NeoTrade 2025 Review: Everything You Need to Know

Summary

NeoTrade presents itself as a user-friendly trading platform targeting small to medium-sized investors. The platform seeks to provide an accessible online trading experience that anyone can understand. This neotrade review examines a broker that has garnered mixed reactions from the trading community, with 86% of users recommending the platform despite notable gaps between expectations and actual user experiences.

NeoTrade operates with a small but user-friendly web trading platform. The platform aims to simplify asset selection and trading processes for everyday users. The broker has received 607 genuine customer reviews, with Trustpilot showing 76% excellent ratings. User feedback consistently highlights discrepancies between what traders expect and what they actually experience when using the platform.

The platform appears to cater primarily to traders who prioritize ease of use over advanced features. This makes it potentially suitable for beginners and intermediate traders who want simple tools. However, several concerns have emerged regarding minimum deposit requirements, customer support quality, and overall platform functionality that prospective users should carefully consider before opening an account.

Important Notice

This review is based on publicly available user feedback, customer testimonials, and market data collected from various sources. Specific regulatory information was not detailed in available materials, so potential users should exercise caution and conduct their own due diligence regarding regulatory compliance and safety measures.

Our evaluation methodology relies on comprehensive analysis of user experiences, platform features, and industry standards. We aim to provide an objective assessment of NeoTrade's services and offerings.

Rating Overview

Broker Overview

NeoTrade operates as an online forex and trading platform. The company focuses on providing a simplified trading experience for retail investors who want easy access to markets. The company has positioned itself in the competitive online trading space by offering what they describe as a "funny small webtrader" that emphasizes ease of use and straightforward asset selection processes.

The broker's primary business model centers around web-based trading services. They target users who prefer simplicity over complex trading tools that might confuse new traders. According to user reports, NeoTrade has been working on expanding their platform capabilities, though specific details about their development roadmap remain unclear from available information.

The company has achieved notable user recommendation rates. However, this neotrade review reveals that the platform's actual performance may not always align with user expectations in real-world trading scenarios. The broker appears to serve a niche market of traders who value accessibility and user-friendly interfaces, though questions remain about their comprehensive service offerings and regulatory standing in the industry.

Regulatory Status: Specific regulatory information was not detailed in available materials. This raises important considerations for potential users regarding oversight and compliance standards.

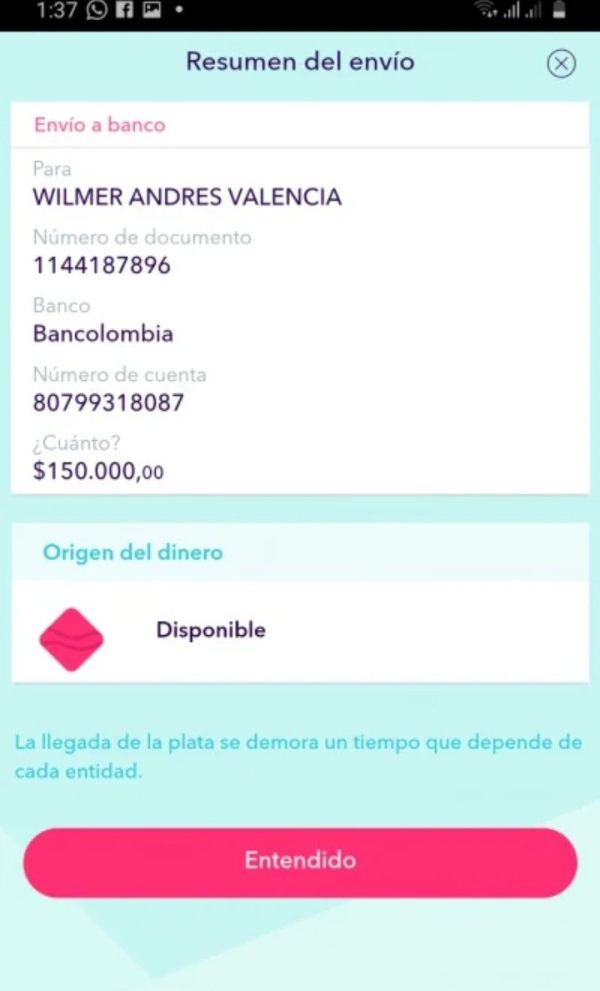

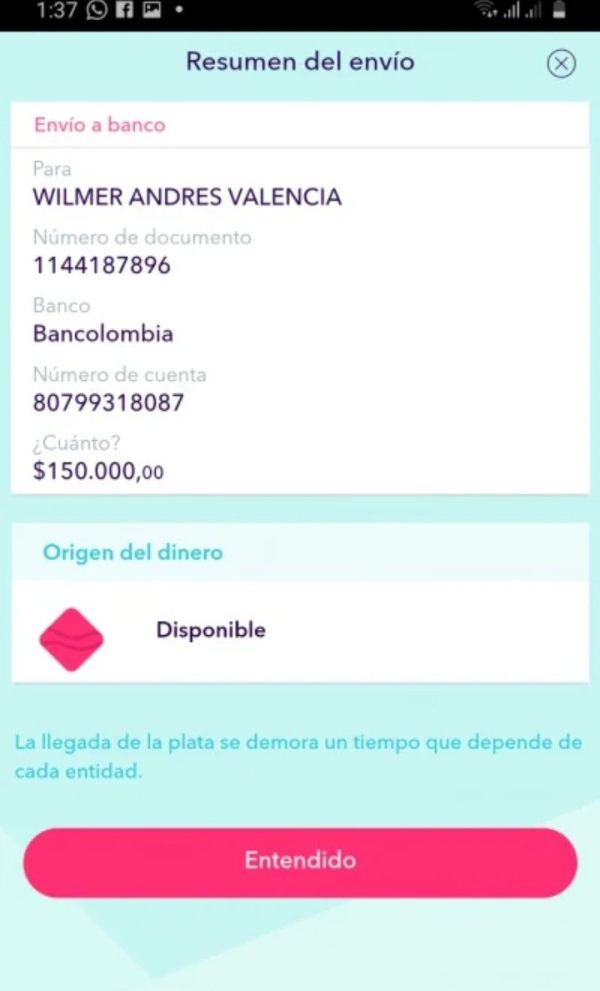

Deposit and Withdrawal Methods: Available materials did not specify the payment methods supported by NeoTrade. Processing times and associated fees for transactions were also not mentioned.

Minimum Deposit Requirements: User reports indicate that NeoTrade requires a rather large minimum deposit. The exact amount was not specified in available information.

Bonuses and Promotions: No specific information about promotional offers or bonus structures was mentioned in available materials.

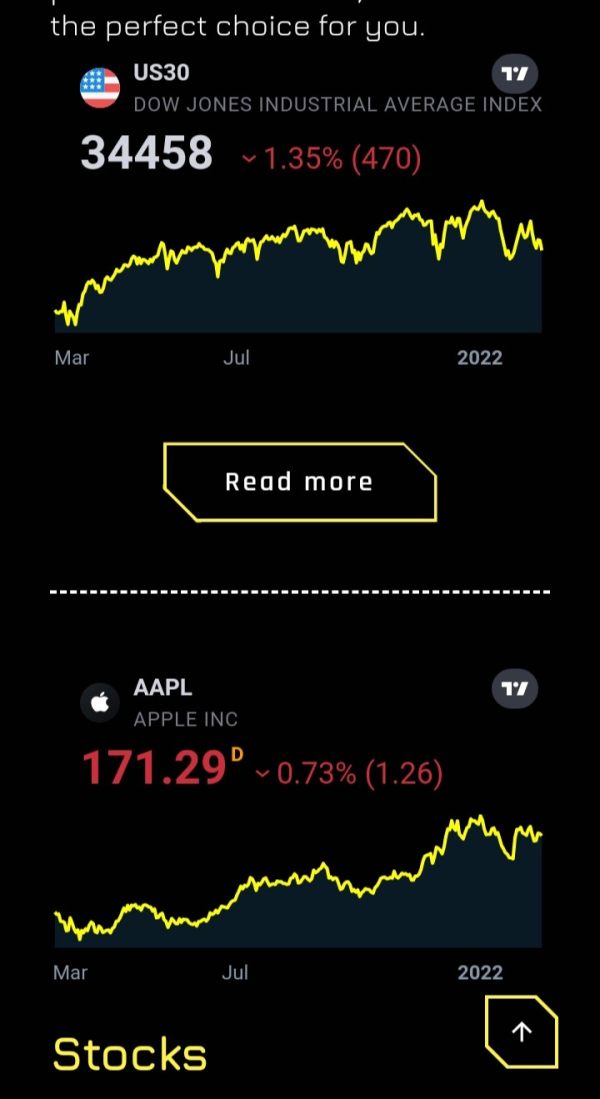

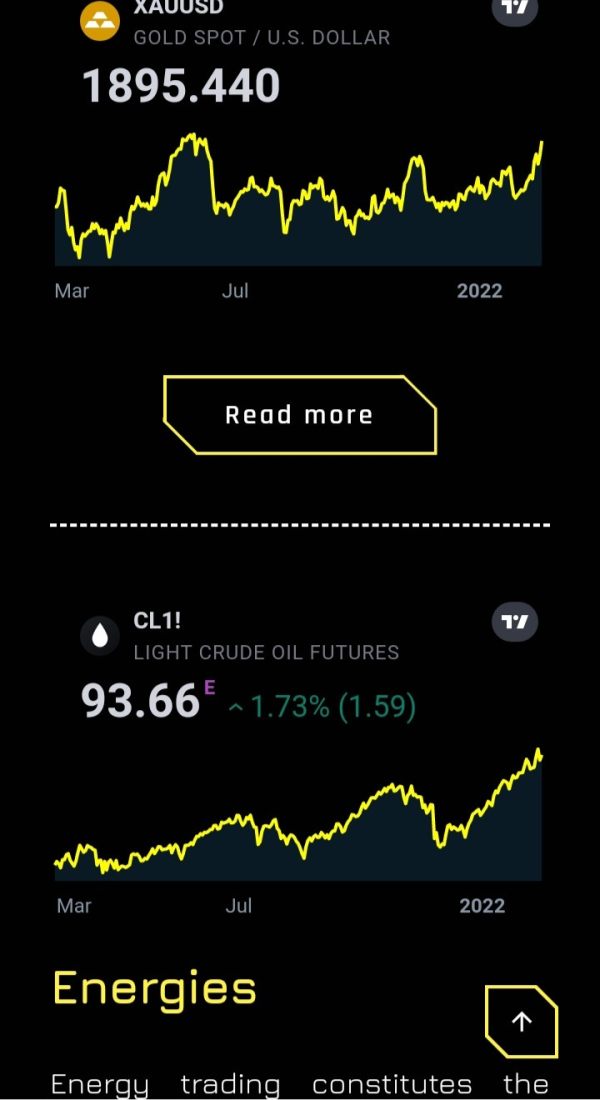

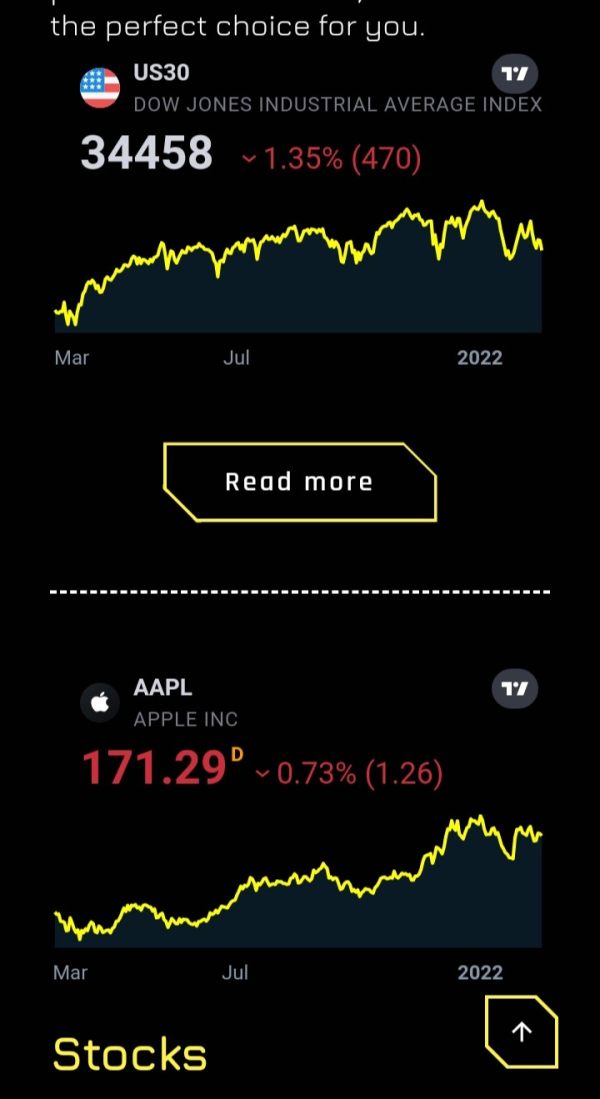

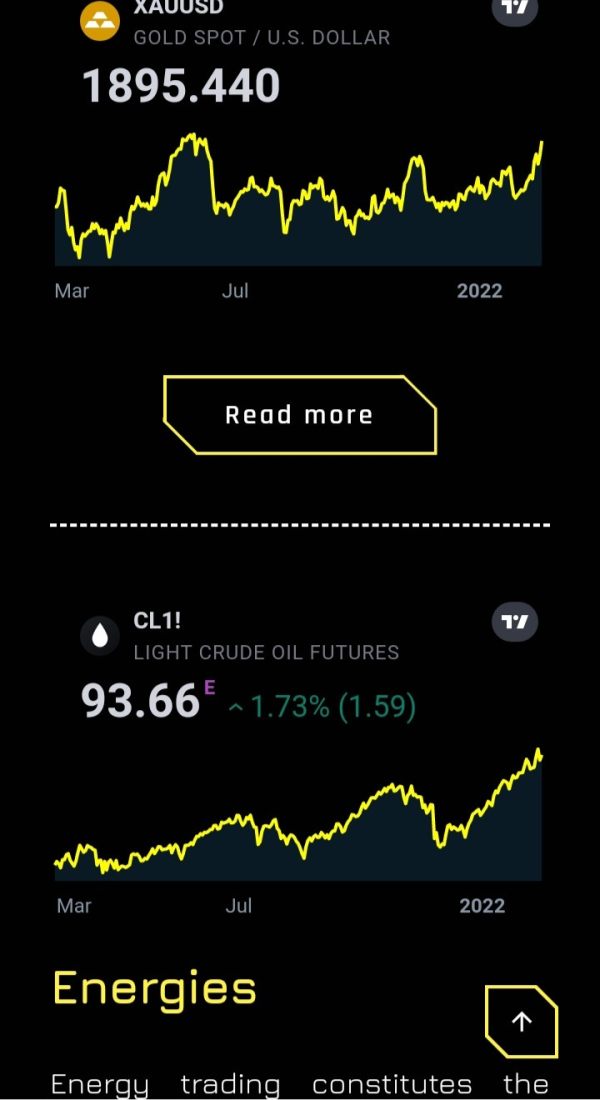

Tradeable Assets: The platform mentions easy asset selection. However, specific details about available instruments, markets, and asset classes were not provided in source materials.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not available in the reviewed materials.

Leverage Options: Leverage ratios and margin requirements were not specified in available information.

Platform Options: NeoTrade offers a user-friendly small web trading platform. The platform is designed for easy asset selection and trading execution.

Geographic Restrictions: Information about regional limitations or restricted countries was not detailed in available materials.

Customer Support Languages: Specific language support options were not mentioned in available information.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

NeoTrade's account conditions present mixed advantages and challenges for potential users. The most significant concern highlighted in user feedback relates to the rather large minimum deposit requirement, though specific amounts were not disclosed in available materials, which creates barriers for new traders or those with limited initial capital.

The lack of detailed information about different account types represents a transparency issue. Their specific features and benefits were not clearly outlined in available materials. According to this neotrade review, the account opening process and verification requirements were not clearly outlined in available materials, which could indicate either streamlined procedures or insufficient disclosure of requirements.

User feedback suggests that some traders appreciate the simplified approach to account management. Others have expressed concerns about the accessibility limitations imposed by higher deposit requirements that make it hard for small investors to start trading. The absence of information about special account features, such as Islamic accounts or professional trading accounts, further limits the platform's appeal to diverse trading communities.

Compared to industry standards, the reported large minimum deposit requirement appears to position NeoTrade in a higher-tier market segment. This potentially excludes smaller retail traders who typically start with minimal capital investments.

NeoTrade's trading tools and resources appear to focus on simplicity rather than comprehensive functionality. The platform features what users describe as a "funny small webtrader" that prioritizes easy asset selection and straightforward trading processes, but this approach may come at the expense of advanced analytical tools and research resources.

Available information suggests limited details about specific trading tools, technical analysis capabilities, or educational resources. User feedback indicates that while the platform's simplicity can be appealing, some traders have experienced gaps between their expectations for platform functionality and the actual available features that can help them make better trading decisions.

The broker reportedly has been working on adding additional features to their platform. This suggests ongoing development efforts that may improve the user experience over time. However, the timeline and specific nature of these improvements were not clearly communicated in available materials, leaving users uncertain about future platform enhancements.

Research and analysis resources, automated trading support, and educational materials were not specifically mentioned in user reviews or platform descriptions. This indicates potential limitations for traders who require comprehensive market analysis tools and learning resources.

Customer Service and Support Analysis (5/10)

Customer service represents a significant area of concern based on available user feedback. While specific details about support channels, availability hours, and response times were not provided in source materials, user comments suggest dissatisfaction with the quality and effectiveness of customer support services that can make or break a trading experience.

The gap between user expectations and actual support experiences appears to be a recurring theme in customer feedback. Some users have reported interactions with support staff regarding platform development and feature additions, indicating that support channels are operational, though their effectiveness may be limited in solving real problems.

Response times, problem resolution capabilities, and the overall quality of support interactions were not specifically detailed in available materials. The absence of information about multiple language support, 24/7 availability, or specialized support for different account types further raises questions about the comprehensiveness of customer service offerings.

User testimonials suggest that while support staff may be accessible, their ability to address complex issues or provide satisfactory solutions may not meet customer expectations. This contributes to the mixed reviews despite high recommendation rates.

Trading Experience Analysis (5/10)

The trading experience on NeoTrade presents a complex picture of user satisfaction and platform limitations. While the broker promotes a user-friendly web trading platform designed for easy asset selection, user feedback consistently points to discrepancies between expectations and actual trading experiences that can frustrate users.

Platform stability and execution quality were not specifically detailed in available materials. User comments suggest that some traders have encountered issues that affected their overall trading experience in ways that impacted their profits. The "small webtrader" approach may appeal to beginners but could limit advanced traders seeking sophisticated execution capabilities.

Order execution quality, including slippage rates and requote frequency, was not specifically documented in user reviews. However, the general sentiment suggesting expectation gaps implies that some users may have experienced execution issues or platform limitations that impacted their trading performance in negative ways.

This neotrade review indicates that while the platform's simplicity can be advantageous for certain user types, it may not provide the robust trading environment that more experienced traders require. Mobile trading capabilities and platform reliability during high-volatility periods were not addressed in available information.

Trust and Security Analysis (5/10)

Trust and security considerations present significant concerns for potential NeoTrade users. The classification as a medium-risk broker with an overall rating of 5 suggests moderate reliability, though specific regulatory oversight and security measures were not detailed in available materials, which makes it hard for users to feel completely safe.

The absence of clear regulatory information raises important questions about investor protection, fund segregation, and compliance with international trading standards. Without specific details about regulatory licenses or oversight bodies, potential users cannot adequately assess the security of their investments or know if their money is truly protected.

Company transparency appears limited based on available information. There is insufficient disclosure about corporate structure, financial backing, or operational history that would help users understand who they are dealing with. This lack of transparency may contribute to user uncertainty and the gaps between expectations and experiences reported in customer feedback.

Third-party security assessments, insurance coverage, and fund protection measures were not mentioned in available materials. This further complicates the trust evaluation for potential users considering the platform for their trading activities.

User Experience Analysis (5/10)

User experience with NeoTrade reveals a paradox between high recommendation rates and reported expectation gaps. Despite 86% of users recommending the platform, consistent feedback indicates that actual experiences may not align with initial expectations, suggesting complex user satisfaction dynamics that are hard to understand.

The user-friendly small web trading platform represents the broker's primary strength. It appeals to traders who prioritize simplicity and ease of use over complex features that might confuse them. However, this simplified approach may limit functionality for users seeking more comprehensive trading capabilities and advanced features.

Registration and verification processes were not specifically detailed in available materials. The focus on user-friendliness suggests streamlined onboarding procedures that should be easy to complete. The absence of information about account verification times and documentation requirements leaves potential users uncertain about the signup experience.

Common user complaints center around the gap between platform expectations and actual functionality. Specific issues were not detailed in available feedback, but this pattern suggests that while the platform may be accessible, it might not deliver the comprehensive trading experience that some users anticipate based on initial impressions or marketing materials.

Conclusion

This neotrade review reveals a broker that occupies a unique position in the online trading landscape. NeoTrade offers a simplified trading experience that appeals to certain user segments while potentially limiting others who need more advanced features. NeoTrade appears most suitable for small to medium-sized investors who prioritize ease of use and straightforward platform navigation over advanced trading features and comprehensive market analysis tools.

The platform's main advantages include its user-friendly web trading interface and relatively high user recommendation rate of 86%. However, significant concerns include large minimum deposit requirements, limited transparency regarding regulatory oversight, and consistent reports of gaps between user expectations and actual platform experiences that could disappoint some traders.

Potential users should carefully consider whether NeoTrade's simplified approach aligns with their trading needs and risk tolerance. This is particularly important given the medium-risk classification and limited regulatory information available for evaluation.