AZAforex 2025 Review: Everything You Need to Know

Executive Summary

AZAforex is an offshore forex broker that started in 2016. It offers high-leverage trading opportunities to traders around the world. This azaforex review shows that the broker has good trading conditions like leverage up to 1:1000 and a very low minimum deposit of just $1, but it works without proper rules from major financial authorities. The broker supports multiple trading platforms including MT4 and MT5. It offers many different types of assets from forex and commodities to cryptocurrencies. AZAforex accepts various payment methods including regular banking, e-wallets like PayPal and Skrill, and even cryptocurrency payments. However, the lack of regulatory protection and limited transparency about company operations make it better for experienced traders who can properly check and manage the risks. The broker appeals mainly to small-scale traders and high-leverage seekers. This comes with big concerns about fund security and dispute resolution methods.

Important Notice

This review uses publicly available information and user feedback collected from various sources as of 2024-2025. AZAforex operates as an unregulated entity. This means traders do not get the protection usually provided by major financial regulatory bodies. Different users may have varying levels of service quality. This evaluation does not cover all possible user scenarios or regional differences in service delivery. Potential clients should do their own research and consider their risk tolerance before working with any unregulated financial service provider. The information presented here reflects the general consensus from available sources. It may not represent the complete picture of the broker's operations.

Rating Framework

Broker Overview

AZAforex entered the financial services market in 2016. The company was founded by a team of hedge fund investors and experienced trading managers with the stated mission of serving traders and investors worldwide. According to available company information, the broker positions itself as a provider of complete trading solutions across multiple asset classes. It targets both individual retail traders and institutional clients seeking diverse market exposure.

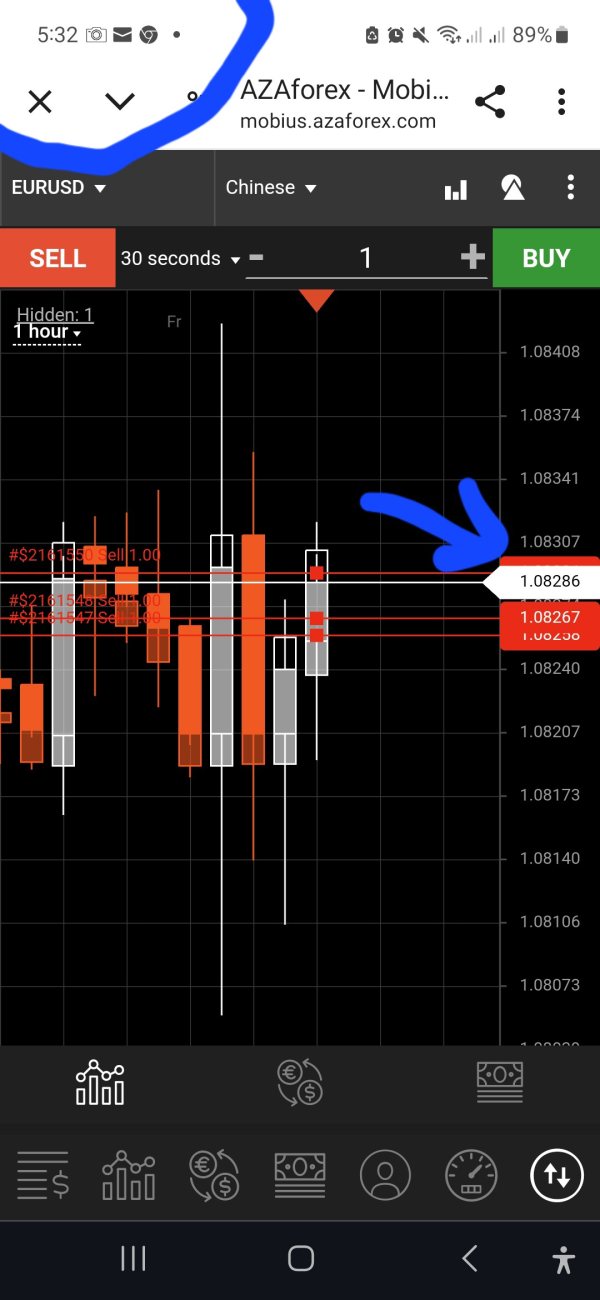

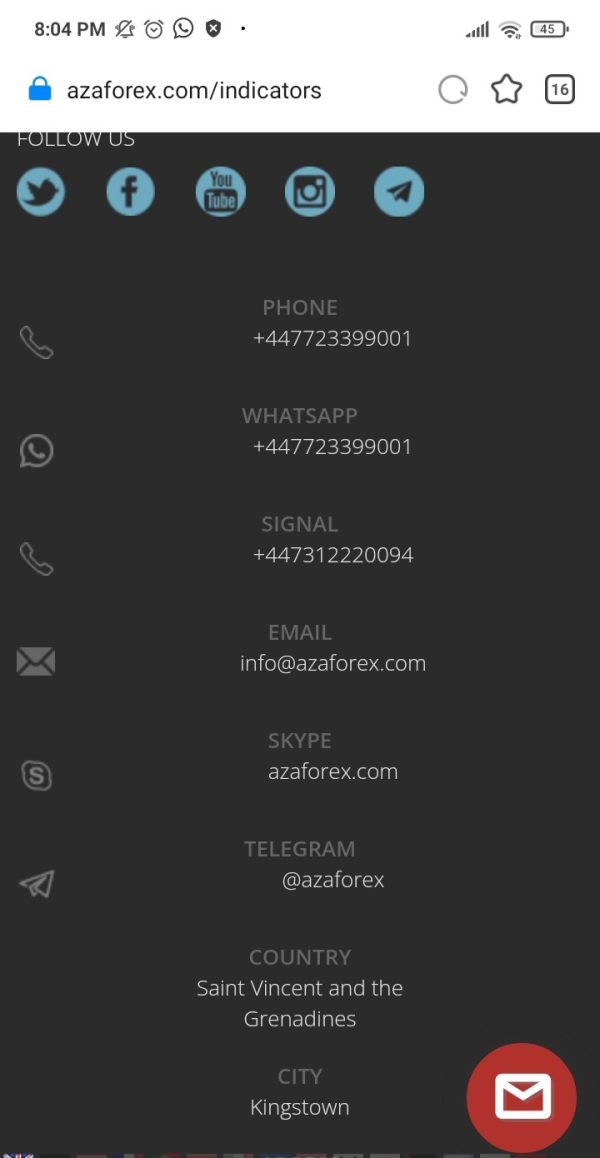

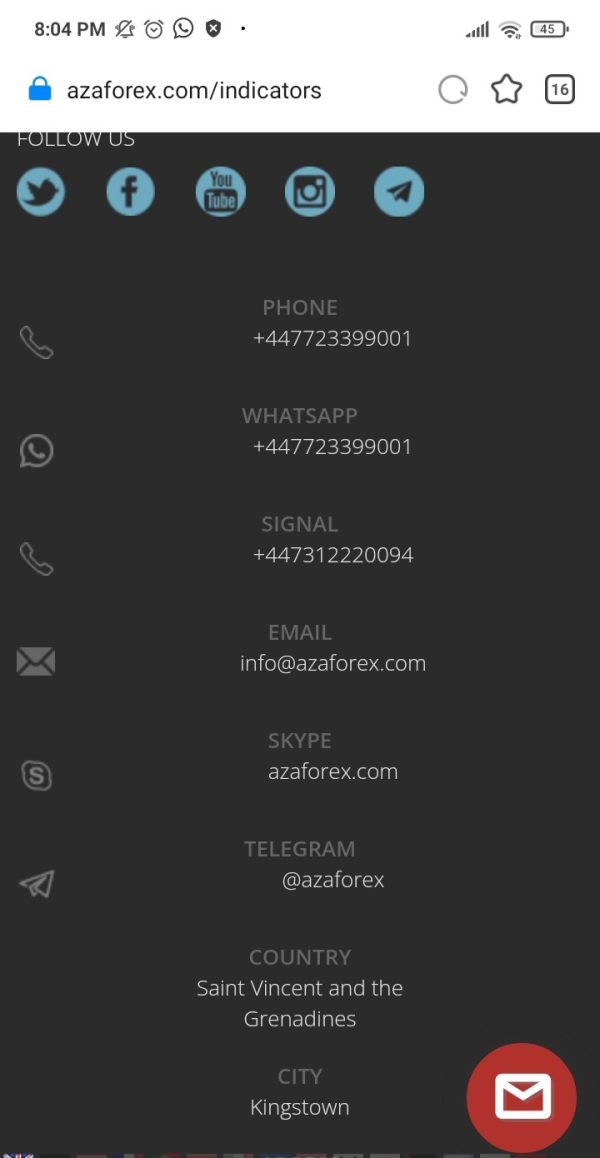

The broker operates through popular trading platforms MT4 and MT5. These platforms offer users access to forex pairs, commodities, stock indices, individual stocks, and cryptocurrency markets. AZAforex claims associations with various regulatory bodies including ASIC, CySEC, BaFin, MAS, VFSC, CIMA, SCA, CNMV, FCA, FSCA, BVI FSC, FSA, FSCM, CMA, NFA, CFTC, FINRA, JFSA, IIROC, AFM, CONSOB, and SEBI, though the broker itself remains unregulated. This azaforex review finds that while the company maintains a professional online presence and offers competitive trading conditions, the lack of direct regulatory oversight raises important questions about client fund protection and dispute resolution mechanisms that potential users must carefully consider.

Regulatory Status: AZAforex operates without direct regulation from major financial authorities. This happens despite claiming associations with multiple regulatory bodies worldwide. This unregulated status means traders lack the typical protections offered by licensed brokers.

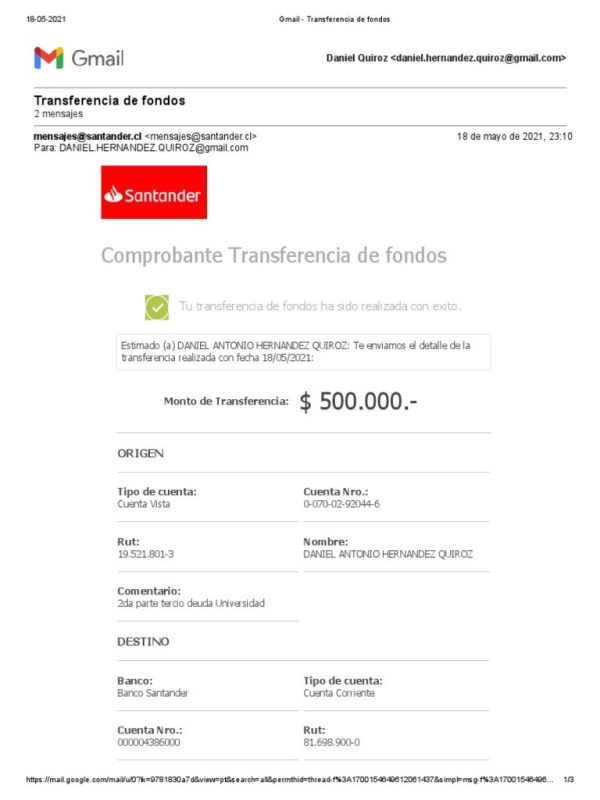

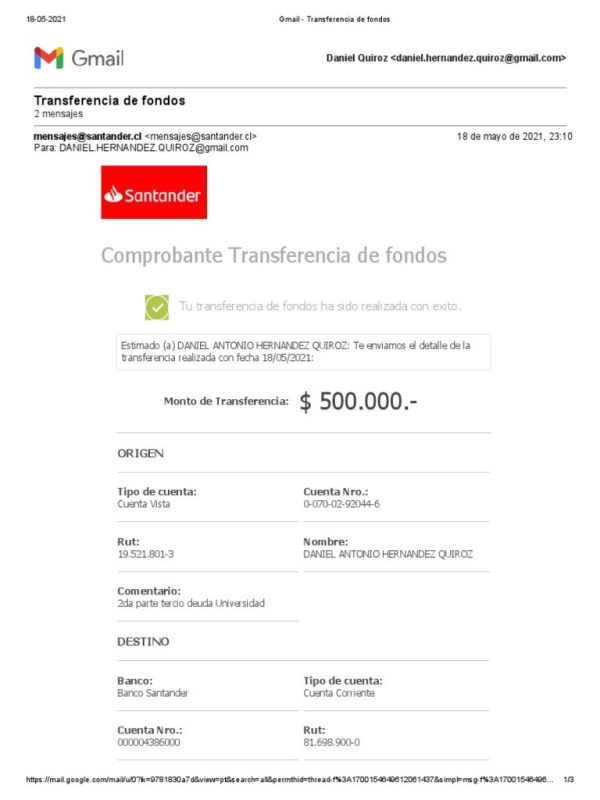

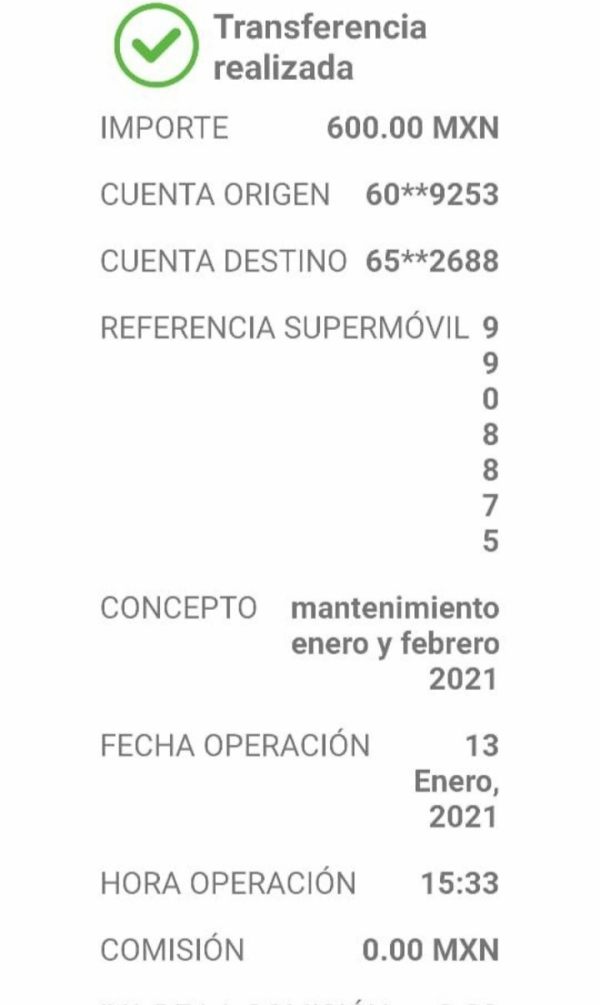

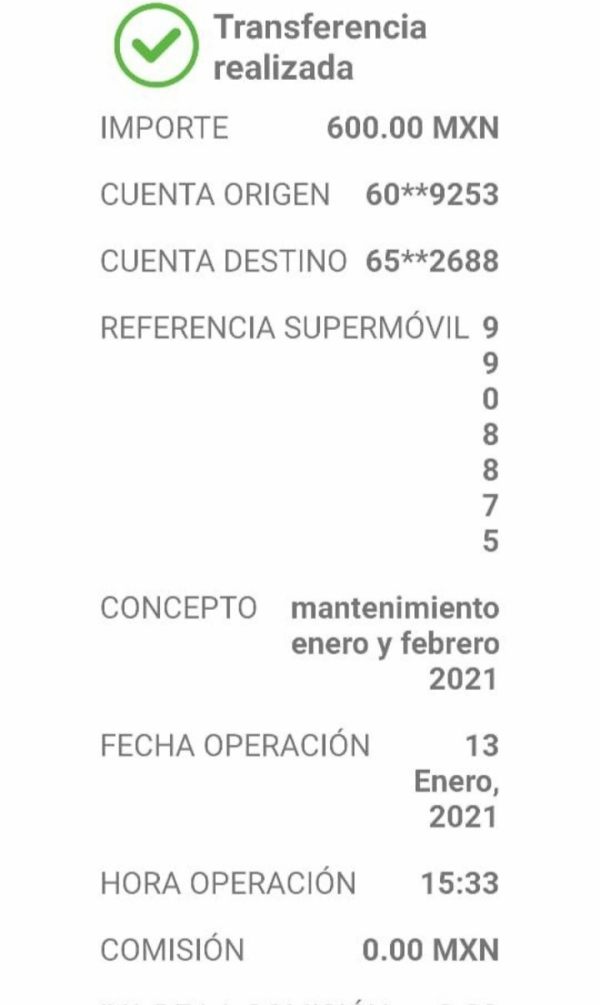

Deposit and Withdrawal Methods: The broker supports diverse payment options including traditional bank transfers, major credit and debit cards, popular e-wallets such as PayPal, Skrill, and Neteller, plus modern cryptocurrency payments including Bitcoin. This provides flexibility for global users.

Minimum Deposit Requirements: With a minimum deposit requirement of just $1, AZAforex offers one of the most accessible entry points in the forex market. This makes it particularly attractive to newcomers and small-scale traders.

Promotional Offerings: Available information does not detail specific bonus structures or promotional campaigns. This suggests either minimal marketing incentives or limited transparency in promotional activities.

Tradable Assets: The broker provides access to a wide range of financial instruments including major and minor forex pairs, precious metals and energy commodities, global stock indices, individual company stocks, and various cryptocurrencies.

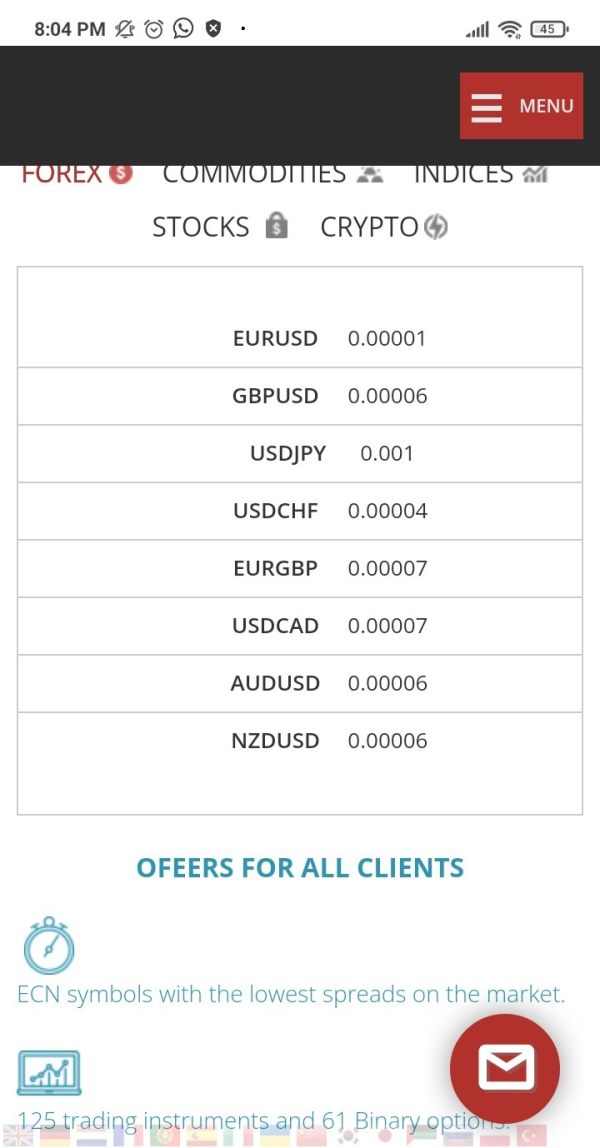

Cost Structure: AZAforex advertises very low spreads across its trading instruments. However, specific numerical values and commission structures are not clearly detailed in available materials, requiring direct inquiry for precise pricing information.

Leverage Options: Maximum leverage reaches 1:1000. This positions the broker among the higher-leverage providers in the market and appeals to traders seeking significant market exposure with limited capital.

Platform Selection: Traders can choose between the industry-standard MT4 and the more advanced MT5 platforms. Both support automated trading, technical analysis tools, and custom indicator implementation.

Geographic Restrictions: Specific information regarding regional limitations or restricted territories is not clearly outlined in available documentation.

Customer Support Languages: The range of supported languages for customer service is not explicitly detailed in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

AZAforex shows exceptional accessibility in its account structure. This is particularly true through its remarkably low $1 minimum deposit requirement that effectively removes barriers for entry-level traders. This azaforex review finds that the broker's flexible approach to account setup allows users to begin trading with minimal financial commitment while still accessing the full range of platform features. The leverage options extending up to 1:1000 provide significant flexibility for traders seeking amplified market exposure. However, this high leverage also increases risk substantially. According to user feedback from various trading forums, the account opening process is streamlined and typically completed within a short timeframe. The broker appears to offer multiple account tiers. Specific details about premium account features and requirements are not extensively documented. Users appreciate the absence of complex account maintenance requirements or hidden fees that might affect smaller accounts. However, the lack of detailed information about account protection measures and segregated fund storage raises questions about the security framework supporting these attractive account conditions. The combination of low barriers to entry and high leverage options makes AZAforex particularly appealing to traders who prioritize accessibility over regulatory protection.

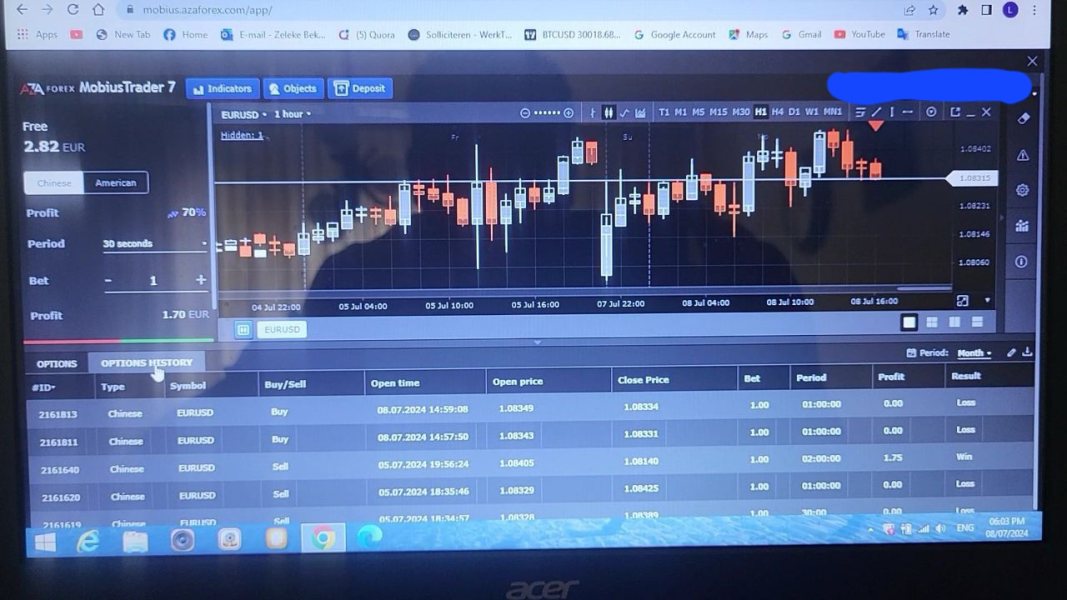

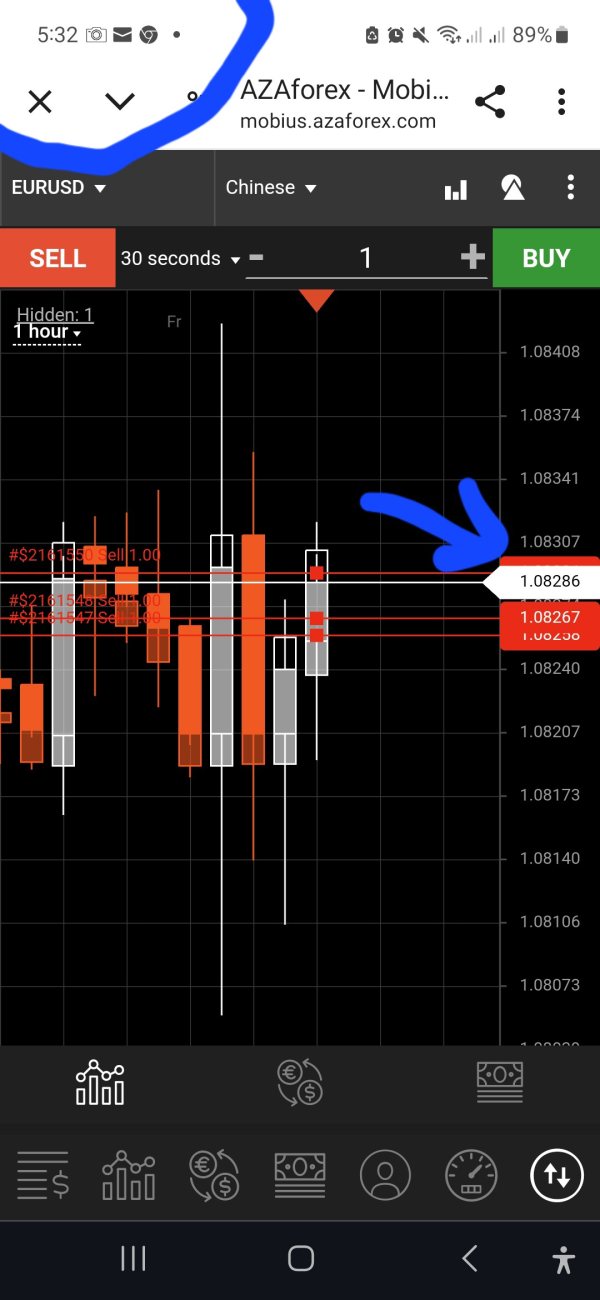

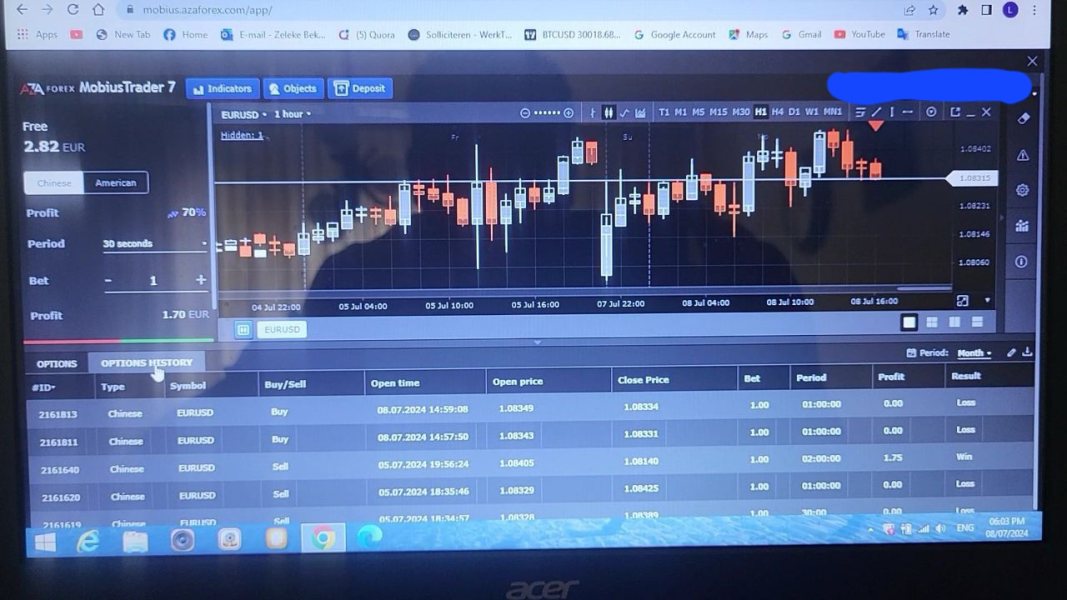

The broker's platform offering centers around the widely-adopted MT4 and MT5 trading environments. These provide users with professional-grade charting capabilities, automated trading support through Expert Advisors, and comprehensive technical analysis tools. User feedback suggests that both platforms function reliably with stable connectivity and responsive order execution. The availability of multiple timeframes, advanced charting packages, and customizable indicators meets the technical requirements of most trading strategies. However, this analysis reveals a notable gap in educational resources and market research materials. Unlike many regulated competitors, AZAforex does not appear to offer extensive educational content, webinar series, or daily market analysis reports that could benefit less experienced traders. The broker's research and analysis section seems limited. This potentially leaves users to seek external sources for fundamental analysis and market insights. Mobile trading capabilities through MT4 and MT5 mobile applications provide on-the-go access. Specific mobile app features and performance metrics are not detailed in available materials. While the core trading infrastructure appears solid, the limited educational and research support may disadvantage traders seeking comprehensive learning resources alongside their trading platform.

Customer Service and Support Analysis (6/10)

Customer service represents an area where AZAforex shows room for improvement. This is primarily due to limited transparency regarding support channels, response times, and service quality metrics. Available information does not clearly outline the specific communication methods available to clients, whether through live chat, email, phone support, or ticketing systems. User feedback on customer service quality appears mixed. Some traders report satisfactory assistance while others note delays or inadequate responses to their inquiries. The absence of clearly published customer service hours, multilingual support options, and escalation procedures creates uncertainty about the level of support clients can expect. Unlike regulated brokers that often maintain detailed customer service standards and response time commitments, AZAforex's support structure lacks this transparency. The broker's unregulated status also means that clients have limited recourse through regulatory complaints procedures if service issues arise. However, some users have reported that when contact is established, support staff demonstrate reasonable knowledge of trading-related matters. The overall customer service experience appears to vary significantly between users. This suggests inconsistent service delivery that could be improved through more structured support protocols and clearer communication channels.

Trading Experience Analysis (7/10)

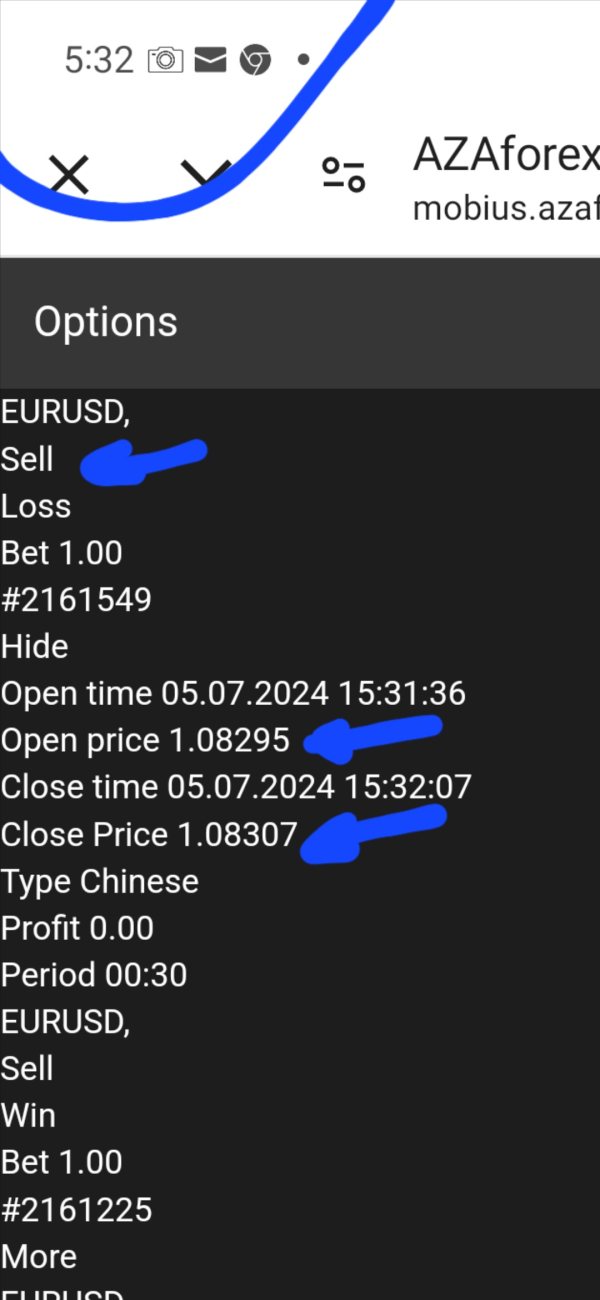

User feedback indicates that AZAforex provides a generally stable trading environment with reliable platform performance across both MT4 and MT5 interfaces. Traders report satisfactory execution speeds for most market conditions. However, specific data on execution quality metrics such as slippage rates and requote frequency is not readily available. The broker's multi-asset approach allows traders to diversify across forex, commodities, indices, stocks, and cryptocurrencies from a single account. This provides convenience for portfolio diversification strategies. Platform stability appears consistent based on user reports, with minimal downtime or technical disruptions affecting trading activities. The very low spreads advertised by the broker contribute to a competitive trading environment. However, actual spread consistency during volatile market periods requires further verification. Mobile trading functionality through standard MT4 and MT5 apps enables flexible trading access. Specific mobile features and performance optimization are not detailed. Some users appreciate the broker's accommodation of various trading styles, from scalping to longer-term position trading. However, the lack of detailed transparency regarding order execution policies, liquidity providers, and potential conflicts of interest creates some uncertainty about the underlying trading environment quality. This azaforex review finds that while the basic trading experience meets user expectations, enhanced transparency would strengthen trader confidence.

Trust and Safety Analysis (4/10)

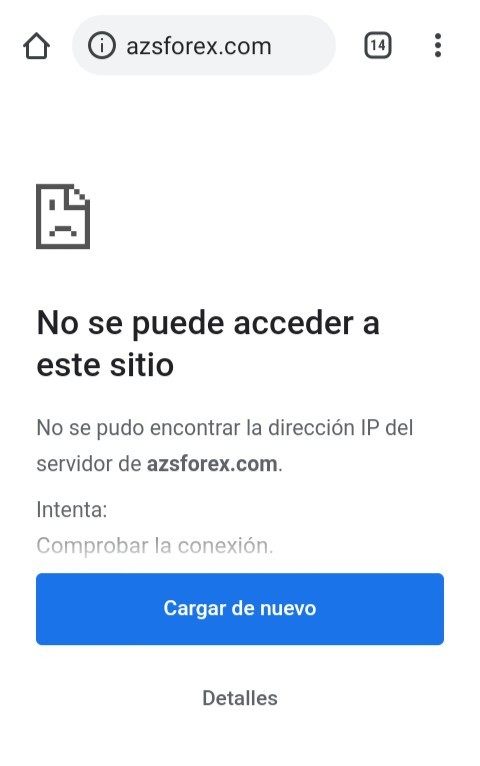

AZAforex's unregulated status represents the most significant concern in this evaluation. It means clients operate without the protection mechanisms typically provided by licensed financial service providers. The broker's claims of association with multiple regulatory bodies including ASIC, CySEC, BaFin, and others appear to reference general industry connections rather than direct regulatory oversight of AZAforex operations. This distinction is crucial because unregulated brokers cannot offer the same fund protection, segregated account guarantees, or dispute resolution mechanisms that regulated entities provide. The lack of clear information about client fund storage, segregation policies, and insurance coverage creates additional uncertainty about financial security. Company transparency regarding ownership structure, financial statements, and operational policies is limited compared to regulated competitors. No information is readily available about third-party audits, compliance procedures, or risk management frameworks that might provide additional assurance to clients. The broker's relatively recent establishment in 2016 means it lacks the extended operational history that might otherwise provide confidence through proven longevity. While some users report satisfactory experiences with fund deposits and withdrawals, the absence of regulatory oversight means these positive experiences cannot guarantee future performance or protection in adverse scenarios.

User Experience Analysis (6/10)

Overall user satisfaction with AZAforex appears mixed. Experiences vary significantly between different client segments and usage patterns. Traders appreciate the straightforward account opening process and the accessibility provided by the low minimum deposit requirement. The platform interface design receives generally positive feedback. Users find both MT4 and MT5 environments familiar and functional for their trading needs. However, user reviews reveal concerns about the limited educational resources and market analysis materials, particularly affecting newer traders who rely on broker-provided learning content. The deposit and withdrawal process receives moderate ratings. Users note the variety of payment methods available but express some uncertainty about processing times and potential fees. Customer service experiences show considerable variation. Some users report prompt and helpful assistance while others describe delays or unsatisfactory responses. The broker's website design and information presentation could benefit from enhanced transparency and more detailed policy explanations. Mobile trading experiences through standard MT4/MT5 apps are generally acceptable. However, some users seek more advanced mobile features. Common user complaints center around the lack of regulatory protection, limited educational content, and inconsistent customer service quality. The overall user experience suggests that AZAforex may be more suitable for experienced traders who require minimal support and can navigate the risks associated with unregulated trading environments.

Conclusion

This comprehensive azaforex review reveals a broker that offers attractive trading conditions including exceptionally low minimum deposits and high leverage options. However, it operates with significant limitations due to its unregulated status. AZAforex appears most suitable for experienced traders who prioritize accessibility and high leverage over regulatory protection and comprehensive support services. The broker's strengths lie in its low barriers to entry, diverse asset offerings, and stable platform performance. Its primary weaknesses center on the lack of regulatory oversight, limited educational resources, and inconsistent customer service quality. Potential clients should carefully weigh these factors against their individual trading needs and risk tolerance before proceeding.