Is Hssmarkets safe?

Business

License

Is HSSMarkets Safe or Scam?

Introduction

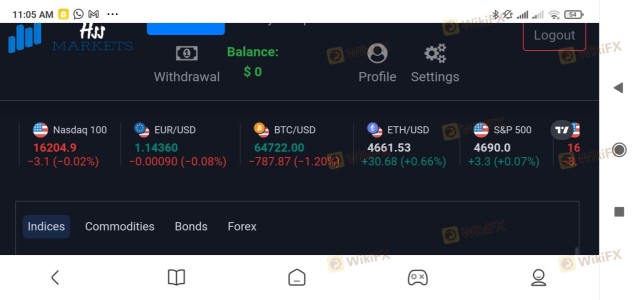

HSSMarkets is a forex broker that has positioned itself within the competitive landscape of online trading. As an entity offering services in forex, binary options, cryptocurrencies, ETFs, and CFDs, it attracts traders looking for diverse investment opportunities. However, the importance of thoroughly evaluating forex brokers cannot be overstated. Traders are often vulnerable to scams and fraudulent practices in an industry that is not uniformly regulated. Therefore, understanding the legitimacy of a broker like HSSMarkets is crucial for safeguarding investments. This article employs a comprehensive investigative approach, utilizing online reviews, regulatory databases, and user experiences to assess whether HSSMarkets is a safe option for trading or if it raises red flags indicating potential scams.

Regulation and Legitimacy

The regulatory framework surrounding a broker is a key indicator of its legitimacy and safety. HSSMarkets claims to operate under several regulatory jurisdictions, including Ireland, Australia, South Africa, the United Arab Emirates, and Japan. However, investigations reveal that it is not registered with any of these authorities, raising significant concerns about its regulatory status.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of credible regulatory oversight means that HSSMarkets is operating in a high-risk environment. Regulated brokers are required to adhere to strict guidelines that protect client funds and ensure fair trading practices. The lack of regulation for HSSMarkets suggests that traders have little recourse in the event of disputes or financial mishaps, making it imperative to question, is HSSMarkets safe?

Company Background Investigation

HSSMarkets presents itself as a trading platform with a seemingly global reach. However, details regarding its history and ownership structure remain vague. There is little to no information available about the management team or their professional backgrounds, which is critical for assessing the broker's credibility. Transparency is a fundamental aspect of trustworthy trading platforms, and HSSMarkets falls short in this regard.

The lack of clear information about the company's history also raises concerns about its operational legitimacy. A reputable broker typically provides comprehensive details about its founding, ownership, and management. In contrast, the absence of such information for HSSMarkets feeds into the skepticism surrounding its safety. When evaluating whether HSSMarkets is safe, traders should consider these transparency issues as significant red flags.

Trading Conditions Analysis

When assessing a broker's trading conditions, it is essential to understand the cost structure and any unusual fees that may apply. HSSMarkets claims to offer competitive spreads and leverage, but the specifics are often unclear. Many users have reported hidden fees that were not disclosed upfront, which can significantly impact trading profitability.

| Fee Type | HSSMarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.7 pips | 1.2 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding fees and commissions raises questions about the broker's commitment to fair trading practices. A broker that does not transparently disclose its fee structure may be attempting to mislead traders, further contributing to the perception that HSSMarkets is not safe.

Client Fund Safety

The safety of client funds is paramount in the trading industry. HSSMarkets claims to implement various measures to protect client funds, such as segregating accounts and offering negative balance protection. However, without regulatory oversight, these claims are difficult to verify.

The absence of a solid regulatory framework means that there is no assurance that client funds are adequately protected. Historical issues related to fund security or disputes with clients further exacerbate concerns about the safety of investments with HSSMarkets. Traders must question whether HSSMarkets is safe when considering the potential risks involved with investing in an unregulated environment.

Customer Experience and Complaints

User feedback is a valuable resource for evaluating a broker's reliability. Many reviews of HSSMarkets highlight a pattern of complaints regarding withdrawal difficulties, lack of customer support, and issues with account access.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Account Access | High | Poor |

The recurring nature of these complaints suggests systemic issues within the broker's operations. For instance, several traders have reported being unable to withdraw their funds after repeated attempts to contact customer support. Such experiences raise significant concerns about whether HSSMarkets is safe and whether traders can trust the platform with their investments.

Platform and Trade Execution

The trading platform's performance is another critical aspect of a broker's reliability. HSSMarkets offers a web-based trading platform, which lacks the robustness and features of industry-standard platforms like MetaTrader 4 or 5. Users have reported issues with order execution, including slippage and rejected orders, which can severely impact trading outcomes.

The quality of order execution directly affects a trader's profitability. If a broker manipulates order execution or fails to provide a stable trading environment, it leads to a loss of trust. Therefore, traders must consider whether HSSMarkets is safe based on the platform's reliability and execution quality.

Risk Assessment

Using HSSMarkets comes with inherent risks that traders should carefully evaluate. The lack of regulation, transparency issues, and numerous complaints about customer service and fund withdrawals contribute to a high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for loss of funds |

| Operational Risk | Medium | Issues with platform stability and support |

To mitigate these risks, traders should conduct thorough research before investing. It is advisable to start with a small amount and monitor the broker's performance closely. If issues arise, traders should be prepared to withdraw their funds promptly.

Conclusion and Recommendations

In conclusion, the investigation into HSSMarkets raises significant concerns regarding its legitimacy and safety. The absence of regulatory oversight, combined with a lack of transparency and numerous user complaints, indicates that traders should exercise extreme caution.

While HSSMarkets may offer attractive trading conditions, the risks associated with using an unregulated broker far outweigh the potential benefits. Therefore, it is crucial for traders to consider safer alternatives. Brokers with established regulatory frameworks, transparent operations, and positive user feedback are recommended for those looking to invest in the forex market.

In summary, the question remains: is HSSMarkets safe? The evidence suggests that it is not a trustworthy option for traders, and potential investors should seek out more reputable brokers to ensure the safety of their funds.

Is Hssmarkets a scam, or is it legit?

The latest exposure and evaluation content of Hssmarkets brokers.

Hssmarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hssmarkets latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.