Evotrade 2025 Review: Everything You Need to Know

Executive Summary

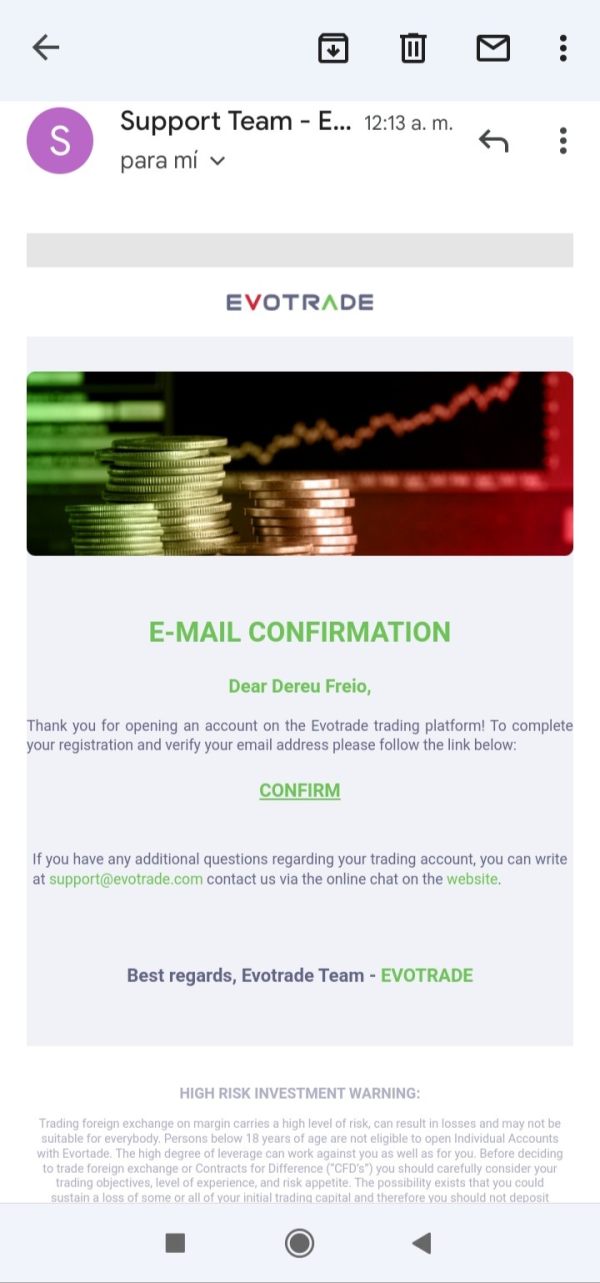

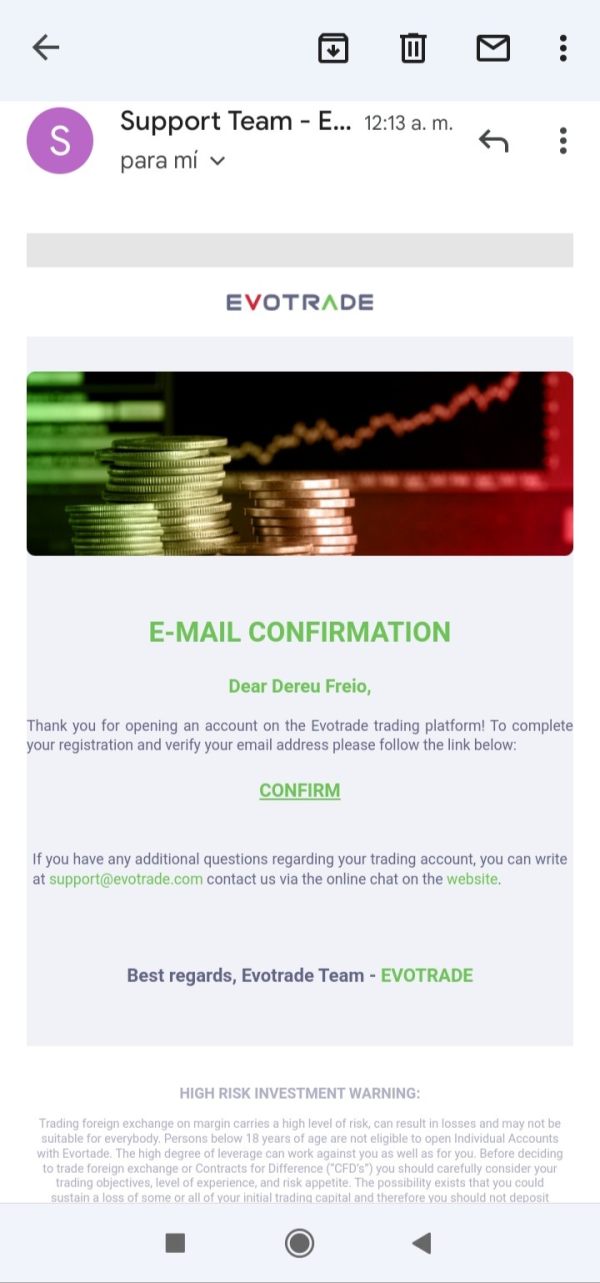

This Evotrade review shows concerning findings about this Indonesian-based forex broker established in 2021. Multiple industry reports and user feedback reveal that Evotrade has a mostly negative reputation in the trading community, with several sources marking it as a potentially fraudulent operation. The broker says it provides automated forex trading solutions. It offers various account tiers including Diamond-VIP, Platinum, Gold, Silver, Bronze, and Micro accounts, alongside proprietary trading robots.

Despite marketing itself to beginner and intermediate traders seeking automated trading tools, user experiences have been largely disappointing. Traders report major issues with the broker's leverage trading methods and overall service quality. The lack of clear regulatory oversight and transparent operational practices has further hurt its credibility in the forex market. While Evotrade claims to offer multiple account types and automated trading capabilities, the absence of detailed information about trading conditions, platform specifications, and regulatory compliance raises serious red flags for potential investors.

Important Notice

This review is based on available public information, user feedback, and industry reports as of 2025. Evotrade's operational status across different regions stays unclear due to insufficient regulatory disclosure. The company has not provided comprehensive information about its cross-regional entities or compliance frameworks, which poses additional risks for international traders.

Our evaluation method uses user testimonials, industry analysis, and publicly available data to provide an objective assessment. However, given the limited transparency from Evotrade itself, some information gaps exist. Potential traders should use extreme caution and conduct additional research before considering any engagement with this broker.

Rating Framework

Broker Overview

Evotrade appeared in the forex market in 2021. It established its headquarters in Indonesia with a focus on automated forex trading solutions. The company positioned itself as a technology-driven broker, emphasizing the deployment of automated trading robots and algorithmic trading strategies. According to available information, Evotrade's business model centers around providing retail traders with access to forex markets through proprietary automated systems, targeting individuals seeking hands-off trading approaches.

The broker's operational framework appears to focus primarily on forex trading services. It places particular emphasis on automated trading robots and algorithmic solutions. However, detailed information about the company's specific trading platforms, technological infrastructure, and operational partnerships remains largely undisclosed. The absence of comprehensive platform specifications and trading environment details has contributed to user uncertainty about the broker's actual capabilities and service quality.

Notably, Evotrade has not provided clear information about its regulatory status or compliance framework. This Evotrade review finds no evidence of oversight by major financial regulatory authorities, which represents a significant concern for trader protection and fund security. The broker's asset coverage appears limited to forex trading, though specific currency pairs, trading instruments, and market access details are not transparently communicated to potential clients.

Regulatory Status: No specific regulatory authorities or compliance frameworks have been identified for Evotrade. The absence of clear regulatory oversight represents a major risk factor for potential traders.

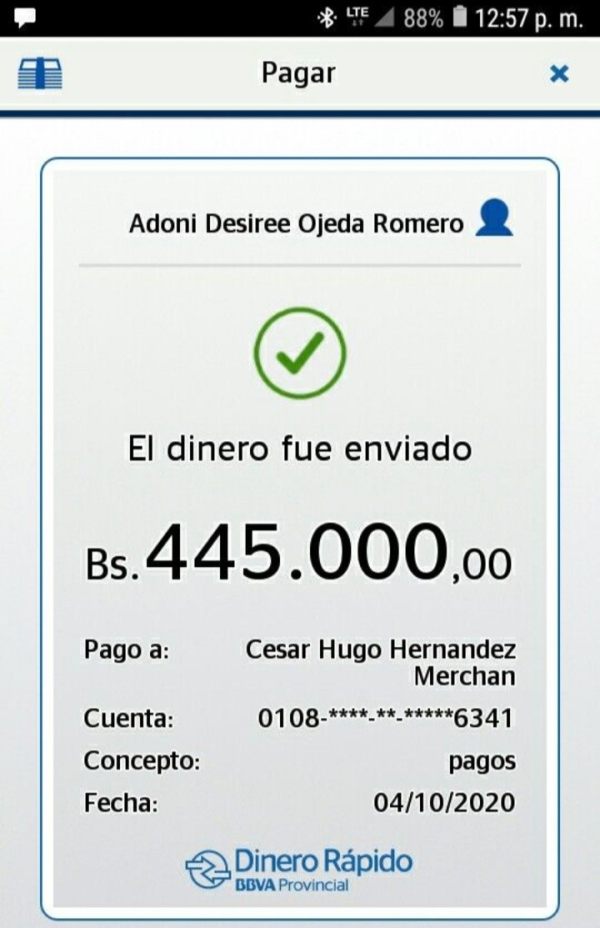

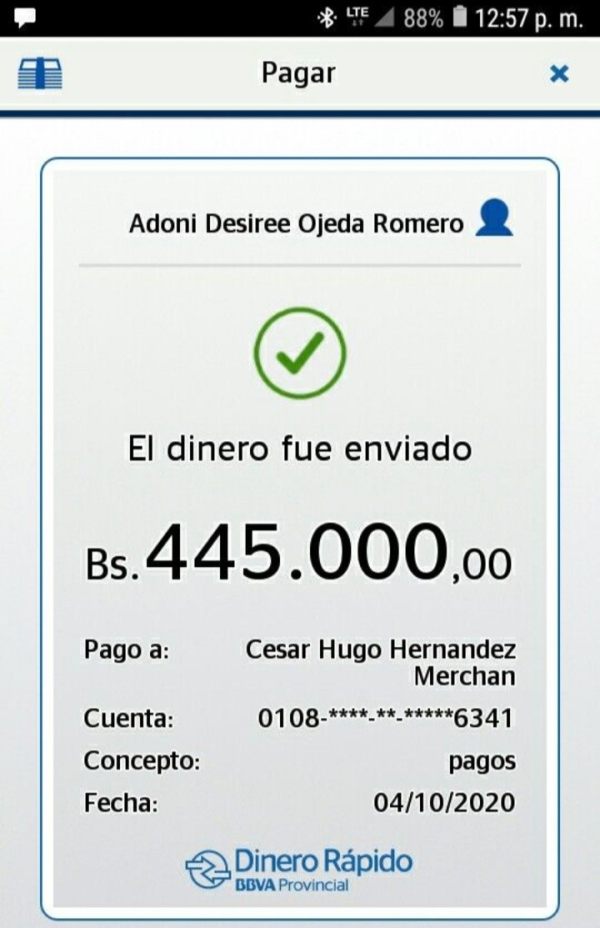

Deposit and Withdrawal Methods: Specific information about funding methods, processing times, and associated fees has not been disclosed in available materials. This creates uncertainty about financial transaction procedures.

Minimum Deposit Requirements: Reports suggest minimum deposit thresholds of $100 to $500 depending on account type. However, exact requirements for each tier remain unclear and inconsistent across sources.

Bonuses and Promotions: No detailed information about promotional offers, welcome bonuses, or ongoing incentive programs has been identified in this Evotrade review.

Tradeable Assets: The broker's focus appears to be on forex trading with automated trading robot integration. However, specific currency pairs, exotic options, and market depth are not specified.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs has not been transparently disclosed. This makes cost comparison with other brokers difficult.

Leverage Ratios: Maximum leverage ratios and risk management parameters have not been clearly communicated. This is despite user reports of dissatisfaction with leverage trading methods.

Platform Options: Specific trading platform software, mobile applications, and technological infrastructure details remain undisclosed in available documentation.

Geographic Restrictions: Information about restricted countries, regional limitations, and jurisdiction-specific services has not been provided.

Customer Support Languages: Available support languages and regional customer service capabilities are not specified in public materials.

Account Conditions Analysis

Evotrade markets multiple account tiers including Diamond-VIP, Platinum, Gold, Silver, Bronze, and Micro accounts. This suggests a tiered service structure designed to accommodate different trader profiles and investment levels. However, the specific benefits, features, and requirements for each account type lack detailed documentation, creating confusion for potential clients attempting to understand value propositions.

The minimum deposit requirements reportedly range from $100 to $500 across different account levels. However, exact specifications and corresponding benefits remain unclear. User feedback indicates dissatisfaction with the clarity of account terms and conditions, particularly regarding leverage trading methods and risk management parameters. This lack of transparency in account structuring has contributed to negative user experiences and complaints about unclear service delivery.

Account opening procedures and verification processes have not been adequately documented. This leaves potential traders uncertain about onboarding requirements, documentation needs, and timeline expectations. The absence of clear account management tools and client portal features further complicates the user experience for those seeking comprehensive account oversight and control.

This Evotrade review finds that while the broker offers multiple account categories, the lack of detailed specifications, transparent pricing, and clear benefit structures significantly undermines the value proposition for potential traders seeking reliable and well-defined trading conditions.

Evotrade's primary technological offering centers around automated trading robots and algorithmic trading systems. It positions itself as a technology-focused broker for traders seeking automated solutions. However, detailed specifications about these trading robots, including performance metrics, strategy types, risk parameters, and historical results, have not been transparently disclosed to potential users.

The broker has not provided comprehensive information about research and analysis resources, market commentary, economic calendars, or educational materials that typically support trader decision-making. This absence of fundamental and technical analysis tools limits the value proposition for traders seeking comprehensive market insights and trading support.

Educational resources, webinars, tutorials, and skill development materials appear to be either limited or not publicly documented. For a broker targeting beginner and intermediate traders, this lack of educational infrastructure represents a significant service gap that could hinder trader development and success rates.

While automated trading support appears to be a core offering, the specific integration methods, customization options, and performance monitoring tools remain unclear. User feedback suggests disappointment with the effectiveness and reliability of the automated trading methods, though detailed performance data and system specifications are not available for independent verification.

Customer Service and Support Analysis

User feedback regarding Evotrade's customer service quality indicates significant dissatisfaction with response times, problem resolution capabilities, and overall support effectiveness. Reports suggest that clients have experienced difficulties in obtaining timely and helpful assistance when encountering issues with their trading accounts or platform functionality.

The specific customer service channels, availability hours, and contact methods have not been clearly documented. This creates additional barriers for users seeking support. The absence of comprehensive support infrastructure, including live chat, phone support, email responsiveness, and multilingual capabilities, appears to contribute to negative user experiences.

Problem resolution processes and escalation procedures remain unclear. This leaves traders uncertain about how to address disputes, technical issues, or account-related concerns effectively. The lack of transparent complaint handling mechanisms and dispute resolution frameworks further undermines confidence in the broker's customer support capabilities.

User testimonials consistently highlight poor service quality and inadequate support responsiveness as major concerns. The combination of unclear support channels, limited availability, and poor response quality has significantly damaged user trust and satisfaction with Evotrade's service delivery.

Trading Experience Analysis

User reports indicate widespread dissatisfaction with Evotrade's overall trading experience. However, specific details about platform stability, execution speed, and system reliability are limited in available documentation. The absence of detailed platform specifications, performance metrics, and technical infrastructure information makes it difficult to assess the actual trading environment quality.

Order execution quality appears to be a concern based on user feedback, with reports suggesting problems with trade processing and system reliability. However, specific data about execution speeds, slippage rates, and order fill quality are not available for objective analysis.

Platform functionality and feature completeness remain unclear due to insufficient technical documentation. The lack of information about charting tools, order types, risk management features, and trading interfaces creates uncertainty about the actual trading capabilities available to users.

Mobile trading experience and cross-platform compatibility have not been adequately documented. This limits understanding of accessibility and convenience features. This Evotrade review finds that the overall trading experience appears to fall short of user expectations, though comprehensive technical analysis is hampered by limited available information.

Trust and Reliability Analysis

Evotrade's trust profile presents significant concerns due to the absence of regulatory oversight from recognized financial authorities. The lack of clear regulatory compliance, licensing information, and supervisory framework creates substantial risks for trader protection and fund security.

Industry reports and user feedback consistently identify Evotrade as a potentially fraudulent operation. Multiple sources flag the broker as a scam. This negative industry reputation, combined with the absence of regulatory protection, creates serious concerns about the safety of client funds and the legitimacy of operations.

Company transparency issues are evident in the limited disclosure of operational details, management information, corporate structure, and business practices. The lack of comprehensive company information, regulatory filings, and operational transparency significantly undermines credibility and trustworthiness.

Fund security measures, segregation practices, and client protection protocols have not been adequately disclosed. This creates uncertainty about asset safety and protection mechanisms. The combination of regulatory absence, negative industry reputation, and limited transparency makes Evotrade a high-risk choice for traders seeking reliable and secure trading environments.

User Experience Analysis

Overall user satisfaction with Evotrade appears to be predominantly negative based on available feedback and industry reports. Users consistently express disappointment with various aspects of the service, including trading methods, platform functionality, and customer support quality.

Interface design and platform usability information is limited. However, user feedback suggests that the overall experience falls short of expectations. The lack of detailed platform documentation and user interface specifications makes it difficult to assess the actual usability and design quality of trading tools.

Registration and account verification processes have not been clearly documented. This contributes to user uncertainty about onboarding procedures and requirements. The absence of clear process documentation and timeline expectations creates additional friction in the user experience.

The target user profile appears to be traders seeking automated trading solutions. However, the actual service delivery seems to fall short of meeting these users' needs and expectations. User complaints focus on lack of trust, poor service quality, and inadequate platform functionality, suggesting fundamental mismatches between marketing promises and actual service delivery.

Conclusion

This Evotrade review reveals a broker with significant concerns across multiple evaluation criteria. The absence of regulatory oversight, negative industry reputation, and consistent user dissatisfaction create a high-risk environment for potential traders. While Evotrade markets multiple account types and automated trading capabilities, the lack of transparency, poor service quality, and questionable operational practices make it unsuitable for most traders.

The broker is particularly inappropriate for risk-averse traders and beginners who require reliable regulatory protection and comprehensive support services. The combination of limited transparency, poor user feedback, and absence of regulatory compliance creates substantial risks that outweigh any potential benefits from the advertised automated trading features.