FUBON Review 1

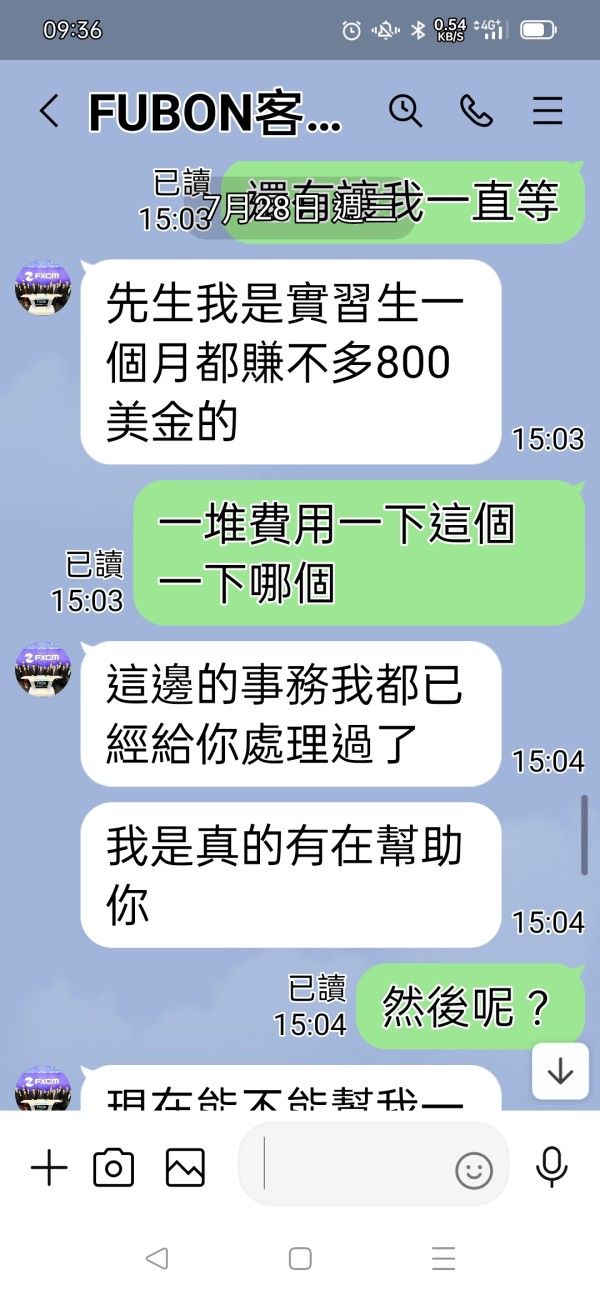

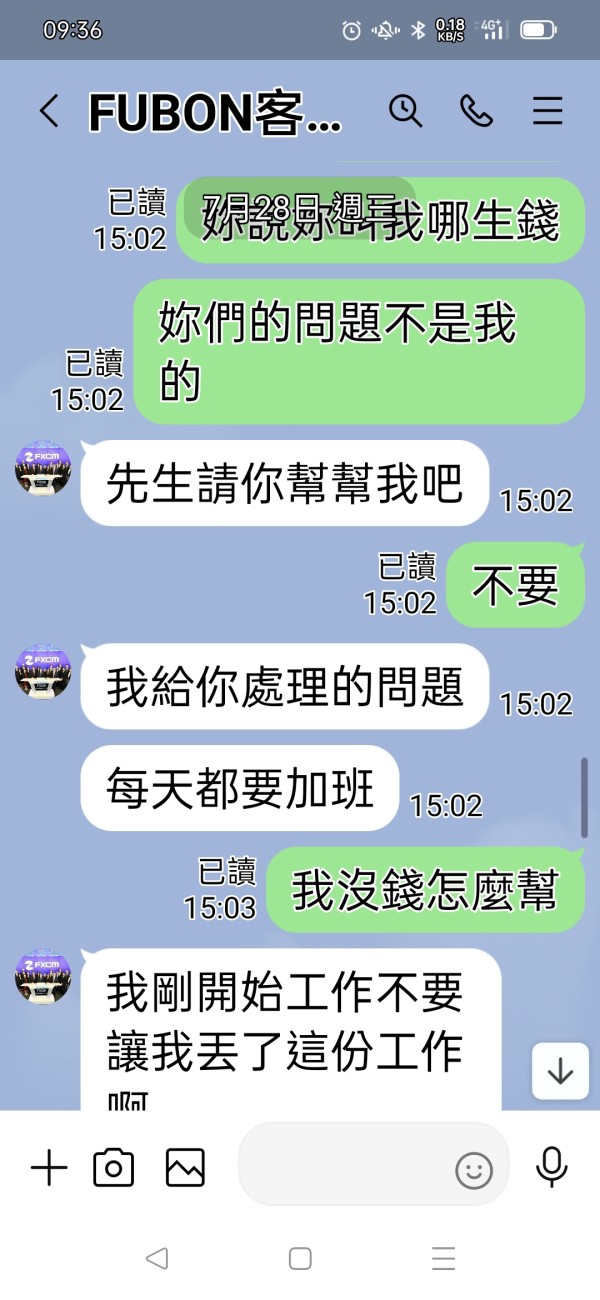

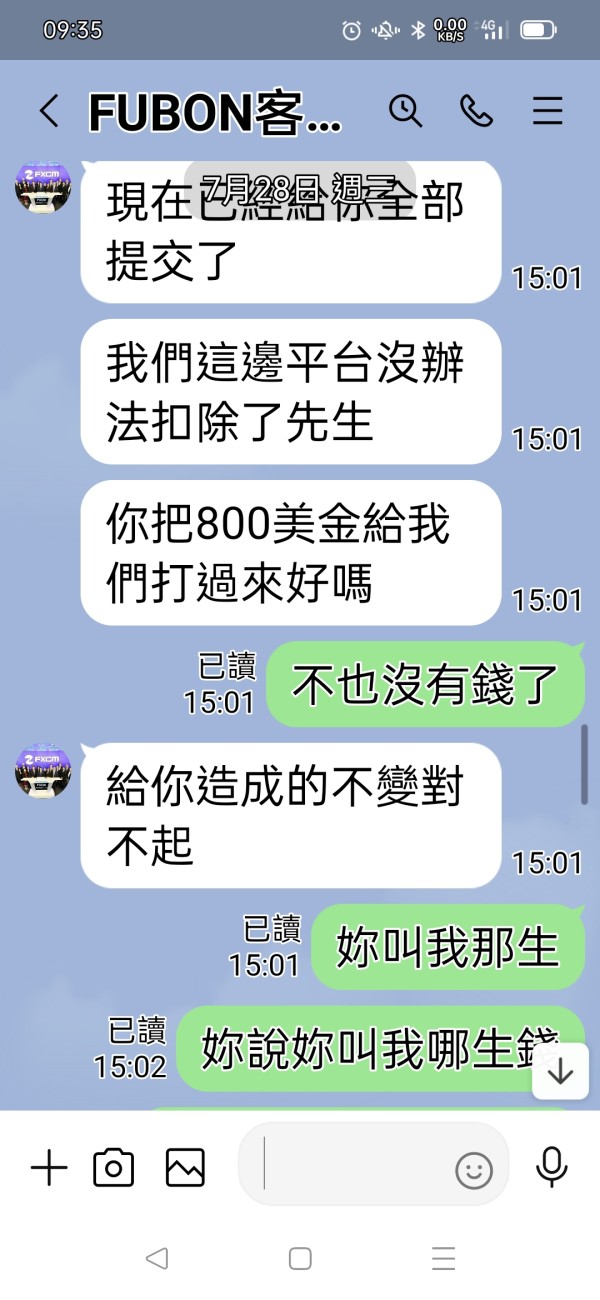

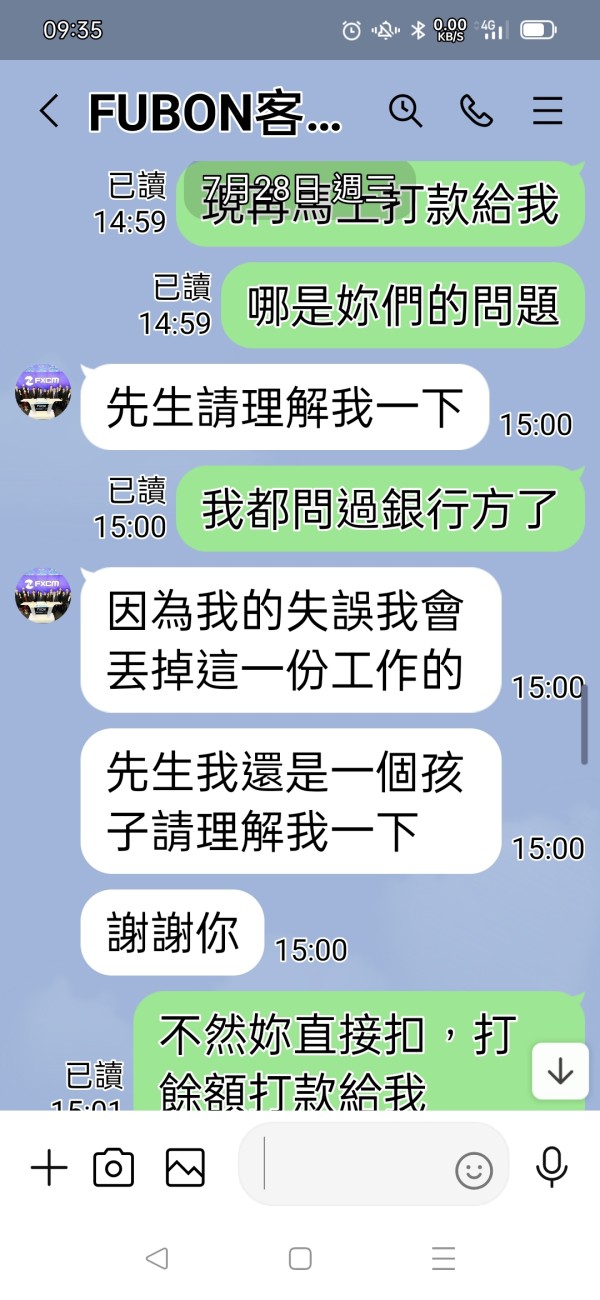

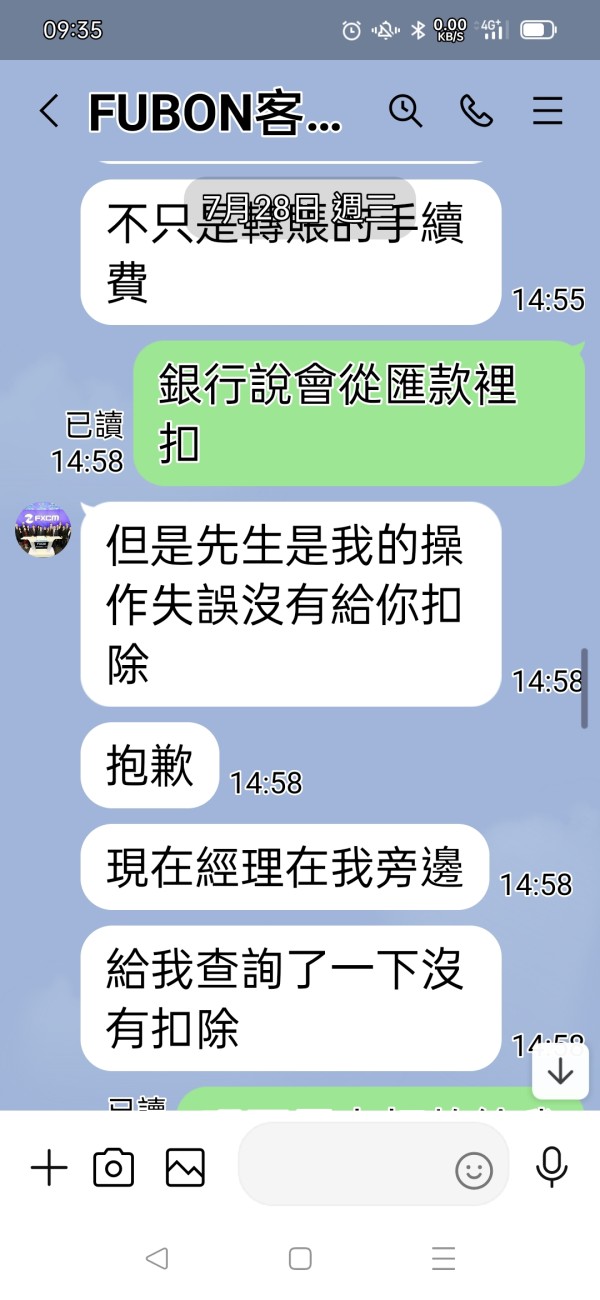

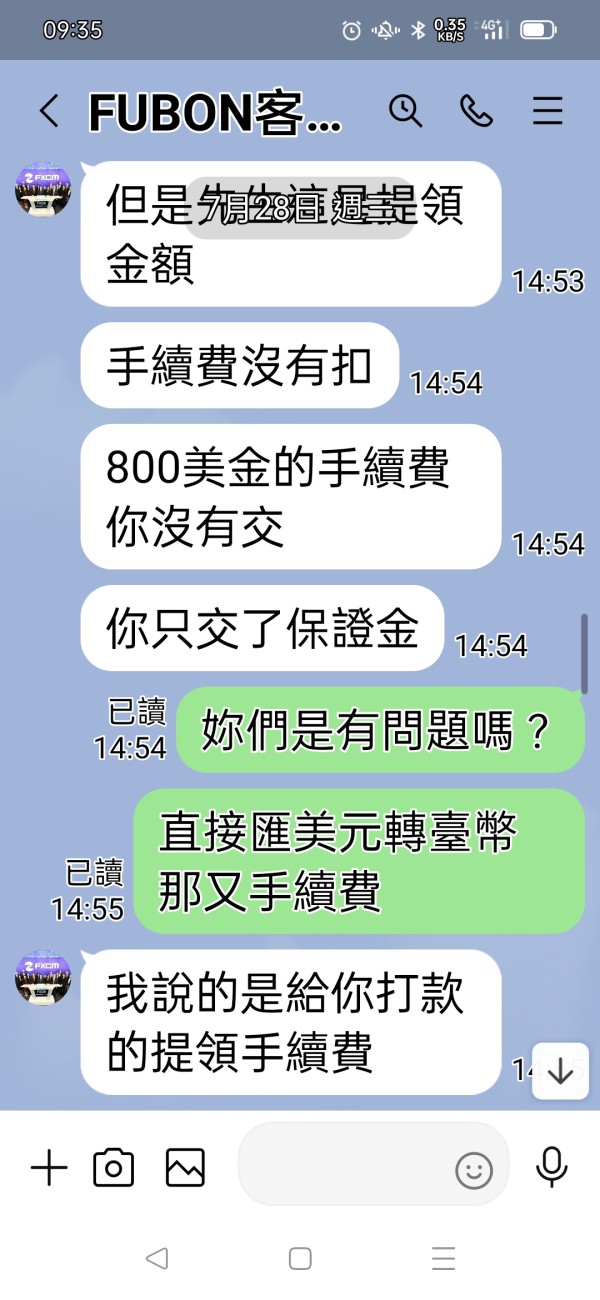

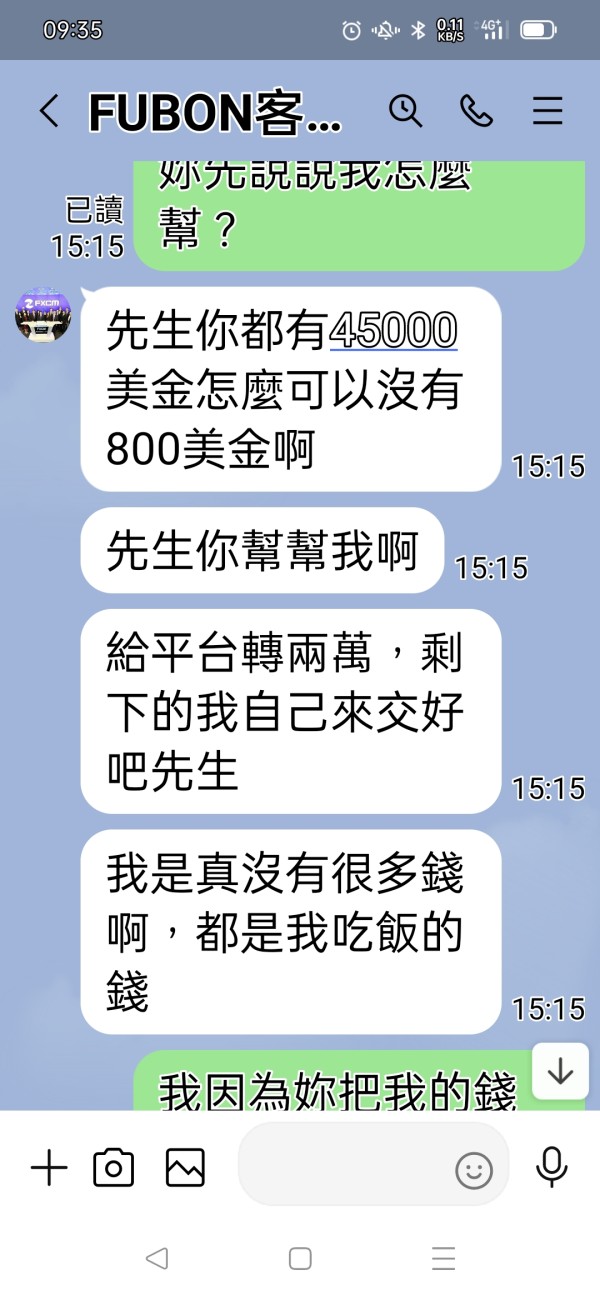

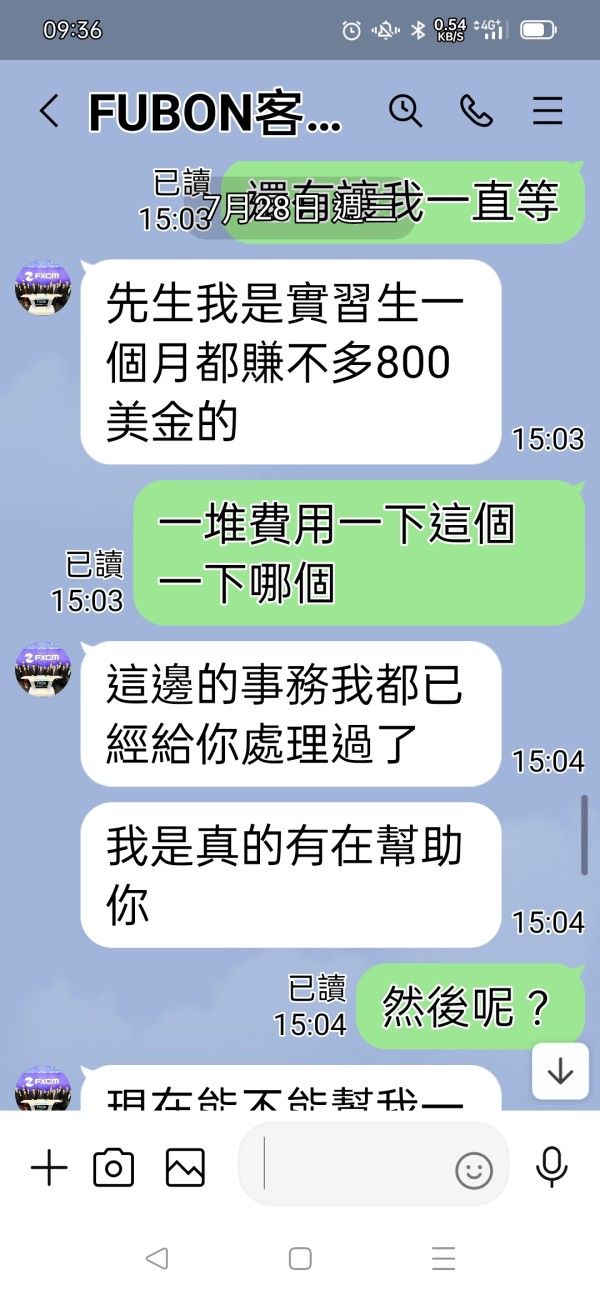

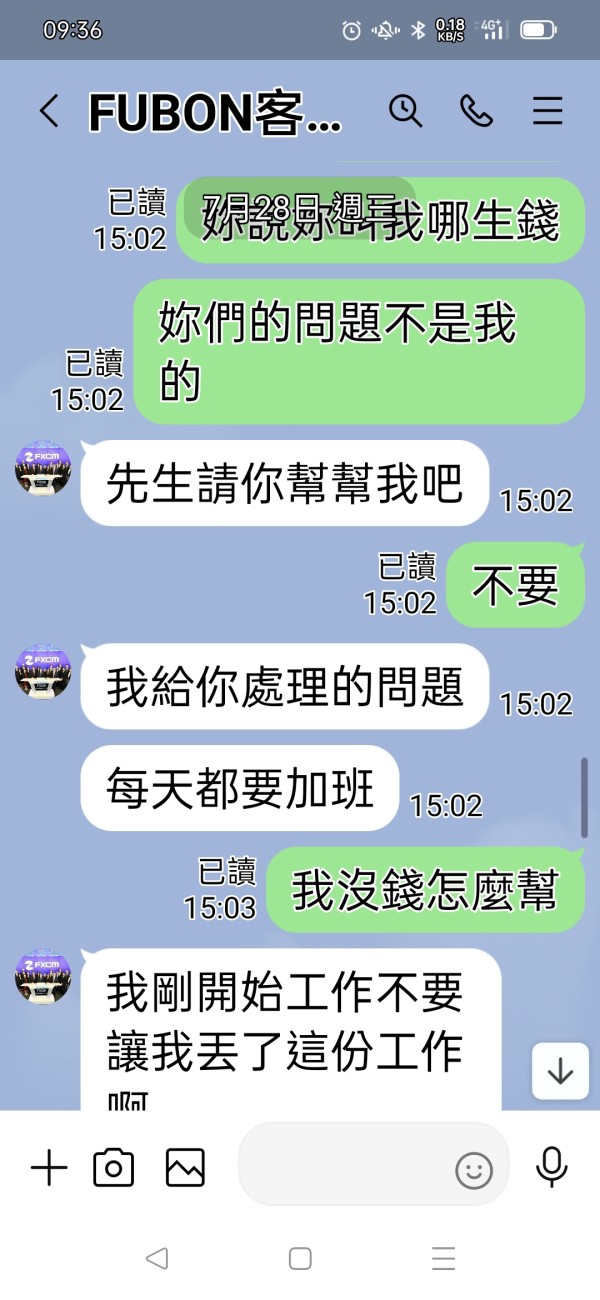

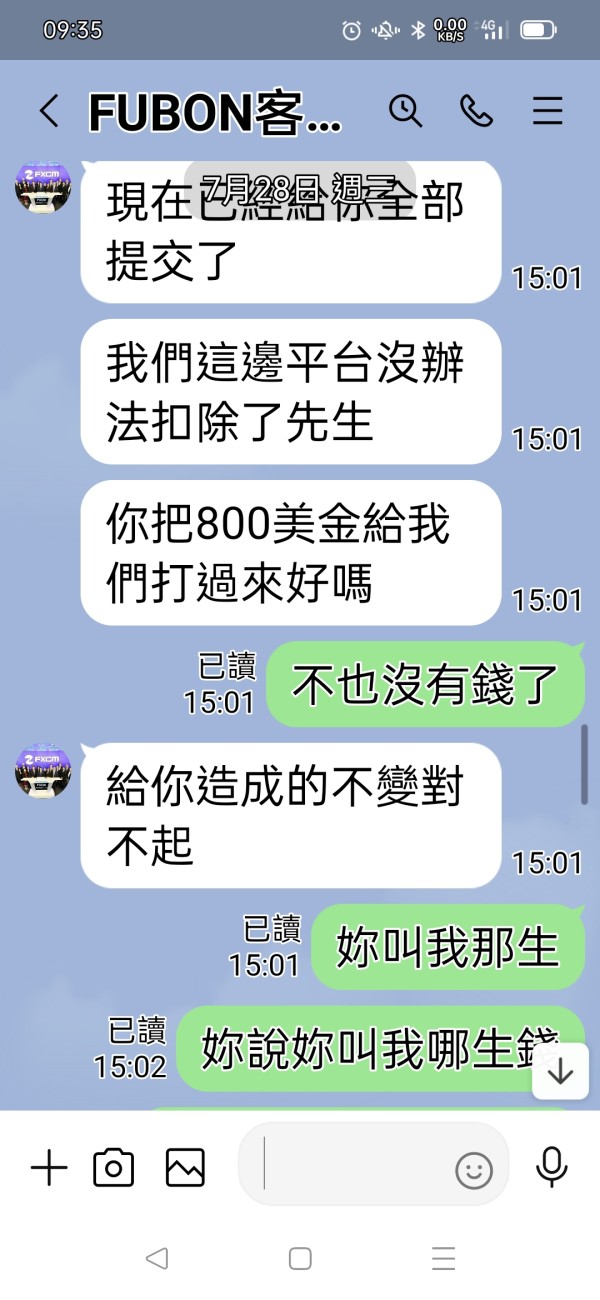

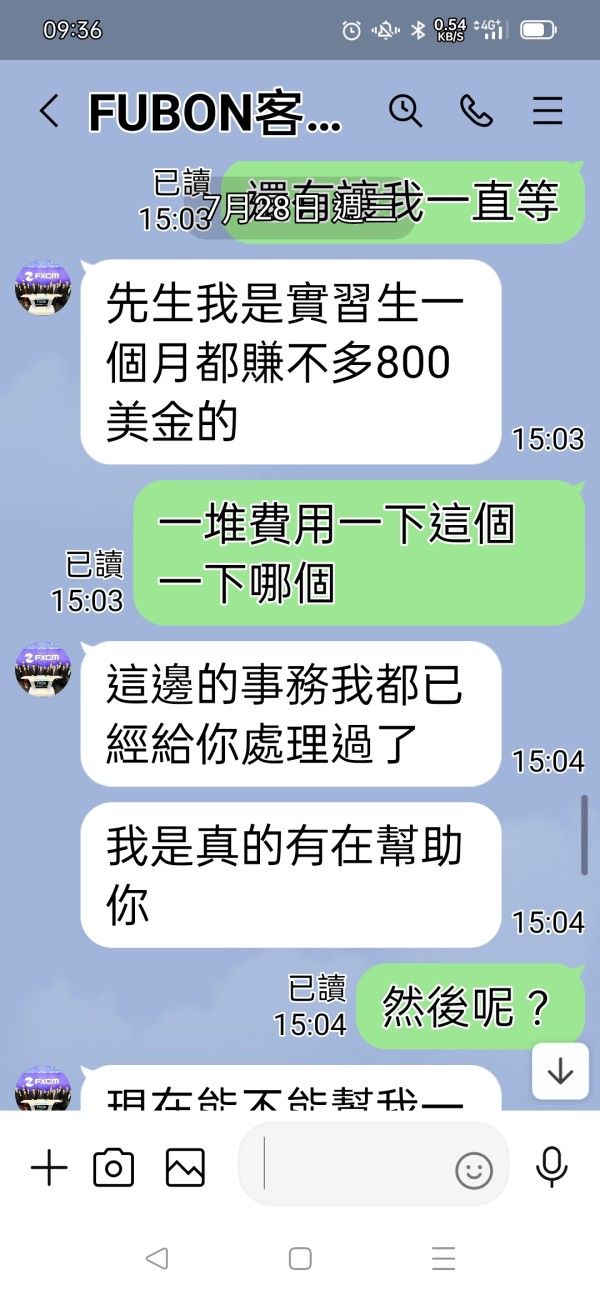

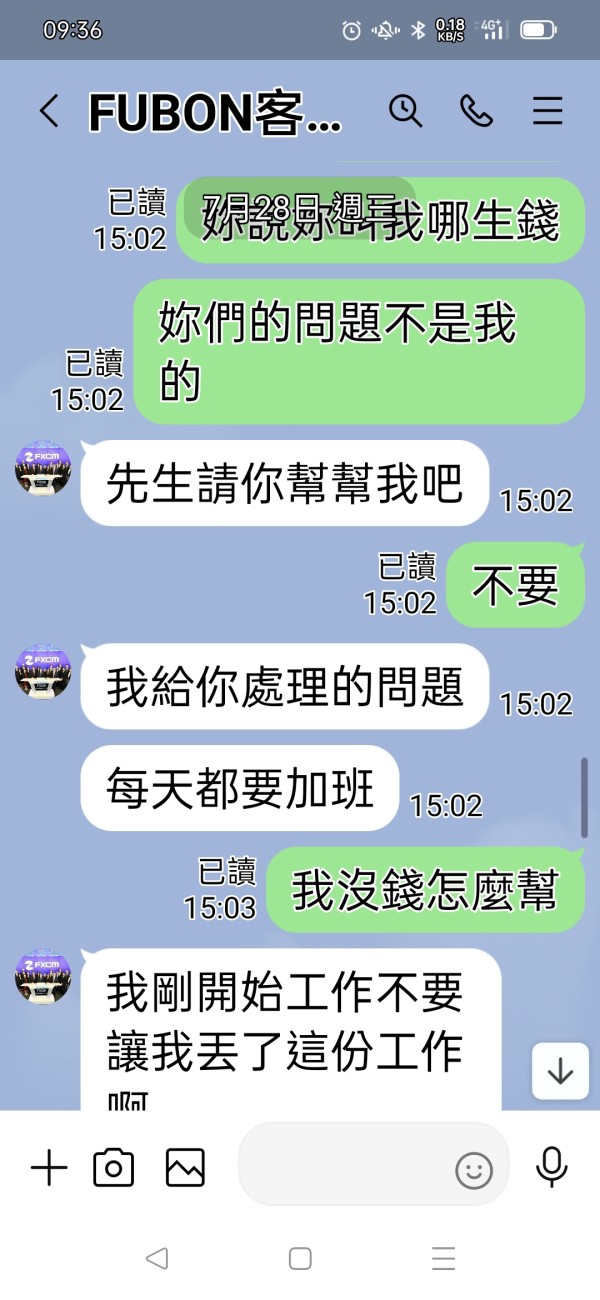

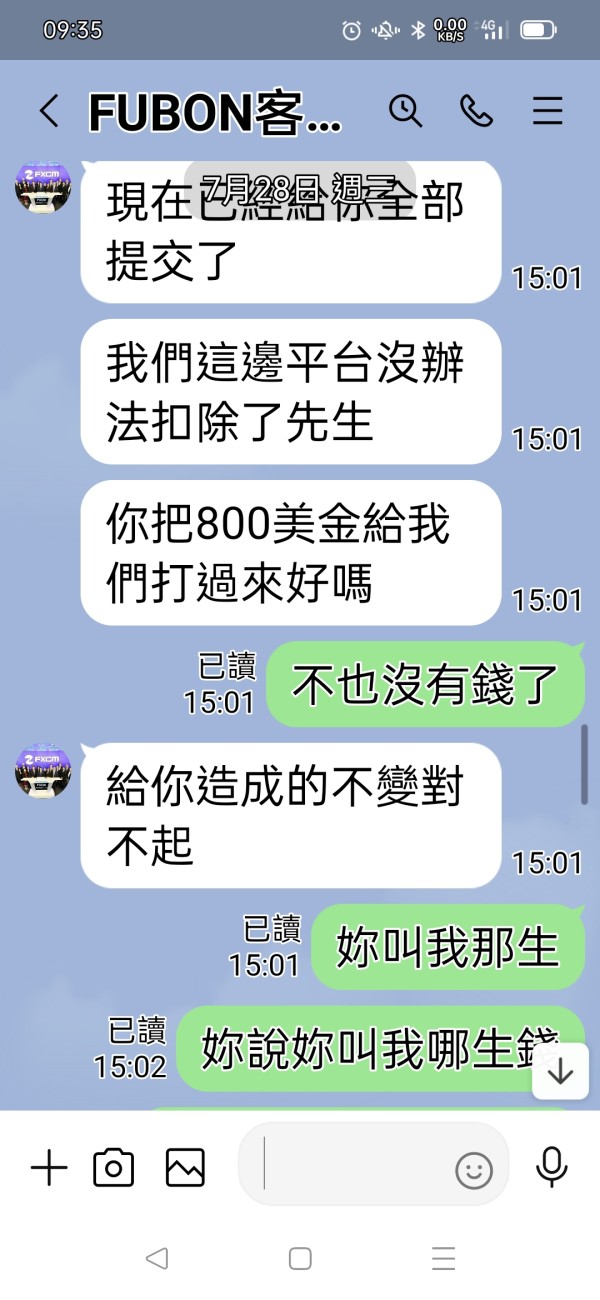

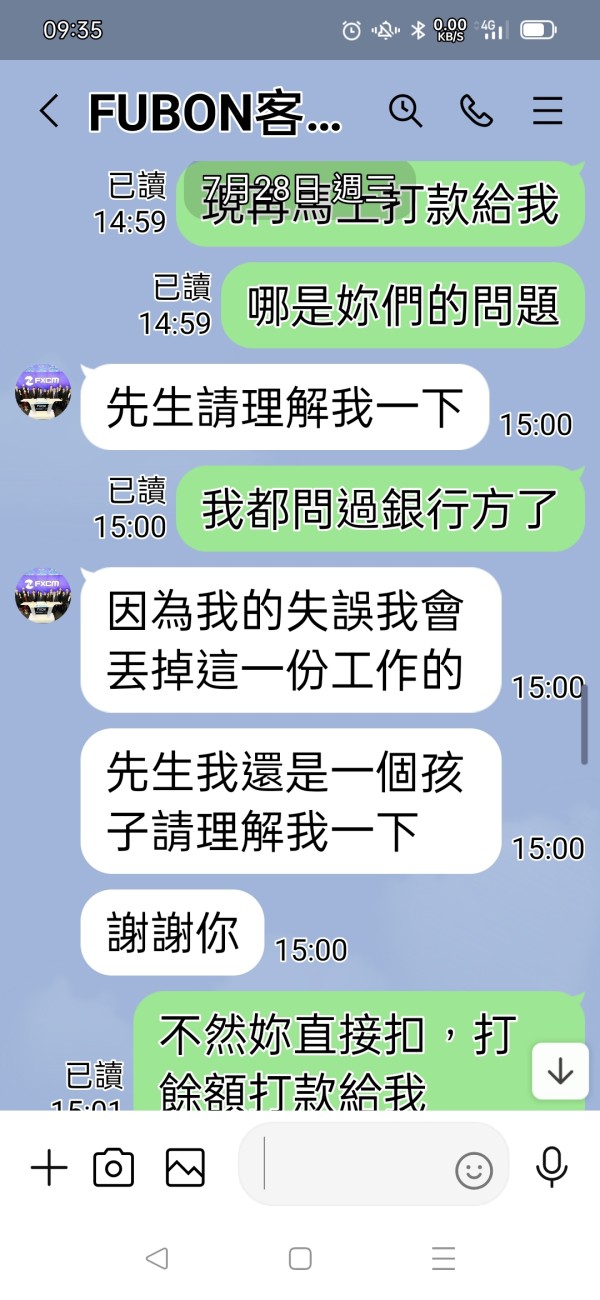

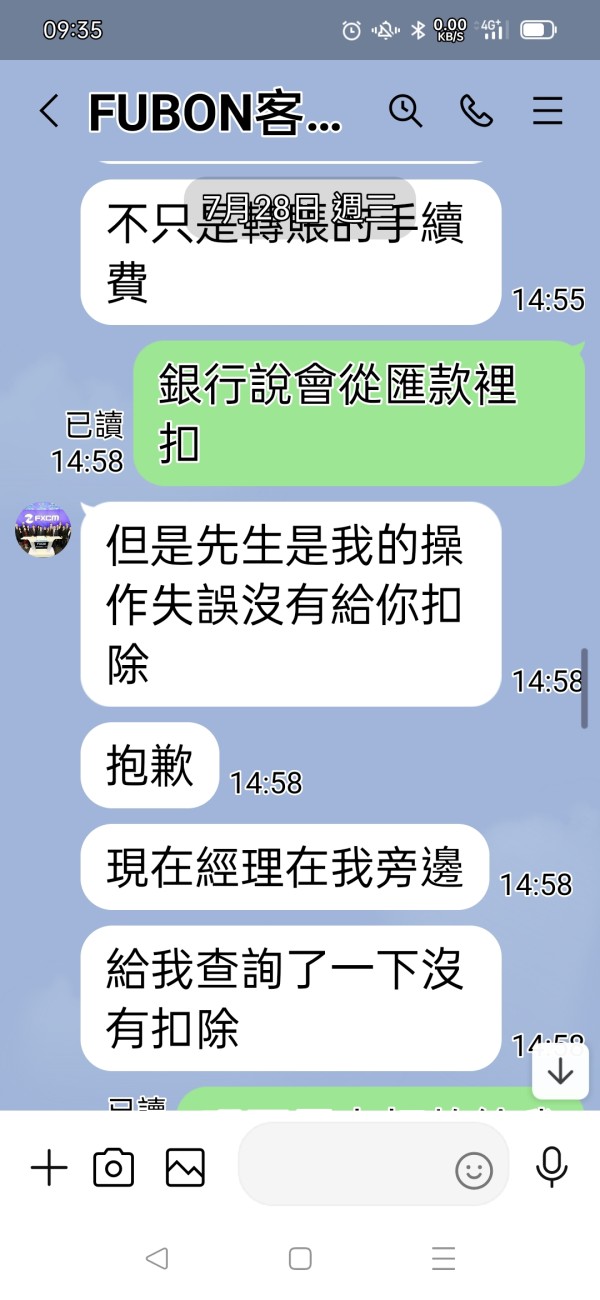

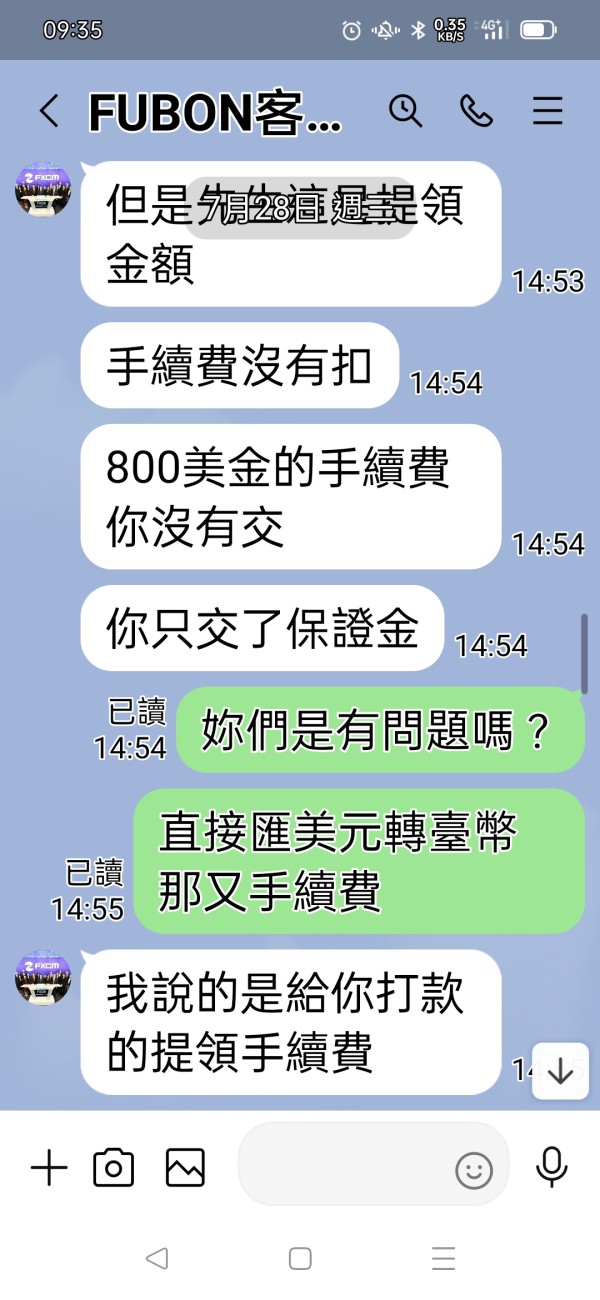

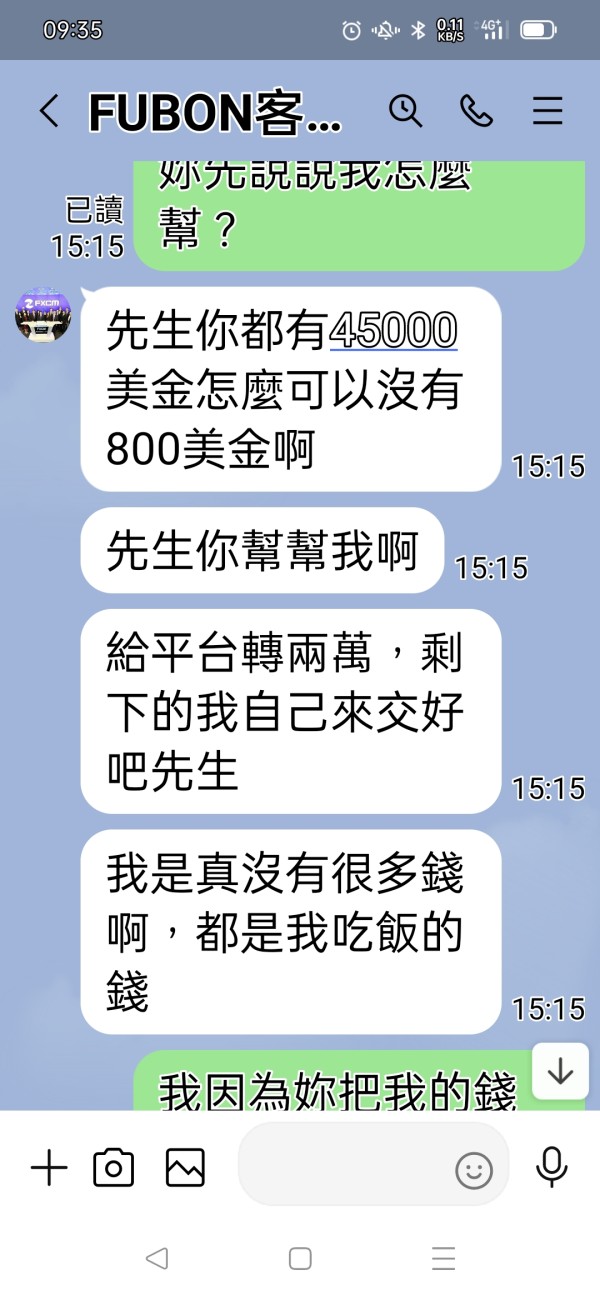

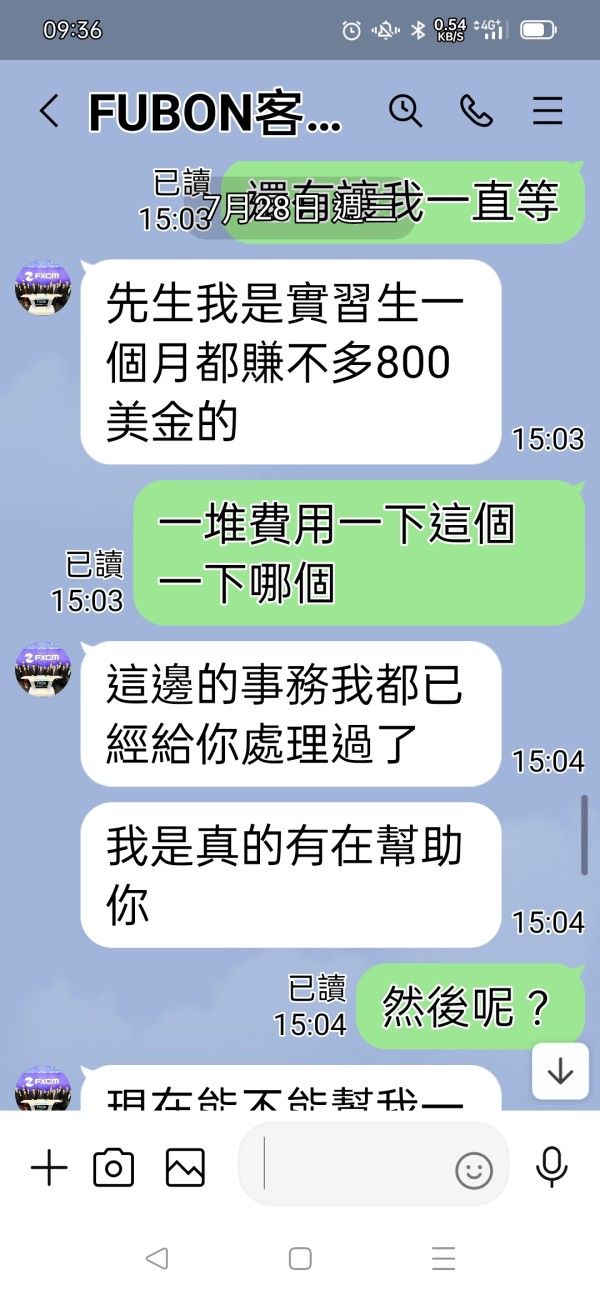

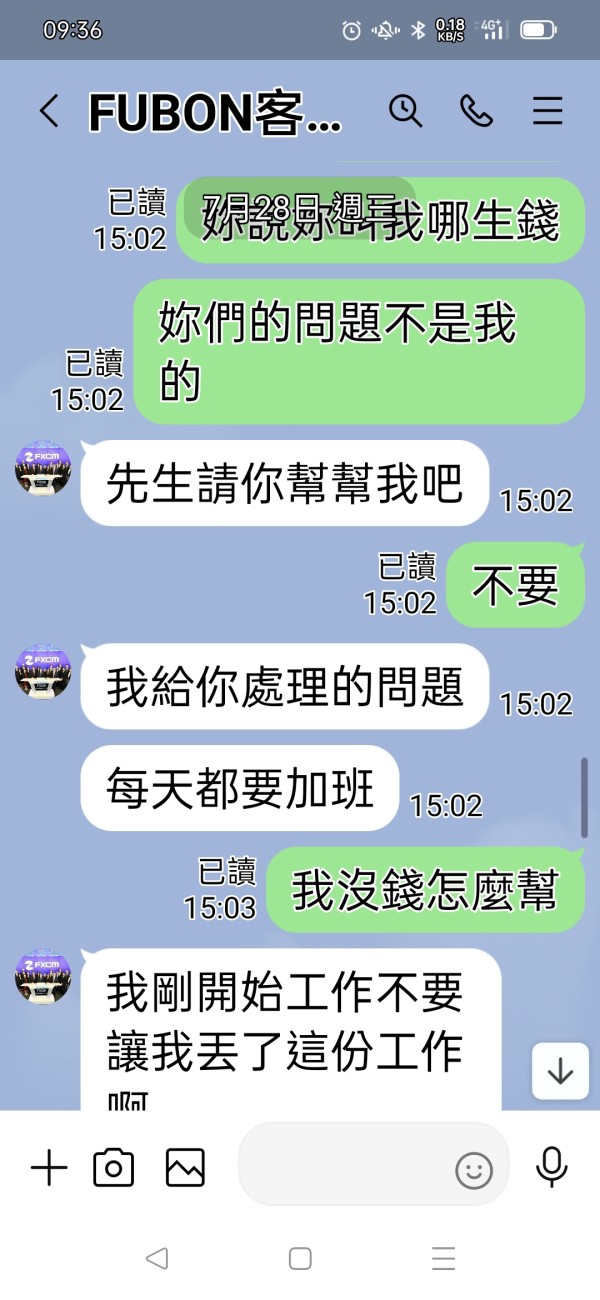

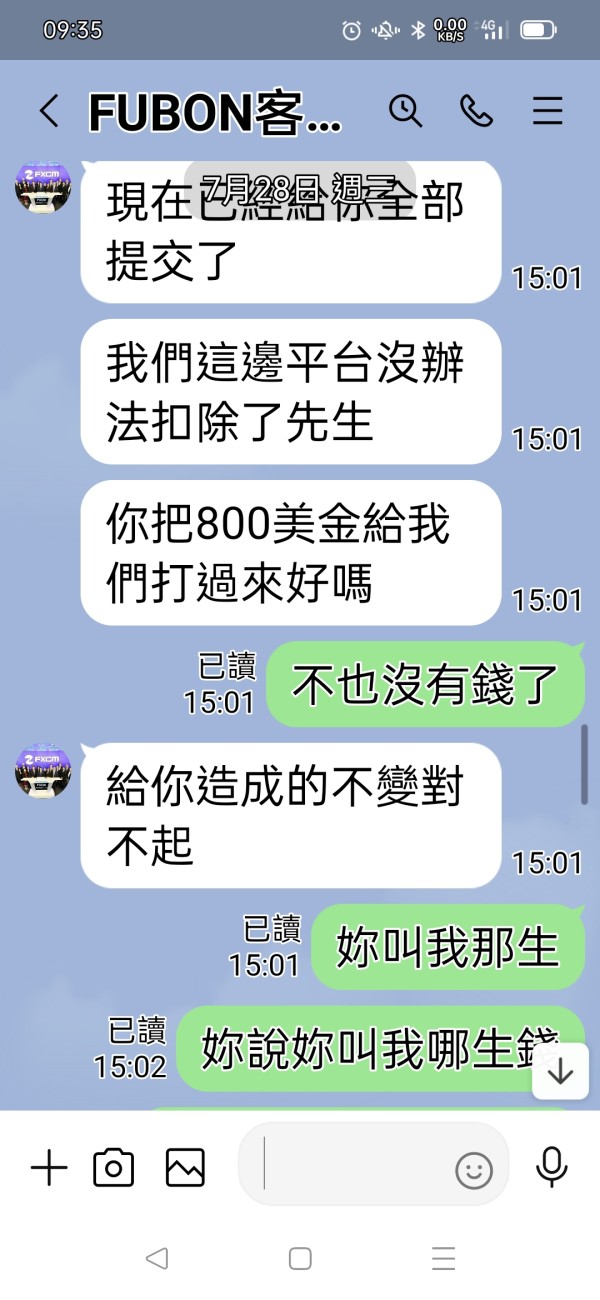

They gave various reasons for not letting me withdraw. They suddenly said that the payment was wrong and asked me to make up, and then said that the money was on the way. They kept me waiting for nothing.

FUBON Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They gave various reasons for not letting me withdraw. They suddenly said that the payment was wrong and asked me to make up, and then said that the money was on the way. They kept me waiting for nothing.

This Fubon review gives you a complete look at what this financial services company offers in 2025. Fubon Financial Holdings started in 1988 and works as a big financial company under the Hong Kong Monetary Authority's watch. The company has many parts including banking, securities, insurance, and asset management services, which makes it a one-stop shop for financial services in Asia.

Users give Fubon a rating of 3.5 out of 5 stars from 46 company reviews, showing that customer experiences are mixed. The company mainly serves small to medium-sized investors who want complete financial services, especially those who want to invest in Asian markets. But potential clients should know about recent rule-breaking issues that might affect their choice.

Fubon's wide range of financial services gives a strong base for different investment needs, though recent rule problems have raised questions about how well they follow the rules.

People thinking about using Fubon should know that this Fubon review covers many companies within the Fubon Financial Holdings group. Fubon Bank Hong Kong Limited got in trouble with the Hong Kong Monetary Authority for breaking Anti-Money Laundering and Counter-Terrorist Financing rules, which might hurt how much people trust the whole organization.

This review uses public information, user feedback, and official reports. Different Fubon companies may work under different rules and standards in different places. Users should do their own research before working with any Fubon company.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | N/A | Specific account condition information not detailed in available materials |

| Tools and Resources | N/A | Trading tools and resource information not specified in available materials |

| Customer Service and Support | N/A | Customer service details not provided in available materials |

| Trading Experience | N/A | Trading experience information not available in reviewed materials |

| Trust and Reliability | 5/10 | Regulatory violations impact overall trustworthiness assessment |

| User Experience | 3.5/10 | Based on user rating of 3.5 stars from 46 reviews |

Fubon Financial Holdings started in 1988 and has become one of Taiwan's top financial companies. Company information shows that Fubon Securities works as a complete securities firm that handles brokerage, underwriting, trading, and wealth management with NT$16 billion in total capital. The organization works as a fully-owned part of Fubon Financial Holdings, showing the company's promise to keep complete financial services under one company structure.

The Fubon group includes many local and international companies, including Fubon Futures, Fubon Securities Investment Services, Fubon Securities Venture Capital, and Fubon Mintou Venture Capital. International work goes through companies including Fubon Securities Hong Kong and JS Cresvale Securities International Ltd, giving the organization big reach across Asian markets.

The company works under the Hong Kong Monetary Authority's watch for its Hong Kong work, while following rules from other regulatory bodies across different places. This Fubon review knows that the organization's regulatory environment is complex, spanning multiple countries and financial service types. The varied business model puts Fubon as a complete financial services provider, though specific trading platform details and asset class offerings need more research for potential forex trading clients.

Regulatory Oversight: Fubon works under the Hong Kong Monetary Authority's watch for its Hong Kong banking work. The company also follows rules across multiple places including Taiwan's Financial Supervisory Commission and other relevant authorities where companies operate.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available materials. Potential clients should contact Fubon directly for current payment processing options and procedures.

Minimum Deposit Requirements: Minimum deposit requirements are not specified in available materials. This information would typically change across different account types and services offered by various Fubon companies.

Promotional Offers: Current promotional offers and bonus structures are not detailed in available materials. Interested parties should check current promotional campaigns directly with Fubon representatives.

Tradeable Assets: While Fubon Securities covers brokerage, underwriting, trading, and wealth management services, specific details about forex trading instruments and available asset classes are not fully outlined in reviewed materials.

Cost Structure: Detailed fee structures, spreads, and commission rates are not specified in available materials. This Fubon review cannot provide specific cost comparisons without access to current pricing information.

Leverage Ratios: Information about maximum leverage ratios for different trading instruments is not available in reviewed materials.

Platform Options: Specific trading platform details and technology offerings are not fully covered in available materials.

Regional Restrictions: Geographic limits for service availability are not detailed in available materials.

Customer Support Languages: Available customer service languages are not specified in reviewed materials.

The account conditions assessment for this Fubon review has big limits because there is not enough detailed information in available materials. Fubon Financial Holdings runs multiple companies offering various financial services, but specific account types, minimum balance requirements, and account features are not fully documented in reviewed sources.

Based on the company's position as a complete financial services provider, one would expect multiple account levels for different investor types. However, without access to specific account documentation, this review cannot provide detailed analysis of account opening procedures, maintenance fees, or special account features such as Islamic accounts for Muslim traders.

The lack of clear account condition information is a potential concern for prospective clients seeking clear understanding of service terms. Professional traders and institutional clients typically need detailed account specifications before committing to a brokerage relationship. The absence of readily available account information may show either limited online disclosure practices or a preference for direct client consultation.

Given Fubon's complete financial services background, the organization likely offers sophisticated account structures, but the evaluation cannot provide specific recommendations without access to current account documentation and terms of service.

The assessment of trading tools and resources stays incomplete because of limited specific information in available materials. While Fubon Securities operates as a complete securities firm covering brokerage and wealth management businesses, the specific technology infrastructure, research capabilities, and educational resources available to forex traders are not detailed in reviewed documentation.

Modern forex trading requires sophisticated analytical tools, real-time market data, and complete research resources. Professional traders typically evaluate brokers based on charting capabilities, technical analysis tools, economic calendars, and market commentary quality. Without specific information about Fubon's trading technology and research offerings, this review cannot provide meaningful assessment of the organization's competitive position in this critical area.

The lack of detailed tool and resource information may reflect the company's focus on traditional financial services rather than specialized forex trading platforms. Alternatively, this information gap might show that Fubon's trading tools are primarily available through direct client consultation rather than public online documentation.

Prospective clients interested in advanced trading tools should directly ask about available resources, platform capabilities, and research services before making account opening decisions.

Customer service evaluation stays limited because of insufficient specific information in available materials. While Fubon operates across multiple places with various companies, details about customer support channels, response times, service quality metrics, and multilingual support capabilities are not fully documented in reviewed sources.

The organization's international presence suggests potential for multilingual customer support, particularly given operations in Hong Kong, Taiwan, Vietnam, and other Asian markets. However, without specific service level information, this review cannot assess the quality or accessibility of customer support services.

The user rating of 3.5 out of 5 stars based on 46 reviews suggests mixed customer experiences, though these reviews may include various Fubon companies and services beyond forex trading. The moderate rating shows room for improvement in customer satisfaction, though specific service issues are not detailed in available feedback.

Given the recent regulatory compliance issues with Fubon Bank Hong Kong Limited, customer service teams may be addressing increased questions about regulatory matters and compliance procedures. The impact of these regulatory challenges on customer service quality and response times stays unclear without more detailed customer feedback analysis.

The trading experience assessment faces big limits because of lack of specific platform performance data and user experience information in available materials. While Fubon Securities operates brokerage services, details about platform stability, execution speed, order processing quality, and mobile trading capabilities are not documented in reviewed sources.

Modern forex trading demands reliable platform performance, competitive execution speeds, and complete mobile trading functionality. Professional traders evaluate brokers based on slippage rates, execution quality during volatile market conditions, and platform uptime statistics. This Fubon review cannot provide meaningful trading experience assessment without access to performance metrics and user experience data.

The absence of specific trading experience information may show that Fubon's primary focus lies in traditional financial services rather than specialized forex trading platforms. Alternatively, the company may provide trading experience details through direct client consultation rather than public documentation.

Given the organization's complete financial services background, Fubon likely has the technical infrastructure necessary for professional trading operations, but specific platform performance and user experience validation requires further investigation through direct platform testing and client feedback collection.

The trust and reliability assessment reveals big concerns that impact Fubon's overall credibility rating. According to Hong Kong Monetary Authority disclosures, Fubon Bank Hong Kong Limited faced disciplinary action for breaking Anti-Money Laundering and Counter-Terrorist Financing rules, representing a serious regulatory compliance failure that directly impacts institutional trustworthiness.

Regulatory compliance forms the foundation of financial services trust, and violations of anti-money laundering regulations raise questions about internal control systems, compliance culture, and risk management practices. While this violation specifically affects Fubon Bank Hong Kong Limited, the regulatory action may influence perceptions of the broader Fubon Financial Holdings organization.

The company's establishment in 1988 and substantial capital base of NT$16 billion for Fubon Securities shows financial stability and longevity in the market. However, recent regulatory challenges overshadow these positive factors when assessing overall trustworthiness.

The Hong Kong Monetary Authority oversight provides regulatory framework protection for clients, but the documented compliance violations suggest ongoing monitoring and potential additional regulatory scrutiny. Prospective clients must weigh the organization's financial strength against documented regulatory compliance issues when making trust assessments.

User experience evaluation reveals mixed customer satisfaction levels based on available feedback. The overall rating of 3.5 out of 5 stars from 46 company reviews shows moderate customer satisfaction, suggesting both positive and negative user experiences across Fubon's service offerings.

The moderate rating suggests that while some customers find value in Fubon's services, significant room for improvement exists in user experience delivery. However, specific details about user interface design, account management processes, registration and verification procedures, and fund operation experiences are not detailed in available materials.

The limited number of reviews may not fully represent the broader customer base, particularly given Fubon's extensive operations across multiple markets and service categories. The review sample may be skewed toward specific service areas or customer segments, limiting the generalizability of satisfaction metrics.

Without detailed user feedback analysis, this review cannot identify specific areas of customer satisfaction or dissatisfaction. Common user complaints, service improvement suggestions, and positive experience highlights remain unclear, limiting the ability to provide targeted recommendations for potential improvements or user expectations management.

This Fubon review presents a mixed assessment of the financial services provider for 2025. While Fubon Financial Holdings shows significant organizational scale and complete financial services capabilities established since 1988, recent regulatory compliance issues raise important concerns for prospective clients. The moderate user rating of 3.5 out of 5 stars reflects mixed customer experiences across the organization's various service offerings.

The documented regulatory violations by Fubon Bank Hong Kong Limited regarding Anti-Money Laundering and Counter-Terrorist Financing compliance represent serious concerns that compliance-sensitive investors should carefully consider. However, the organization's diversified financial services background and substantial capital resources provide a foundation for complete investment services.

Potential clients seeking forex trading services should conduct thorough research and directly verify current service offerings, regulatory compliance status, and platform capabilities before making account opening decisions.

FX Broker Capital Trading Markets Review