Access Direct 2025 Review: Everything You Need to Know

Executive Summary

Access Direct works as a retail broker that offers multi-asset trading services to individual traders. This access direct review shows a company that sees itself as a simple alternative to traditional brokers, giving access to ETFs, shares, CFDs, futures, and FX trading from one account platform. The broker focuses on efficiency by removing third-party middlemen. This approach theoretically allows for lower commission structures compared to regular brokerage firms.

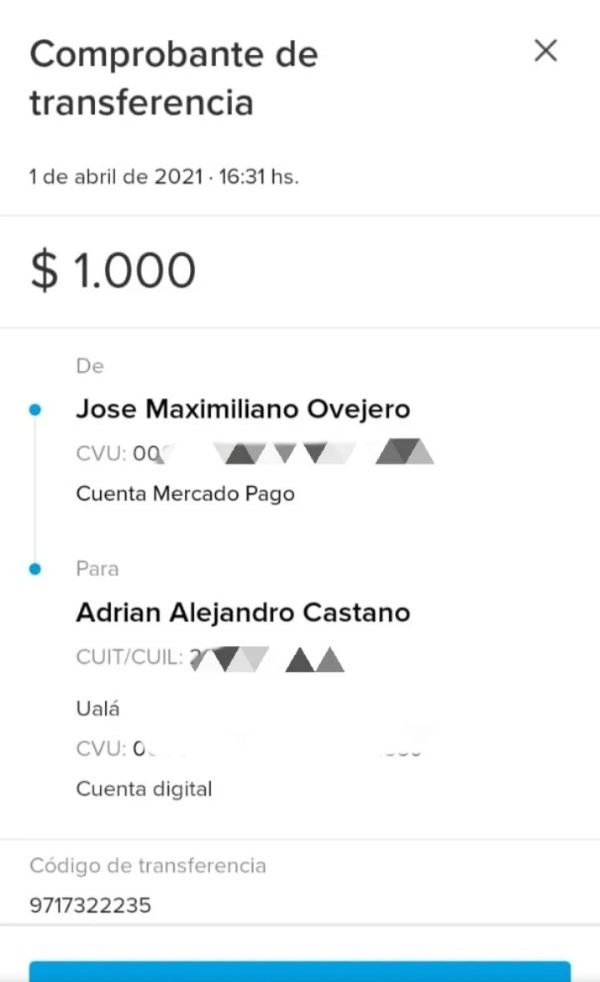

User reviews suggest that Access Direct delivers services "as advertised." One client noted nearly two years of good partnership experience. The company runs multiple telemarketing centers in Iowa and targets retail traders who want diversified asset exposure. However, specific regulatory information and detailed operational data remain limited in available public documents. This may impact transparency assessments for potential clients.

The broker's business model emphasizes cost reduction and efficiency improvements through direct market access. It appeals primarily to active traders who need advanced platform features and streamlined execution capabilities.

Important Notice

This access direct review is put together based on available public information and user feedback. Readers should note that specific regulatory details, complete fee structures, and detailed platform specifications are not well documented in accessible sources. Different regional entities may operate under varying regulatory frameworks. This potentially affects service availability and investor protection levels across different jurisdictions.

The evaluation method relies on user testimonials, company-provided information, and industry standard comparisons where specific data points are available. Prospective clients should conduct independent verification of regulatory status and service terms before engaging with the platform.

Rating Framework

Broker Overview

Access Direct works as a retail-focused brokerage firm that emphasizes multi-asset trading capabilities through a unified account structure. The company's operational model centers on providing direct market access while reducing traditional middleman costs that typically increase commission expenses for end users. This approach positions Access Direct within the category of brokers that prioritize efficiency and cost-effectiveness over traditional full-service brokerage offerings.

The firm operates through telemarketing centers located in Iowa. This suggests a direct sales approach to client acquisition and relationship management. This business model indicates a focus on active client engagement and personalized service delivery, though specific details about the scope and quality of these interactions remain limited in available documentation.

Access Direct's platform supports trading across multiple asset classes including exchange-traded funds, individual stocks, contracts for difference, futures contracts, and foreign exchange instruments. This diversified offering suggests the broker targets traders seeking comprehensive market exposure without the need to maintain multiple brokerage relationships. The company's self-described mission involves delivering services that match their advertised capabilities. User feedback generally supports this claim.

Regulatory Status: Specific regulatory information for Access Direct is not detailed in available source materials. This represents a significant information gap for potential clients evaluating broker credibility and investor protection measures.

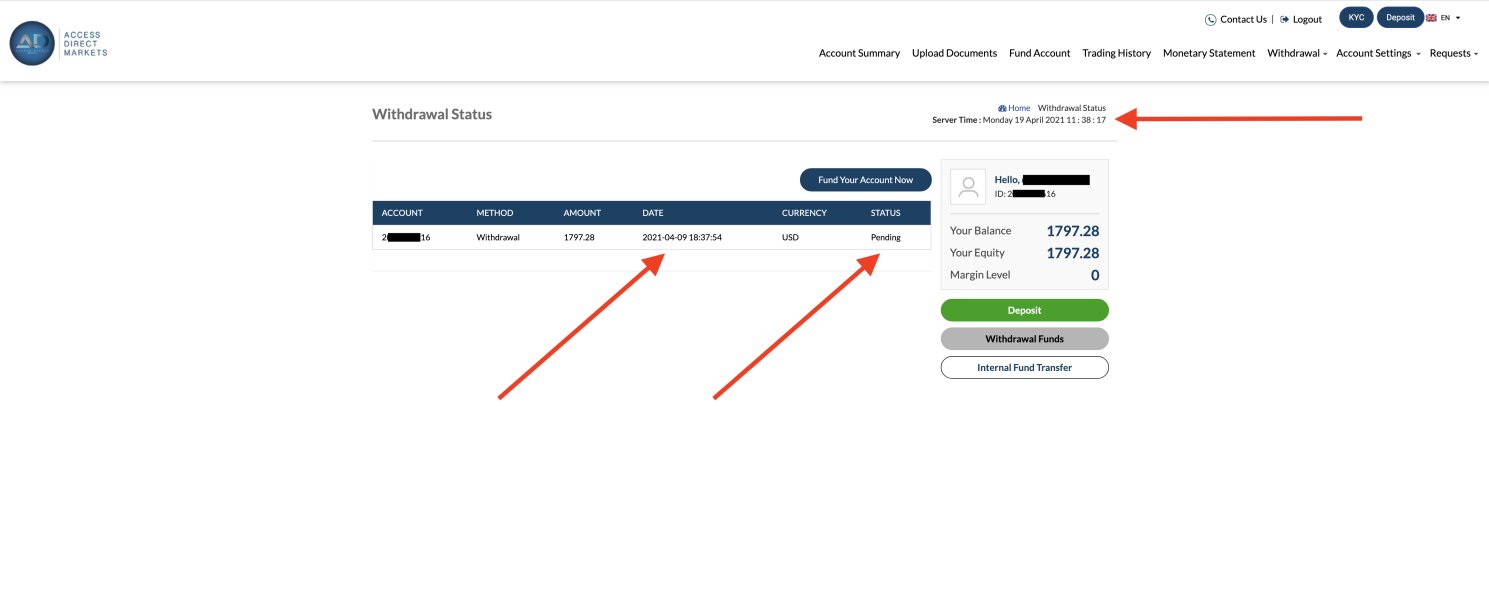

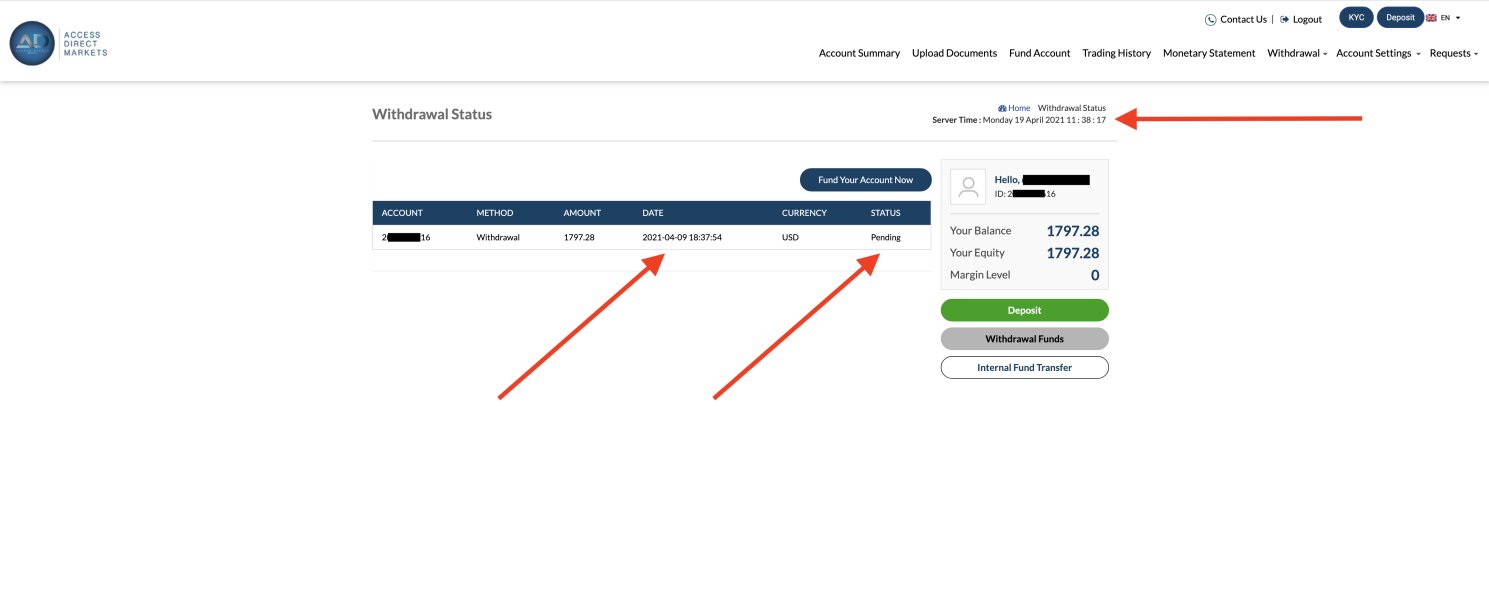

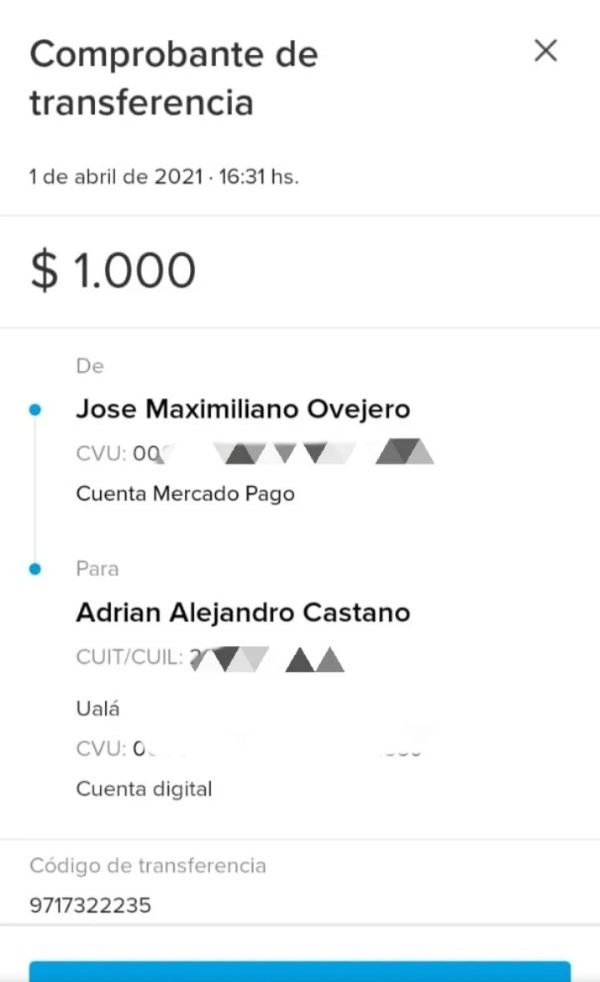

Deposit and Withdrawal Methods: The broker's funding mechanisms and withdrawal procedures are not clearly outlined in accessible documentation. This requires direct inquiry for prospective account holders.

Minimum Deposit Requirements: Specific minimum funding thresholds are not disclosed in available public information. This suggests these details may be provided during the account opening consultation process.

Promotions and Bonuses: Current promotional offerings or new client incentives are not documented in reviewed materials. This indicates either absence of such programs or limited public disclosure of promotional terms.

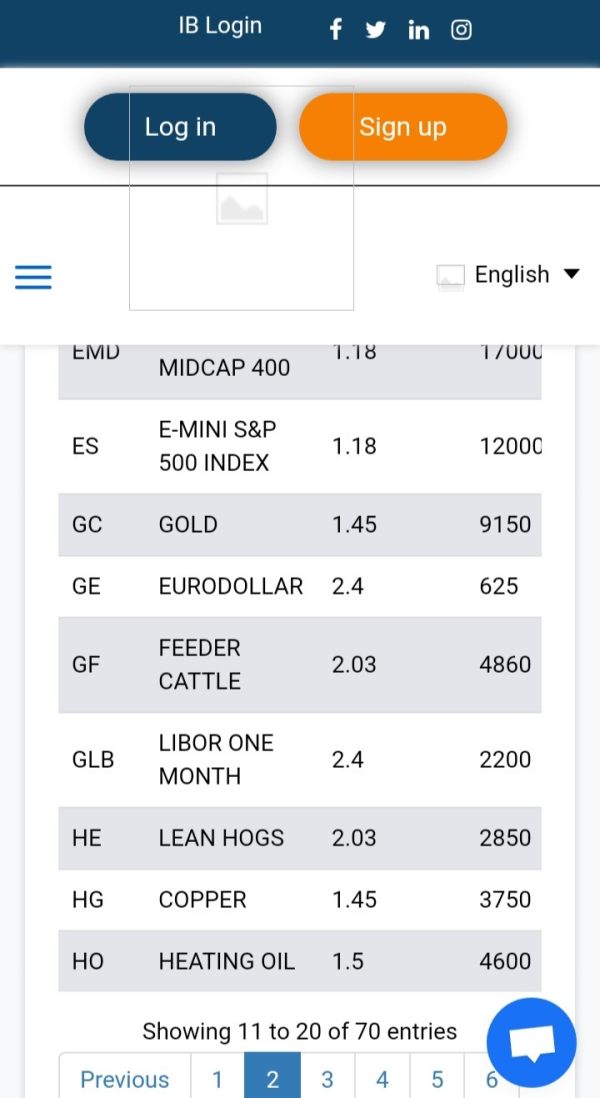

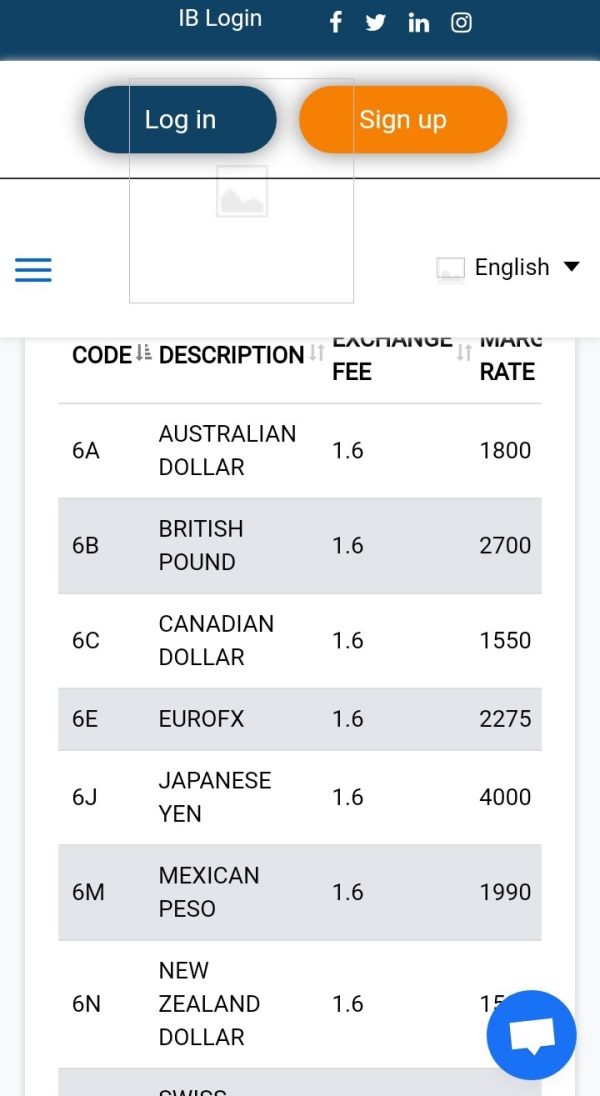

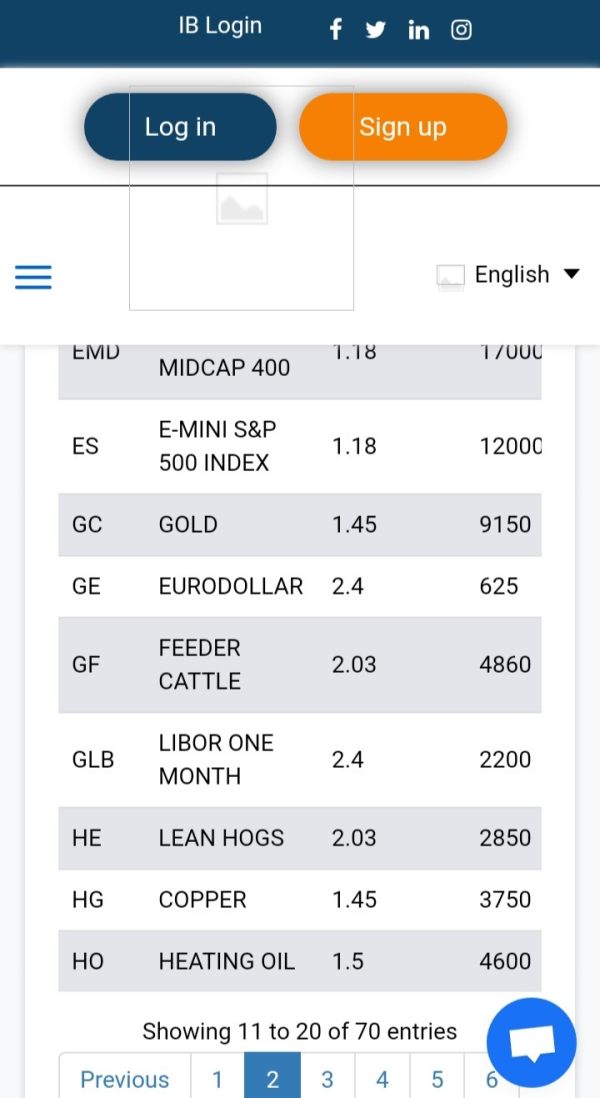

Tradeable Assets: Access Direct provides trading access to exchange-traded funds, individual shares, contracts for difference, futures contracts, and foreign exchange instruments. This represents a comprehensive multi-asset platform approach.

Cost Structure: Detailed information regarding spreads, commissions, overnight financing costs, and other fee components is not well documented in available sources. However, the broker claims cost advantages through elimination of third-party middlemen.

Leverage Ratios: Specific maximum leverage offerings across different asset classes are not detailed in reviewed documentation.

Platform Options: The exact trading platform technology and interface specifications are not well described in available materials.

Geographic Restrictions: Specific country or regional trading restrictions are not outlined in accessible documentation.

Customer Support Languages: Available customer service language options are not specified in reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Access Direct's account conditions faces significant limitations due to insufficient publicly available information regarding account types, minimum deposit requirements, and specific terms of service. This access direct review cannot provide complete analysis of account tier structures, special features, or comparative advantages without access to detailed account documentation.

Available information suggests the broker operates a unified account model supporting multiple asset classes. This may simplify account management for traders seeking diversified exposure. However, without specific details regarding account opening procedures, verification requirements, or special account features such as Islamic-compliant options, prospective clients must rely on direct broker consultation for complete account condition evaluation.

The absence of detailed account information in public documentation may reflect either a customized approach to account structuring based on individual client needs or limited transparency in marketing materials. Industry standards typically require clear disclosure of account terms. This makes this information gap notable for potential clients conducting due diligence.

Access Direct's tool and resource offering centers on multi-asset trading capability, providing access to ETFs, shares, CFDs, futures, and FX markets through a unified platform interface. This complete asset coverage suggests the broker has invested in platform infrastructure capable of supporting diverse trading strategies and portfolio construction approaches.

The broker's emphasis on eliminating third-party middlemen may translate to more direct market access and potentially improved execution efficiency. However, specific performance metrics are not documented in available materials. Advanced trading platforms typically offer features tailored for active traders, which aligns with Access Direct's positioning, but detailed feature specifications require further investigation.

Research and analysis resources, educational materials, and automated trading support capabilities are not well documented in reviewed sources. This represents a significant information gap for traders who rely on broker-provided research, market analysis, or educational content to support their trading decisions. The absence of detailed tool specifications may indicate either a focus on execution services over research provision or limited public disclosure of available resources.

Customer Service and Support Analysis

Access Direct's customer service model appears to center on telemarketing centers located in Iowa, suggesting a direct phone-based support approach. This model may provide more personalized interaction compared to purely digital support systems. However, specific service quality metrics and response time commitments are not documented in available materials.

User testimonials reference nearly two years of satisfactory service relationship, indicating some level of ongoing support quality. The limited sample size prevents complete service quality assessment. The telemarketing center approach may appeal to clients who prefer direct phone communication over chat or email support channels.

Specific details regarding customer service availability hours, multi-language support options, and escalation procedures are not outlined in reviewed documentation. The absence of complete customer service information makes it difficult for potential clients to assess whether support capabilities align with their trading schedule and communication preferences.

Trading Experience Analysis

The evaluation of Access Direct's trading experience quality is limited by the absence of detailed platform performance data, execution quality metrics, and user interface specifications in available source materials. This access direct review cannot provide complete analysis of platform stability, order execution speed, or trading environment quality without access to technical performance documentation.

The broker's multi-asset trading capability suggests platform infrastructure designed to handle diverse order types and market conditions across different asset classes. However, specific details regarding platform reliability, execution algorithms, or mobile trading capabilities are not documented in reviewed materials.

User feedback regarding trading experience quality is limited in available sources. This makes it difficult to assess real-world platform performance from client perspectives. The absence of detailed trading experience information represents a significant gap for active traders who prioritize platform performance and execution quality in broker selection decisions.

Trust Factor Analysis

Access Direct's trust factor assessment faces significant challenges due to limited regulatory information disclosure in available documentation. The absence of specific regulatory authority references, license numbers, or compliance framework details creates uncertainty regarding investor protection measures and regulatory oversight.

Fund safety measures, segregation policies, and insurance coverage details are not outlined in reviewed materials. This represents critical information gaps for clients concerned about capital protection. Industry best practices typically involve clear disclosure of regulatory status and client fund protection measures. These omissions are notable.

Company transparency regarding management structure, financial reporting, and operational oversight is not well documented in available sources. Third-party ratings or industry recognition are not referenced in reviewed materials, limiting external validation of the broker's reputation and operational standards. The limited transparency may impact client confidence, particularly for larger account holders or institutional clients.

User Experience Analysis

User experience evaluation for Access Direct relies primarily on limited testimonial evidence suggesting services delivered "as advertised" with satisfactory long-term client relationships. However, the small sample size of available user feedback prevents complete satisfaction assessment across different client types and trading scenarios.

Platform interface design, navigation efficiency, and overall usability are not detailed in available documentation. This makes it difficult to assess the user-friendliness of the trading environment. Registration and account verification procedures are not outlined, preventing evaluation of onboarding experience quality.

Fund management operations, including deposit and withdrawal experience, are not documented in reviewed materials. Common user complaints or satisfaction trends are not extensively reported, limiting insight into typical client experience patterns. The absence of complete user experience data suggests potential clients should prioritize direct platform demonstration and trial periods when evaluating the broker's suitability for their trading requirements.

Conclusion

This complete access direct review reveals a broker that positions itself as an efficient, multi-asset trading solution for retail clients seeking alternatives to traditional brokerage services. While user testimonials suggest service delivery that meets advertised expectations, significant information gaps regarding regulatory status, detailed fee structures, and complete platform specifications limit the ability to provide definitive recommendations.

Access Direct appears most suitable for traders prioritizing multi-asset access through a unified account structure and those comfortable with direct phone-based relationship management. However, the limited transparency regarding regulatory oversight and detailed operational terms may concern clients who prioritize complete disclosure and regulatory clarity in broker selection decisions.