Regarding the legitimacy of ZYGJ forex brokers, it provides SFC and WikiBit, .

Is ZYGJ safe?

Pros

Cons

Is ZYGJ markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Zhong Yang Securities Limited

Effective Date:

2016-03-04Email Address of Licensed Institution:

cs@zyzq.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.zyzq.com.hkExpiration Time:

--Address of Licensed Institution:

香港干諾道西118號1101室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is ZYGJ Safe or a Scam?

Introduction

ZYGJ, a relatively new player in the forex market, has garnered attention for its aggressive marketing and promises of high returns. As the forex market continues to grow, so does the number of brokers entering this space, making it crucial for traders to carefully evaluate their options. The potential for scams in the forex industry is significant; thus, traders must conduct thorough due diligence before committing their funds. This article aims to provide an objective analysis of ZYGJ's legitimacy, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

To conduct this investigation, we analyzed various online sources, including user reviews, regulatory information, and expert opinions. Our evaluation framework encompasses critical aspects of broker safety, including regulation, company history, trading fees, customer support, and platform performance.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors to consider when assessing its safety. Regulation ensures that brokers adhere to specific standards, providing a layer of protection for traders. Unfortunately, ZYGJ appears to lack proper regulation, which raises red flags regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Not Applicable | N/A | N/A | Unverified |

The absence of regulation by a recognized financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US, significantly undermines ZYGJ's credibility. Unregulated brokers often lack the necessary oversight to ensure fair trading practices, making them more susceptible to fraudulent activities. Furthermore, the lack of historical compliance records raises concerns about ZYGJ's operational integrity.

Company Background Investigation

A comprehensive understanding of ZYGJ's company history and ownership structure is vital for evaluating its safety. ZYGJ was established recently, with its online presence beginning in 2023. The company claims to offer various trading services, but little is known about its founders or management team.

The lack of transparency regarding the company's ownership and management raises concerns. A reputable broker typically provides detailed information about its team, including their qualifications and experience in the financial sector. Unfortunately, ZYGJ fails to meet this standard, which could indicate a lack of accountability.

Moreover, the company has received mixed reviews online, with some users expressing dissatisfaction with the services provided. While it is common for new brokers to face initial challenges, the absence of a robust track record can be a warning sign for potential investors.

Trading Conditions Analysis

Understanding the trading conditions offered by ZYGJ is crucial for evaluating its overall value proposition. The broker claims to offer competitive spreads and various account types, but a closer look reveals potential issues.

The following table summarizes ZYGJ's core trading costs:

| Fee Type | ZYGJ | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.5 pips | 1.0-1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% | 0.2-0.5% |

While ZYGJ advertises low commissions, the spreads offered are significantly higher than the industry average, which could impact overall trading profitability. High spreads may limit traders' ability to execute profitable trades, making it essential for potential clients to consider whether these conditions align with their trading strategies.

Customer Funds Security

The security of customer funds is a crucial consideration when evaluating any forex broker. ZYGJ claims to implement various measures to protect client funds, but the lack of regulatory oversight raises concerns about the effectiveness of these measures.

Typically, reputable brokers segregate client funds from their operational funds and offer investor protection schemes. However, ZYGJ's website does not provide clear information on whether it adheres to these best practices. The absence of such assurances can leave traders vulnerable to potential losses in the event of financial instability or fraud.

Additionally, there have been no reported instances of funds being compromised at ZYGJ; however, the lack of transparency makes it difficult to assess the broker's commitment to safeguarding client assets.

Customer Experience and Complaints

Customer feedback is a valuable resource for understanding a broker's reputation and service quality. Reviews of ZYGJ are mixed, with some users reporting positive experiences while others express dissatisfaction.

Common complaints about ZYGJ include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

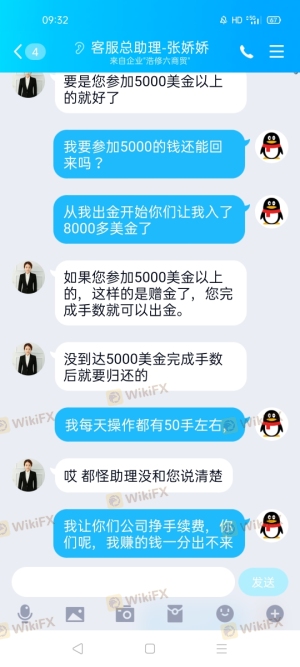

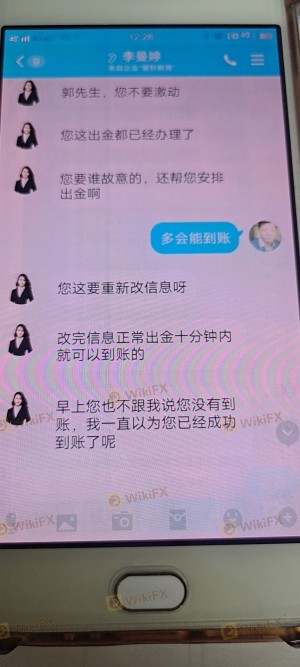

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Average |

| High Spreads | Low | Ignored |

Many users have reported difficulties in withdrawing their funds, a significant concern that often indicates deeper issues within a brokerage. Furthermore, complaints about unresponsive customer support suggest a lack of commitment to client satisfaction, which is essential for building trust in this industry.

One particular case involved a trader who struggled to withdraw funds after several attempts, leading to frustration and a loss of confidence in the broker. Such experiences can deter potential clients and reflect poorly on ZYGJ's overall reputation.

Platform and Trade Execution

The performance of a trading platform is vital for a trader's success. ZYGJ offers a trading platform that claims to be user-friendly and efficient; however, user experiences vary widely.

Traders have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading results. The platform's stability is also a concern, with some users experiencing frequent outages during high volatility periods.

Signs of potential platform manipulation have surfaced, with reports suggesting that ZYGJ may engage in practices that disadvantage traders. Such actions, if proven true, could indicate a lack of integrity and trustworthiness.

Risk Assessment

Using ZYGJ presents various risks that potential traders should consider carefully. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation and oversight |

| Financial Risk | Medium | High spreads and potential withdrawal issues |

| Operational Risk | High | Platform stability and execution issues |

| Customer Service Risk | Medium | Poor response to complaints |

To mitigate these risks, traders should exercise caution and consider starting with a small investment or exploring alternative brokers with better regulatory standing and customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that ZYGJ may not be a safe option for forex trading. The lack of regulation, mixed customer feedback, and potential issues with trading conditions raise significant concerns. While some users report satisfactory experiences, the overall risk profile indicates that traders should proceed with caution.

For traders looking for reliable alternatives, consider brokers regulated by top-tier authorities, such as the FCA or ASIC, which offer greater transparency and security. Always conduct thorough research and consider your trading needs before selecting a broker. Ultimately, the question, "Is ZYGJ safe?" leans towards a cautious "no," and it is advisable to explore other options for safer trading experiences.

Is ZYGJ a scam, or is it legit?

The latest exposure and evaluation content of ZYGJ brokers.

ZYGJ Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ZYGJ latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.