Is TYLENOL safe?

Pros

Cons

Is Tylenol Safe or Scam?

Introduction

Tylenol is a relatively new player in the forex brokerage scene, operating primarily out of Hong Kong. As a brokerage firm, it offers a variety of trading instruments, including forex, commodities, and indices. However, with the rapid growth of the online trading industry, it has become essential for traders to exercise caution and thoroughly evaluate the legitimacy and safety of any brokerage firm they consider partnering with. This article aims to provide an objective assessment of Tylenol, examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. Our investigation is based on a comprehensive analysis of available data, user reviews, and expert opinions to offer a balanced view of whether Tylenol is a safe option for traders or if it raises red flags.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining the safety of any brokerage. Tylenol currently operates without valid regulation, which is a significant concern for potential investors. The absence of regulatory oversight raises questions about investor protection and the overall legitimacy of the brokerage.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hong Kong | Unverified |

The lack of a regulatory license means that Tylenol does not adhere to any established guidelines or standards for financial practices. This absence of oversight can expose traders to various risks, including fraudulent activities and financial mismanagement. Additionally, without a regulatory framework, there is no authority to turn to in case of disputes or issues with fund withdrawals.

Historically, unregulated brokers have been linked to numerous scams, leading to significant financial losses for traders. Therefore, it is crucial for traders to consider the implications of trading with an unregulated firm like Tylenol, and to seek out regulated alternatives that provide greater transparency and security.

Company Background Investigation

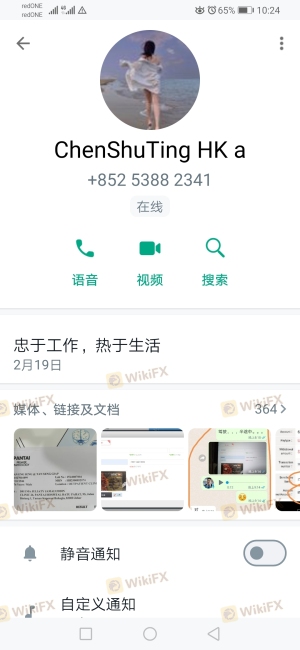

Tylenol, officially registered as Tyll Co., Ltd., has been in operation for about two years. The company is based in Hong Kong and primarily targets the Chinese market. However, details about its ownership structure and management team are sparse, which raises concerns about transparency.

The management team's background is essential in assessing the credibility of a brokerage. Unfortunately, there is limited publicly available information regarding the experience and qualifications of Tylenol's leadership. This lack of transparency can lead to skepticism about the firm's operational practices and its commitment to ethical trading.

Furthermore, the company's website does not provide comprehensive information about its history or mission, which is often a red flag for potential investors. A brokerage that is unwilling to disclose its operational history and team members may not have the best interests of its clients at heart.

Given these factors, Tylenol's lack of transparency and the unverified nature of its management team contribute to the concerns surrounding its legitimacy. Traders should be cautious and conduct thorough research before engaging with such firms.

Trading Conditions Analysis

When evaluating a brokerage, understanding the trading conditions it offers is crucial. Tylenol claims to provide competitive trading conditions, including access to popular trading platforms like MetaTrader 4 (MT4). However, the absence of specific details regarding trading fees and commissions raises concerns.

| Fee Type | Tylenol | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.9 pips | 0.6-0.8 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread offered by Tylenol on major currency pairs is slightly above the industry average, which could indicate higher trading costs for clients. Additionally, the lack of clarity regarding commission structures and overnight interest rates can lead to unexpected charges, making it difficult for traders to accurately assess their potential profitability.

Furthermore, traders have reported issues with severe slippage and high minimum deposit requirements, which could further complicate the trading experience. A high minimum deposit requirement of $10,000 is particularly concerning, as it may deter retail traders from accessing the market. Overall, the trading conditions at Tylenol appear to be less favorable compared to more established brokers, raising questions about its suitability for traders.

Customer Fund Safety

The security of customer funds is a paramount concern for any trader. Tylenol's lack of regulation raises significant questions about the safety of client funds. Without regulatory oversight, there are no guarantees regarding fund segregation, investor protection, or negative balance protection policies.

Historically, unregulated brokers have faced numerous allegations regarding the mishandling of client funds. Traders have reported difficulties in withdrawing their funds, with some claiming that their withdrawal requests were ignored or delayed indefinitely. Such issues highlight the risks associated with trading with unregulated firms like Tylenol.

In addition to the lack of regulatory protections, there is also no information available regarding Tylenol's internal security measures for protecting client data and funds. This absence of information further adds to the uncertainty surrounding the safety of trading with this brokerage.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a brokerage. Reviews and testimonials about Tylenol indicate a mixed experience among users. While some users appreciate the availability of the MT4 platform and the range of trading instruments, others have expressed frustration over withdrawal issues and poor customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Slippage Reports | Medium | No Resolution |

| Customer Support Quality | High | Poor Communication |

Common complaints revolve around difficulties in withdrawing funds and severe slippage during trading. Users have reported that their withdrawal requests were either delayed or denied without proper explanations. This lack of responsiveness from Tylenol raises concerns about its commitment to customer service and support.

Additionally, the quality of customer support has been criticized, with many users stating that they struggled to get timely assistance. The combination of these complaints suggests that Tylenol may not prioritize customer satisfaction, which is a vital aspect of any reputable brokerage.

Platform and Trade Execution

The trading platform's performance is a critical factor in a trader's experience. Tylenol offers the widely used MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. However, reports of order execution issues, including slippage and rejections, have surfaced among users.

Traders have noted that they experienced significant slippage during high volatility periods, which can lead to unexpected losses. Moreover, instances of order rejections have raised concerns about the platform's reliability and the overall trading experience.

The potential for platform manipulation is another factor to consider. Traders should be cautious if they notice patterns of unfavorable execution or discrepancies in pricing compared to other brokers. Such issues can undermine the integrity of the trading experience and lead to significant financial losses.

Risk Assessment

Using Tylenol as a trading platform comes with inherent risks, primarily due to its unregulated status and customer feedback.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight and protection |

| Fund Security Risk | High | Potential mishandling of client funds |

| Customer Support Risk | Medium | Poor response to user inquiries |

| Execution Risk | Medium | Issues with slippage and order rejection |

Traders should exercise caution when considering Tylenol as a trading option. The lack of regulation and transparency, combined with negative customer feedback, indicates a high level of risk. To mitigate these risks, it is advisable to seek regulated alternatives that offer better investor protection and more reliable trading conditions.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tylenol raises several red flags for potential traders. The lack of regulation, combined with customer complaints about fund security and poor support, indicates that Tylenol may not be a safe choice for trading.

While some traders may still consider using Tylenol, it is essential to remain vigilant and cautious. For those seeking a more secure trading environment, it is advisable to explore alternative brokers that are regulated and have a proven track record of customer satisfaction.

Overall, Tylenol's current standing in the forex market suggests that traders should carefully assess their options and consider whether the risks associated with this brokerage outweigh the potential benefits.

Is TYLENOL a scam, or is it legit?

The latest exposure and evaluation content of TYLENOL brokers.

TYLENOL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TYLENOL latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.