NYX 2025 Review: Everything You Need to Know

Executive Summary

This nyx review shows big problems with NYX Broker's safety for traders. NYX Broker works as an unregulated forex broker, which creates major red flags for protecting investors and keeping funds secure. Many sources have warned about possible fraud linked to this company, making it a very risky choice for traders who want reliable broker services.

The broker says it offers trading services for many types of assets, including forex, stocks, commodities, and cryptocurrencies. But the lack of proper oversight from major financial authorities like the FCA, ASIC, or CySEC makes any possible benefits worthless. The missing regulatory information and multiple scam warnings make this broker wrong for traders, especially those new to the forex market.

Our investigation found very few real user reviews or positive feedback to support the broker's claims about quality trading services. The main target seems to be traders who want diverse asset trading options, but the risks are much bigger than any possible benefits. Traders should be very careful and look at regulated alternatives that provide proper investor protection and clear operations.

Important Notice

Regional Entity Differences: Different areas have different legal rules about unregulated brokers. Some regions may not ban trading with unregulated companies, but the lack of oversight means traders have little help if disputes or fraud happen. The absence of regulatory protection affects all regions the same way, no matter what local trading laws say.

Review Methodology: This evaluation uses publicly available information, user feedback from various online sources, and regulatory database searches. We did not directly test the broker's services because of the identified risk factors. All assessments come from external sources and industry standard evaluation criteria for broker legitimacy and safety.

Scoring Framework

Broker Overview

NYX Broker claims to be a trading platform that offers access to multiple financial markets, but specific details about when it started and company background remain unclear. The broker works without proper licenses from major financial regulatory bodies including the Financial Conduct Authority, Australian Securities and Investments Commission, or Cyprus Securities and Exchange Commission. This unregulated status immediately creates concerns about the broker's legitimacy and client fund safety.

The company's business model seems to focus on attracting traders through promises of diverse asset trading opportunities across forex, stocks, commodities, and cryptocurrency markets. But the absence of clear operational information, company registration details, and verified regulatory compliance creates a problematic foundation for any trading relationship. Multiple independent sources have flagged potential fraud activities linked to this entity.

The broker's platform and service offerings lack the transparency and verification typically expected from legitimate financial service providers. Without proper regulatory oversight, traders have no guarantee of fair trading conditions, fund security, or dispute resolution methods. This nyx review emphasizes how important regulatory compliance is in broker selection, particularly for retail traders who need investor protection schemes and regulated operational standards.

Regulatory Status: No verifiable regulatory licenses identified from major financial authorities. The absence of proper regulatory oversight means no investor protection schemes apply.

Deposit and Withdrawal Methods: Specific information about supported payment methods and processing procedures is not clearly documented in available sources.

Minimum Deposit Requirements: Exact minimum deposit amounts are not specified in accessible documentation, raising transparency concerns.

Bonus and Promotions: Details about promotional offers or bonus structures are not clearly outlined in available materials.

Tradable Assets: The broker claims to offer trading in forex pairs, stocks, commodities, and cryptocurrencies, though specific instrument lists and trading conditions remain unclear.

Cost Structure: Comprehensive information about spreads, commissions, overnight fees, and other trading costs is not readily available from reliable sources.

Leverage Options: Specific leverage ratios and margin requirements are not clearly documented in accessible materials.

Platform Options: Information about trading platform types, features, and compatibility is not sufficiently detailed in available sources.

Geographic Restrictions: Specific country restrictions and service availability are not clearly outlined in accessible documentation.

Customer Support Languages: Available support languages and communication channels are not clearly specified in reliable sources.

This nyx review highlights the concerning lack of transparent information across all critical trading aspects, which is atypical of legitimate, regulated brokers.

Detailed Scoring Analysis

Account Conditions Analysis

The evaluation of NYX Broker's account conditions is severely hampered by the lack of transparent and verifiable information. Legitimate brokers typically provide clear details about account types, minimum deposits, account features, and opening procedures. But NYX Broker fails to meet these basic transparency standards, making it impossible to properly assess their account offerings.

Without access to verified account documentation or regulatory filings, potential traders cannot determine what types of accounts are available, whether Islamic accounts are offered for Muslim traders, or what specific features each account type provides. The absence of clear minimum deposit information prevents traders from understanding the financial commitment required to begin trading.

The account opening process appears to lack the standard verification procedures typically required by regulated brokers. Legitimate brokers implement Know Your Customer and Anti-Money Laundering procedures as part of regulatory compliance. The unclear nature of NYX Broker's account opening process raises questions about their adherence to international financial standards.

Furthermore, the lack of detailed account terms and conditions means traders cannot understand their rights, obligations, or the broker's policies regarding account management, dormancy fees, or account closure procedures. This opacity is particularly concerning for traders who require clear contractual terms before committing funds to any trading platform.

The assessment of trading tools and resources offered by NYX Broker is complicated by the limited reliable information available about their platform capabilities. Professional trading requires access to comprehensive market analysis tools, real-time data feeds, technical indicators, and educational resources to support informed decision-making.

Without verified platform demonstrations or credible user testimonials, it's impossible to determine the quality and comprehensiveness of analytical tools provided. Legitimate brokers typically offer economic calendars, market news feeds, technical analysis software, and research reports from reputable financial institutions. The absence of detailed information about such resources raises concerns about the broker's commitment to supporting trader success.

Educational resources play a crucial role in trader development, particularly for newcomers to financial markets. The lack of clear information about webinars, tutorials, market analysis, or educational content suggests either inadequate resource provision or poor transparency in communicating available services.

Automated trading support, including Expert Advisor compatibility and algorithmic trading tools, represents an important consideration for many modern traders. However, specific details about such capabilities are not clearly documented in available sources, making it difficult for traders to assess whether the platform meets their automated trading requirements.

Customer Service and Support Analysis

Evaluating NYX Broker's customer service quality presents significant challenges due to the absence of verifiable user experiences and clear service documentation. Professional forex brokers typically maintain multiple communication channels including live chat, email support, telephone assistance, and comprehensive FAQ sections to address trader inquiries promptly.

The lack of documented customer service hours, response time commitments, or service quality standards raises concerns about the broker's dedication to client support. Legitimate brokers usually provide 24/5 support during market hours and clearly communicate their service availability to ensure traders can receive assistance when needed.

Multilingual support capabilities are essential for international brokers serving diverse client bases. However, available information does not clearly specify which languages are supported or whether native-speaking representatives are available for non-English speaking traders. This communication gap could create significant barriers for international clients.

Problem resolution procedures and escalation processes are typically outlined by reputable brokers to ensure fair handling of client concerns. The absence of clear dispute resolution mechanisms or ombudsman services further compounds the risks associated with choosing an unregulated broker that lacks proper oversight and accountability structures.

Trading Experience Analysis

The trading experience evaluation for NYX Broker is severely limited by the lack of verified user feedback and platform performance data. Critical factors such as execution speed, order filling quality, platform stability, and slippage rates cannot be properly assessed without access to reliable performance metrics or credible user testimonials.

Platform functionality assessment requires examination of charting capabilities, order types, risk management tools, and overall interface design. However, the absence of detailed platform specifications or verified user experiences makes it impossible to determine whether the trading environment meets professional standards expected by serious traders.

Mobile trading capabilities have become essential for modern traders who require platform access across multiple devices. Without clear documentation of mobile app features, compatibility, or user interface quality, traders cannot assess whether the broker provides adequate mobile trading solutions for their needs.

The overall trading environment assessment must consider factors such as market depth, liquidity provision, and execution transparency. However, the unregulated status of NYX Broker means these critical aspects lack the oversight and verification typically provided by regulatory authorities, creating additional uncertainty about trading conditions quality.

Trust and Safety Analysis

The trust and safety evaluation of NYX Broker reveals the most concerning aspects of this nyx review. The broker operates without proper regulatory licensing from recognized financial authorities, immediately placing it in the high-risk category for potential fraud and fund security issues. Regulated brokers must adhere to strict capital requirements, segregated client fund policies, and regular auditing procedures that provide essential investor protections.

Multiple independent sources have issued warnings about potential fraudulent activities associated with NYX Broker, significantly undermining any claims of legitimacy or trustworthiness. These warnings come from various industry watchdogs and review platforms that monitor broker activities for signs of fraudulent behavior or questionable business practices.

The absence of proper fund segregation policies means client deposits may not be protected from company operational expenses or potential insolvency. Regulated brokers are required to maintain client funds in segregated accounts with tier-one banks, providing additional security layers that appear to be absent in this case.

Company transparency regarding ownership, management, and operational procedures is severely lacking. Legitimate brokers typically provide detailed information about their corporate structure, key personnel, and business operations. The opacity surrounding NYX Broker's organizational details further compounds trust concerns and suggests potential efforts to avoid regulatory scrutiny.

User Experience Analysis

The user experience assessment for NYX Broker is hampered by the absence of credible user testimonials and verified customer feedback. Legitimate brokers typically accumulate substantial user reviews across multiple platforms, providing insights into real-world experiences with platform functionality, customer service quality, and overall satisfaction levels.

Interface design and platform usability cannot be properly evaluated without access to verified platform demonstrations or credible user feedback about navigation ease, feature accessibility, and overall design quality. Professional trading platforms require intuitive interfaces that support efficient trade execution and portfolio management.

The registration and account verification process appears to lack the comprehensive procedures typically implemented by regulated brokers. Standard Know Your Customer and Anti-Money Laundering compliance requires thorough identity verification, address confirmation, and financial suitability assessments. The unclear nature of these procedures raises concerns about regulatory compliance and security standards.

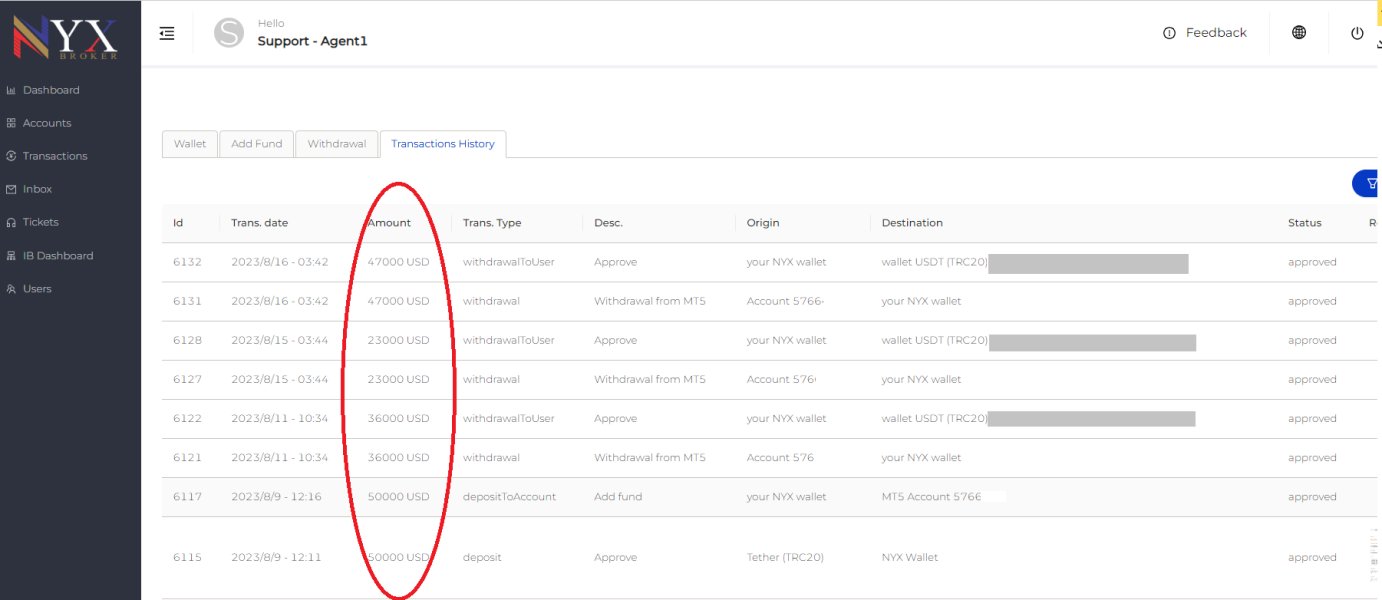

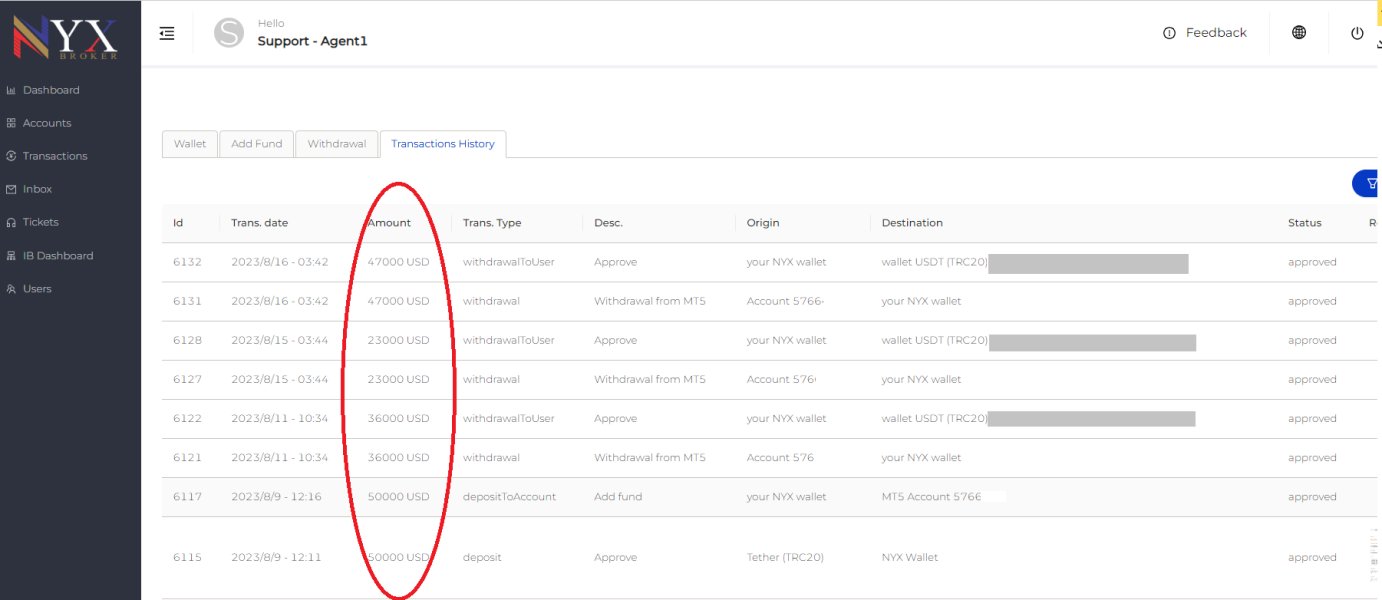

Common user complaints identified in available sources primarily focus on potential fraudulent activities and withdrawal difficulties, which represent the most serious possible issues traders can encounter. The presence of multiple scam warnings from independent sources suggests significant problems with the broker's operations and client treatment, making it unsuitable for any serious trading consideration.

Conclusion

This comprehensive nyx review concludes that NYX Broker presents unacceptable risks for traders seeking reliable and secure forex trading services. The broker's unregulated status, combined with multiple fraud warnings from independent sources, creates a dangerous environment for potential investors. The absence of proper regulatory oversight means traders have no protection against potential fund loss or fraudulent activities.

The broker is not recommended for any trader category, particularly beginners who require the security and protection provided by regulated brokers. Experienced traders should also avoid this broker due to the fundamental lack of transparency and regulatory compliance that underpins safe trading operations.

The primary disadvantages include the complete absence of regulatory protection, multiple scam warnings, lack of transparent operational information, and unclear fund security measures. No significant advantages were identified that could justify the substantial risks associated with trading through an unregulated entity facing multiple fraud allegations. Traders should prioritize regulated brokers that provide proper investor protection and transparent operations.