Is Xnzt666 safe?

Business

License

Is xnzt666 Safe or Scam?

Introduction

In the rapidly evolving world of forex trading, choosing a reliable broker is paramount for traders aiming to safeguard their investments and enhance their trading experience. One such broker under scrutiny is xnzt666, which has emerged as a player in the forex market. However, with the increasing number of scams and unregulated brokers, traders must exercise caution and conduct thorough evaluations before committing their funds. The purpose of this article is to assess whether xnzt666 is a safe option or a potential scam.

To achieve this, we will employ a multi-faceted evaluation framework that includes an analysis of regulatory compliance, company background, trading conditions, client fund security, customer experiences, and platform performance. By synthesizing data from various sources, including user reviews and regulatory information, we aim to provide a comprehensive overview of xnzt666 and its standing in the forex market.

Regulation and Legitimacy

The regulatory environment plays a critical role in determining the legitimacy of a forex broker. A well-regulated broker is typically subject to stringent oversight, ensuring that they adhere to industry standards and protect client funds. Unfortunately, xnzt666 operates without valid regulatory oversight, which raises significant concerns regarding its legitimacy and safety.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation is a red flag, as it suggests that xnzt666 is not held accountable to any governing body, leaving traders vulnerable to potential fraud. Moreover, the lack of historical compliance data further complicates the assessment of this broker's reliability. In the forex industry, brokers without regulatory oversight often engage in unethical practices, which can result in significant financial losses for traders.

Company Background Investigation

Understanding the background of a broker is essential for evaluating its credibility. xnzt666 is operated by HX Worldwide Company Limited, which is registered in the Virgin Islands. Established for approximately 2 to 5 years, the company lacks transparency regarding its ownership structure and operational history.

The management teams qualifications and experience are crucial indicators of a broker's reliability. However, there is limited publicly available information about the individuals behind xnzt666. This lack of transparency raises questions about the company's commitment to ethical trading practices and customer service.

Furthermore, the company's information disclosure level appears to be insufficient. A reputable broker typically provides comprehensive details about its operations, management, and financial status, fostering trust among potential clients. The absence of such information for xnzt666 adds to the skepticism surrounding its legitimacy.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital for assessing overall costs and potential profitability. xnzt666 offers a variety of trading instruments, including shares, options, futures, and warrants. However, the fee structure and trading conditions warrant careful examination.

| Fee Type | xnzt666 | Industry Average |

|---|---|---|

| Spread on Major Pairs | From 3 pips | 1-2 pips |

| Commission Model | $0.07 per side | $0.02 per side |

| Overnight Interest Range | High | Moderate |

The spreads and commissions at xnzt666 are notably higher than the industry average, which could significantly impact trading profitability. Additionally, the broker's high overnight interest rates may deter long-term positions, further complicating trading strategies for clients. Such unfavorable trading conditions are often indicative of a broker that may not prioritize the interests of its clients.

Client Fund Security

Client fund security is a critical aspect of any brokerage. A reputable broker implements robust measures to protect clients' funds, including segregation of accounts, investor protection schemes, and negative balance protection policies. Unfortunately, xnzt666 lacks valid regulatory oversight, which raises concerns about the safety of client funds.

The absence of clear information regarding fund segregation and investor protection mechanisms heightens the risk for traders using xnzt666. Without these safeguards, clients may find themselves at risk of losing their investments in the event of financial instability or fraudulent activities.

Customer Experience and Complaints

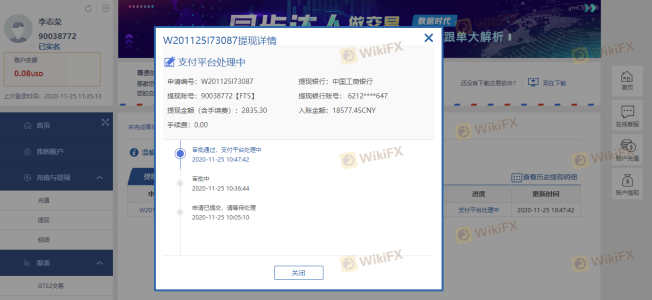

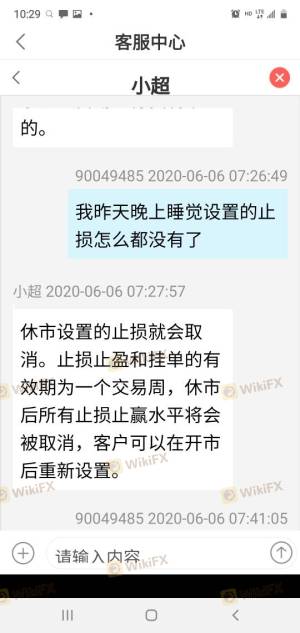

Analyzing customer feedback provides valuable insights into a broker's reliability and service quality. Reviews of xnzt666 reveal a range of experiences, with many users reporting issues such as account bans, high withdrawal fees, and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Account Bans | High | Poor |

| High Withdrawal Fees | Medium | Inconsistent |

| Poor Customer Support | High | Slow |

Common complaint patterns suggest that xnzt666 may engage in practices that frustrate clients, such as account restrictions and excessive fees. The company's slow response to complaints indicates a lack of commitment to customer service, further diminishing trust in its operations.

For example, one user reported being banned from their account without clear reasoning, while another expressed frustration over high fees when attempting to withdraw funds. These experiences highlight the potential risks associated with trading through xnzt666.

Platform and Trade Execution

A broker's trading platform is the primary interface through which clients engage with the market. xnzt666 utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading tools. However, the platform's performance and reliability are crucial factors in assessing overall trading experience.

Concerns regarding order execution quality, slippage, and rejection rates have been raised by users of xnzt666. Reports of frequent slippage during volatile market conditions and instances of rejected orders suggest that the broker may not provide the optimal trading environment that clients expect. Such issues can lead to significant financial losses and frustration for traders.

Risk Assessment

Engaging with xnzt666 presents several risks that potential clients should consider. The absence of regulatory oversight, coupled with a lack of transparency and numerous customer complaints, raises the overall risk level associated with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Lack of fund protection mechanisms |

| Operational Risk | Medium | Reports of poor execution and support |

To mitigate these risks, potential traders are advised to conduct thorough research, consider starting with a minimal investment, and remain vigilant regarding the broker's practices. It is also recommended to seek alternatives that offer better regulatory protection and customer service.

Conclusion and Recommendations

In conclusion, the evidence suggests that xnzt666 operates in a high-risk environment with significant concerns surrounding its legitimacy and safety. The lack of regulatory oversight, combined with numerous customer complaints and unfavorable trading conditions, raises red flags that traders should not ignore.

For those considering trading with xnzt666, it is crucial to weigh the potential risks against the benefits. If you are a novice trader or someone looking for a reliable trading partner, it may be prudent to explore alternative brokers that offer robust regulatory protections and a proven track record of positive customer experiences.

Some recommended alternatives include well-regulated brokers with strong reputations, such as Exness and Forex.com, which provide better security and customer service. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is Xnzt666 a scam, or is it legit?

The latest exposure and evaluation content of Xnzt666 brokers.

Xnzt666 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Xnzt666 latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.