Is VEGO TRADE safe?

Business

License

Is Vego Trade Safe or Scam?

Introduction

Vego Trade is a forex broker that has emerged in the competitive landscape of online trading, primarily targeting the Chinese market. As traders navigate the complexities of the forex market, it becomes crucial to assess the credibility and reliability of the brokers they choose. The importance of this evaluation cannot be overstated, as a broker's legitimacy can significantly impact traders' investments and overall trading experience. In this article, we will investigate whether Vego Trade is a safe option or a potential scam. Our analysis will be based on a thorough review of available data, including regulatory status, company background, trading conditions, customer feedback, and security measures.

Regulation and Legitimacy

One of the first aspects to consider when evaluating the safety of any forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards and practices that protect investors. In the case of Vego Trade, the information available indicates a concerning lack of regulation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

Vego Trade does not appear to be regulated by any recognized financial authority, which raises significant red flags. The absence of regulation can expose traders to higher risks, as unregulated brokers are not required to follow strict operational guidelines or maintain transparency. Furthermore, reports from various sources indicate that Vego Trade has been associated with complaints about withdrawal issues and potential fraudulent activities. This lack of oversight and the potential for misconduct warrant caution among prospective traders considering Vego Trade.

Company Background Investigation

Vego Trade Limited, the entity behind Vego Trade, is relatively young and lacks a well-documented history. The broker operates primarily in China and focuses on offering a range of trading services, including forex and CFDs. However, detailed information about the company's ownership structure and management team is sparse. This lack of transparency can be concerning for traders who prefer to know the individuals behind the broker, as it reflects on the company's accountability and reliability.

The absence of a robust corporate history and the use of a white-label trading platform further complicate the assessment of Vego Trade's legitimacy. A white-label solution often indicates that the broker is not fully independent and may rely on third-party services for trading operations. This arrangement can lead to potential conflicts of interest and a lack of accountability. Overall, the companys limited transparency raises questions about its commitment to ethical trading practices and investor protection.

Trading Conditions Analysis

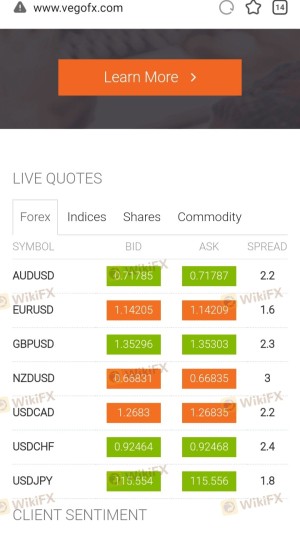

When assessing whether Vego Trade is safe, it is essential to analyze its trading conditions, including fees and spreads. Vego Trade offers a maximum leverage of up to 3000:1, which is significantly higher than the industry average. While high leverage can amplify profits, it also increases the risk of substantial losses, especially for inexperienced traders.

| Fee Type | Vego Trade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.3 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spread for major currency pairs at Vego Trade starts at 1.3 pips, which is relatively competitive but not the lowest in the market. Additionally, the absence of a clear commission structure can be misleading, as hidden fees may exist. Traders should be aware of potential costs that may not be immediately apparent, as they can significantly impact profitability. Overall, while Vego Trade may offer attractive trading conditions, the high leverage and lack of transparency concerning fees warrant a cautious approach.

Customer Fund Security

The security of customer funds is a critical factor in determining whether Vego Trade is safe. Reports indicate that Vego Trade does not provide sufficient information regarding its fund protection measures. The broker's practices concerning fund segregation and investor protection are unclear, which poses a risk to traders' capital.

In regulated environments, brokers are typically required to keep client funds in segregated accounts, ensuring that they are not used for operational expenses. Without such measures, traders funds could be at risk in the event of the broker's insolvency. Furthermore, Vego Trade has faced complaints regarding difficulties in withdrawing funds, which raises concerns about the safety and accessibility of traders' investments.

Customer Experience and Complaints

Customer feedback is a vital component in assessing the safety and reliability of a broker. In the case of Vego Trade, multiple reviews and complaints suggest a troubling pattern of customer dissatisfaction. Common issues reported by users include difficulties in fund withdrawals and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Poor Customer Service | Medium | Fair |

One notable case involved a trader who reported losing their initial deposit due to alleged manipulation of their account by the broker. Such experiences highlight the potential risks associated with trading through Vego Trade and suggest a lack of adequate support for clients facing issues. The overall sentiment among users indicates a lack of trust in the broker, which is a significant concern for potential traders.

Platform and Trade Execution

The trading platform offered by Vego Trade is another critical aspect to consider. While the broker utilizes popular platforms like MetaTrader 4 and 5, the performance and reliability of these platforms can vary. Reports suggest that users have experienced issues with order execution, including slippage and order rejections.

The effectiveness of trade execution is essential for traders, as delays or errors can lead to significant financial losses. Furthermore, any signs of platform manipulation or unfair practices can raise serious concerns about the broker's integrity. Traders should carefully evaluate their experiences with the platform and consider how it aligns with their trading strategies.

Risk Assessment

Based on the analysis conducted, several risks are associated with trading through Vego Trade.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Financial Risk | High | High leverage and unclear fee structures. |

| Customer Service Risk | Medium | Poor response to customer complaints. |

| Platform Risk | Medium | Issues with execution and potential manipulation. |

To mitigate these risks, traders should consider using smaller amounts for initial deposits, thoroughly researching other brokers, and ensuring they understand the trading platform's functionality. Additionally, seeking out regulated brokers with a strong reputation for customer service and transparency is advisable.

Conclusion and Recommendations

In conclusion, the investigation into Vego Trade raises significant concerns regarding its safety and legitimacy. The lack of regulation, transparency issues, and numerous customer complaints suggest that traders should exercise caution when considering this broker. While Vego Trade may present appealing trading conditions, the associated risks and potential for fraud cannot be ignored.

For traders looking for safer alternatives, it is advisable to explore brokers that are regulated by top-tier authorities and have a proven track record of positive customer experiences. Overall, while Vego Trade may not be outright classified as a scam, the numerous warning signs indicate that it is not a safe choice for traders seeking a reliable forex broker.

Is VEGO TRADE a scam, or is it legit?

The latest exposure and evaluation content of VEGO TRADE brokers.

VEGO TRADE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VEGO TRADE latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.