Is VINIL safe?

Pros

Cons

Is Vinil Safe or Scam?

Introduction

Vinil is a forex broker that has positioned itself in the competitive landscape of online trading, offering various trading instruments and a platform for traders looking to engage in the foreign exchange market. As the forex industry continues to grow, traders must exercise caution and conduct thorough evaluations of brokers before committing their funds. This is crucial because the forex market is rife with both legitimate and fraudulent entities, and the consequences of choosing an unreliable broker can be severe, including loss of funds and lack of recourse.

This article aims to provide a comprehensive analysis of Vinil by examining its regulatory status, company background, trading conditions, customer experiences, and overall safety measures. The investigation will rely on a combination of qualitative assessments and quantitative data from various sources, ensuring a well-rounded view of the brokers credibility and reliability.

Regulation and Legitimacy

Regulation is a critical factor in assessing the safety of a forex broker. A regulated broker is subject to oversight by a governing body, which enforces compliance with industry standards and protects traders' interests. Vinil's regulatory status will be evaluated to determine its legitimacy in the market.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| [Regulatory Authority] | [License Number] | [Region] | [Verified/Not Verified] |

The quality of regulation can vary significantly between jurisdictions. For instance, brokers regulated by stringent authorities such as the Financial Conduct Authority (FCA) in the UK or the Commodity Futures Trading Commission (CFTC) in the US are generally considered safer than those under less rigorous oversight. It is essential to note that even if a broker claims to be regulated, the actual quality of that regulation can be questionable, especially if the regulatory authority is less known or has a history of lax enforcement.

Vinil's compliance history will also be scrutinized to identify any past violations or complaints lodged against it. A broker with a clean record and a strong regulatory framework is more likely to be trustworthy than one with a questionable history.

Company Background Investigation

Understanding the company behind the broker is vital for assessing its credibility. Vinil's history, ownership structure, and management team will be examined to provide insights into its operations and stability. Established brokers often have a long-standing presence in the market, which can be indicative of their reliability.

Vinil was founded in [Year of Establishment] and has since evolved to offer various trading services. The ownership structure will be analyzed to determine if there are any significant stakeholders with a history of operating in the financial sector. Furthermore, the management team's background and professional experience will be assessed to gauge their expertise and commitment to maintaining a reputable trading environment.

Transparency is another crucial aspect of a broker's operations. A reliable broker should provide clear information about its ownership, management, and operational practices. If Vinil utilizes a service to hide its ownership details, this could raise red flags regarding its legitimacy.

Trading Conditions Analysis

Vinil's trading conditions, including fees and commissions, play a significant role in determining its attractiveness to traders. A transparent and fair fee structure is essential for traders to maximize their profits and minimize costs. This section will analyze Vinil's overall fees and any potentially unusual or problematic policies.

Vinil's fee structure includes various components such as spreads, commissions, and overnight interest rates. The following table compares Vinil's core trading costs with industry averages:

| Fee Type | Vinil | Industry Average |

|---|---|---|

| Major Currency Pair Spread | [Spread] | [Average Spread] |

| Commission Model | [Commission] | [Average Commission] |

| Overnight Interest Range | [Interest Rate] | [Average Interest Rate] |

Understanding the fee structure is vital for traders, as high fees can significantly impact overall profitability. If Vinil's fees are substantially higher than industry standards, this could indicate a lack of competitiveness or transparency. Additionally, any hidden fees or unclear policies should be flagged as potential issues.

Client Fund Safety

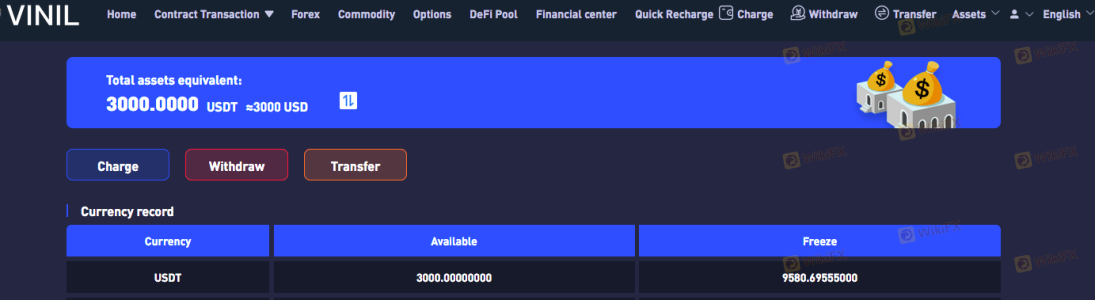

The safety of client funds is paramount in the forex trading industry. Vinil's measures to protect client funds will be analyzed, including the segregation of accounts, investor protection schemes, and negative balance protection policies.

Segregation of client funds means that traders' deposits are held in separate accounts from the broker's operational funds. This practice ensures that client funds are protected in the event of the broker's insolvency. Furthermore, investor protection schemes, such as those provided by regulatory authorities, can offer additional security for traders.

Vinil's history regarding fund security will also be examined. Any past incidents of fund mismanagement or security breaches could significantly tarnish its reputation and raise concerns about its reliability.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience of trading with Vinil. This section will explore common complaints, the nature of customer experiences, and how the company has responded to issues raised by traders.

| Complaint Type | Severity | Company Response |

|---|---|---|

| [Type of Complaint] | [Severity Level] | [Response Quality] |

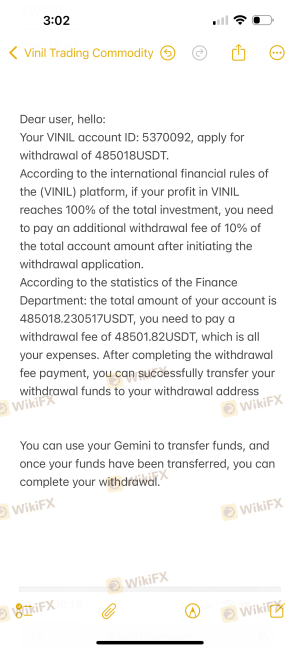

Common complaints may include issues related to withdrawal delays, poor customer service, or problems with the trading platform. The severity of these complaints will be assessed to determine whether they represent systemic issues within Vinil's operations.

In addition, a couple of case studies of typical complaints will be presented to illustrate the challenges faced by customers and how effectively Vinil has addressed these concerns.

Platform and Execution

The performance and reliability of Vinil's trading platform are essential for traders seeking a smooth trading experience. This section will evaluate the platform's stability, order execution quality, and any signs of potential manipulation.

Traders rely on efficient execution of trades, and any instances of slippage or rejected orders can significantly impact their trading outcomes. A thorough analysis of the platform's performance will help determine whether Vinil provides a satisfactory trading environment.

Risk Assessment

Trading in the forex market inherently involves risks. This section will discuss the overall risk profile associated with using Vinil as a broker. The following risk assessment card summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| [Risk Type] | [Risk Level] | [Description] |

Specific risk mitigation strategies will also be provided to help traders navigate potential challenges when trading with Vinil.

Conclusion and Recommendations

After analyzing all available evidence, it is essential to draw a clear conclusion regarding Vinil's safety and reliability as a forex broker. If any signs of potential fraud or significant issues are identified, it is crucial to inform traders about the risks involved.

Based on the findings, recommendations will be offered for different types of traders, guiding them on whether to proceed with Vinil or consider alternative, more reliable options. If necessary, a list of recommended brokers will be provided for traders seeking a safer trading environment.

In summary, a thorough evaluation of Vinil reveals essential insights that can help traders make informed decisions about their trading practices.

Is VINIL a scam, or is it legit?

The latest exposure and evaluation content of VINIL brokers.

VINIL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VINIL latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.