Is Optionsi safe?

Business

License

Is Optionsi Safe or a Scam?

Introduction

Optionsi is an online forex and options trading platform that has gained attention in the financial trading community. Operating in a highly competitive market, it positions itself as a user-friendly broker aimed at both novice and experienced traders. However, the online trading landscape is fraught with potential pitfalls, making it essential for traders to thoroughly evaluate the legitimacy and safety of any broker before committing their funds. This article aims to investigate the safety and reliability of Optionsi by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. Our analysis is based on data collected from various reputable sources and reviews, ensuring a comprehensive and objective evaluation.

Regulation and Legitimacy

The regulatory status of a trading broker is a crucial factor in determining its legitimacy and safety. Regulated brokers are subject to strict oversight by financial authorities, which helps protect traders' interests and funds. In the case of Optionsi, initial findings indicate a lack of regulation by any recognized financial authority. This absence of oversight raises significant concerns about the broker's practices and the safety of client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory framework means that traders using Optionsi may not have access to the same protections as those trading with regulated brokers. Furthermore, the lack of regulatory history raises questions about the broker's compliance with financial standards. In the absence of a credible regulatory body, traders are left vulnerable to potential fraud or unethical practices, making it imperative to proceed with caution when considering Optionsi as a trading option.

Company Background Investigation

Optionsi's company background is another critical aspect to consider when assessing its reliability. The broker's history, ownership structure, and management team can provide valuable insights into its operational integrity. However, information on Optionsi's founding date, ownership, and management team appears to be limited and not readily available. This lack of transparency can be a red flag for potential traders, as reputable brokers typically provide comprehensive information about their history and leadership.

In assessing the management team's qualifications and experience, it is essential to determine whether they possess a solid track record in the financial industry. A well-experienced team can indicate a commitment to ethical trading practices and a focus on client satisfaction. Unfortunately, the lack of accessible information about Optionsi's management makes it difficult to evaluate these factors adequately. The absence of transparency can lead to mistrust among potential clients, further complicating the decision-making process regarding whether to engage with the broker.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is vital. Optionsi claims to provide competitive trading conditions, but a detailed examination of their fee structure and trading costs is necessary to ascertain the broker's overall value proposition.

| Fee Type | Optionsi | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies by broker |

| Overnight Interest Range | N/A | 1.5% - 3.0% |

The lack of specific information regarding spreads, commissions, and other essential trading costs raises concerns about the broker's transparency. Traders should be wary of hidden fees or unfavorable trading conditions that could erode their profits. Additionally, if Optionsi's fees are significantly higher than industry averages, it could indicate a less favorable trading environment for clients. Transparency in fee structures is a hallmark of reputable brokers, and the absence of such details with Optionsi is a cause for concern.

Client Fund Security

The safety of client funds is paramount when choosing a trading broker. Optionsi's policies regarding fund security, including fund segregation, investor protection, and negative balance protection, are essential factors to consider. A reputable broker typically employs measures to ensure that client funds are kept separate from operational funds, which helps protect traders in the event of insolvency.

Unfortunately, there is limited information available regarding Optionsi's fund security measures. This lack of detail can be alarming, as traders need assurance that their investments are secure. Furthermore, if the broker has a history of fund safety issues or controversies, it could indicate potential risks that traders should be aware of before opening an account. In the absence of clear information, traders are advised to exercise caution and consider alternative brokers with a proven track record of fund security.

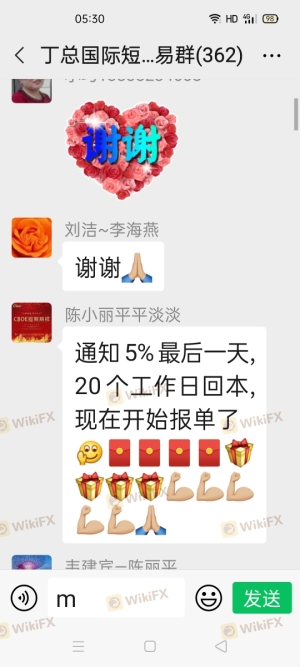

Customer Experience and Complaints

Understanding customer feedback and experiences is crucial in evaluating a broker's reliability. Optionsi has received mixed reviews from users, with some praising its user-friendly platform while others have raised concerns about customer service and responsiveness to complaints. Identifying common complaint patterns can provide valuable insights into the broker's operational integrity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Account Verification | Medium | Unresponsive |

| Platform Stability | High | Ongoing Issues |

Typical complaints include difficulties with withdrawals, slow customer service response times, and issues with platform stability. These concerns are significant as they can directly impact a trader's experience and financial security. For example, if clients face delays in accessing their funds, it could lead to frustration and financial losses. A broker's ability to address and resolve complaints effectively is a key indicator of its commitment to client satisfaction.

Platform and Trade Execution

The performance and reliability of a trading platform are critical factors in determining a broker's overall value. Optionsi's platform should be evaluated for its stability, user experience, order execution quality, and any signs of manipulation. Traders need a platform that is efficient and reliable, as delays or issues can result in missed trading opportunities.

While specific performance metrics for Optionsi's platform are not readily available, anecdotal evidence suggests that users have experienced issues with order execution and slippage. Traders should be cautious of brokers that exhibit signs of platform manipulation or failure to execute trades promptly, as these issues can significantly impact trading outcomes.

Risk Assessment

Using Optionsi comes with inherent risks that traders must consider. Understanding the broker's risk profile can help traders make informed decisions about their trading activities.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns about safety. |

| Fund Security Risk | High | Limited information on fund protection measures. |

| Customer Service Risk | Medium | Complaints about slow response times and issues. |

Given these risks, traders should consider implementing risk mitigation strategies, such as using stop-loss orders and diversifying their investments. Additionally, conducting thorough research before engaging with Optionsi can help traders make informed decisions and protect their capital.

Conclusion and Recommendations

In conclusion, the investigation into Optionsi raises several red flags regarding its safety and reliability. The lack of regulatory oversight, transparency in trading conditions, and mixed customer experiences suggest that traders should approach this broker with caution. While Optionsi may offer certain appealing features, the potential risks associated with trading through an unregulated platform outweigh the benefits.

For traders seeking a safer and more reliable trading environment, it is advisable to consider alternative brokers that are regulated by reputable financial authorities and demonstrate a commitment to transparency and customer service. Brokers such as eToro, IG, or OANDA may offer a more secure trading experience, complete with robust regulatory protections and positive user feedback. Ultimately, conducting thorough research and exercising due diligence is crucial for traders looking to navigate the complex world of forex trading safely.

Is Optionsi a scam, or is it legit?

The latest exposure and evaluation content of Optionsi brokers.

Optionsi Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Optionsi latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.