Is AZA FOREX safe?

Pros

Cons

Is AZAforex A Scam?

Introduction

AZAforex, established in 2016, positions itself as a global forex and CFD broker, catering to traders with a wide range of financial instruments, including forex pairs, cryptocurrencies, commodities, and binary options. Given the competitive nature of the forex market, it is crucial for traders to carefully evaluate the trustworthiness and reliability of their chosen broker. The potential for fraud and mismanagement in the unregulated forex space necessitates thorough due diligence. This article investigates AZAforex's legitimacy by examining its regulatory status, company background, trading conditions, customer fund safety, user feedback, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory environment plays a vital role in ensuring the safety and security of traders' funds. AZAforex operates without regulation from any major financial authority, which raises significant concerns regarding its legitimacy. The broker is registered in Saint Vincent and the Grenadines under the Global Financial Services Authority (GLOFSA), a body that lacks the stringent oversight typically associated with reputable regulatory agencies.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| GLOFSA | N/A | Saint Vincent and the Grenadines | Unverified |

The absence of robust regulatory oversight means that AZAforex is not subject to the same level of scrutiny and accountability as regulated brokers. This lack of oversight can lead to potential risks, including inadequate fund protection, lack of transparency, and limited recourse for traders in case of disputes. Furthermore, warnings have been issued by various regulatory bodies, indicating that AZAforex may pose a risk to traders. Therefore, it is essential to approach this broker with caution and consider the implications of trading with an unregulated entity.

Company Background Investigation

AZAforex operates under the ownership of AZA Pro LLC, with its headquarters located in Kingstown, Saint Vincent and the Grenadines. The broker has been in operation since 2016, but its relatively short history raises questions about its stability and reliability. The management teams background is not well-documented, leading to concerns about their experience and qualifications in the financial industry.

Transparency is a critical factor in establishing trust with clients. Unfortunately, AZAforex lacks comprehensive information about its ownership structure and management team, which can be a red flag for potential investors. Furthermore, the company's commitment to disclosing relevant information is minimal, making it difficult for traders to assess the broker's credibility fully. Without a clear understanding of the company's history and management, traders may find it challenging to trust AZAforex with their funds.

Trading Conditions Analysis

AZAforex offers a variety of trading conditions, including high leverage of up to 1:1000 and competitive spreads. However, the overall fee structure can be complex and may include hidden costs that traders should be aware of.

| Fee Type | AZAforex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.1 pips (Start Account) | 0.6 pips |

| Commission Model | $1.50 per trade | $0.50 per trade |

| Overnight Interest Range | Variable | Variable |

While the spreads on certain accounts can be attractive, the commission structure appears to be higher than the industry average, which could significantly impact profitability, especially for high-frequency traders. Additionally, the broker's overnight interest rates can vary, potentially leading to unexpected costs for traders holding positions overnight.

AZAforex does not charge deposit or withdrawal fees, which is a positive aspect. However, traders should be cautious of any fees imposed by payment processors, particularly when using cryptocurrencies. The broker's fee structure could present challenges for traders, particularly those with smaller account sizes or those who engage in frequent trading.

Customer Fund Safety

Fund safety is a paramount concern for traders, and AZAforex has implemented several measures to protect client funds. The broker claims to maintain segregated accounts, which separate client funds from the company's operational funds, thereby providing a level of security in the event of financial difficulties.

Moreover, AZAforex offers negative balance protection, ensuring that traders cannot lose more than their initial deposit. This feature is particularly important in the volatile forex market, where rapid price movements can lead to significant losses. However, the lack of regulation raises concerns about the enforceability of these safety measures. Traders must consider the risks associated with trading through an unregulated broker, as there may be limited recourse in the event of fund mismanagement or disputes.

Historically, there have been no major reported incidents of fund safety issues with AZAforex, but the absence of regulatory oversight means that traders are operating in a riskier environment compared to regulated brokers. Therefore, it is crucial for traders to weigh the benefits of the broker's safety measures against the potential risks associated with its unregulated status.

Customer Experience and Complaints

Customer feedback provides valuable insights into the overall experience of trading with AZAforex. Reviews from users indicate a mixed bag of experiences, with some praising the broker's competitive spreads and fast execution times, while others express dissatisfaction with customer service and withdrawal processes.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Customer Support | Medium | Mixed feedback |

| Platform Stability | Medium | Occasional glitches |

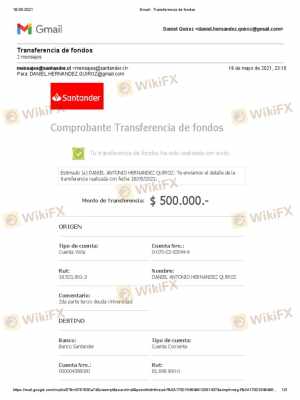

Common complaints include difficulties with the withdrawal process and delayed responses from customer support. Some users have reported being unable to withdraw their funds, leading to frustration and concerns about the broker's reliability. Additionally, while the broker offers multiple channels for customer support, including live chat and email, the responsiveness of these services has been questioned.

One notable case involved a trader who reported a withdrawal request being delayed for several weeks, leading to significant frustration and a lack of communication from the broker. This highlights the importance of reliable customer support and efficient withdrawal processes in establishing trust with clients.

Platform and Trade Execution

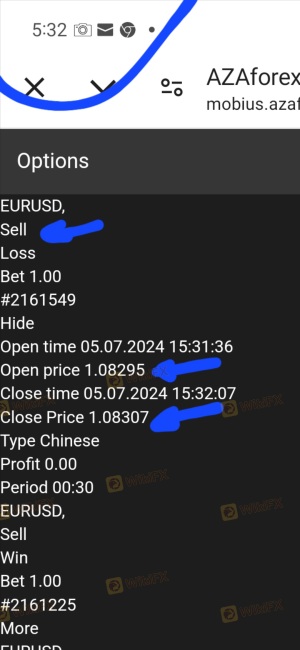

AZAforex utilizes the proprietary Mobius Trader 7 platform, which is designed to offer a user-friendly trading experience. However, compared to industry-standard platforms like MetaTrader 4 and 5, Mobius Trader 7 lacks many advanced features and customization options that traders have come to expect.

The platform's performance has been generally stable, but there have been reports of occasional glitches and execution delays, which can impact trading outcomes. Traders have expressed concerns about the potential for slippage and rejected orders, particularly during periods of high market volatility.

Overall, while the Mobius Trader 7 platform provides essential trading functionalities, its limitations may not meet the needs of more experienced traders seeking advanced tools and features. Additionally, the lack of transparency regarding the platform's underlying technology raises questions about potential manipulation or inaccuracies in market data.

Risk Assessment

Trading with AZAforex involves several risks that traders should carefully consider before opening an account. The lack of regulation is a significant concern, as it exposes traders to potential fraud and mismanagement of funds. Furthermore, the high leverage offered by the broker can lead to substantial losses, particularly for inexperienced traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Fund Safety | Medium | Segregated accounts but limited protection |

| Trading Conditions | Medium | High leverage and potential hidden fees |

To mitigate these risks, traders should conduct thorough research and consider using risk management strategies, such as setting stop-loss orders and limiting the amount of capital allocated to trading. Additionally, it may be prudent to explore regulated alternatives that offer greater transparency and investor protection.

Conclusion and Recommendations

In conclusion, the investigation into AZAforex reveals several red flags that warrant caution. The broker's lack of regulation, mixed customer feedback, and potential issues with fund safety raise significant concerns about its legitimacy. While AZAforex offers attractive trading conditions, such as high leverage and competitive spreads, these benefits must be weighed against the potential risks associated with trading through an unregulated entity.

For traders considering AZAforex, it is essential to approach with caution and conduct thorough research. Beginners, in particular, may want to explore regulated alternatives that provide greater security and a more transparent trading environment. Brokers such as Dukascopy, Deriv, or other well-regarded options may offer a safer trading experience with robust regulatory oversight and better customer support. Ultimately, the decision to trade with AZAforex should be made with a clear understanding of the associated risks and a commitment to safeguarding one's investment.

Is AZA FOREX a scam, or is it legit?

The latest exposure and evaluation content of AZA FOREX brokers.

AZA FOREX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AZA FOREX latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.