E-Futures Review 2

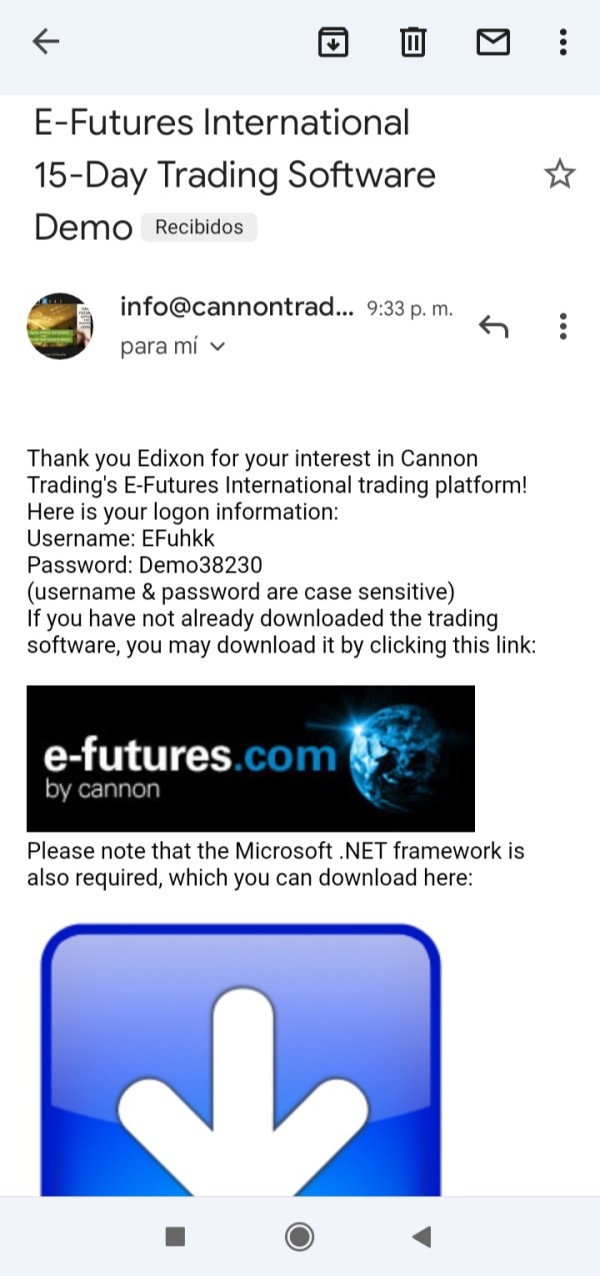

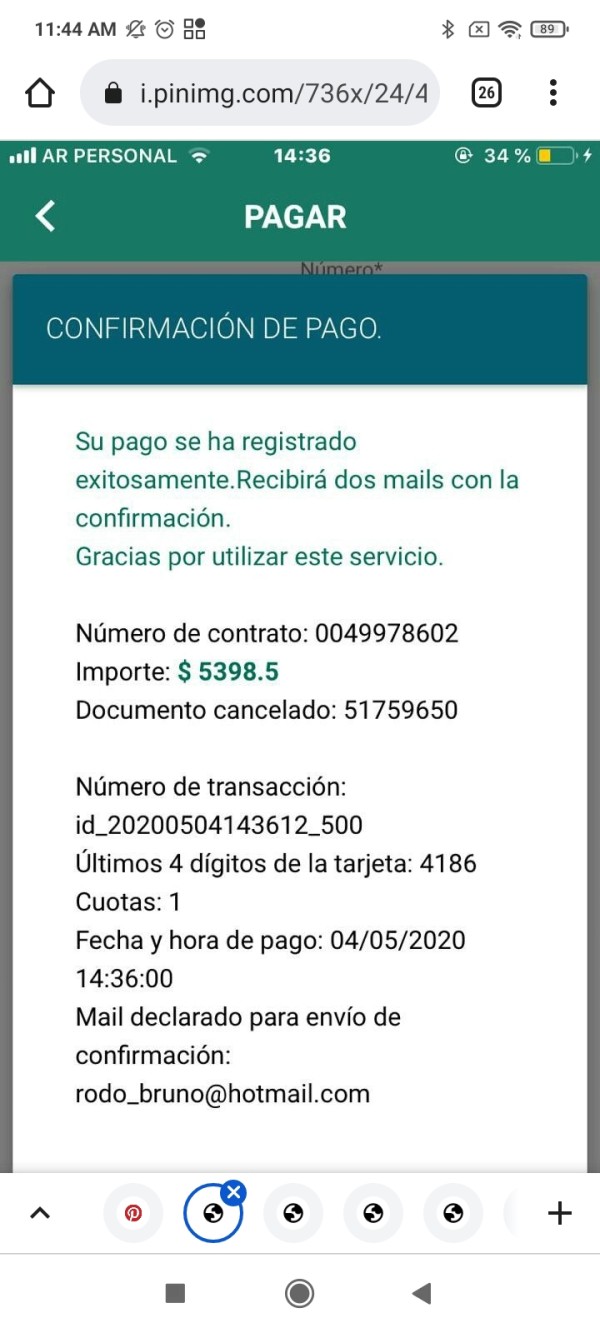

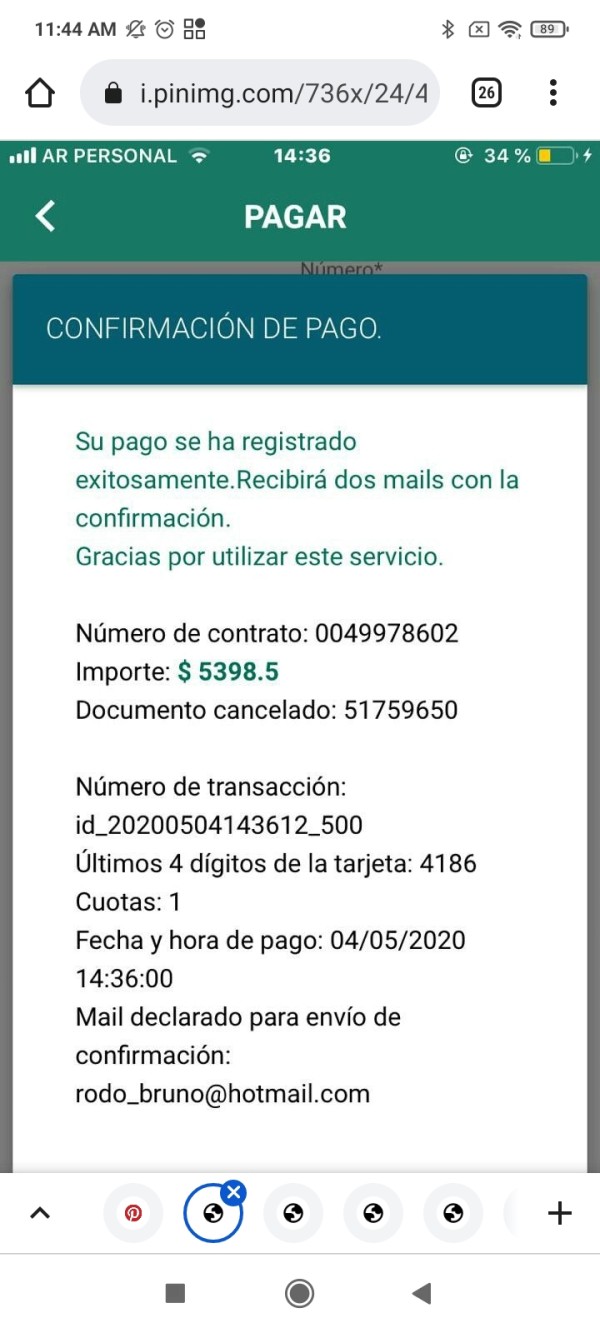

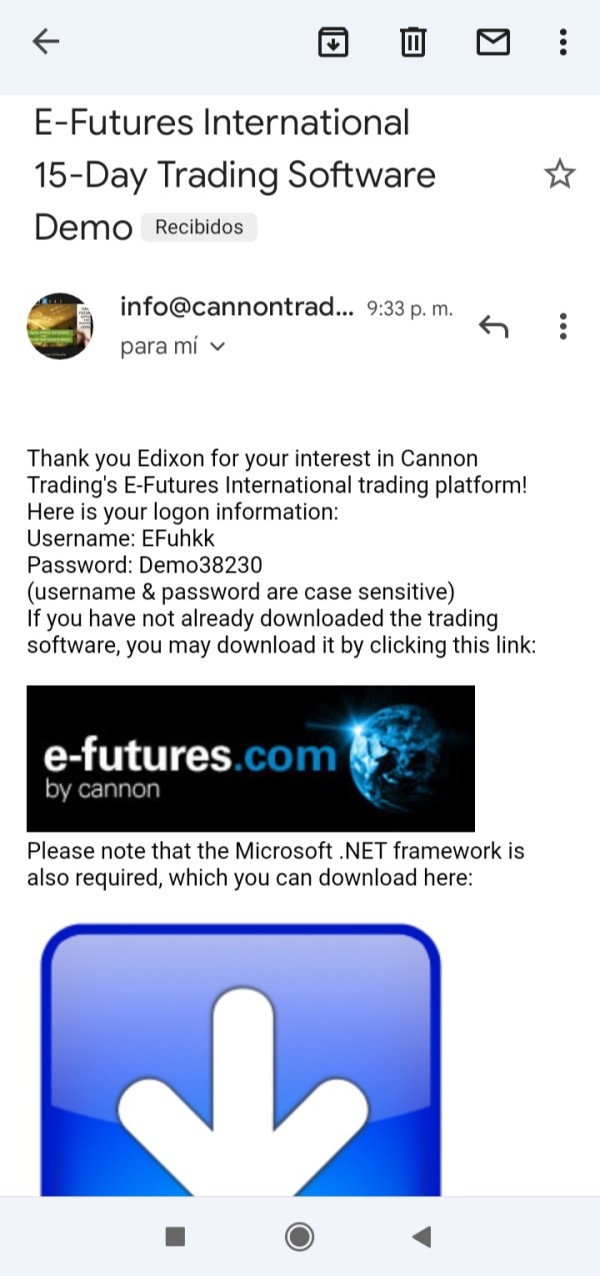

They asked me to deposited 50%, about $25000. I wanted to withdraw $5398 and here was the total shares.

I believed I would gain a lot so I deposited $60. I earned $300 but they did not pay me.

E-Futures Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

They asked me to deposited 50%, about $25000. I wanted to withdraw $5398 and here was the total shares.

I believed I would gain a lot so I deposited $60. I earned $300 but they did not pay me.

In the competitive landscape of futures trading in 2024, e-futures.com has emerged as a highly-rated brokerage providing a user-friendly platform coupled with advanced trading tools. With a stellar 4.9 out of 5-star rating on Trustpilot, e-futures.com distinguishes itself through its low fees and remarkable customer support. The platform caters to both novice and experienced traders, offering resources that empower users to confidently navigate the complexities of futures trading. However, potential traders must remain vigilant about certain risks related to regulatory compliance and fund withdrawals, particularly amid criticisms of execution delays and withdrawal issues. As such, while e-futures.com presents significant trading opportunities, understanding these risks is imperative for achieving long-term success.

Attention Traders:

Before engaging with any trading platform, including e-futures.com, please consider the following critical information regarding potential risks and methods of self-verification:

How to Self-Verify:

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Regulatory Compliance | 4 | CFTC and NFA regulation provide credibility and security. |

| Customer Support | 5 | High responsiveness and helpfulness as reflected in reviews. |

| Platform Usability | 4 | User-friendly interface, but mixed opinions on robustness. |

| Trading Costs | 4 | Competitive fees but potential hidden charges. |

| Educational Resources | 5 | Comprehensive educational offerings greatly benefit traders. |

| Withdrawals & Execution | 3 | Criticisms regarding execution delays and withdrawal issues. |

Founded in 1988, e-futures.com is a well-established player in the futures trading industry, backed by its parent company, Cannon Trading Company. The firm operates from the United States and has cultivated a reputation for transparency, reliability, and excellent customer service throughout its history. With over three decades in business, e-futures has positioned itself as a protector of traders' interests, marrying time-tested experience with modern technological capabilities.

e-futures.com specializes in futures and options trading across several asset classes, including commodities, indices, and currencies. Their platform provides clients with access to advanced trading tools, real-time market data, and comprehensive analytical resources. As a member of the National Futures Association (NFA) and regulated by the CFTC, e-futures ensures compliance with stringent industry standards, granting clients peace of mind regarding fund safety and trading practices.

| Feature | Details |

|---|---|

| Regulation | CFTC, NFA regulative oversight |

| Minimum Deposit | $500 |

| Leverage | Up to 50:1 |

| Major Fees | Commissions as low as $0.25 per trade |

| Withdrawal Timeframe | 3-5 business days (potential delays) |

Analysis of Regulatory Information Conflicts

Despite a solid regulatory framework in place, e-futures.com faces criticism concerning mixed user experiences. Reports indicate conflicts in regulatory compliance from different users perspectives, particularly regarding withdrawal processes during high volatility. Although these issues have been noted, e-futures maintains a clean backend with statutory regulatory bodies (CFTC, NFA) which mandates operational integrity.

User Self-Verification GuideTo ensure safety while trading:

The reputation of e-futures.com predominantly skews positive, based largely on excellent user reviews highlighting its transparency in operations and mediation during trade executions. Nonetheless, complaints about fund safety and withdrawal processes must be approached with caution, highlighting the need for trader vigilance.

Advantages in Commissions

e-futures.com provides a competitive commission structure, particularly at $0.25 per side, which is significantly lower than many of its key competitors. This low-cost entry structure appeals primarily to active traders seeking to maximize profits by minimizing fees.

The "Traps" of Non-Trading FeesTraders, however, should remain cautious about potential hidden charges that may emerge during specific services, which may inadvertently erode profit margins.

User Complaint Example:

"I was charged an extra $20 for withdrawal, which I was not informed about beforehand."

Cost Structure SummaryOverall, the competitive commission rates and transparent pricing models render e-futures.com as an excellent platform for cost-conscious traders. However, residual concerns about hidden fees could limit the full cost-effectiveness for more casual traders.

Platform Diversity

The trading platforms supported by e-futures.com, particularly the CannonX powered by CQG, provide a range of features for traders of all experience levels. The platform boasts intuitive charting tools and real-time data integration, catering to dynamic trading needs.

Quality of Tools and ResourcesAlongside feature-rich platforms, e-futures ensures that users are equipped with high-quality educational materials, including webinars and market analyses, thereby promoting a knowledgeable trading environment.

Platform Experience SummaryThe overall user feedback indicates a generally favorable reception towards the usability and efficiency of e-futures.com. Users endorse the intuitive interface and performance but voice mixed concerns when trades are executed during heavy market fluctuations.

Onboarding Process

The onboarding experience on e-futures.com is reported to be straightforward and welcoming for new users, with many highlighting the ease of account creation and initial funding processes.

Trading ExperienceUser experience across the CannonX platform provides an overall positive sentiment, bolstered by satisfactory speed in trade execution—crucial in the fast-paced world of futures trading.

Community and SupportTraders appreciate the availability of customer support, particularly praising the quick resolution of issues; however, notable complaints about customer service delays during peak trading hours have been reported.

Availability of Support

e-futures.com offers multiple communication channels, including phone support, live chat, and email, ensuring traders can reach out whenever necessary, especially during market intricacies.

Quality of SupportOverall, users have commended the expertise and responsiveness of the support staff, although reports of delays during critical periods four times highlight an area for potential improvement.

Educational SupportThe educational resources available to clients provide invaluable assistance, ensuring that both novice and advanced traders can navigate futures trading with confidence and clarity.

Account Types and Features

e-futures.com presents a range of account types tailored to various trader needs, thus showcasing their commitment to flexibility and accessibility.

Minimum Deposit and LeverageWith a minimum deposit requirement of $500 and leverage options of up to 50:1, e-futures positions itself as an accommodating broker catering to diverse trading strategies.

Comparison with CompetitorsWhen benchmarked against other industry players, e-futures.com remains competitive, particularly regarding low commissions and educational resources, while providing a robust platform that balances complexity with user-friendliness.

In summary, e-futures.com presents an appealing option for futures traders in 2024. With its user-centric approach, advanced technology, and favorable trading conditions, it could either be a gateway to success or a platform that presents challenges if risks are not adequately managed. While there are undeniable benefits, such as competitive costs and responsive customer support, traders need to be cognizant of regulatory compliance issues and withdrawal processes before committing fully.

Ultimately, through diligent research and careful self-verification of risks, traders can enjoy a rewarding experience with e-futures.com as a reliable partner in navigating the complexities of futures trading in 2024 and beyond.

FX Broker Capital Trading Markets Review