BT Markets Review 21

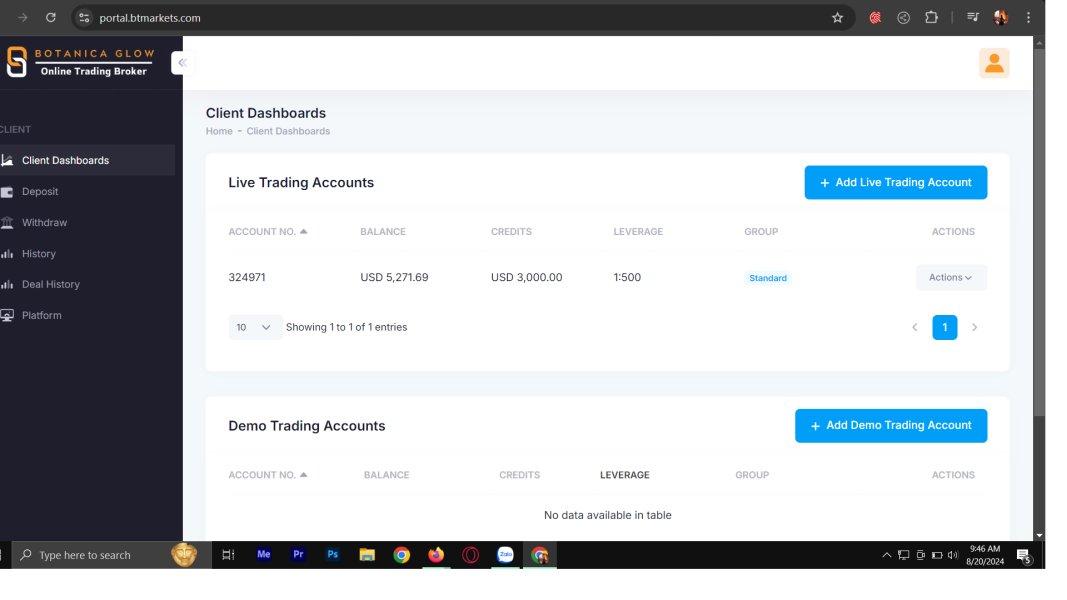

BT Markets Exchange has tempted me to deposit a large amount of money and lured me into trading a suspicious index called Ita20, and manipulated this index to burn my account.

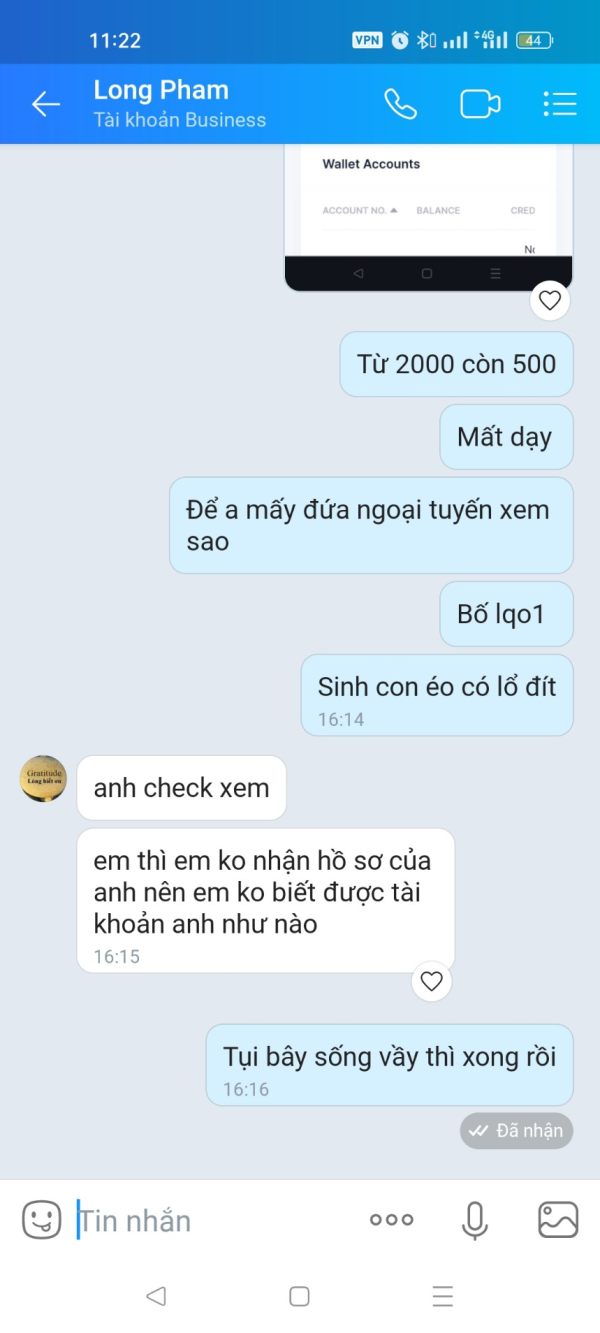

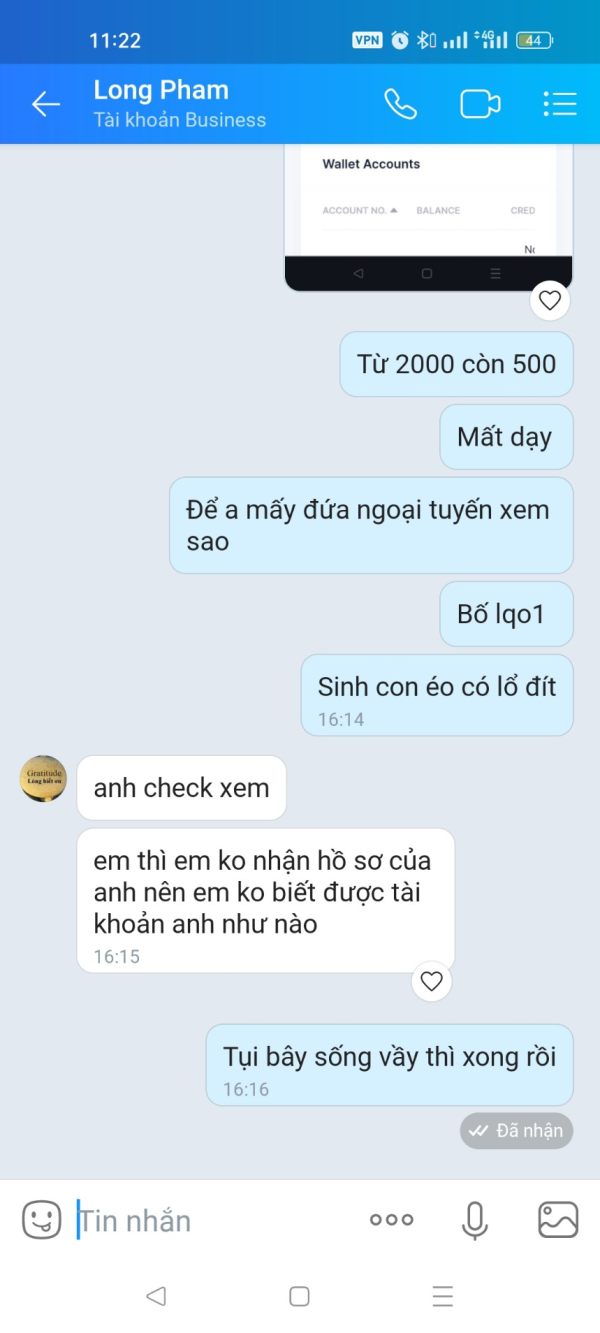

A group of players enticed others to deposit $500 through the website https://portal.btmarkets.com/ but I don't want to deposit, and they cursed and kicked me out of the group! If it's good, then play on your own, why do you have to broker orders. If it's good, then they would have joined as well.

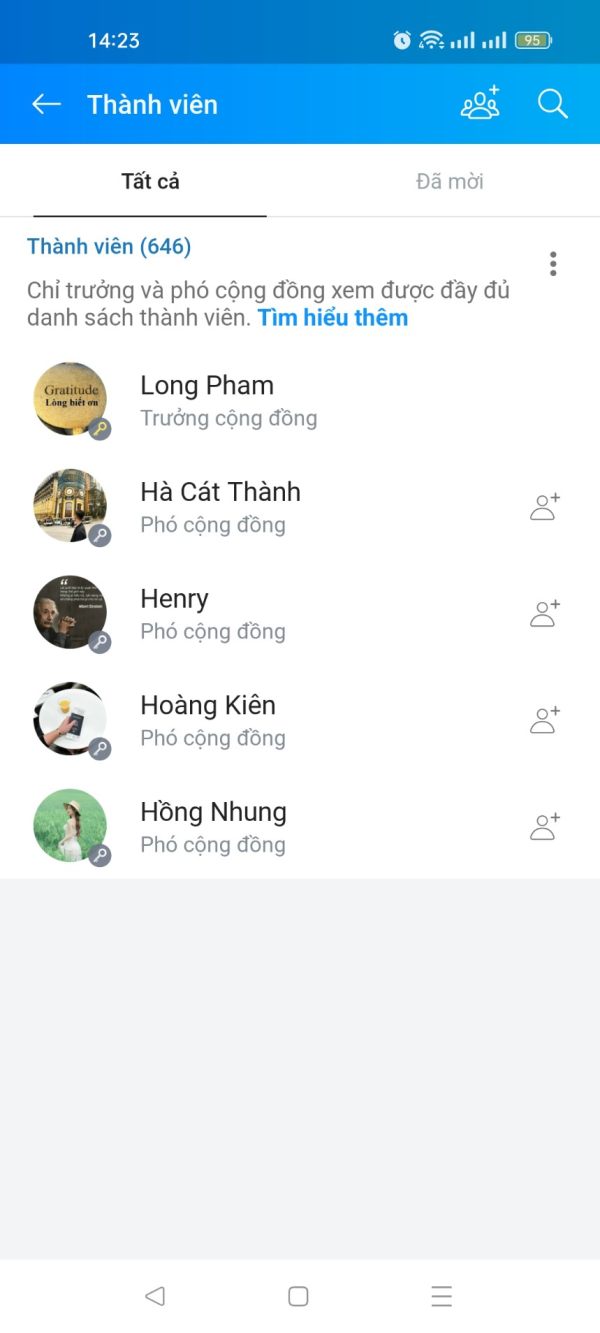

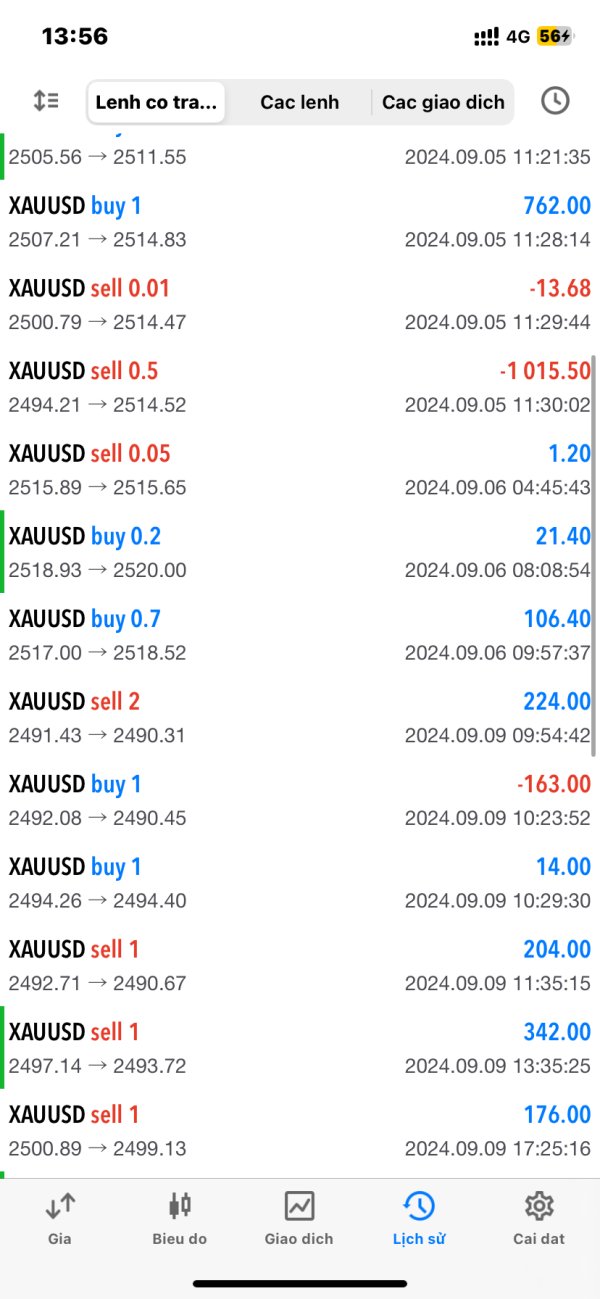

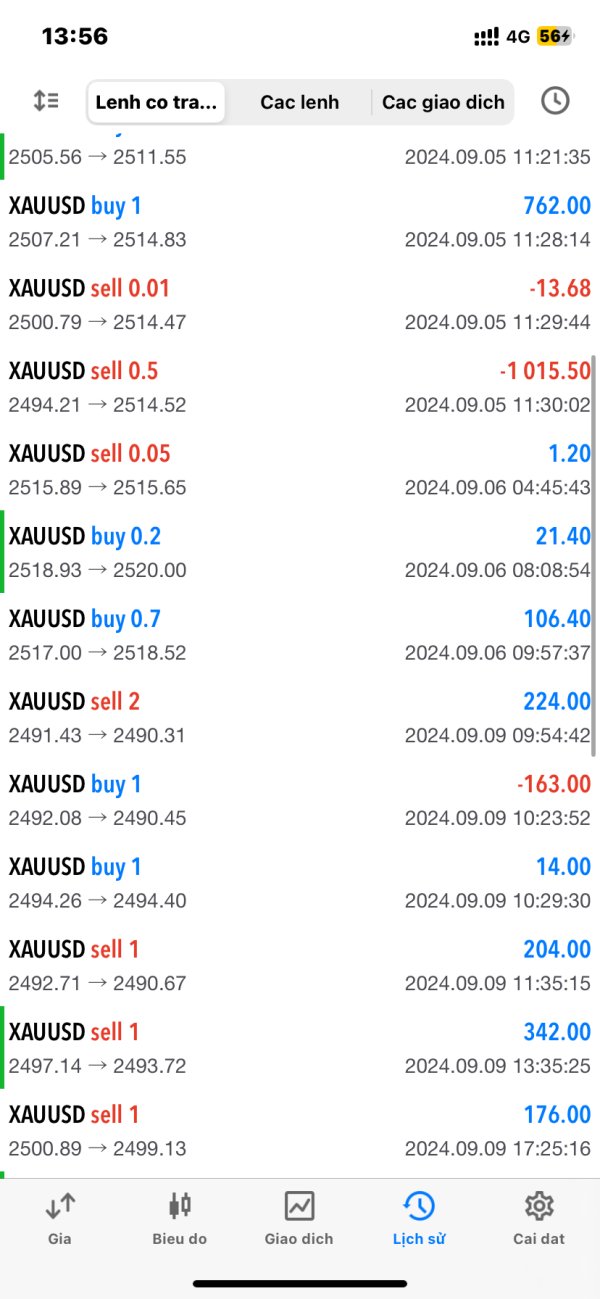

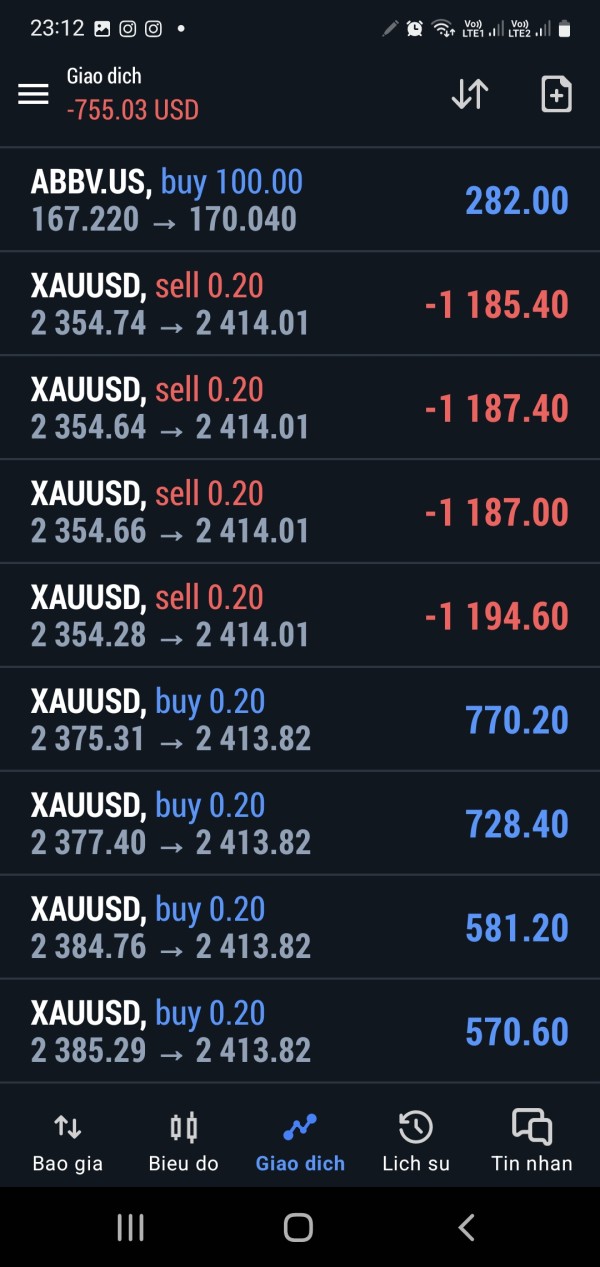

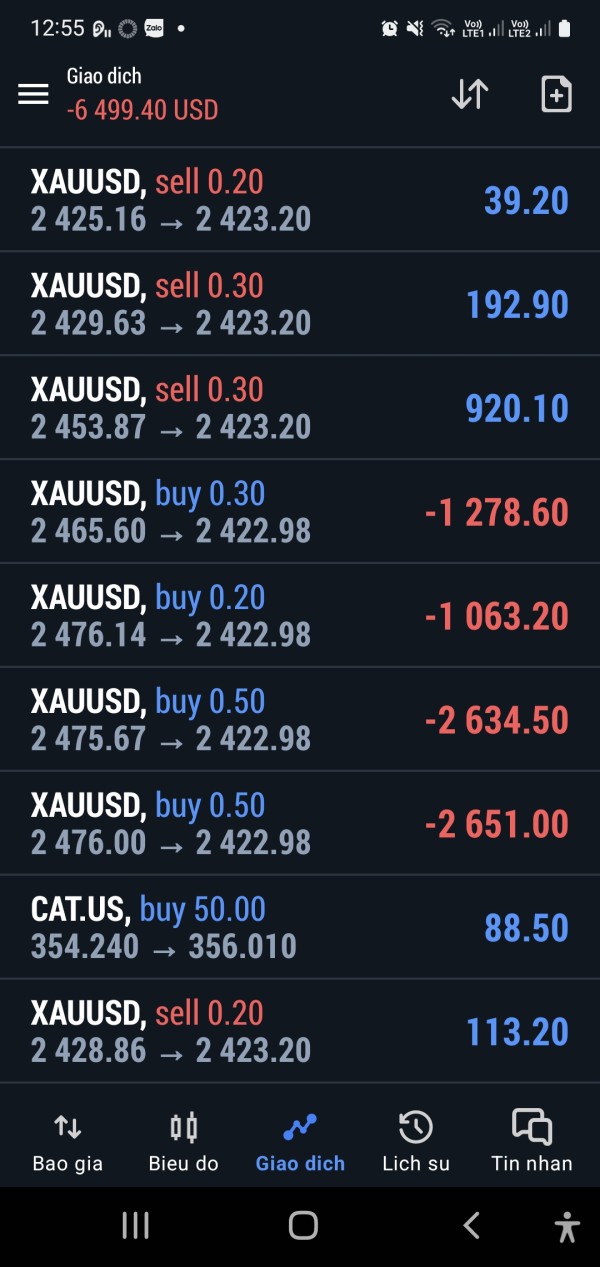

Please note that this is a very sophisticated and professional scam exchange!!! Their tricks are as follows: 1. They lure victims into Zalo groups, which are very active. Every day, people post orders and report profits, but if you are observant, you will realize that these are fake groups because the participants are all fake accounts with no real avatars. After the group admin posts an article, they will receive hundreds of likes in a few seconds, which is a like boosting tool. 2. As long as the victims intend to deposit money, they will continuously entice them with various tricks, such as being able to deposit into a bonus 100% exchange or receiving additional gifts like gold, 1 tael of gold, 2 taels of gold (no international exchange would give away gold like this) 3. They will guide the victims in trading and, especially, they will never instruct them to set a stop loss to protect their accounts. The victims' accounts burn quickly, and then they are enticed to deposit more. 4. They use their own codes on the exchange to manipulate prices and burn the victims' accounts. For example: ITA20 code 5. After the accounts are burned, they will lure the victims to deposit more, and sometimes they even use their own money to help them deposit.

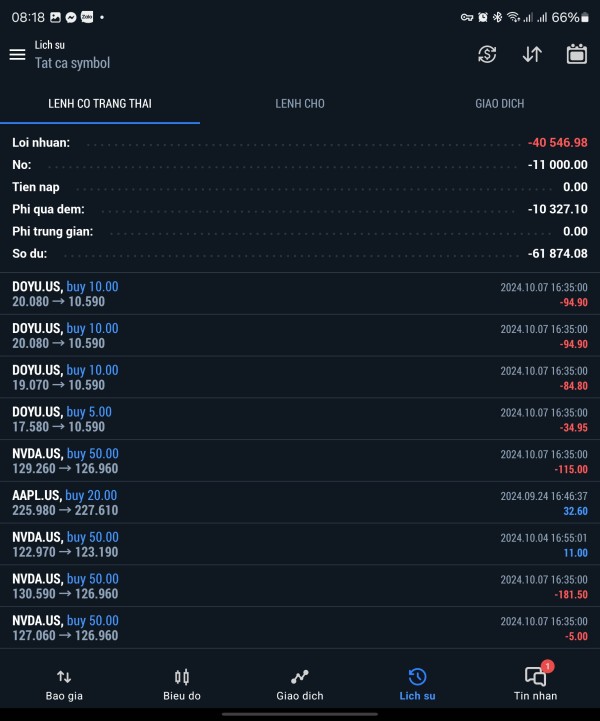

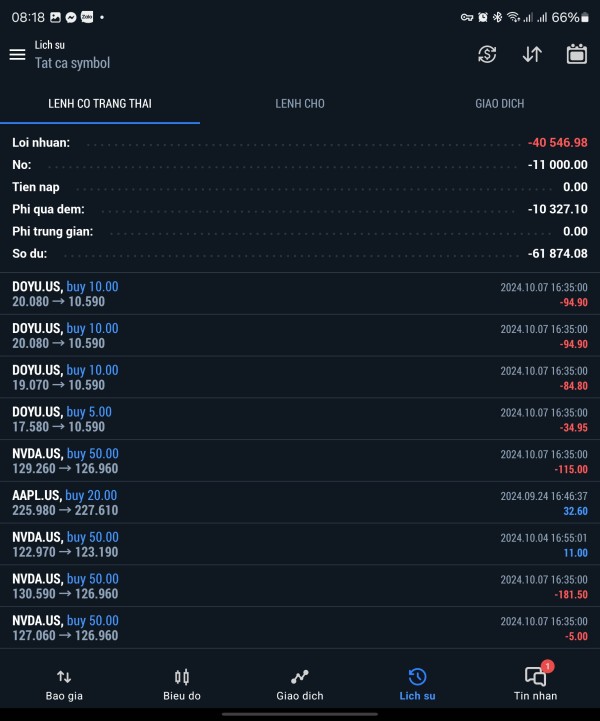

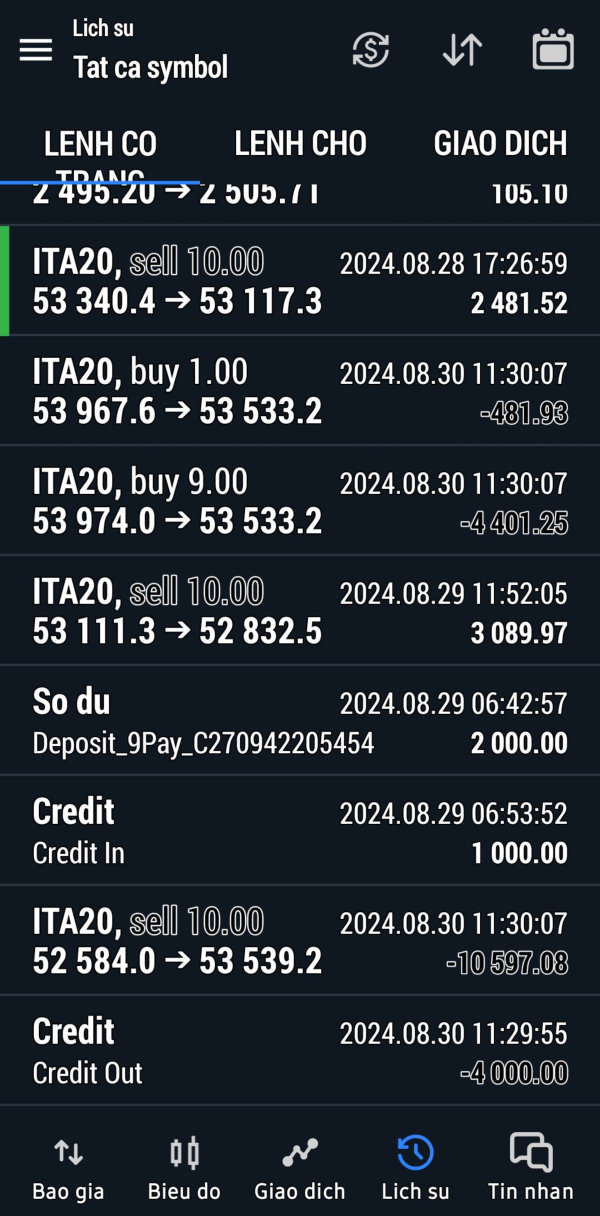

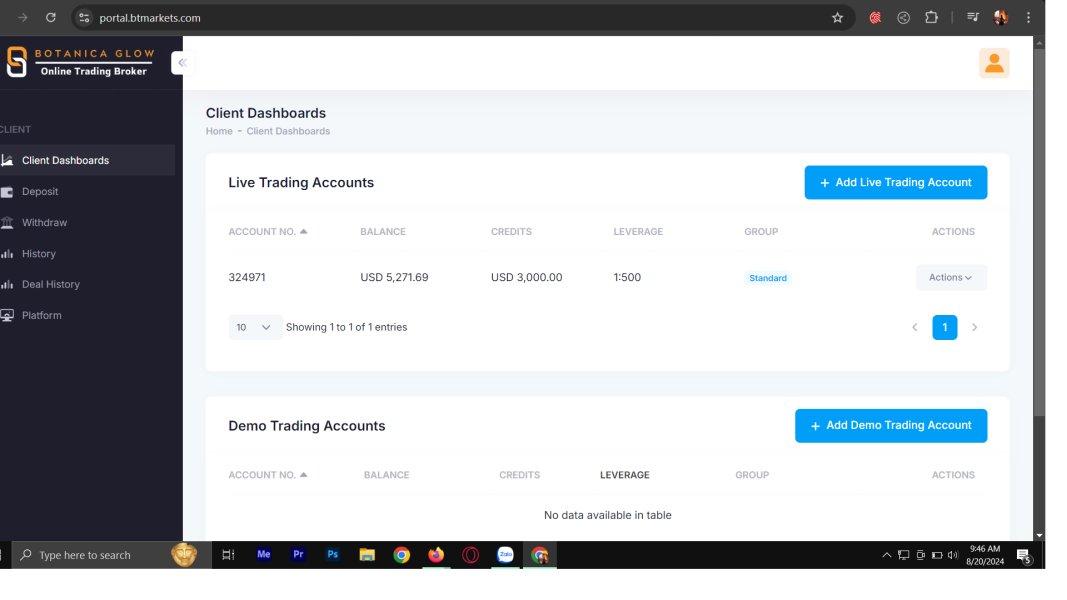

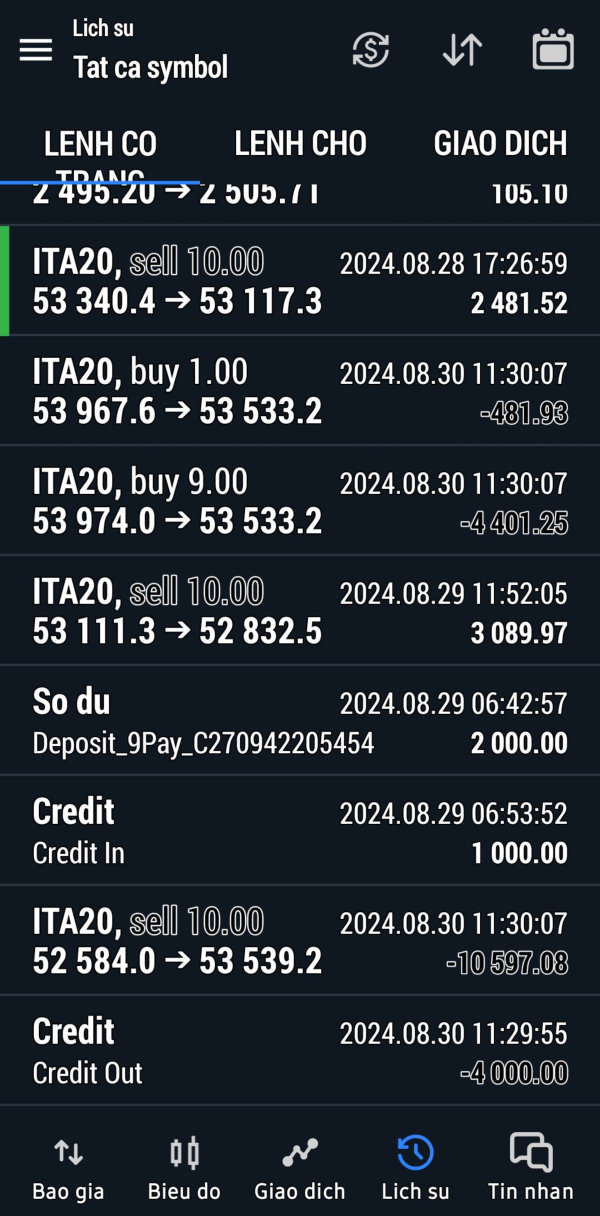

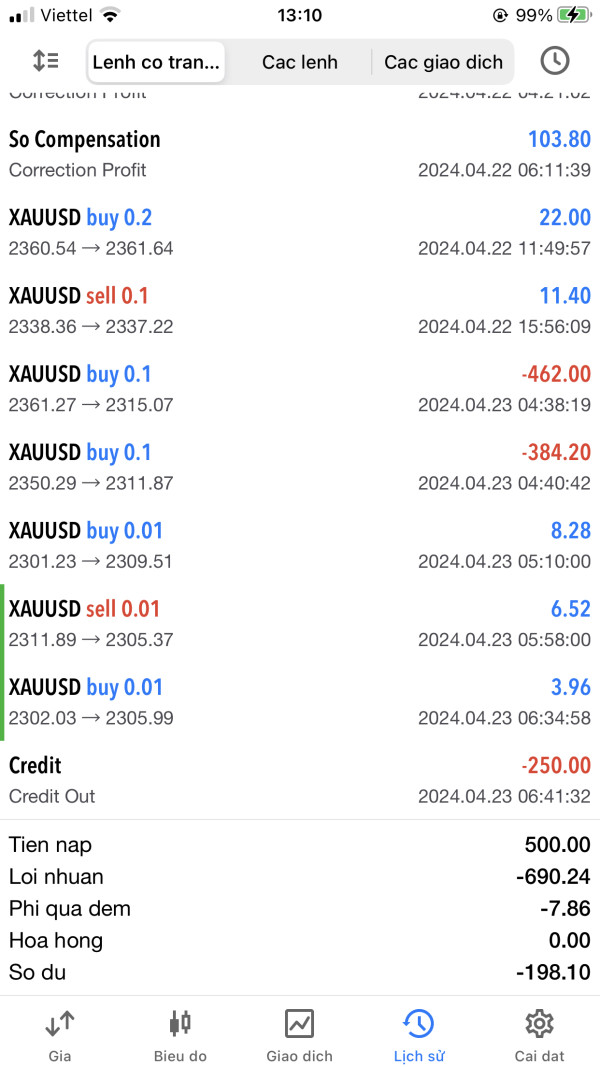

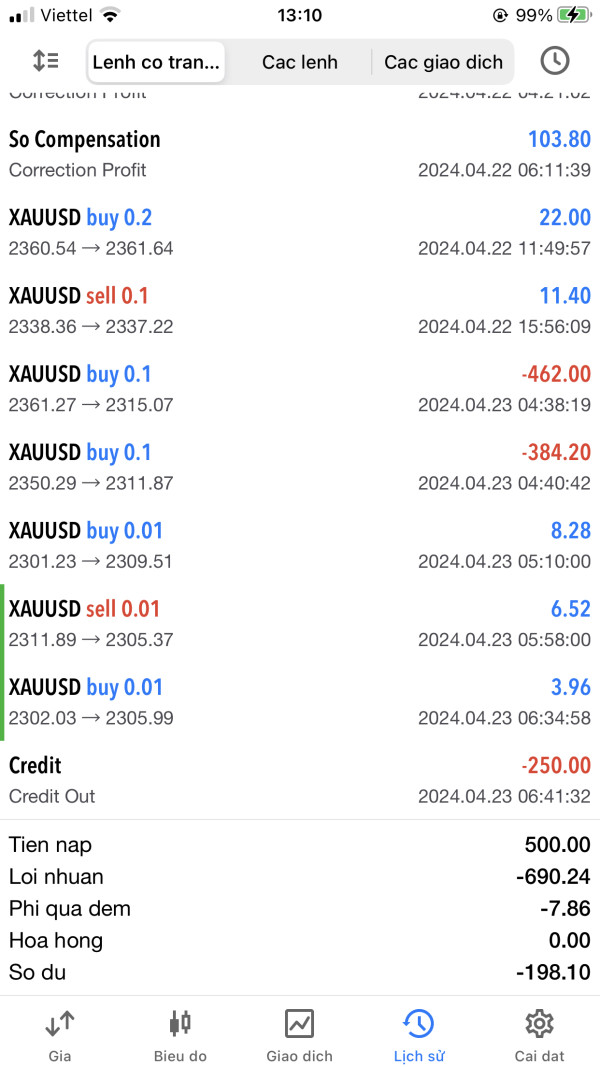

At first, I deposited 2k USD. Initially, because I didn't know, I entered orders myself, leading to a negative account balance. The support suggested adding more capital to save the account. I added an additional 2.4k. After 2 days, it increased to 4.5k. From there, the support advised me to place counter-trend orders, leading to a negative account balance. Then they requested additional funds to save the account. I accepted losing 4.4k USD (over 100 million).

It's beginner-friendly with a mobile-accessible interface, while experienced traders can benefit from advanced analytics on the MT5 platform. Don't miss!!

Supports fired-back orders, causing customer accounts to burn. Leave customers overwhelmed with negative orders and blame the market. If customers request to withdraw money, they will use holiday reasons to prevent them from withdrawing money.

Quite concerned about their regulatory status; it doesn't seem solid. Plus, the costs aren't as transparent as they claim, with hidden fees cropping up.

If your name is on Zalo, do not join the group called Investment Strategy Analysis led by Long Pham. There are acts of not allowing money to be withdrawn, and changing passwords on mt5, then burning accounts to take over. Attached a picture of this name on zalo (it may be a fake picture, but whoever sees this picture runs away, if you upload it, you will lose everything)