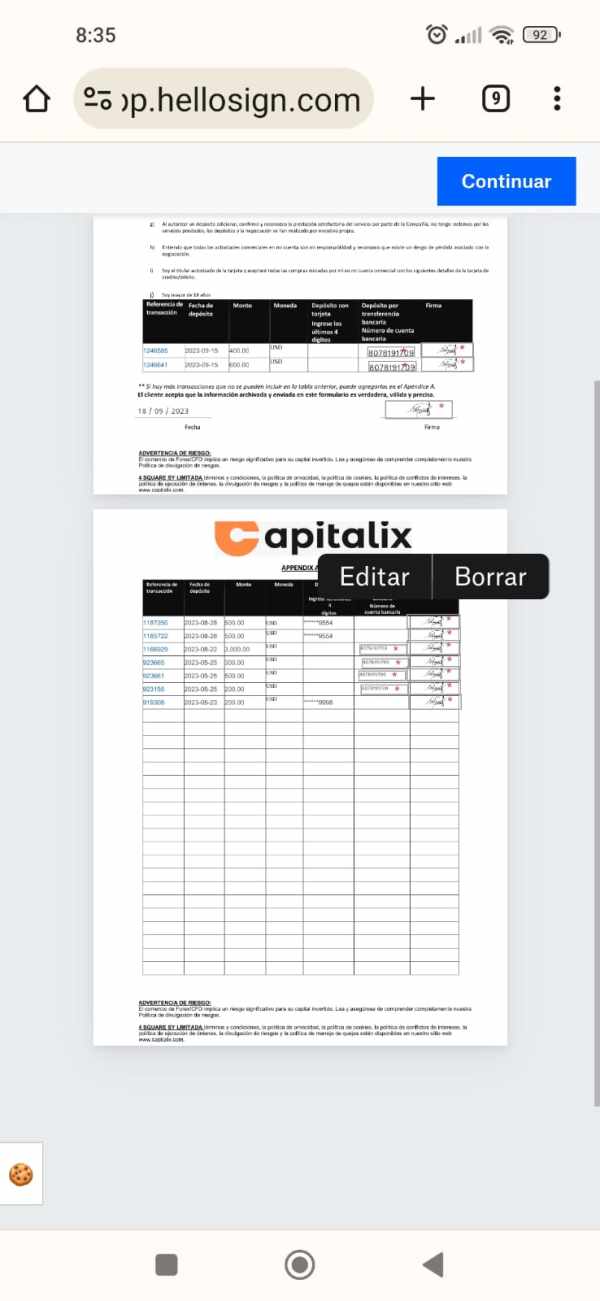

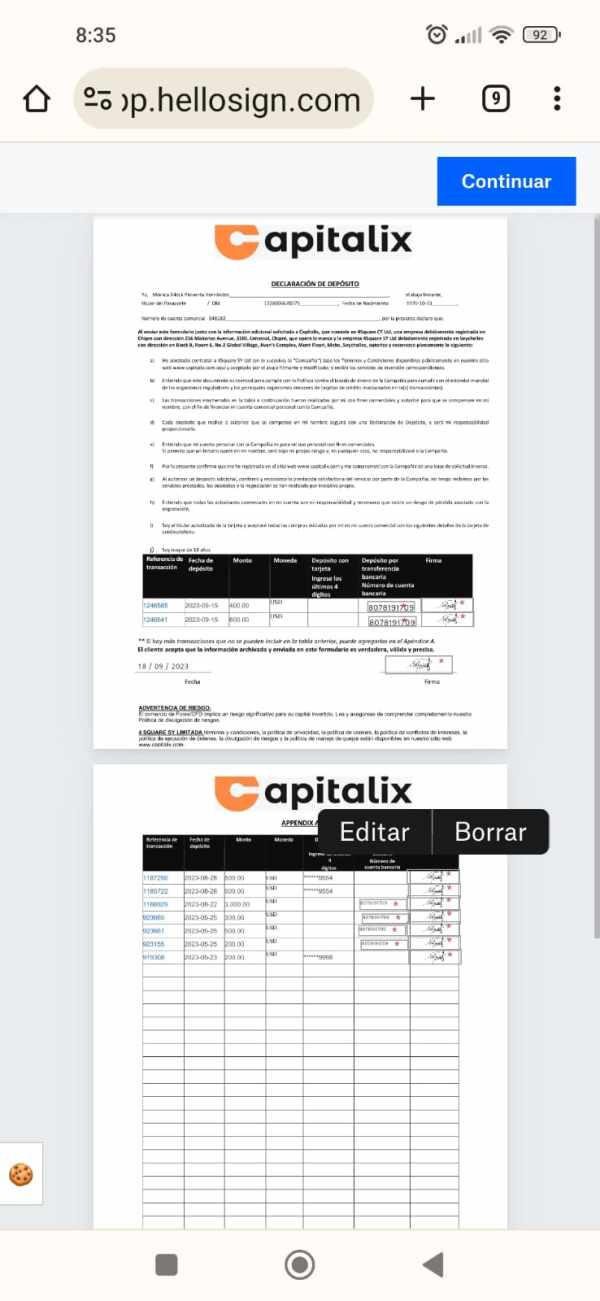

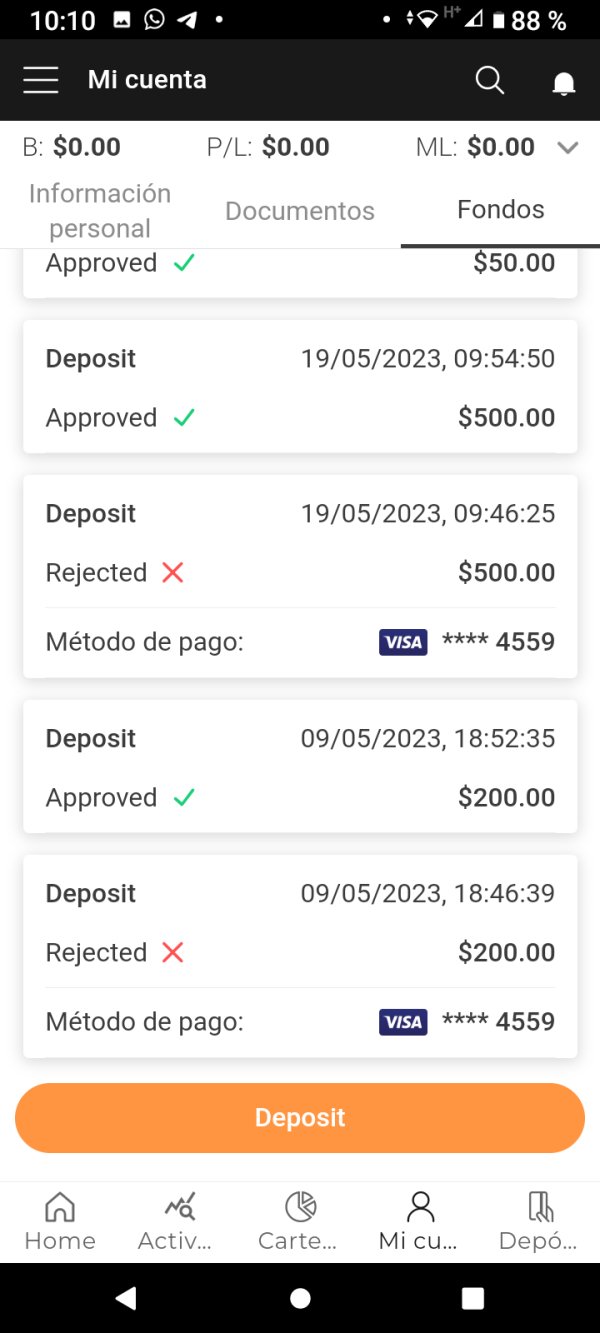

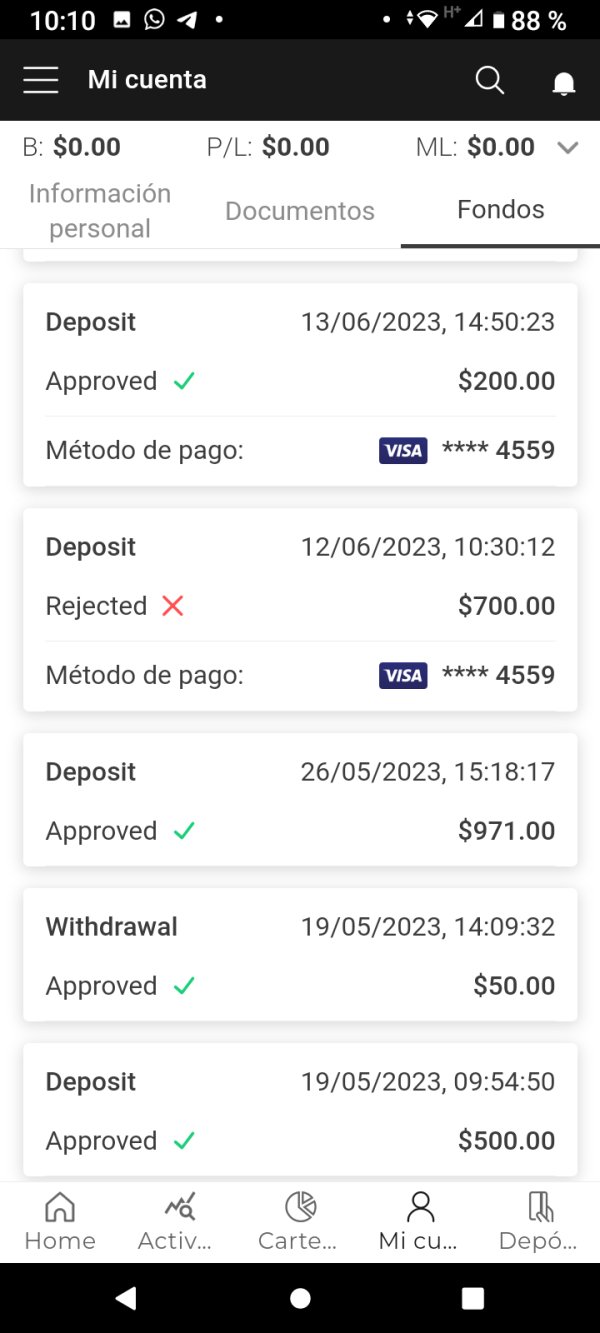

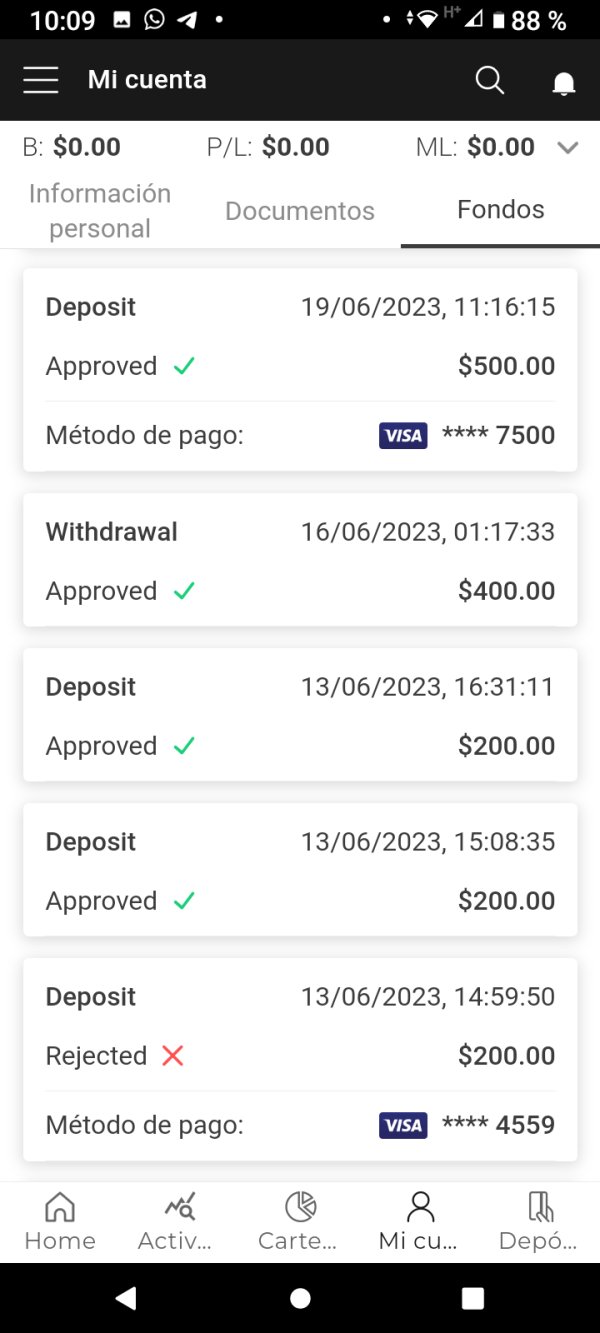

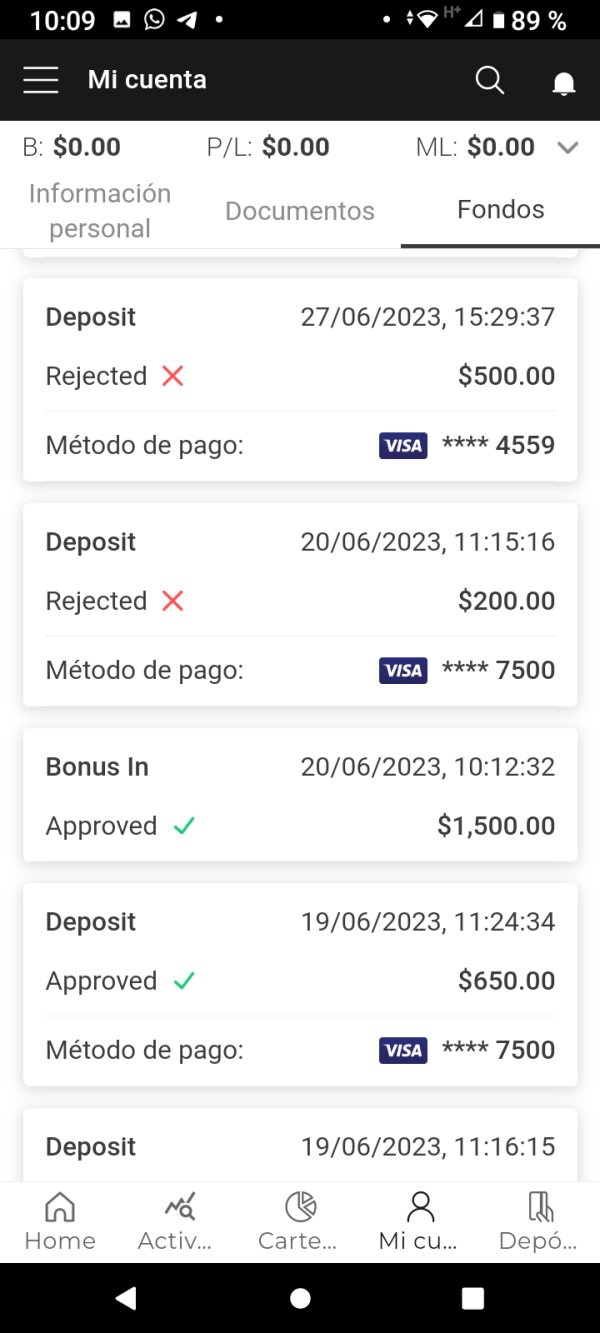

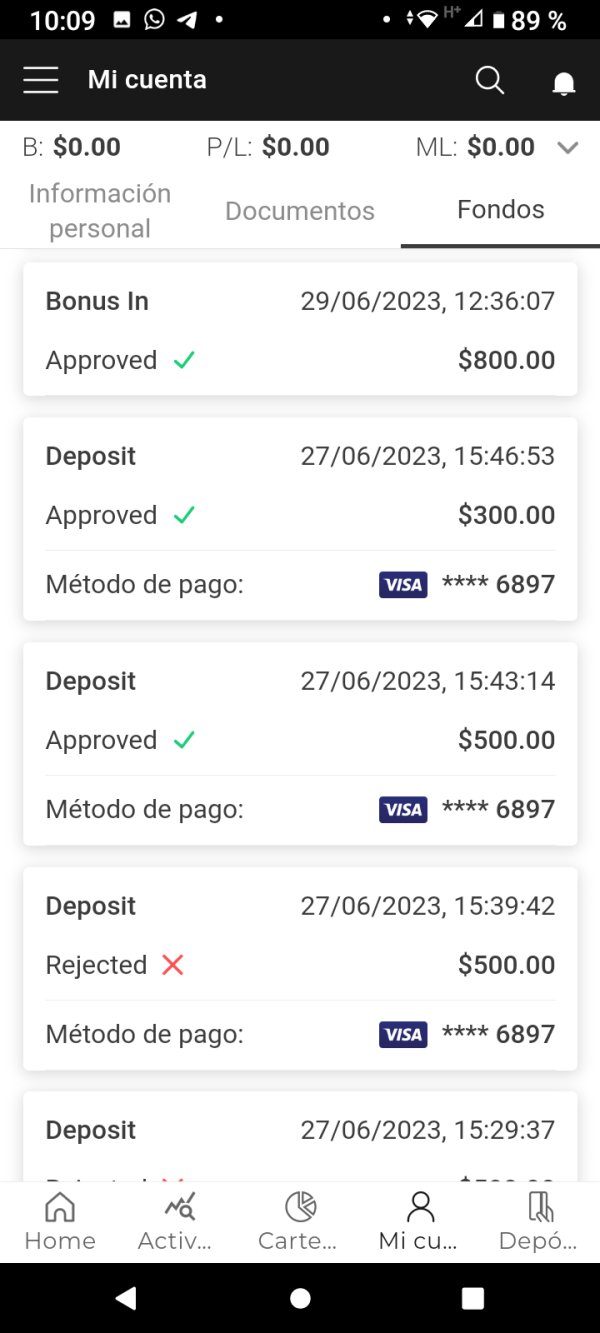

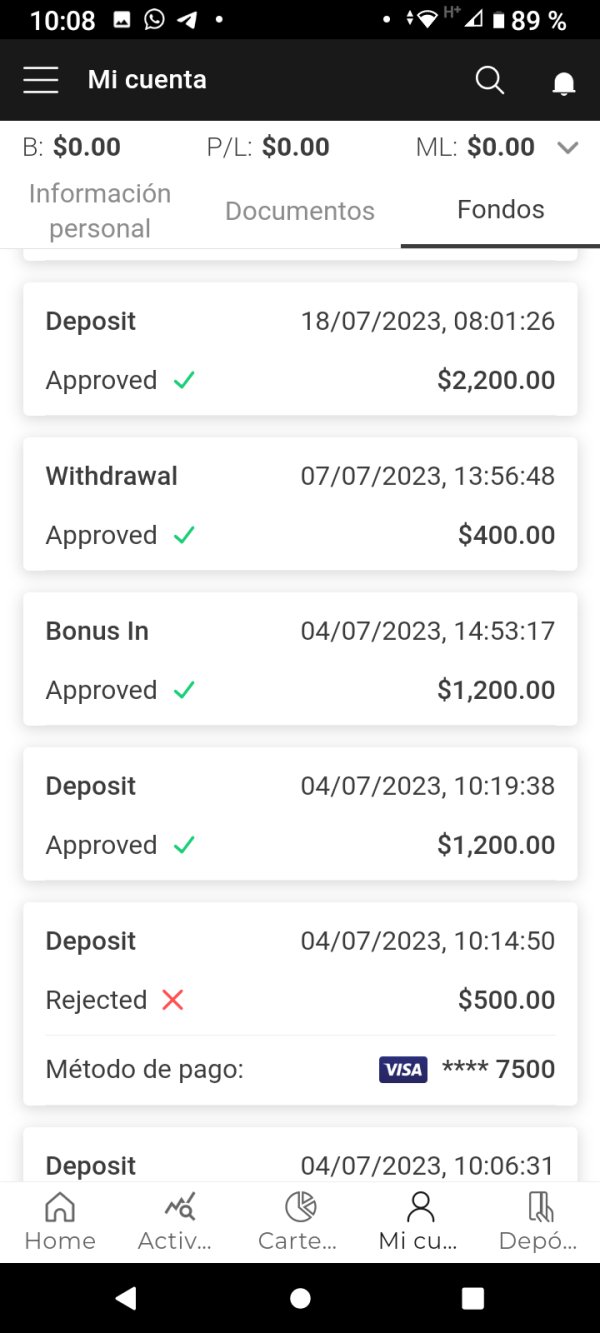

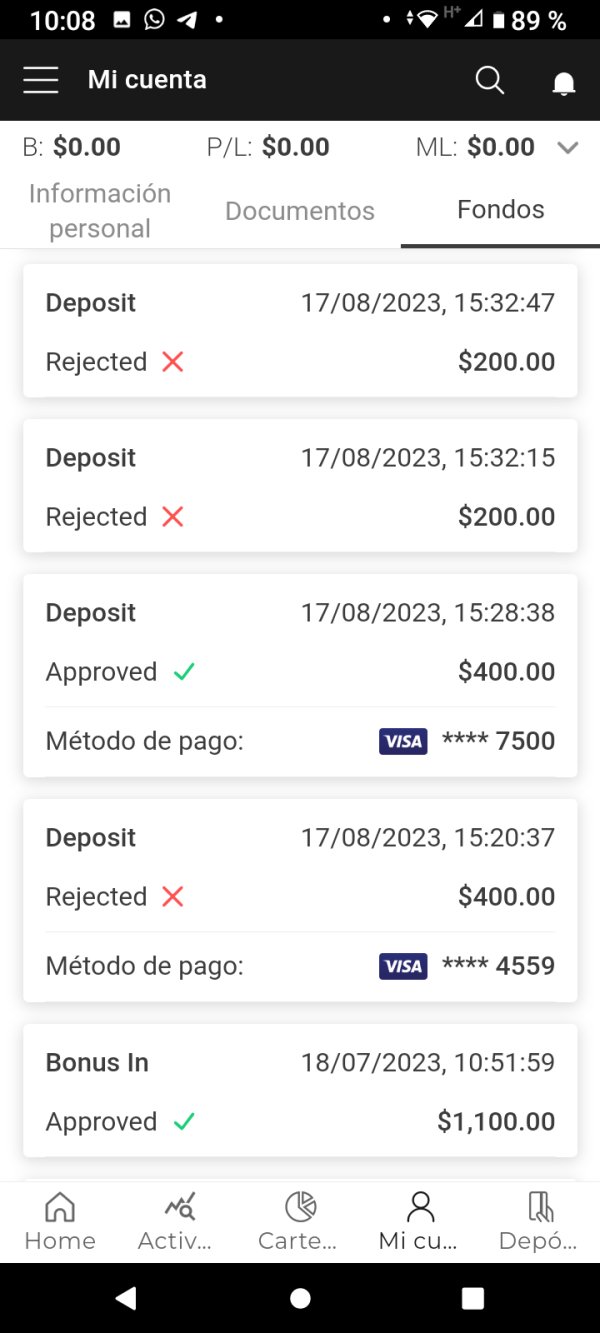

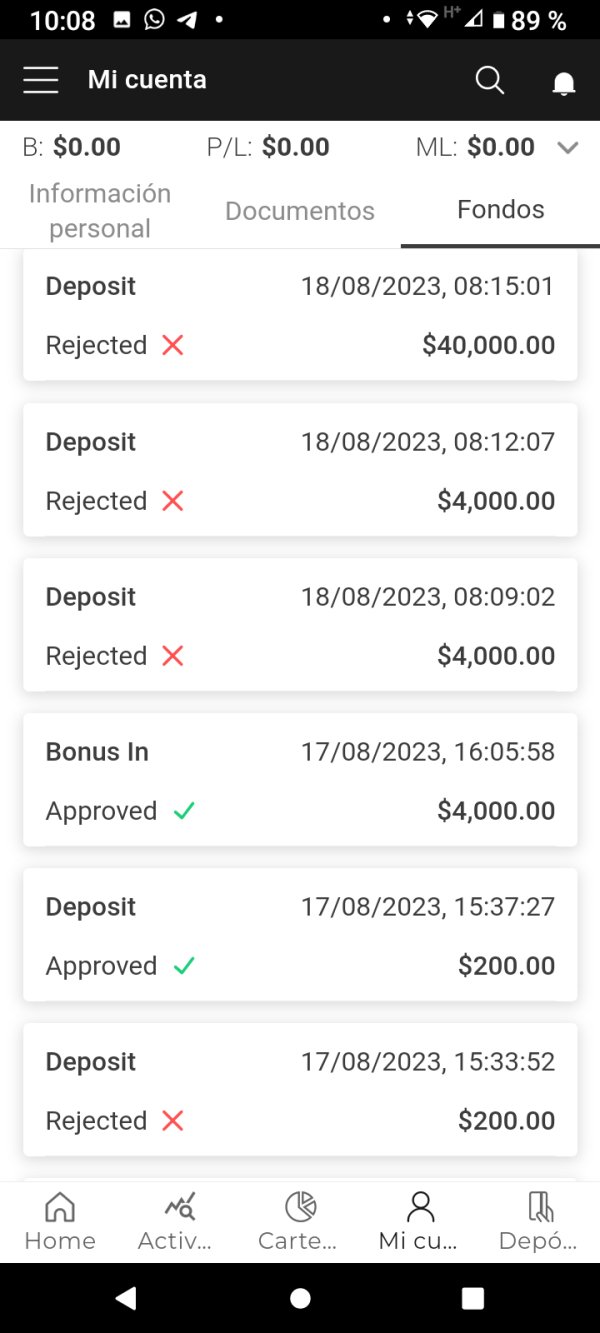

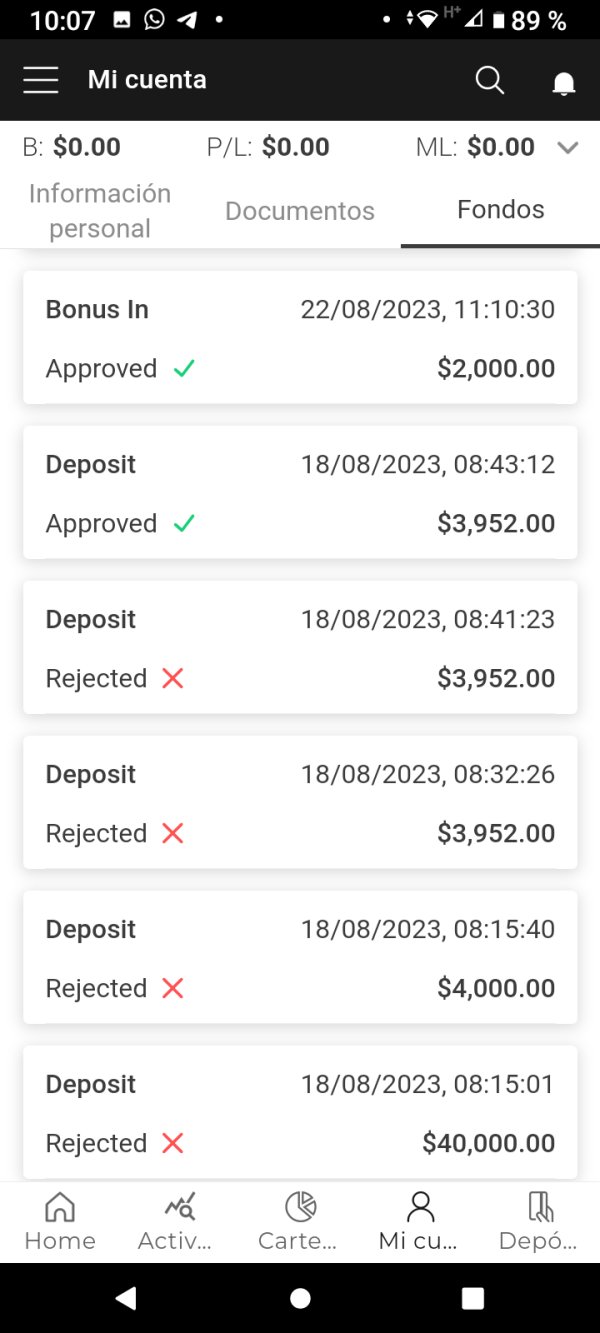

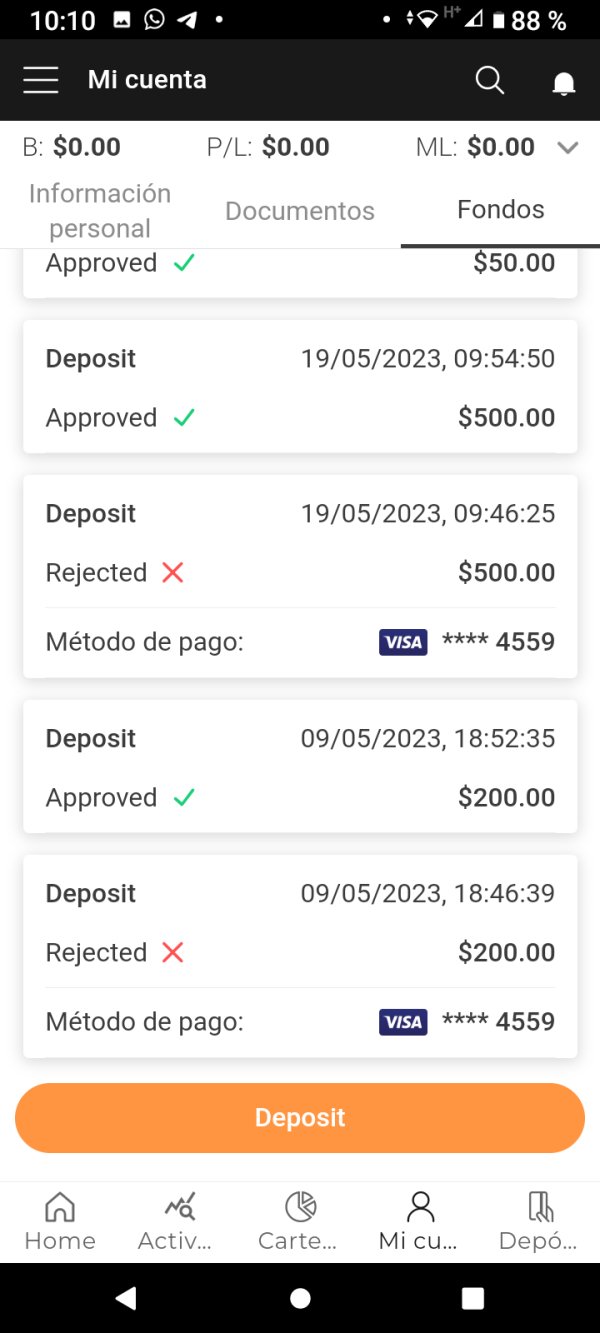

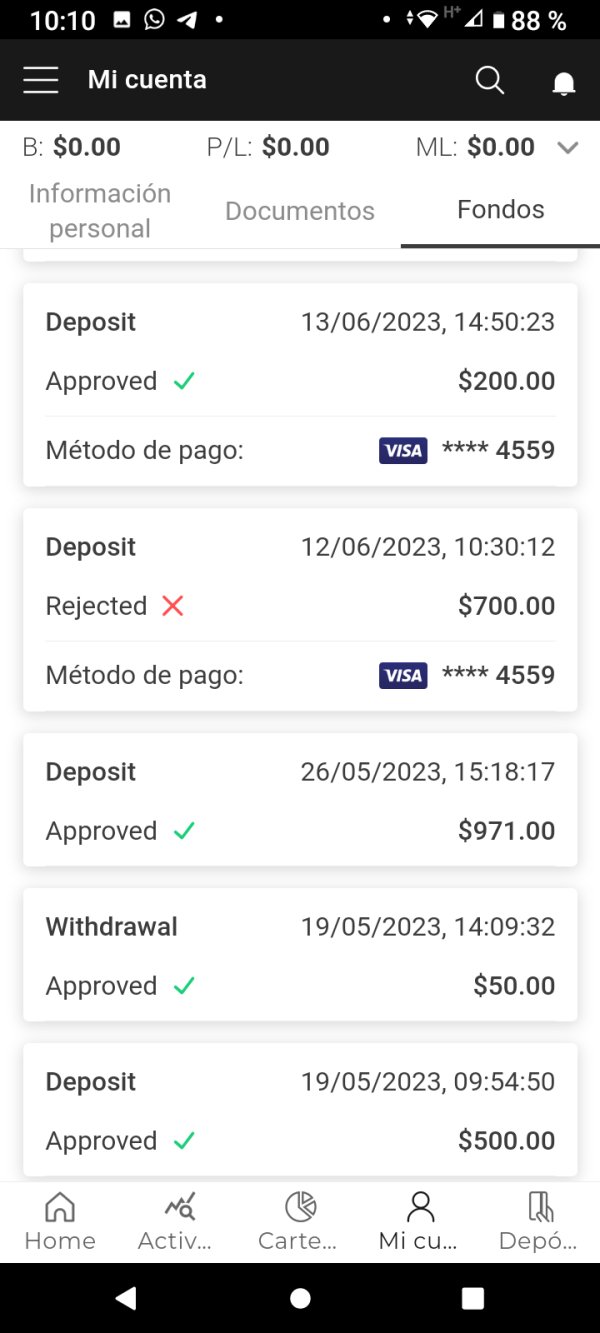

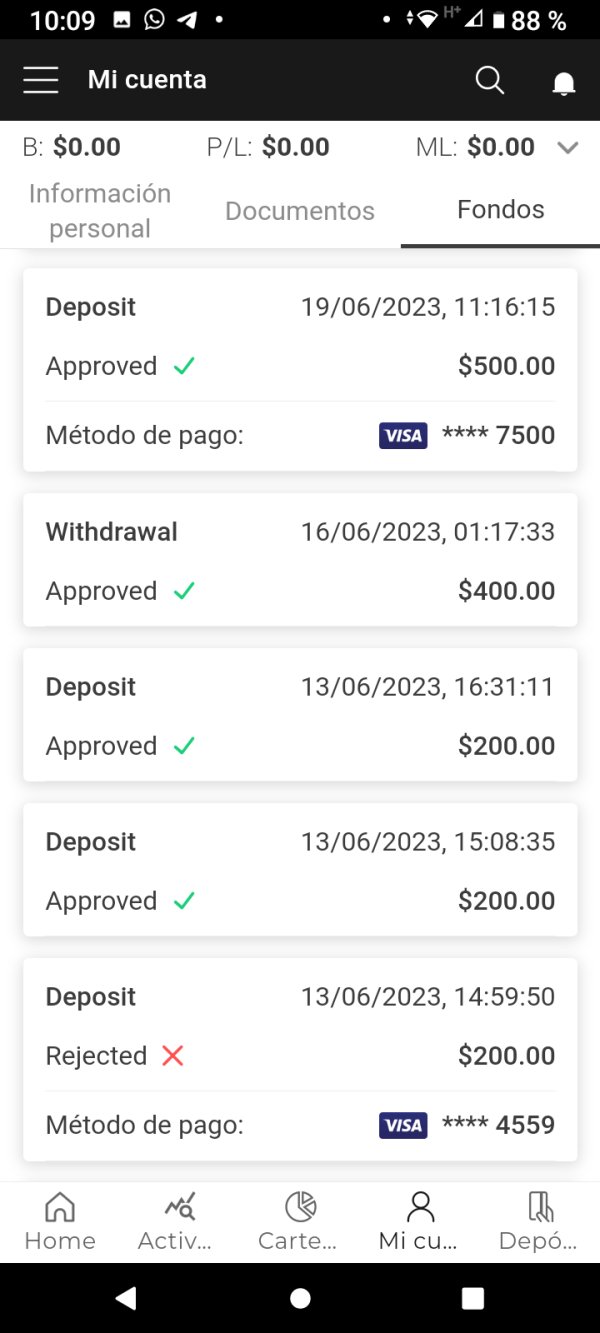

Fund management experiences generate particular concern among users. Reports include difficulties in both deposit and withdrawal processes. These issues are among the most serious concerns for any trading platform, as they directly impact users' ability to access their funds.

The significant gap between the small percentage of satisfied users and the majority of negative experiences suggests systemic issues with the platform. These go beyond individual isolated problems.

Conclusion

This comprehensive Capitalix review reveals a broker that falls significantly short of industry standards across virtually all evaluation criteria. With a 2-star rating based on 600 reviews and only 27% of users recommending the platform, Capitalix presents substantial risks for potential traders.

The broker may appeal to traders seeking exposure to multiple asset classes including forex and cryptocurrencies. However, the overwhelming negative feedback and flagged review activity suggest that even traders interested in these markets would be better served by more reputable alternatives.

Key advantages are limited, with only occasional positive feedback about expert team support. The disadvantages are substantial, including lack of regulatory transparency, poor user experience, questionable trustworthiness, and below-average trading conditions. The absence of clear information about essential aspects like regulatory compliance, account conditions, and fee structures creates additional concerns about transparency and professionalism.

Based on this analysis, traders are advised to exercise extreme caution when considering Capitalix. They should thoroughly research alternative brokers with better regulatory standing and user feedback before making any investment decisions.