HD Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive HD Markets review reveals concerning findings about this South African-based forex broker established in 2017. While HD Markets offers attractive features such as a minimal USD 5 minimum deposit and leverage up to 1:1000, our analysis indicates significant red flags that potential traders should carefully consider. The broker operates without clear regulatory oversight from major financial authorities. This raises substantial concerns about trader protection and fund safety.

HD Markets provides access to popular trading platforms including MT4 and MT4 Mobile, with over 45 tradeable assets spanning forex pairs, commodities, indices, stocks, precious metals, energy, and cryptocurrencies including Bitcoin. The broker offers 24/5 customer support and accepts various deposit methods including credit cards, bank transfers, and PayFast. However, user feedback consistently highlights issues with price manipulation, poor customer service quality, and withdrawal difficulties. These problems make trading with this broker risky.

The platform primarily targets high-risk investors and traders seeking high-leverage opportunities, but the lack of regulatory protection makes it unsuitable for most retail traders. Our evaluation suggests extreme caution when considering HD Markets for forex trading activities.

Important Notice

This HD Markets evaluation is based on publicly available information and user feedback as of 2025. Potential traders should be aware that information about regulatory status and specific service offerings may vary by region and change over time. The absence of clear regulatory information in available sources significantly increases investment risk for potential clients.

Our assessment methodology incorporates user testimonials, platform features analysis, and comparison with industry standards. However, traders are strongly advised to conduct independent verification of all claims and carefully assess their risk tolerance before engaging with any unregulated broker. This is especially important when dealing with HD Markets.

Rating Framework

Broker Overview

HD Markets entered the forex brokerage market in 2017, positioning itself as a South African-based online trading platform specializing in foreign exchange and CFD trading services. The company has established its operations with a focus on providing retail traders access to global financial markets through popular trading platforms. Despite its relatively recent establishment, HD Markets has attempted to carve out a niche in the competitive forex brokerage landscape by offering competitive entry requirements and high leverage ratios. However, many traders report serious problems with this broker.

The broker's business model centers on providing comprehensive trading services across multiple asset classes, including traditional forex currency pairs, commodities trading, stock indices, individual equities, precious metals like gold and silver, energy products including oil, and an expanding selection of cryptocurrency offerings including Bitcoin and other digital assets. HD Markets operates primarily through MetaTrader 4 and its mobile variant, leveraging these industry-standard platforms to deliver trading functionality to its client base. However, the lack of detailed regulatory information in available sources raises questions about the broker's compliance framework and client protection measures. These concerns are serious red flags for potential traders.

Regulatory Status: Available information does not specify oversight by major financial regulatory authorities, creating uncertainty about investor protection standards and compliance frameworks that typically govern legitimate forex brokers.

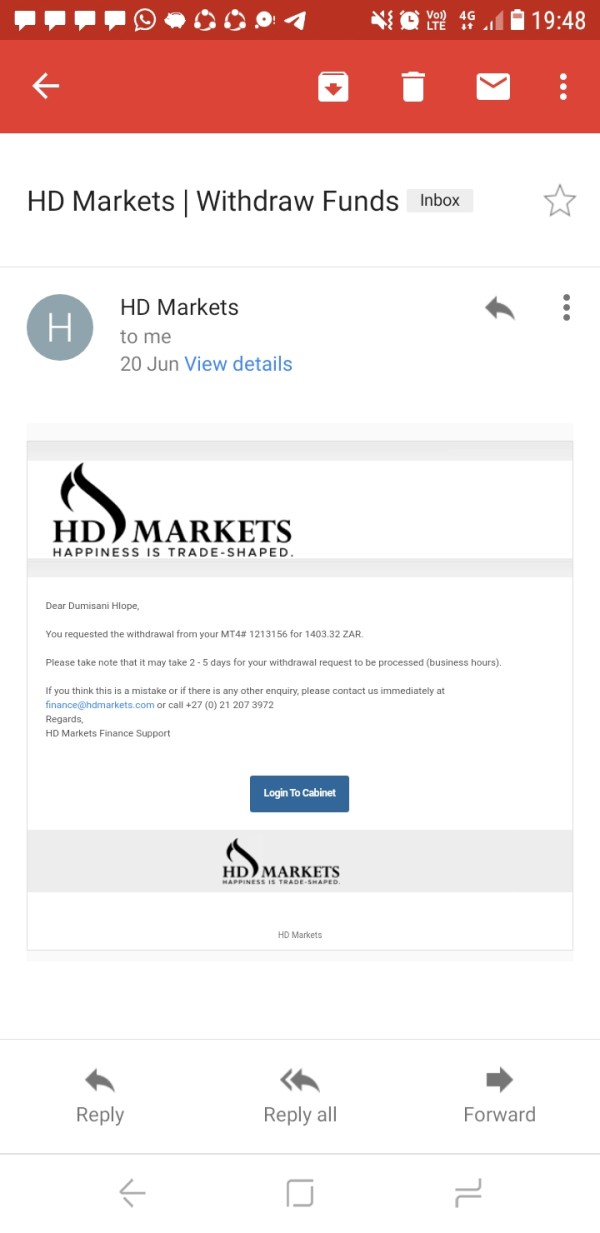

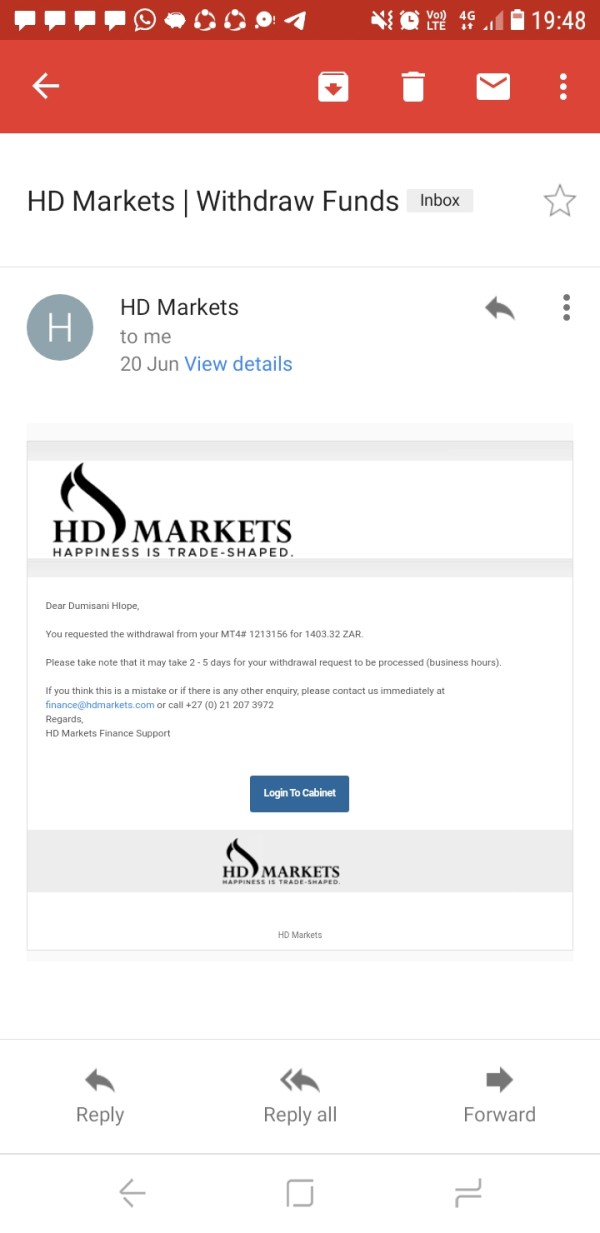

Deposit and Withdrawal Methods: HD Markets accepts deposits through multiple channels including credit card payments, traditional bank wire transfers, and PayFast payment processing, providing South African clients with localized payment solutions. However, users report significant problems with withdrawals.

Minimum Deposit Requirements: The broker maintains an extremely low barrier to entry with minimum deposits starting at USD 5, though some sources indicate USD 10, making it accessible to novice traders with limited capital.

Promotional Offerings: Current available information does not detail specific bonus programs or promotional campaigns, suggesting either limited marketing incentives or lack of transparency in promotional terms. This lack of transparency is concerning for traders.

Asset Selection: Traders can access over 45 different trading instruments spanning major, minor, and exotic forex currency pairs, commodities including agricultural and energy products, global stock indices, individual company shares, precious metals, crude oil variations, and cryptocurrency pairs including Bitcoin trading opportunities.

Cost Structure: The broker advertises competitive spreads starting from 0.1 pips on the EUR/USD currency pair, though commission structures and additional fees remain unclear in available documentation. This lack of clarity about costs is a major problem.

Leverage Capabilities: HD Markets offers maximum leverage ratios up to 1:1000, providing significant amplification potential for experienced traders while creating substantial risk exposure for inexperienced participants.

Platform Options: Clients can choose between MetaTrader 4 desktop application and MT4 Mobile for smartphone and tablet trading, both providing comprehensive charting tools and order management capabilities. However, users report frequent technical issues with both platforms.

Geographic Restrictions: Specific information regarding restricted jurisdictions or regional limitations is not detailed in available sources, requiring potential clients to verify eligibility independently.

Customer Support Languages: The range of supported languages for customer service interactions is not specified in current documentation, potentially limiting accessibility for international clients. This creates additional barriers for traders seeking help.

Account Conditions Analysis

HD Markets' account structure presents a mixed picture for potential traders considering this HD Markets review. The broker's most attractive feature remains its exceptionally low minimum deposit requirement of USD 5, making it one of the most accessible entry points in the forex brokerage industry. This low threshold particularly appeals to novice traders or those with limited initial capital who want to explore forex trading without significant upfront investment. However, this accessibility comes with notable transparency concerns that should worry potential clients.

The account opening process details are not comprehensively documented in available sources, creating uncertainty about verification requirements, documentation needs, and approval timelines. This lack of clarity extends to account type variations, as specific information about different account tiers, their respective features, and eligibility criteria remains unspecified. The absence of details about specialized account options, such as Islamic accounts for Muslim traders or professional accounts for experienced investors, further limits understanding of the broker's service range. These gaps in information make it difficult for traders to make informed decisions.

User feedback regarding account conditions reveals mixed experiences, with some traders appreciating the low entry barrier while others express frustration about hidden fees and unclear commission structures. The lack of transparent fee disclosure creates potential for unexpected charges that could significantly impact trading profitability, particularly for high-frequency traders or those with smaller account balances where fees represent a larger percentage of total capital. Many users report being surprised by fees they were not told about initially.

HD Markets provides trading infrastructure centered around the MetaTrader 4 platform, a widely recognized and industry-standard trading solution that offers comprehensive charting capabilities, technical analysis tools, and automated trading support through Expert Advisors. The availability of MT4 Mobile extends this functionality to smartphone and tablet users, enabling traders to monitor positions and execute trades while away from desktop computers. However, the broker's implementation of these platforms has received criticism from users.

The platform selection demonstrates HD Markets' commitment to providing familiar and reliable trading technology that most forex traders recognize and understand. MT4's extensive technical indicator library, customizable chart layouts, and one-click trading functionality provide essential tools for both technical and fundamental analysis approaches. However, the broker's offering appears limited to MetaTrader 4 variants, without access to newer platforms like MetaTrader 5 or proprietary trading solutions that some competitors provide. This limitation may disappoint traders looking for more advanced features.

Research and educational resources represent a significant gap in HD Markets' service offering, with available information not detailing market analysis, economic calendars, trading education materials, or expert commentary that many established brokers provide to support trader development. This absence of supplementary resources may disadvantage newer traders who rely on broker-provided education and market insights to develop their trading skills and market understanding. The lack of educational support is particularly problematic for beginners.

The lack of detailed information about additional trading tools, such as advanced charting packages, algorithmic trading support, or third-party research integration, suggests a relatively basic service offering compared to full-service brokers who provide comprehensive trading ecosystems.

Customer Service and Support Analysis

HD Markets advertises 24/5 customer support availability, covering standard forex market hours from Monday through Friday, which aligns with global trading sessions and provides reasonable accessibility for most traders. However, user feedback consistently indicates significant shortcomings in service quality, response times, and problem resolution effectiveness that substantially impact the overall client experience. These problems are widespread and serious.

Customer testimonials frequently highlight extended response delays, with support tickets remaining unresolved for days or weeks, creating frustration for traders who require timely assistance with account issues, trading problems, or withdrawal requests. The quality of support interactions also receives criticism, with users reporting unhelpful responses, lack of technical expertise among support staff, and inadequate escalation procedures for complex issues. Many traders report feeling ignored by customer service representatives.

Communication channel options are not comprehensively detailed in available sources, leaving uncertainty about whether clients can access support through live chat, telephone, email, or other preferred communication methods. This lack of clarity about contact options may create additional barriers for clients seeking assistance, particularly during urgent trading situations or account emergencies. Traders need reliable ways to contact support when problems arise.

The absence of multilingual support information raises concerns about service accessibility for international clients, potentially limiting effective communication for non-English speaking traders who require assistance in their native languages. Professional forex brokers typically provide comprehensive language support to serve diverse client bases effectively.

Trading Experience Analysis

User feedback regarding HD Markets' trading environment reveals significant concerns about execution quality and market conditions that substantially impact the overall trading experience. Multiple user reports indicate issues with price manipulation, where quoted prices allegedly differ from market rates in ways that disadvantage client positions. These manipulation allegations represent serious concerns about the broker's market-making practices and commitment to fair trading conditions. Such practices can cost traders significant money.

Slippage and requote incidents appear frequently in user testimonials, suggesting that orders may not execute at requested prices, particularly during volatile market conditions or high-impact news events. Such execution problems can significantly impact trading profitability and strategy effectiveness, especially for scalping strategies or time-sensitive position management approaches. Traders report losing money due to poor execution quality.

Platform stability receives mixed reviews, with some users reporting connection issues, platform freezes, or delayed price updates that interfere with trading activities. While MetaTrader 4 is generally considered a stable platform, server quality and broker infrastructure play crucial roles in ensuring consistent performance that these reports suggest may be inadequate. Technical problems can prevent traders from managing their positions effectively.

The mobile trading experience through MT4 Mobile appears to suffer from similar issues, with users reporting difficulties accessing accounts, delayed order execution, and synchronization problems between mobile and desktop platforms. These technical issues create particular challenges for traders who rely on mobile access for position monitoring or emergency trade management. Mobile trading problems are especially frustrating for active traders.

Despite competitive spread advertising starting at 0.1 pips for EUR/USD, the practical trading environment appears compromised by execution quality issues that may offset any cost advantages, making this HD Markets review particularly concerning for serious traders.

Trust and Safety Analysis

The most significant concern emerging from this HD Markets evaluation centers on the absence of clear regulatory oversight from established financial authorities. Major forex brokers typically operate under licenses from respected regulatory bodies such as the FCA, ASIC, CySEC, or other recognized financial supervisors that enforce strict capital requirements, client fund segregation, and operational standards designed to protect retail traders. HD Markets does not appear to have such protection.

HD Markets' regulatory status remains unclear in available documentation, with no specific mention of oversight by major financial authorities that would provide standard investor protections. This regulatory uncertainty creates substantial risk for client fund safety, as unregulated brokers may not be required to maintain segregated client accounts, carry professional indemnity insurance, or participate in compensation schemes that protect traders in case of broker insolvency. Without regulation, traders have little recourse if problems arise.

User testimonials consistently include serious allegations of fraudulent behavior, with multiple references to "scam" operations and warnings from experienced traders about potential fund safety issues. While individual user experiences may vary, the pattern of negative feedback regarding fund security and withdrawal difficulties suggests systemic issues that extend beyond isolated incidents. These fraud allegations are extremely concerning for potential clients.

The broker's transparency regarding corporate structure, management team, financial reporting, and operational procedures appears limited based on available information. Legitimate forex brokers typically provide comprehensive corporate information, regulatory compliance details, and clear policies regarding client fund protection that appear absent from HD Markets' public documentation. This lack of transparency raises serious red flags.

Third-party verification of the broker's claims, regulatory status, and operational legitimacy is not readily available through independent sources, further complicating due diligence efforts for potential clients seeking to verify the broker's credibility and safety standards.

User Experience Analysis

Overall user satisfaction with HD Markets appears significantly below industry standards, with feedback consistently highlighting fundamental concerns about platform reliability, customer service quality, and most importantly, fund security. The pattern of negative reviews suggests systemic issues rather than isolated problems that might be expected with any financial service provider. These widespread problems indicate serious operational deficiencies.

The user interface experience centers around MetaTrader 4, which provides a familiar environment for experienced forex traders but may present learning curves for newcomers to the platform. While MT4's functionality is generally well-regarded, the overall user experience depends heavily on broker implementation, server quality, and customer support effectiveness, areas where HD Markets appears to underperform based on available feedback. Poor implementation undermines even good software.

Account registration and verification processes are not well-documented in available sources, creating uncertainty about onboarding procedures, required documentation, and approval timelines. This lack of clarity may create frustration for new clients attempting to establish accounts and begin trading activities. Unclear processes make it difficult for new traders to get started.

Fund management experiences represent the most serious area of user dissatisfaction, with multiple reports of withdrawal difficulties, delayed processing times, and in some cases, complete inability to access deposited funds. These issues represent fundamental breaches of trust that make HD Markets unsuitable for traders who prioritize fund security and reliable access to their capital. Problems with withdrawals are the most serious concern any trader can face.

The broker appears to attract primarily high-risk tolerance traders drawn by low minimum deposits and high leverage ratios, but even risk-seeking traders require basic reliability and fund security that user feedback suggests may be compromised. Recommendations for improvement include establishing clear regulatory oversight, implementing transparent fee structures, improving customer service quality, and most importantly, ensuring reliable fund security and withdrawal processing.

Conclusion

This comprehensive HD Markets review reveals a broker that, despite offering attractive entry-level features such as low minimum deposits and high leverage ratios, presents substantial risks that outweigh potential benefits for most traders. The absence of clear regulatory oversight, combined with consistent user reports of fund security issues and poor service quality, creates an environment unsuitable for serious forex trading activities. These problems make HD Markets a poor choice for most traders.

While HD Markets may appeal to high-risk investors attracted by the USD 5 minimum deposit and 1:1000 leverage offering, the fundamental lack of investor protections and negative user experiences suggest that even risk-tolerant traders should exercise extreme caution. The broker's limited transparency regarding regulatory status, fee structures, and corporate governance creates additional concerns about long-term reliability and fund safety. Even traders comfortable with high risk should avoid unregulated brokers.

Potential traders are strongly advised to consider regulated alternatives that provide standard investor protections, transparent fee structures, and proven track records of reliable service delivery. The forex market offers numerous legitimate, well-regulated brokers that provide competitive trading conditions without the substantial risks associated with unregulated platforms.