Is MyCapital safe?

Pros

Cons

Is Mycapital A Scam?

Introduction

Mycapital has emerged as a notable player in the forex market, attracting attention with its promises of lucrative trading opportunities and a variety of financial instruments. However, as with any trading platform, it is essential for traders to exercise caution and conduct thorough due diligence before investing their funds. The forex market is rife with unregulated brokers and potential scams, making it crucial for traders to evaluate the legitimacy and safety of their chosen broker. In this article, we will investigate the safety and reliability of Mycapital through a comprehensive analysis that includes its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory environment surrounding a broker is one of the most critical factors determining its trustworthiness. Mycapital is reportedly not regulated by any major financial authority, which raises significant red flags regarding its legitimacy. The absence of regulation means that the broker is not subject to the stringent oversight that protects traders from fraud and malpractice.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of regulation is a significant concern, as it implies that Mycapital does not adhere to industry standards designed to ensure fair trading practices, transparency, and the protection of client funds. Furthermore, the company's claims of being regulated have not been substantiated by any verifiable documentation, which adds to the skepticism surrounding its operations. Without oversight from a reputable regulatory body, traders are left vulnerable to potential fraud and manipulation.

Company Background Investigation

Mycapital's establishment and ownership structure are also critical to understanding its reliability. The broker is often linked to offshore jurisdictions, specifically Saint Vincent and the Grenadines, which is known for its lax regulatory framework. This association raises questions about the broker's operational integrity and commitment to ethical business practices.

The management team behind Mycapital lacks publicly available information, which contributes to concerns about the company's transparency. A broker's management team should ideally have a wealth of experience in the financial sector, but the anonymity surrounding Mycapital's executives raises suspicion. Furthermore, the absence of a physical address and contact information further diminishes the broker's credibility.

Trading Conditions Analysis

Mycapital offers a variety of trading accounts with different minimum deposit requirements and spreads. However, the overall fee structure appears to be on the higher side, which can eat into traders' profits.

| Fee Type | Mycapital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.4 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Mycapital are significantly higher than the industry average, which could deter traders from achieving profitable trades. Additionally, the absence of a clear commission structure raises concerns about hidden fees that may be imposed on traders, further complicating the overall cost of trading with this broker.

Client Fund Safety

When evaluating the safety of funds, it is essential to consider how a broker manages client deposits. Mycapital has not provided transparent information regarding its fund security measures, such as whether client funds are kept in segregated accounts or if there are any investor protection schemes in place.

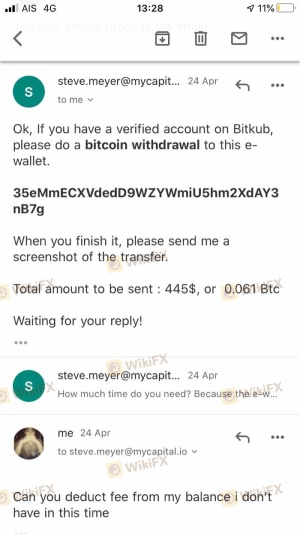

Without proper fund segregation and protection policies, traders' investments could be at risk in the event of the broker's insolvency or fraudulent activities. Additionally, there have been reports of withdrawal difficulties experienced by clients, indicating potential issues with accessing their funds. Such historical concerns further highlight the risks associated with trading with an unregulated broker like Mycapital.

Customer Experience and Complaints

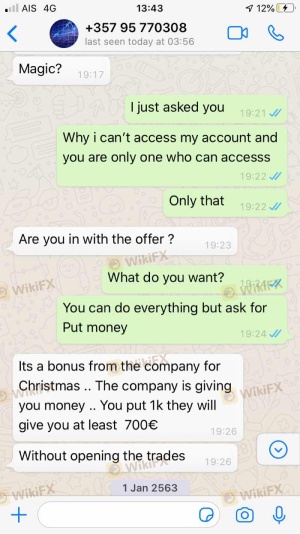

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Mycapital reveal a pattern of complaints regarding withdrawal issues, slow customer support response times, and overall dissatisfaction with the trading experience.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

For instance, several clients have reported being unable to withdraw their funds, with some claiming that their requests were ignored or met with unreasonable conditions. Such complaints point to a lack of accountability and responsiveness on the part of Mycapital, raising concerns about its commitment to customer service.

Platform and Execution

The trading platform offered by Mycapital is primarily the widely used MetaTrader 4 (MT4). While MT4 is known for its robust features and user-friendly interface, the quality of order execution and overall platform performance is another critical aspect to consider. Reports of slippage and rejected orders have surfaced, suggesting potential issues with trade execution that could negatively impact traders' profitability.

Moreover, any signs of platform manipulation, such as unusual price spikes or sudden changes in spreads, could indicate a lack of integrity in the broker's operations. Such practices are often associated with unregulated brokers, making it essential for traders to remain vigilant.

Risk Assessment

Trading with Mycapital presents several risks that traders should consider before opening an account.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation means no protection. |

| Fund Safety Risk | High | Lack of transparency regarding fund security. |

| Customer Service Risk | Medium | Poor response to client complaints. |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers that offer greater security and transparency. It is advisable to seek out brokers with a solid reputation and established regulatory oversight to ensure a safer trading environment.

Conclusion and Recommendations

Based on the evidence gathered, it is clear that Mycapital poses significant risks for potential traders. The lack of regulation, poor customer feedback, high trading costs, and concerns about fund safety collectively indicate that this broker may not be a reliable option for trading. Therefore, it is prudent for traders to exercise caution and consider alternatives that provide better regulatory protection and customer service.

For those seeking a reliable trading experience, we recommend exploring brokers that are regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers not only offer better safety for client funds but also provide a more transparent trading environment, ultimately enhancing the overall trading experience. In summary, Is Mycapital Safe? The evidence suggests that it is not, and traders should be wary of engaging with this broker.

Is MyCapital a scam, or is it legit?

The latest exposure and evaluation content of MyCapital brokers.

MyCapital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MyCapital latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.