Executive Summary

This comprehensive meta fx global review examines a forex broker that has been operating since 2005. The broker is registered in Saint Vincent and the Grenadines. Meta FX Global presents a mixed profile in the forex trading landscape, offering over 250 trading assets with ultra-tight spreads that appeal to traders seeking portfolio diversification. The broker targets intermediate to advanced traders. These traders value asset variety and competitive pricing structures.

However, user feedback reveals a polarized experience, with positive reviews highlighting the broker's trading tools and asset selection, while negative feedback raises concerns about service reliability and trustworthiness. According to WikiFX monitoring data, Meta FX Global has received mixed user reviews. These include positive feedback, neutral assessments, and exposure reports that warrant careful consideration.

The broker's regulatory status under Saint Vincent and the Grenadines jurisdiction may present different compliance standards compared to major regulatory frameworks. Potential clients should factor this into their decision-making process. This review provides an objective analysis based on available market data, user experiences, and regulatory information to help traders make informed decisions about this forex broker.

Important Notice

Due to Meta FX Global's registration in Saint Vincent and the Grenadines, traders should be aware that this jurisdiction may operate under different regulatory standards compared to major financial centers. The regulatory framework in this jurisdiction may offer varying levels of investor protection and oversight. This differs from brokers regulated by authorities such as the FCA, ASIC, or CySEC.

This review is compiled based on comprehensive analysis of user feedback, available market information, and publicly accessible data about Meta FX Global's services and operations. Readers should conduct their own due diligence. They should also consider their individual trading needs and risk tolerance when evaluating this broker. The assessment reflects conditions and information available at the time of writing and may be subject to changes in the broker's offerings or regulatory status.

Rating Framework

Broker Overview

Meta FX Global established its presence in the forex market in 2005. The company positioned itself as an online forex broker registered in Saint Vincent and the Grenadines. The company has built its business model around providing comprehensive trading services across multiple financial asset classes, catering primarily to traders seeking diversified investment opportunities. Over its years of operation, the broker has developed a service framework that emphasizes competitive spreads and a broad asset selection.

The broker's business approach focuses on delivering trading access to various financial markets through its online platform infrastructure. Meta FX Global operates as an intermediary between retail traders and global financial markets. The company offers services that span foreign exchange, commodities, indices, and equity markets. According to available information, the company has maintained its operational base while serving an international client base, though specific platform details are not extensively documented in available materials.

This meta fx global review indicates that the broker's primary value proposition centers on providing access to over 250 trading instruments with competitive pricing structures. The company's longevity in the market since 2005 suggests operational continuity. However, traders should carefully evaluate the regulatory implications of the Saint Vincent and the Grenadines registration when considering their trading options.

Regulatory Jurisdiction: Meta FX Global operates under registration in Saint Vincent and the Grenadines. Specific regulatory authority details are not clearly specified in available documentation.

Deposit and Withdrawal Methods: Specific information regarding payment methods and processing procedures is not detailed in available materials.

Minimum Deposit Requirements: The broker's minimum deposit thresholds are not specified in current available information.

Bonus and Promotional Offers: Details regarding promotional programs or bonus structures are not documented in accessible materials.

Tradeable Assets: The broker provides access to 250+ trading instruments across multiple asset classes. These include forex pairs, commodities, market indices, and individual stocks, offering substantial diversification opportunities for portfolio construction.

Cost Structure: Meta FX Global advertises ultra-tight spreads as a key competitive advantage. Specific commission structures and fee schedules are not detailed in available information.

Leverage Options: Information regarding maximum leverage ratios and margin requirements is not specified in current materials.

Platform Selection: Specific trading platform offerings and technological infrastructure details are not extensively documented in available sources.

Geographic Restrictions: Regional availability and trading restrictions are not clearly outlined in accessible information.

Customer Support Languages: Specific language support options are not detailed in available materials.

This meta fx global review reveals that while the broker offers substantial asset variety and competitive spreads, many operational details require direct inquiry with the broker for complete information.

Account Conditions Analysis

The account structure at Meta FX Global presents several areas where information transparency could be improved. Available materials do not provide clear details about different account tiers, minimum deposit requirements, or specific account features. These details would typically help traders make informed decisions about their trading setup.

The absence of clearly specified minimum deposit amounts makes it challenging for potential clients to assess whether the broker's account conditions align with their available capital and trading objectives. This lack of transparency in account opening requirements may pose difficulties for traders attempting to plan their initial investment approach.

Account opening procedures and verification processes are not detailed in available documentation. This means prospective clients would need to initiate contact with the broker to understand the onboarding requirements. The availability of specialized account types, such as Islamic accounts for traders requiring swap-free trading conditions, is not specified in accessible materials.

User feedback regarding account conditions shows mixed responses, with some traders expressing satisfaction with their account setup while others have raised concerns about various aspects of the account management process. The variability in user experiences suggests that account conditions may differ based on individual circumstances or account types. These differences are not publicly documented.

This meta fx global review assessment of account conditions reflects the need for greater transparency in communicating account specifications and requirements to potential clients. Traders considering this broker should directly inquire about specific account features, minimum deposits, and any special conditions that may apply to their trading situation.

Meta FX Global promotes the availability of advanced trading tools as part of its service offering. Specific details about these tools are not comprehensively documented in available materials. The broker's emphasis on providing sophisticated trading resources suggests an attempt to cater to more experienced traders who require analytical capabilities beyond basic charting functions.

The quality and variety of research and analysis resources offered by the broker are not clearly specified. This limits the ability to assess how well the broker supports traders' decision-making processes. Educational resources, which are crucial for trader development, are not detailed in accessible information, making it difficult to evaluate the broker's commitment to client education and skill development.

Automated trading support and algorithmic trading capabilities are not specifically addressed in available documentation. This represents a significant information gap. Many modern traders rely on automated strategies and expert advisors as part of their trading approach.

User feedback regarding the broker's tools and resources includes positive comments about the available trading infrastructure. This suggests that clients who have accessed these tools have found them beneficial. However, the lack of specific details about tool functionality and capabilities makes it challenging to provide a comprehensive assessment of this aspect of the broker's service.

The trading tools landscape is highly competitive, with traders expecting sophisticated charting packages, technical indicators, and analytical resources. Without detailed information about Meta FX Global's specific offerings in this area, potential clients would need to evaluate these tools directly through demo accounts or direct consultation with the broker.

Customer Service and Support Analysis

Meta FX Global advertises 24/7 customer support availability. This represents a positive aspect of their service infrastructure. Round-the-clock support can be particularly valuable for forex traders who operate across different time zones and may require assistance during various market sessions.

However, user feedback indicates inconsistent service quality experiences. This suggests that while support may be available continuously, the effectiveness and reliability of that support may vary. Response times and resolution efficiency are not specifically documented in available materials, making it difficult to assess the practical effectiveness of the support system.

The range of communication channels available for customer support is not clearly specified. The 24/7 availability suggests multiple contact options should be accessible. Modern traders typically expect support through various channels including live chat, email, and telephone, but specific availability of these options is not confirmed in accessible information.

Multi-language support capabilities are not detailed in available documentation. This could be a consideration for international clients who prefer support in their native languages. Given the broker's international client base, language support options could significantly impact user experience quality.

User experiences with customer service show mixed results, with some feedback indicating satisfactory support interactions while other users have reported challenges with service quality consistency. The variability in user experiences suggests that support quality may depend on specific circumstances, timing, or the nature of inquiries being addressed.

Problem resolution case studies and specific examples of customer service effectiveness are not documented in available materials. This limits the ability to assess how well the broker handles complex client issues or disputes.

Trading Experience Analysis

The trading experience at Meta FX Global receives mixed feedback from users. Generally positive comments are tempered by some expressed concerns about various aspects of the trading environment. This balanced but cautious user sentiment suggests that while basic trading functionality may be satisfactory, there are areas where improvements could enhance overall user experience.

Platform stability and execution speed are critical factors for trading success. Specific performance metrics and reliability data are not documented in available materials. User feedback indicates generally positive experiences but with some reservations, suggesting that platform performance may be adequate for basic trading needs while potentially falling short of expectations for more demanding trading strategies.

Order execution quality, including factors such as slippage, rejection rates, and fill accuracy, are not specifically detailed in available information. These technical aspects of trading experience are crucial for trader profitability. They require more detailed analysis than is currently available through public sources.

Mobile trading capabilities and cross-platform functionality are not specifically addressed in accessible documentation. Given the importance of mobile trading in today's market environment, the absence of detailed mobile platform information represents a significant information gap for potential clients.

The trading environment's stability regarding spreads and liquidity conditions is partially addressed through the broker's emphasis on ultra-tight spreads. Specific liquidity provider relationships and spread consistency data are not detailed. User feedback suggests satisfactory trading conditions but with some underlying concerns that warrant careful consideration.

This meta fx global review of trading experience indicates that while basic trading functionality appears adequate based on user feedback, the lack of detailed technical specifications and performance data makes comprehensive evaluation challenging.

Trust and Reliability Analysis

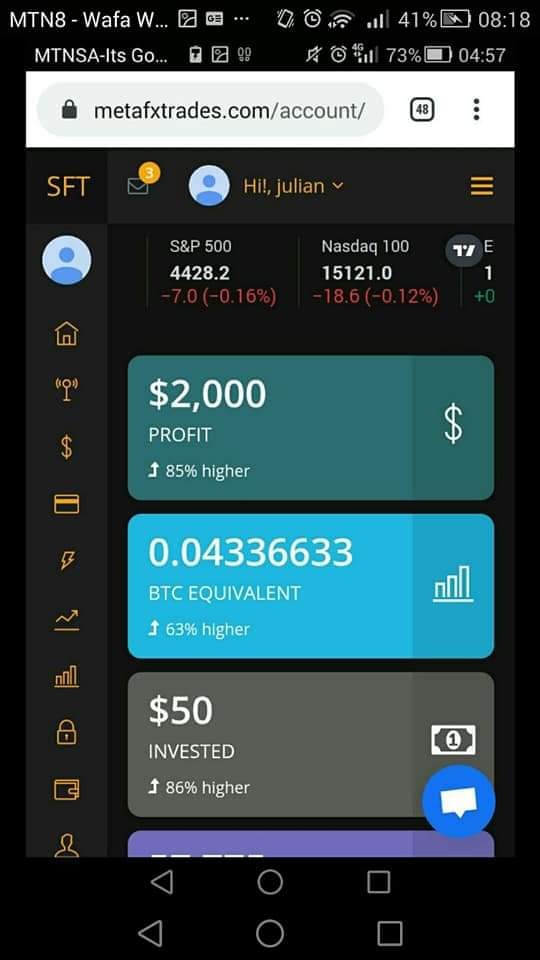

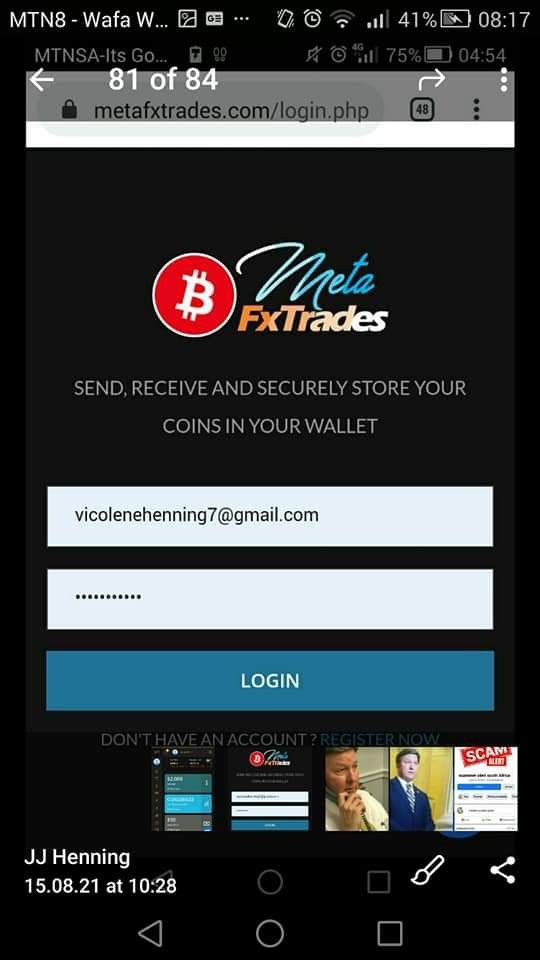

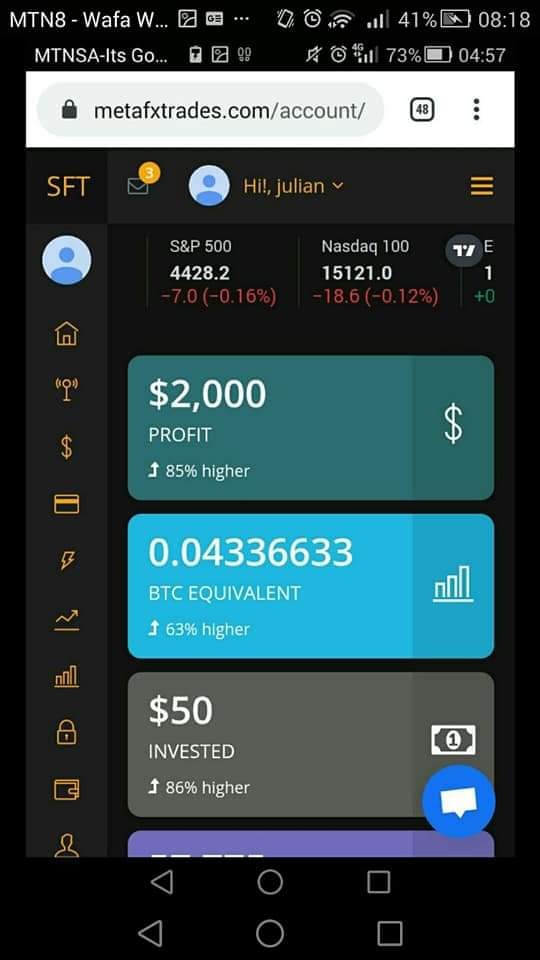

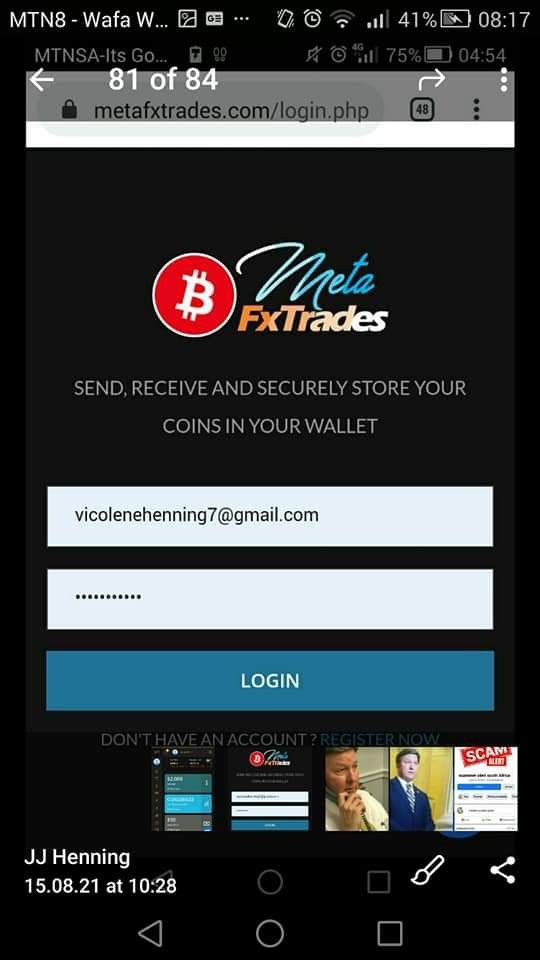

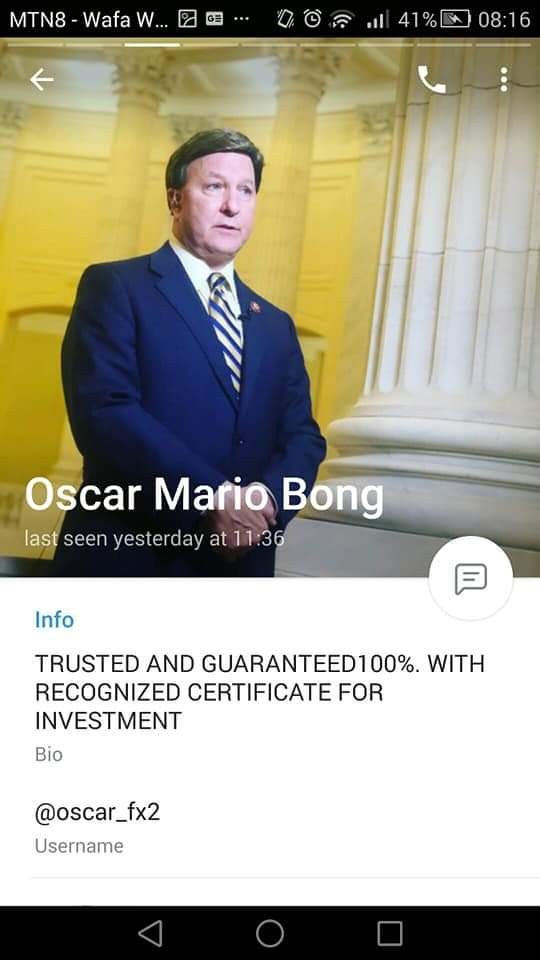

The trust and reliability assessment of Meta FX Global reveals significant concerns that potential clients should carefully consider. User feedback includes reports characterizing the broker as a scam website. These represent serious allegations that impact the broker's credibility and trustworthiness in the trading community.

Regulatory oversight through Saint Vincent and the Grenadines registration provides some level of official recognition. This jurisdiction is generally considered to offer lighter regulatory oversight compared to major financial regulatory authorities. The regulatory framework in this jurisdiction may not provide the same level of investor protection and dispute resolution mechanisms available through more established regulatory bodies.

Fund safety measures and client money protection protocols are not detailed in available information. This is concerning given the importance of capital security in forex trading. The absence of clear information about segregated accounts, deposit insurance, or other protective measures represents a significant transparency gap.

Company transparency regarding ownership, financial statements, and operational procedures is limited in accessible materials. This lack of transparency can make it difficult for potential clients to assess the broker's financial stability and operational integrity.

Industry reputation based on available feedback shows mixed signals, with some positive user experiences contrasted against serious allegations and negative reports. The presence of exposure reports and scam allegations significantly impacts the broker's overall trust profile. These require careful consideration by potential clients.

Negative event handling and dispute resolution capabilities are not documented in available materials. This makes it unclear how the broker addresses client complaints or resolves trading disputes. The handling of negative feedback and client concerns is crucial for maintaining trust and credibility in the forex industry.

User Experience Analysis

Overall user satisfaction with Meta FX Global shows a mixed pattern. Feedback spans positive experiences to serious concerns about the broker's operations. This diversity in user experiences suggests that satisfaction may depend on individual trading circumstances, account types, or specific interactions with the broker's services.

Interface design and platform usability are not specifically detailed in available documentation. User feedback suggests that basic functionality is accessible to traders. The absence of detailed platform reviews or usability assessments makes it challenging to evaluate how well the broker's interface serves different types of traders.

Registration and verification processes are not clearly outlined in accessible materials. This means potential clients cannot easily assess the complexity or requirements of the account opening procedure. Streamlined onboarding processes are important for user satisfaction and initial experience quality.

Fund management and transaction experiences are not specifically documented in user feedback. This represents an area where more detailed information would be valuable for potential clients. Deposit and withdrawal experiences significantly impact overall user satisfaction but are not well-documented in available sources.

Common user complaints based on available feedback include concerns about service reliability and questions about the broker's legitimacy. The presence of serious allegations and negative exposure reports represents significant user experience concerns. Potential clients should carefully evaluate these issues.

User demographic analysis suggests that the broker may be more suitable for intermediate to advanced traders who are seeking portfolio diversification opportunities. However, the mixed feedback indicates that even experienced traders should exercise caution. They should conduct thorough due diligence before engaging with this broker.

Improvement opportunities based on user feedback include enhanced transparency in operations, more consistent customer service quality, and clearer communication about regulatory compliance and fund safety measures. These improvements could help address some of the trust and reliability concerns expressed in user feedback.

Conclusion

This meta fx global review presents a broker with mixed credentials that require careful evaluation by potential clients. While Meta FX Global offers competitive features such as ultra-tight spreads and access to over 250 trading instruments, significant concerns about trust and reliability overshadow these potential advantages.

The broker may be suitable for experienced traders who prioritize asset diversity and competitive spreads. However, the serious allegations and mixed user feedback suggest that extreme caution is warranted. The regulatory framework under Saint Vincent and the Grenadines provides limited investor protection compared to major regulatory jurisdictions.

Key advantages include competitive spread offerings and substantial asset variety. Major disadvantages include trust concerns, limited transparency, and inconsistent service quality. Potential clients should conduct extensive due diligence and consider alternative brokers with stronger regulatory oversight and more positive user feedback before making trading decisions.