Is Wealth Gold Bond safe?

Business

License

Is Sig WGB Safe or Scam?

Introduction

In the highly volatile world of forex trading, Sig WGB has emerged as a player that attracts both novice and experienced traders. Positioned as a brokerage that offers various trading services, it promises to provide competitive spreads and a user-friendly trading platform. However, the influx of brokers in the forex landscape necessitates a careful evaluation of their trustworthiness. Traders must be vigilant and conduct thorough research to avoid potential scams that could jeopardize their investments. This article aims to dissect the safety and legitimacy of Sig WGB through a structured evaluation framework, focusing on regulatory status, company background, trading conditions, customer experiences, and risk assessments.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its reliability. Brokers that operate under stringent regulatory oversight are generally considered safer for investors. Unfortunately, Sig WGB does not appear to be regulated by any top-tier financial authority. This lack of oversight raises significant concerns regarding the safety of funds and the broker's operational integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of a regulatory framework means that Sig WGB is not bound by the stringent requirements that reputable regulators impose. This includes transparency in operations, fair pricing, and safeguarding client funds. As a result, traders could face challenges in recovering their funds in case of disputes. The lack of regulatory oversight is a strong red flag and indicates that traders should exercise extreme caution when considering whether is Sig WGB safe.

Company Background Investigation

Understanding the background of a brokerage is essential for evaluating its credibility. Sig WGB appears to lack comprehensive information regarding its ownership structure and operational history. The absence of a clear corporate identity raises questions about its transparency and accountability. Furthermore, details about the management team and their qualifications are scarce, making it difficult for potential clients to gauge the broker's expertise in the field.

A well-established broker typically provides information about its founders, key executives, and their professional backgrounds. However, Sig WGB does not offer such insights, which could be a cause for concern. The lack of transparency regarding its operations and management team further suggests that traders should be cautious when assessing whether is Sig WGB safe.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions they offer can provide valuable insights into their operational integrity. Sig WGB claims to provide competitive spreads and various trading instruments; however, the details surrounding their fee structures remain unclear.

| Fee Type | Sig WGB | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | TBD | 1.0 - 2.0 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Rate Range | TBD | Varies |

The lack of clarity regarding fees and commissions is a potential red flag. Traders should be cautious of brokers that do not provide transparent information about their costs, as hidden fees can significantly impact profitability. Thus, the ambiguity surrounding Sig WGB's trading conditions raises concerns about whether it is a safe brokerage option.

Customer Funds Safety

The safety of customer funds is a critical factor in determining a broker's reliability. Sig WGB does not provide clear information about its fund security measures. Effective fund protection mechanisms, such as segregated accounts and investor compensation schemes, are essential for safeguarding traders' investments.

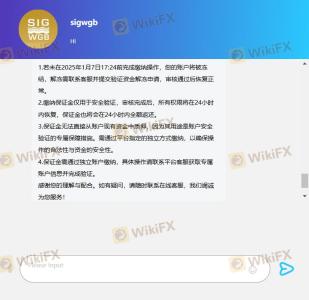

Without a robust framework for fund safety, traders may find themselves vulnerable to potential losses. Reports of past incidents involving fund mismanagement or withdrawal difficulties could further exacerbate concerns. Therefore, the lack of concrete information on how Sig WGB manages customer funds leads to doubts about its overall safety.

Customer Experience and Complaints

Customer feedback can offer valuable insights into a broker's operational practices. However, reviews regarding Sig WGB are mixed, with some users reporting positive experiences while others highlight significant issues. Common complaints include difficulties in fund withdrawals and lack of responsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Inconsistent |

These complaints suggest a pattern of customer dissatisfaction, particularly concerning withdrawal processes. If customers struggle to access their funds, it raises serious questions about the broker's reliability and whether is Sig WGB safe for traders.

Platform and Execution

A broker's trading platform is a crucial aspect of the trading experience. Sig WGB promotes its platform as user-friendly and efficient; however, user reviews indicate mixed feedback. Traders have reported issues such as slippage and order rejections, which can significantly affect trading outcomes.

The presence of such issues raises concerns about the broker's execution quality. If traders consistently face problems with order fulfillment, it could indicate underlying operational inefficiencies or even manipulative practices. Thus, the overall performance of Sig WGB's trading platform is a critical factor in assessing its safety.

Risk Assessment

Using Sig WGB comes with inherent risks that traders must consider. The absence of regulatory oversight, unclear fees, and mixed customer feedback contribute to a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation raises concerns. |

| Financial Risk | Medium | Unclear fee structure may impact profits. |

| Operational Risk | High | Issues with execution and withdrawals. |

To mitigate these risks, potential traders should conduct thorough research and consider starting with a small investment. Additionally, utilizing brokers with a proven track record and strong regulatory oversight could provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about whether is Sig WGB safe for forex trading. The lack of regulatory oversight, unclear fee structures, and mixed customer experiences indicate that traders should approach this broker with caution. While some users may have had positive experiences, the potential risks far outweigh the benefits.

For traders seeking reliable alternatives, it is advisable to consider brokers that are regulated by top-tier authorities, have transparent fee structures, and maintain a good reputation for customer service. Overall, exercising due diligence is crucial in the forex market to protect against potential scams and ensure a secure trading experience.

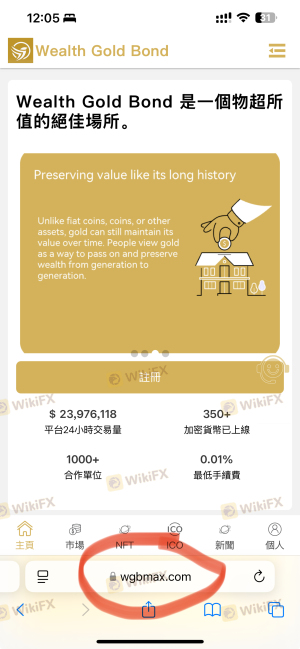

Is Wealth Gold Bond a scam, or is it legit?

The latest exposure and evaluation content of Wealth Gold Bond brokers.

Wealth Gold Bond Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Wealth Gold Bond latest industry rating score is 1.20, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.20 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.