Is Xinhao International safe?

Business

License

Is Xinhao International Safe or a Scam?

Introduction

Xinhao International is a forex broker that has recently attracted attention in the trading community. Positioned as a platform for retail traders, it promises access to various financial markets and trading instruments. However, the rise of online trading has also led to an increase in fraudulent schemes, making it essential for traders to carefully evaluate the legitimacy of brokers before committing their funds. In this article, we will investigate whether Xinhao International is safe or if it poses risks to potential investors. Our evaluation will be based on a thorough analysis of regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its legitimacy and safety for traders. A well-regulated broker is subject to strict oversight, ensuring compliance with financial laws and protecting clients' interests. Unfortunately, Xinhao International lacks valid regulatory information, raising significant concerns about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that traders using Xinhao International may not have recourse in the event of disputes or malpractices. Without a governing body to enforce compliance, the broker's operations could be deemed high-risk. Moreover, the lack of historical compliance records only adds to the skepticism surrounding its business practices. Traders should be cautious and consider the potential risks of dealing with an unregulated entity.

Company Background Investigation

Xinhao International was incorporated in November 2020, and its registered office was located in London, United Kingdom. However, it was dissolved in July 2023, which raises serious questions about its operational viability and commitment to its clients. The companys short lifespan in the industry, combined with its dissolution, suggests a lack of stability and reliability.

The management team behind Xinhao International remains largely anonymous, with little publicly available information regarding their professional backgrounds or expertise in the financial sector. This lack of transparency is concerning as it prevents potential clients from assessing the qualifications and credibility of the individuals managing their investments. Additionally, the company's information disclosure practices appear to be inadequate, further diminishing trustworthiness.

Trading Conditions Analysis

When evaluating whether Xinhao International is safe, it is essential to consider its trading conditions, including fees and commissions. A broker's fee structure can significantly impact a trader's profitability and overall trading experience. Unfortunately, Xinhao International does not provide transparent information about its fee structure, which is a red flag for potential clients.

| Fee Type | Xinhao International | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Unknown | 1-2 pips |

| Commission Structure | Unknown | Varies |

| Overnight Interest Range | Unknown | 2-5% |

The lack of clarity regarding trading costs can lead to unexpected expenses, ultimately affecting traders' bottom lines. Moreover, if the broker employs unusual or hidden fees, it could indicate a lack of integrity and a potential scam. Therefore, it is vital for traders to seek clarity on these aspects before engaging with Xinhao International.

Customer Fund Safety

A broker's commitment to safeguarding client funds is paramount in assessing its safety. Xinhao International's policies regarding fund security remain unclear. There is no information available about whether the broker segregates client funds, offers investor protection, or implements negative balance protection measures.

The absence of these critical safety features raises serious concerns about the security of traders' investments. Without proper safeguards, clients could face significant risks, including the potential loss of their entire investment. Furthermore, any historical incidents of fund mismanagement or disputes would further highlight the broker's inadequate safety measures.

Customer Experience and Complaints

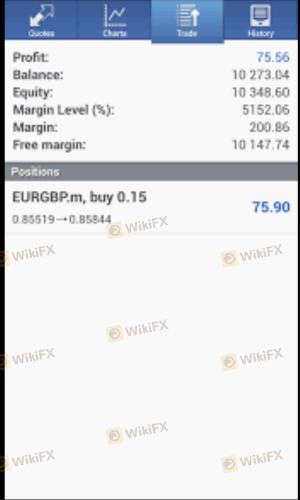

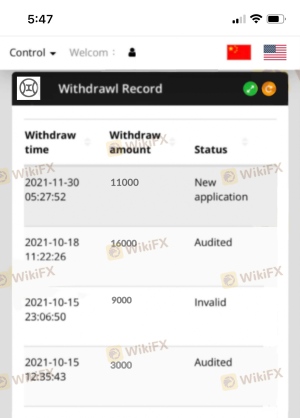

Customer feedback is a valuable indicator of a broker's reliability and service quality. Unfortunately, reviews and complaints regarding Xinhao International suggest a troubling pattern. Many users have reported difficulties in withdrawing funds, which is a common red flag in the forex trading industry.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Lack of Transparency | High | Poor |

Typical cases include traders who successfully made profits but were later unable to withdraw their funds, leading to accusations of the broker being a scam. Such experiences contribute to a growing perception that Xinhao International may not be a safe option for traders looking to invest their money.

Platform and Execution

The performance and reliability of a trading platform are critical for a trader's success. Xinhao International claims to offer a trading platform, but user experiences indicate that it may not meet industry standards. Issues such as slippage, order rejections, and overall platform stability have been reported, which can severely impact trading outcomes.

Moreover, signs of potential platform manipulation, such as frequent re-quotes and execution delays, have raised concerns among users. These factors contribute to the overall perception that Xinhao International may not provide a trustworthy trading environment.

Risk Assessment

Using Xinhao International involves several risks that potential clients should carefully consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation and oversight. |

| Financial Risk | High | Unclear fee structure and potential hidden costs. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

To mitigate these risks, traders should conduct thorough research, consider using regulated brokers, and start with small investment amounts to assess the broker's reliability before committing larger sums.

Conclusion and Recommendations

Based on the comprehensive evaluation, it is evident that Xinhao International raises several red flags that suggest it may not be a safe option for traders. The lack of regulation, transparency, and customer trust points towards a potentially risky environment.

For traders seeking to invest in the forex market, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of reliability and customer satisfaction. Some recommended alternatives include brokers regulated by top-tier authorities like the FCA or ASIC, which offer robust consumer protections and a more secure trading environment.

In conclusion, while Xinhao International may present itself as a legitimate trading option, the evidence suggests that caution is warranted, and potential clients should be wary of the associated risks.

Is Xinhao International a scam, or is it legit?

The latest exposure and evaluation content of Xinhao International brokers.

Xinhao International Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Xinhao International latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.