Is RouteForex safe?

Business

License

Is RouteForex A Scam?

Introduction

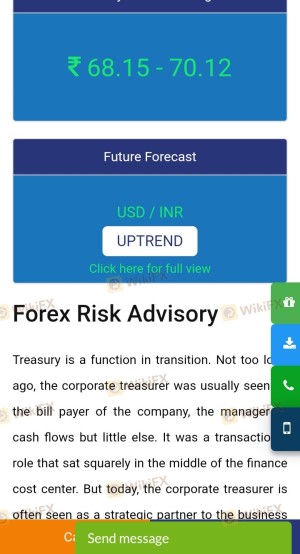

RouteForex is a forex broker that positions itself as a comprehensive solution for foreign exchange services, particularly catering to clients in India. As the forex market continues to grow, it becomes increasingly essential for traders to carefully evaluate the brokers they choose to work with. This evaluation is crucial not only for safeguarding investments but also for ensuring compliance with regulatory standards. In this article, we will investigate whether RouteForex is safe or a scam by analyzing its regulatory status, company background, trading conditions, customer safety measures, and user feedback. Our assessment is based on a thorough review of available information, including regulatory databases, customer reviews, and financial reports.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and legitimacy. Regulation ensures that brokers adhere to strict guidelines designed to protect traders and their funds. Unfortunately, RouteForex does not hold any valid regulatory licenses, which raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that RouteForex is not subject to oversight by any recognized financial authority. This lack of oversight can expose traders to various risks, including potential fraud and the inability to recover funds in case of disputes. Many financial experts recommend working only with regulated brokers to ensure a level of protection and accountability. Given that RouteForex is unregulated, it is essential for potential clients to exercise extreme caution.

Company Background Investigation

RouteForex Solutions Private Limited claims to operate from New Delhi, India. However, there are doubts about the accuracy of this information, as no verifiable details about the company's actual location or ownership are readily available. The lack of transparency surrounding its operational history raises questions about the company's credibility.

Furthermore, the management team behind RouteForex is not well-documented, which complicates the assessment of their expertise and experience in the forex market. A broker's management team plays a vital role in its operations, and a lack of information can indicate a potential red flag. Transparency and information disclosure are crucial for establishing trust, and RouteForex appears to fall short in this regard.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is essential. RouteForex offers a range of services, but its fee structure and trading costs are not clearly outlined. Many traders have reported hidden fees that can significantly affect their overall profitability.

| Fee Type | RouteForex | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding trading costs can lead to confusion and frustration for traders. Furthermore, any unusual fee policies could indicate an attempt to exploit clients. It is essential for traders to fully understand the cost structure before committing to a broker, especially one like RouteForex that does not provide clear information.

Customer Funds Safety

The safety of customer funds is paramount when choosing a forex broker. RouteForex's measures for ensuring the safety of client funds are unclear, which is concerning. A reputable broker typically segregates client funds from operational funds and offers investor protection schemes.

However, without proper regulation, there is no assurance that RouteForex has implemented such safety measures. The absence of information about fund segregation, investor protection, and negative balance protection policies raises alarms about the potential risks associated with trading through this broker. Historical incidents involving unregulated brokers often highlight the risks of losing funds without recourse.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of RouteForex reveal a mixed bag of experiences, with many users expressing dissatisfaction. Common complaints include difficulties in withdrawing funds, lack of customer support, and unclear trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support Quality | Medium | Inconsistent |

| Transparency of Fees | High | Poor |

One notable case involved a trader who reported being unable to withdraw funds for several months. Despite multiple attempts to contact customer support, the responses were either delayed or unhelpful. Such experiences can significantly impact a trader's trust in a broker and highlight the importance of evaluating customer service quality.

Platform and Trade Execution

The trading platform offered by RouteForex is another crucial aspect to consider. A reliable trading platform should be stable and user-friendly, providing traders with the tools they need to make informed decisions. However, there are concerns regarding the performance and reliability of RouteForex's platform.

Users have reported issues with order execution, including slippage and rejected orders. These problems can severely affect trading outcomes and indicate potential manipulation or technical shortcomings. A broker's ability to execute trades efficiently is vital for maintaining a good trading experience, and any signs of platform manipulation should be taken seriously.

Risk Assessment

Using RouteForex presents several risks that potential clients must consider. The absence of regulation, unclear trading conditions, and negative user feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status exposes traders to potential fraud. |

| Financial Risk | High | Lack of transparency in fees and withdrawal issues. |

| Operational Risk | Medium | Technical issues with the trading platform can affect execution. |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers with transparent practices. Always ensure that you are aware of the risks involved and have a clear plan for managing your investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that RouteForex may not be a safe option for traders. The lack of regulation, transparency issues, and negative customer feedback raise significant red flags. While the platform may offer some attractive features, the risks associated with trading through an unregulated broker are substantial.

For traders seeking reliable options, it is advisable to consider regulated brokers with proven track records and positive user experiences. Companies like IG, OANDA, and Forex.com offer safer alternatives with robust regulatory oversight and transparent practices. Ultimately, exercising caution and conducting thorough research is essential when navigating the complex landscape of forex trading.

Is RouteForex a scam, or is it legit?

The latest exposure and evaluation content of RouteForex brokers.

RouteForex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RouteForex latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.