Regarding the legitimacy of Capitalix forex brokers, it provides FSA and WikiBit, .

Is Capitalix safe?

Business

License

Is Capitalix markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

4 Square SY Limited

Effective Date:

--Email Address of Licensed Institution:

compliance@4squaresy.comSharing Status:

No SharingWebsite of Licensed Institution:

www.fxroad.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 4B, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Capitalix A Scam?

Introduction

Capitalix is a forex and CFD broker that has gained attention in the trading community since its inception in 2019. Based in Seychelles, it offers a wide range of trading instruments, including forex, indices, commodities, and cryptocurrencies. However, the legitimacy of Capitalix has come under scrutiny, prompting traders to exercise caution when evaluating this broker. Given the volatile nature of the forex market and the prevalence of scams, it is crucial for traders to thoroughly assess the credibility and safety of any broker before committing their funds. This article aims to provide an objective analysis of whether Capitalix is a safe trading platform or a potential scam. Our investigation is based on a review of regulatory information, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Capitalix claims to be regulated by the Seychelles Financial Services Authority (FSA), which is known for its less stringent regulatory framework compared to other jurisdictions. Below is a summary of Capitalix's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD 052 | Seychelles | Verified |

While the FSA does provide a level of oversight, it is considered an offshore regulator, which often raises concerns regarding the quality and enforcement of regulations. Brokers regulated by top-tier authorities such as the UK's Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) are generally viewed as more trustworthy due to their stringent compliance requirements. The lack of a license from a reputable authority such as CySEC in Cyprus, despite claims of registration there, further complicates Capitalix's standing. Traders should be aware that operating under an offshore license may expose them to higher risks, including potential fraud or mismanagement of funds.

Company Background Investigation

Capitalix operates under the ownership of 4 Square SY Ltd, which is registered in Seychelles. The company has positioned itself as a broker focused on providing a user-friendly trading environment with various account types. However, the lack of transparency regarding the management team raises questions about the broker's credibility. Information about the backgrounds and professional experiences of key personnel is scarce, making it difficult for potential clients to gauge the expertise behind the operations.

In terms of transparency, Capitalix appears to provide some basic information on its website, but there is a noticeable absence of detailed disclosures about its operational practices, financial health, and any potential conflicts of interest. This lack of openness can be a red flag for traders who prioritize transparency and accountability in their trading relationships. Without a clear understanding of the company's structure and management, traders may find it challenging to trust Capitalix fully.

Trading Conditions Analysis

When evaluating a broker's reliability, understanding its trading conditions is essential. Capitalix offers a range of trading instruments and claims to provide competitive fees. However, the overall fee structure and policies warrant closer examination.

| Fee Type | Capitalix | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 0.5 pips | 1.0-2.0 pips |

| Commission Model | None | Varies (often present) |

| Overnight Interest Range | Not specified | 0.5%-2.5% |

While Capitalix advertises zero commissions and low spreads, some user reviews have indicated hidden fees and unclear policies regarding overnight interest and deposit charges. Such discrepancies can lead to unexpected costs for traders, making it imperative for potential clients to read the fine print carefully. Furthermore, the absence of a demo account is a significant drawback, especially for new traders who wish to practice before entering real trades.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Capitalix states that it employs several security measures, including segregated accounts and negative balance protection. These measures are designed to ensure that client funds are kept separate from the broker's operating capital, thereby providing a layer of security.

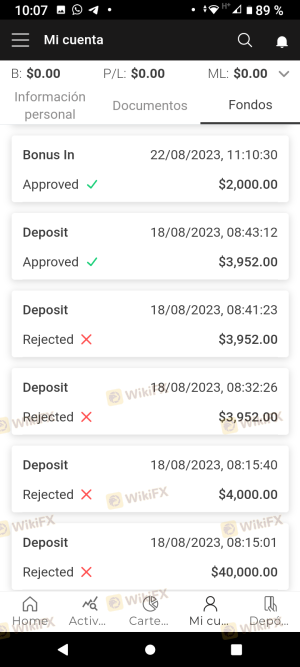

However, the effectiveness of these measures can only be fully assessed in practice. There have been reports of difficulties in fund withdrawals and customer service responses, which could indicate potential issues with fund management. Traders should remain vigilant and consider these factors when assessing whether Capitalix is safe for trading.

Customer Experience and Complaints

User feedback is a valuable indicator of a broker's reliability. A review of customer experiences with Capitalix reveals a mix of opinions. While some users report positive experiences with the trading platform and customer service, others have raised significant complaints regarding withdrawal processes and aggressive sales tactics.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Slow, unresponsive |

| Pressure to Deposit More | Medium | Aggressive follow-ups |

| Account Management Issues | High | Lack of support |

Several users have reported feeling pressured to deposit more funds after initial investments, a common tactic among potentially fraudulent brokers. Cases of unresponsive customer service when clients sought to withdraw funds have also been highlighted, which raises concerns about the broker's commitment to customer satisfaction.

Platform and Trade Execution

Capitalix provides a proprietary trading platform, but it lacks the widely used MetaTrader 4 or 5, which many traders prefer for their advanced features. The platform's performance and user experience are critical aspects to consider, as they directly impact trading efficiency.

The execution quality has been reported as variable, with some users experiencing slippage and delays in order processing. Any signs of platform manipulation or poor execution can lead to significant financial losses for traders, further emphasizing the need for thorough evaluation.

Risk Assessment

Using Capitalix comes with inherent risks that traders must consider. Below is a risk summary based on the findings:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation raises concerns. |

| Fund Security Risk | Medium | Reports of withdrawal issues and customer service complaints. |

| Trading Risk | High | High leverage and market volatility can lead to significant losses. |

To mitigate these risks, traders should adopt sound risk management practices, such as setting strict stop-loss orders and only trading with funds they can afford to lose. Additionally, conducting thorough research on the broker's practices and user experiences can help inform better trading decisions.

Conclusion and Recommendations

In conclusion, while Capitalix presents itself as a legitimate broker with various offerings, there are significant concerns regarding its regulatory status, customer experiences, and overall transparency. The combination of offshore regulation, mixed user feedback, and reports of aggressive sales tactics raises red flags that potential traders should carefully consider.

For those looking to engage in forex trading, it may be prudent to explore alternative brokers that are regulated by top-tier authorities, such as FCA or ASIC, which offer greater security and reliability. Ultimately, whether Capitalix is safe or a scam hinges on individual risk tolerance and the importance placed on regulatory protection and customer service. Traders are encouraged to conduct their own due diligence before proceeding with any investments.

Is Capitalix a scam, or is it legit?

The latest exposure and evaluation content of Capitalix brokers.

Capitalix Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Capitalix latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.