CItI group Review 1

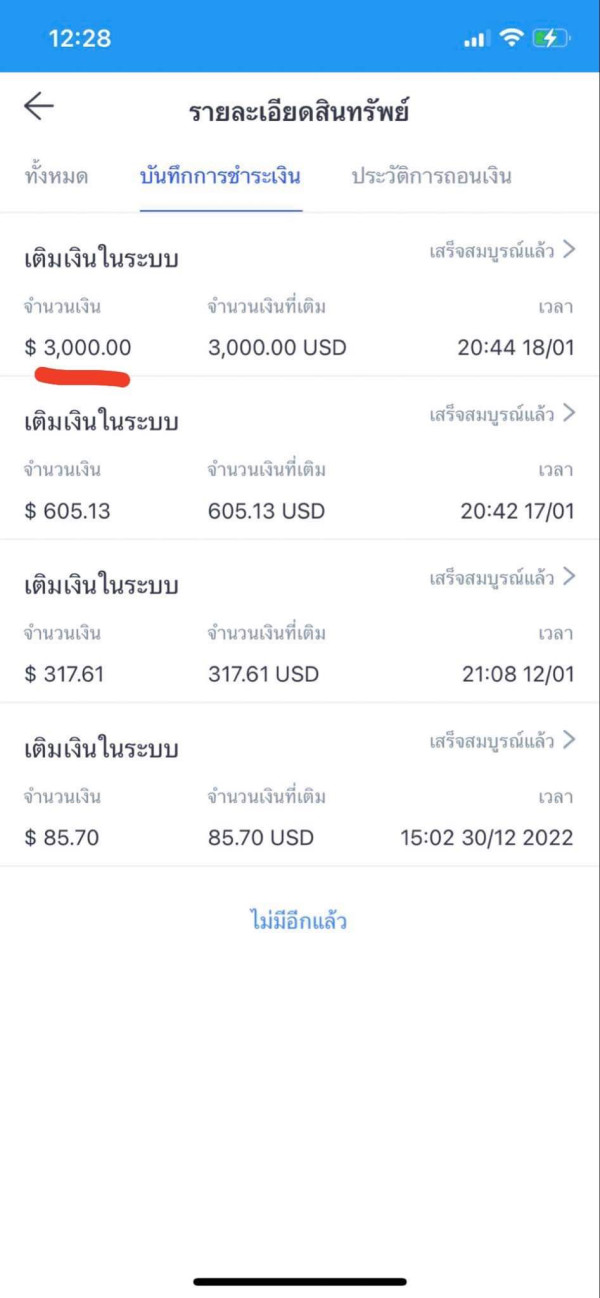

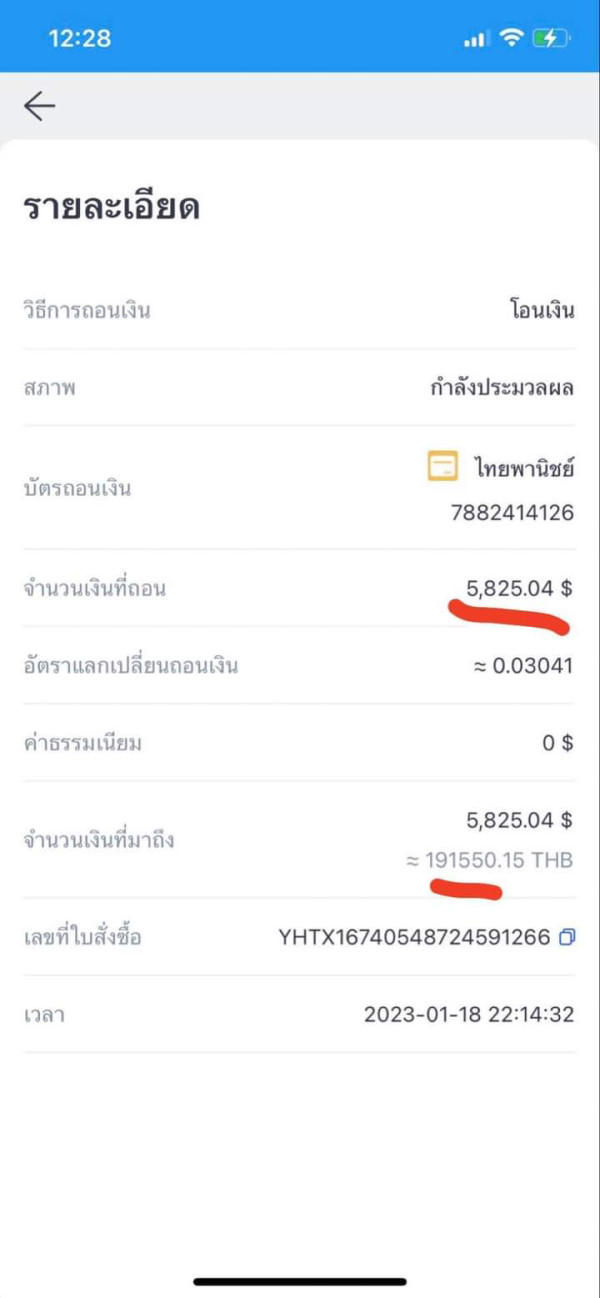

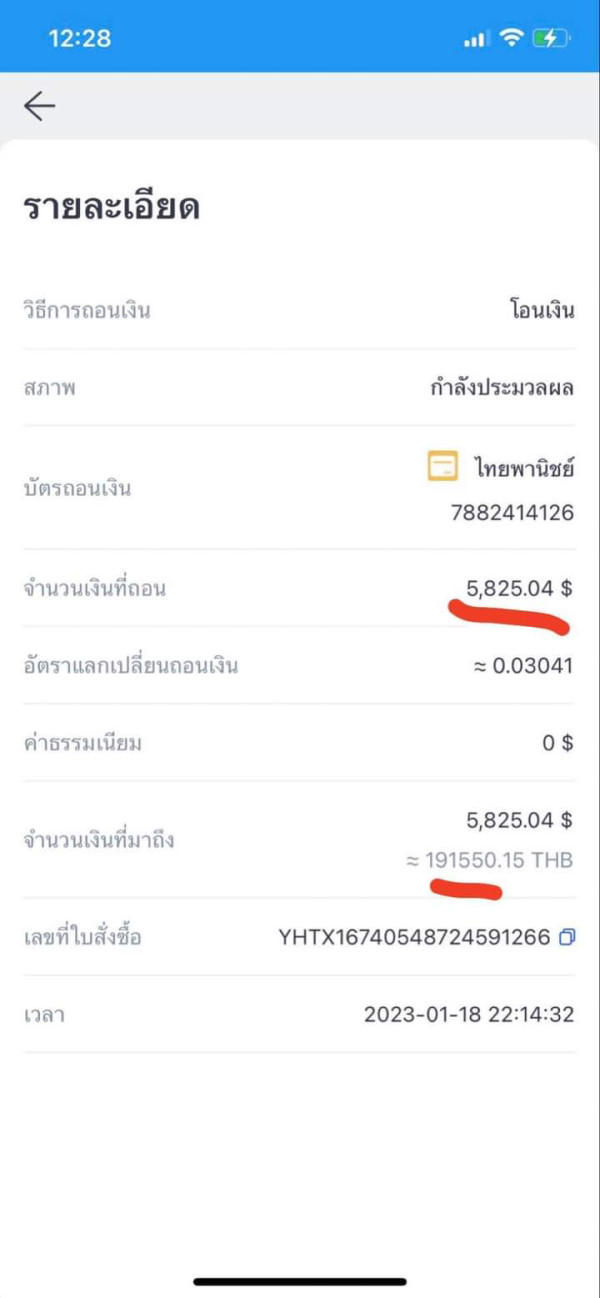

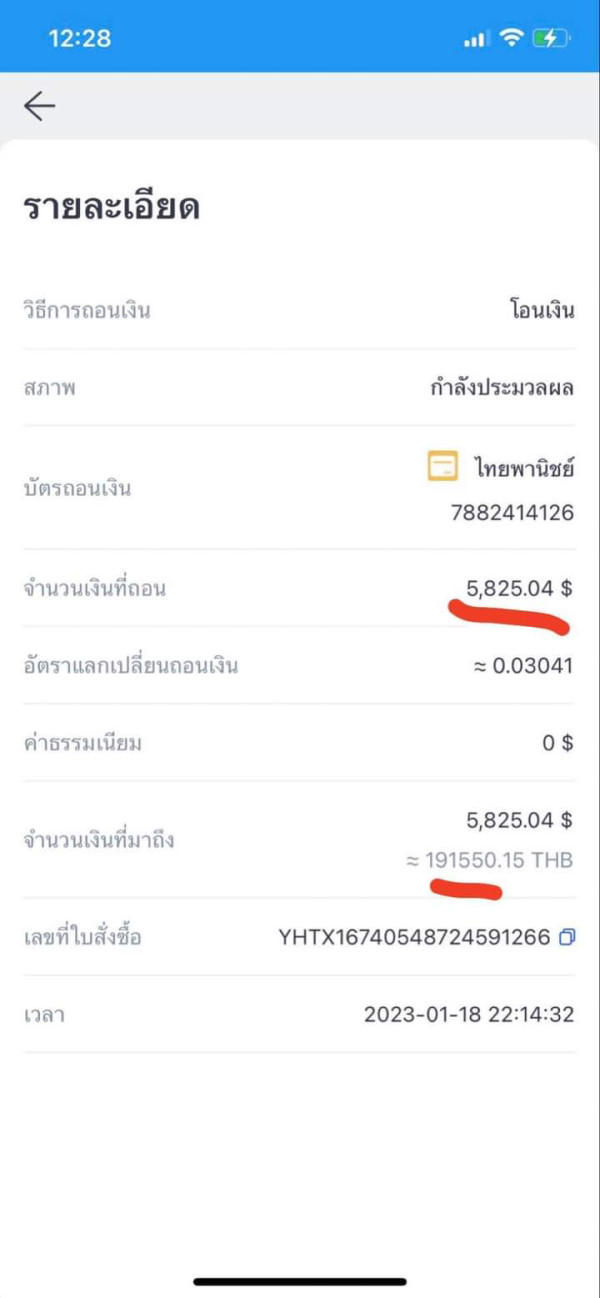

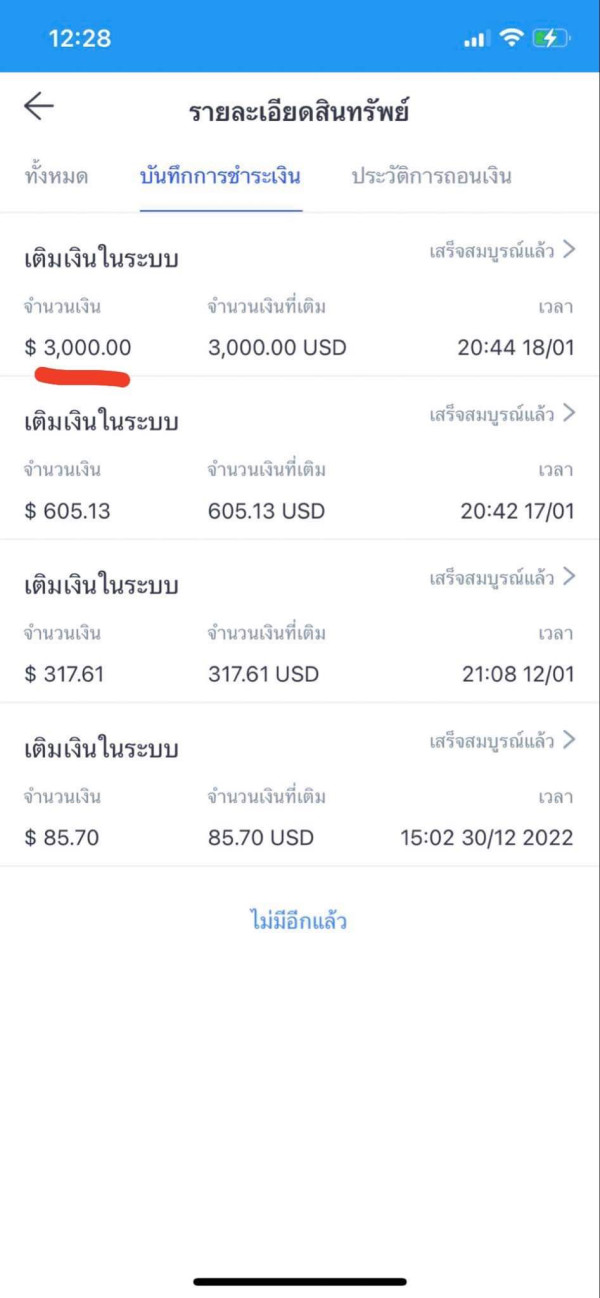

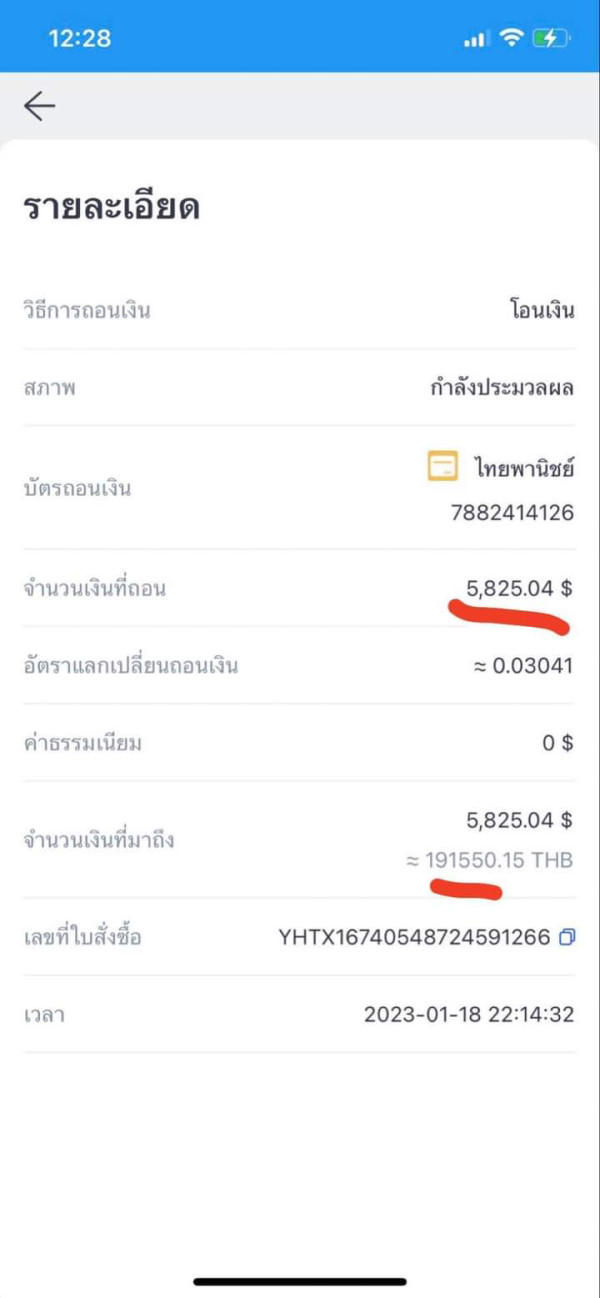

Come to trick love into investing. Give money to help fill the pot. When withdrawing money, you have to transfer another 30%.

CItI group Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Come to trick love into investing. Give money to help fill the pot. When withdrawing money, you have to transfer another 30%.

This comprehensive Citi Group review provides an in-depth analysis of one of the world's largest financial institutions. Citi Group has established itself as a global financial powerhouse since its founding on October 8, 1998, offering diverse banking services, commercial banking, credit cards, personal loans, and mortgage services to both individual and corporate clients worldwide.

According to available data from Comparably, Citi Group demonstrates mixed performance in employee satisfaction. 69% of 682 reviews show positive feedback while 31% provide constructive criticism regarding work environment and advancement opportunities. However, the overall user rating for Citigroup services reaches an impressive 4.2 out of 5 stars according to MarketWatch data. This indicates strong customer satisfaction across their banking and financial service offerings.

The institution primarily targets clients requiring comprehensive financial solutions. These clients range from retail banking customers to large corporate entities seeking sophisticated financial services. While Citi Group's reputation in traditional banking remains solid, specific information regarding their forex trading conditions, platforms, and retail trading services requires further investigation for potential forex traders.

Regional Entity Differences: Citi Group operates across multiple jurisdictions worldwide. Services may vary significantly between regions due to local regulatory requirements and market conditions. Potential clients should verify specific offerings and regulatory compliance in their respective jurisdictions before engaging with any Citi Group services.

Review Methodology: This evaluation is based on publicly available information, user feedback, and company-provided data. The assessment aims to provide comprehensive market analysis while acknowledging limitations in available specific forex trading information. Readers should conduct their own due diligence and consult current official sources for the most up-to-date service details.

| Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | N/A/10 | Specific forex account conditions not detailed in available information |

| Tools and Resources | N/A/10 | Trading tools and resources information not specified in source materials |

| Customer Service and Support | N/A/10 | Detailed customer service metrics not provided in available data |

| Trading Experience | N/A/10 | Specific trading experience details not mentioned in source materials |

| Trust and Reliability | N/A/10 | While Citi Group is a major institution, specific trust metrics not detailed |

| User Experience | N/A/10 | Comprehensive user experience data not available in provided information |

Citi Group stands as one of the most recognizable names in global finance. Its origins trace back to October 8, 1998, when the modern entity was formally established. As a multinational financial services corporation, Citi Group has built an extensive network spanning across continents, providing comprehensive banking solutions, investment services, and financial products to millions of clients worldwide.

The institution's business model centers on delivering integrated financial solutions through multiple channels. It serves both retail customers seeking personal banking services and institutional clients requiring sophisticated financial instruments. The company's approach to financial services encompasses traditional banking operations, credit card services, personal and business lending, mortgage products, and wealth management solutions.

According to available information from Wikipedia, Citi Group has maintained its position as a significant player in the global financial landscape. The institution has headquarters located at 388 Greenwich Street. The institution's operating income reached $14 billion in 2024, demonstrating its substantial market presence and financial stability.

However, specific details regarding Citi Group's forex trading platforms, available trading instruments, and retail forex services are not comprehensively detailed in the available source materials. While the institution undoubtedly offers foreign exchange services as part of its broader financial portfolio, potential forex traders would need to consult directly with the company for detailed information about trading conditions, platform specifications, and available currency pairs.

Regulatory Jurisdictions: Specific regulatory information for Citi Group's forex operations is not detailed in available source materials. As a major financial institution, it operates under various international regulatory frameworks.

Deposit and Withdrawal Methods: The available information does not specify particular deposit and withdrawal methods for forex trading accounts with Citi Group.

Minimum Deposit Requirements: Specific minimum deposit requirements for trading accounts are not mentioned in the provided source materials.

Bonus and Promotions: Details regarding trading bonuses or promotional offers are not included in the available information about Citi Group's services.

Tradeable Assets: While Citi Group undoubtedly offers various financial instruments, specific details about tradeable forex pairs and other assets are not comprehensively outlined in source materials.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not specified in the available Citi Group review materials.

Leverage Ratios: Specific leverage options for retail forex trading are not mentioned in the provided information.

Platform Options: Trading platform specifications and available software are not detailed in source materials.

Regional Restrictions: Geographic limitations for trading services are not specified in available information.

Customer Service Languages: Supported languages for customer service are not detailed in source materials.

The evaluation of Citi Group's account conditions faces significant limitations due to insufficient specific information in available source materials. While Citi Group operates as a major financial institution offering various banking products, details regarding forex trading account types, their specific features, and associated benefits are not comprehensively outlined in the provided information.

Regarding minimum deposit requirements, the available data does not specify particular thresholds for different account categories or trading services. This lack of transparency makes it challenging for potential clients to understand the financial commitment required to begin trading with the institution. Similarly, the account opening process, including required documentation, verification procedures, and timeline for account activation, remains unclear based on current information.

The availability of specialized account features, such as Islamic accounts for clients requiring Sharia-compliant trading conditions, is not mentioned in the source materials. This represents a significant information gap, particularly for clients with specific religious or ethical trading requirements. Without detailed account condition information, this Citi Group review cannot provide a meaningful assessment of how competitive their offerings are compared to specialized forex brokers in the market.

The assessment of Citi Group's trading tools and resources is significantly hampered by the absence of specific information in available source materials. While major financial institutions typically provide various analytical tools and research resources, the particular trading tools offered by Citi Group for forex markets are not detailed in the provided information.

Research and analysis resources, which are crucial for informed trading decisions, are not specifically outlined in available data. This includes market analysis reports, economic calendars, technical analysis tools, and fundamental research materials that traders typically rely upon for market insights. The quality and depth of such resources often distinguish professional trading platforms from basic service providers.

Educational resources represent another critical component for trader development, particularly for those new to forex markets. However, the available information does not specify whether Citi Group provides educational materials, webinars, tutorials, or other learning resources for their trading clients. Additionally, support for automated trading systems, algorithmic trading, or expert advisors is not mentioned in source materials, leaving questions about the platform's capabilities for advanced trading strategies.

Evaluating Citi Group's customer service and support capabilities for trading services proves challenging due to limited specific information in available source materials. While the institution undoubtedly maintains customer service operations as part of its broader banking services, details regarding support channels specifically for trading clients are not comprehensively outlined.

Response times for customer inquiries, which are crucial for time-sensitive trading situations, are not specified in the available information. Similarly, the quality of technical support for trading platforms, account issues, or market-related questions cannot be assessed based on current data. The availability of 24/5 or 24/7 support, which is often essential for forex trading given market hours, is not detailed in source materials.

Multilingual support capabilities, important for Citi Group's international client base, are not specifically mentioned in available information. This includes both the languages supported and the availability of native-speaking representatives for different regions. Without comprehensive customer service information, potential clients cannot adequately assess whether Citi Group's support infrastructure meets their specific trading needs and expectations.

The analysis of trading experience with Citi Group faces substantial limitations due to insufficient specific information about their forex trading platforms and execution quality. Platform stability and execution speed, which are fundamental to successful forex trading, are not detailed in available source materials. These factors are crucial for traders, particularly those engaging in short-term strategies or trading during high volatility periods.

Order execution quality, including factors such as slippage, requotes, and fill rates, cannot be assessed based on current information. Similarly, the comprehensiveness of platform functionality, including charting capabilities, order types, and risk management tools, remains unclear from available sources. Mobile trading experience, increasingly important for modern traders who require flexibility and accessibility, is not specifically addressed in the provided materials.

The overall trading environment, including factors such as market depth, liquidity provision, and execution model, is not detailed in source materials. This Citi Group review cannot provide meaningful insights into the practical trading experience without access to specific platform information, user testimonials regarding execution quality, or technical performance data.

Assessing Citi Group's trustworthiness and reliability in the forex trading context requires examination of regulatory compliance, financial stability, and industry reputation. While Citi Group operates as a major global financial institution with substantial assets and regulatory oversight, specific regulatory credentials for forex trading services are not detailed in available source materials.

The institution's financial stability, evidenced by its $14 billion operating income in 2024 according to available information, suggests strong underlying financial health. However, specific measures for client fund protection, segregation of client accounts, and insurance coverage for trading accounts are not outlined in source materials. These factors are crucial for trader confidence and regulatory compliance in forex markets.

Industry reputation and handling of negative events or disputes specifically related to trading services cannot be assessed based on current information. While Citi Group maintains a significant presence in global financial markets, the specific track record for forex trading services, including any regulatory actions or client complaints, is not detailed in available sources. This limits the ability to provide comprehensive trust assessment for potential trading clients.

Evaluating user experience with Citi Group's trading services encounters significant challenges due to limited specific information in available source materials. Overall user satisfaction metrics specifically for trading platforms and services are not provided, making it difficult to assess how clients perceive the quality and usability of trading offerings.

Interface design and ease of use for trading platforms cannot be evaluated based on current information. These factors significantly impact trader efficiency and satisfaction, particularly for users who spend considerable time analyzing markets and executing trades. The registration and verification process for trading accounts, including required documentation and approval timelines, is not specifically outlined in available sources.

The experience of funding and withdrawing from trading accounts, including processing times, available methods, and associated fees, cannot be assessed from current information. Common user complaints or areas of dissatisfaction specifically related to trading services are not detailed in source materials, preventing identification of potential issues or limitations that new clients might encounter.

This Citi Group review reveals a significant information gap regarding the institution's specific forex trading services and conditions. While Citi Group demonstrates strong financial stability and maintains a substantial global presence with impressive user ratings of 4.2/5 for general banking services, the lack of detailed information about trading conditions, platforms, and client support specifically for forex markets presents challenges for potential trading clients.

The institution appears most suitable for clients seeking comprehensive financial services beyond pure forex trading. These services include banking, lending, and wealth management solutions. Citi Group's strength lies in its diversified financial service offerings and established market position, supported by substantial operating income and global reach.

However, the primary limitations include insufficient transparency regarding trading conditions, commission structures, platform specifications, and customer service capabilities specifically for forex trading. Potential clients interested in forex trading services should conduct direct consultation with Citi Group representatives to obtain comprehensive information about available trading conditions, regulatory compliance, and platform capabilities before making any trading decisions.

FX Broker Capital Trading Markets Review