Trade Principal 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Trade Principal emerges as an online broker claiming to cater to both novice and experienced traders, offering a platform to trade forex, CFDs, and commodities. However, lurking behind its appealing facade are significant red flags that raise substantial doubts regarding its legitimacy. Importantly, Trade Principal operates without any regulatory oversight, which poses considerable risks for potential investors. Numerous complaints highlight issues with fund withdrawals and customer support, prompting a deeper analysis of its operations. This review aims to equip potential users with a comprehensive understanding of Trade Principal's offerings, particularly aimed at novice traders who are actively seeking accessible trading options, and serves as a cautionary tale for experienced investors who prioritize safety and regulatory compliance.

⚠️ Important Risk Advisory & Verification Steps

WARNING: Trade Principal is an unregulated broker. You should exercise extreme caution when considering investment with this platform due to the following potential harms:

- High fraud exposure: The absence of regulatory oversight increases the likelihood of scams.

- Withdrawal difficulties: Multiple reports from users indicate substantial challenges in withdrawing funds.

- Poor customer support: Clients have frequently cited slow response times and unhelpful service.

How to Self-Verify:

- Check Regulatory Bodies:

- Visit the websites of major financial regulatory authorities such as the FCA, ASIC, or NFA.

- Use their search tools to verify if Trade Principal is registered.

- Examine Reviews:

- Look for user reviews on platforms like Trustpilot or ForexPeaceArmy to gauge overall user sentiment.

- Seek Legal Records:

- Search the internet for any regulatory warnings or alerts against Trade Principal. Notable authorities, such as the CNMV, have flagged it previously.

- Review Contact Information:

- Cross-check the legitimacy of contact details such as phone numbers and email addresses available on their official site.

- Consult Expert Opinions:

- Read reviews from well-known financial advisory sites or forums discussing Trade Principals credibility.

Rating Framework

Broker Overview

Company Background and Positioning

Established in Saint Vincent and the Grenadines, Trade Principal positions itself as a forex and CFD broker offering entry into various asset classes. Despite its claims, the absence of verifiable regulatory licensure raises questions about its legitimacy and reliability. There is a lack of transparency regarding the company's operations and ownership, leaving potential traders to navigate a questionable broker environment.

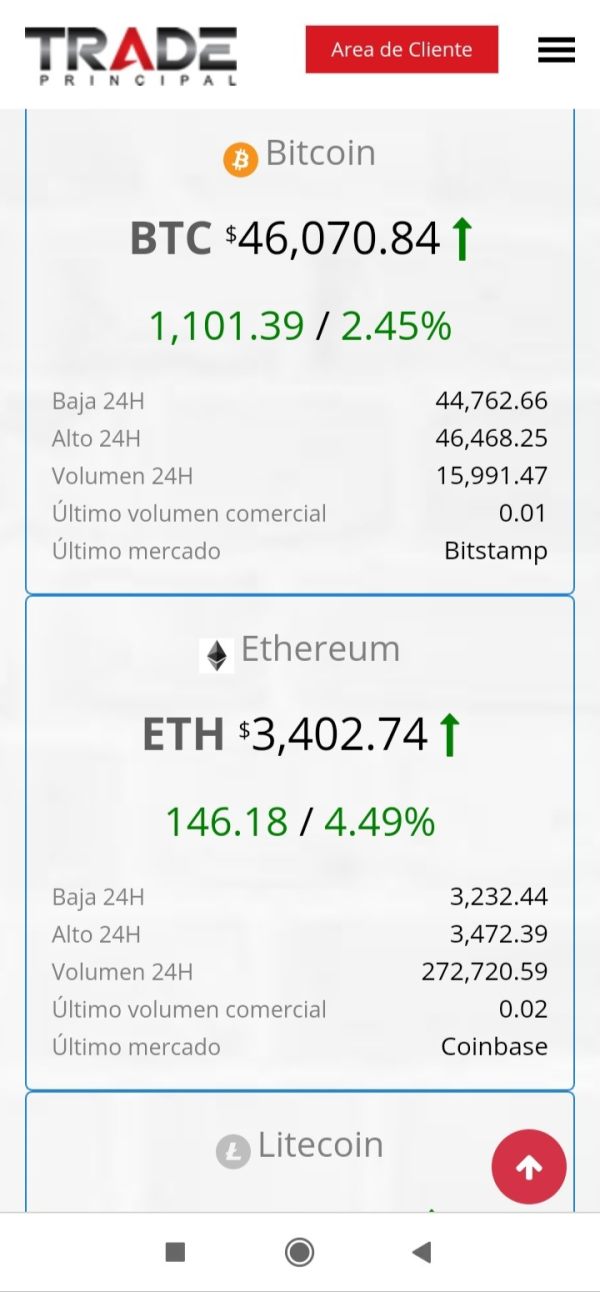

Core Business Overview

Trade Principal provides trading options across forex, CFDs, and commodities, utilizing the MetaTrader 4 platform. However, it lacks clear disclosures about commissions, fees, and trading conditions, which invites scrutiny. Unregulated entities typically exhibit less accountability, increasing risks for traders, particularly those investing significant funds.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty.

Trade Principals unregulated status presents a formidable risk for traders. Regulatory oversight plays a crucial role in protecting investors by ensuring that companies adhere to established financial protocols. The absence of such oversight raises significant concerns, particularly regarding:

- Contradictions in Regulatory Information: Reports consistently indicate that Trade Principal does not have any applicable licenses from reputable financial authorities, such as FCA, ASIC, or NFA. This lack of regulation means less recourse for users if they encounter issues.

- User Self-Verification Guide

- Visit nfa.futures.org and use the BASIC database to check regulatory compliance.

- For EU investors, check the ESMA website for company licensing details.

- Channel reports to regulatory authorities if fraudulent behavior is suspected.

- Industry Reputation and Summary

Trading Costs Analysis

The double-edged sword effect.

Trade Principals cost structure can be appealing due to lower commissions, but hidden charges transform this advantage into a potential liability.

- Advantages in Commissions

- Users experience relatively low commission rates, making it sound attractive for novice traders looking for cost-effective options.

- The "Traps" of Non-Trading Fees

- $30 was cited in user complaints about withdrawal fees, illustrating that transaction costs can considerably eat into profits.

- Cost Structure Summary

- Although the broker offers low trading commissions, high fees for withdrawals hinder the profitability for many active traders, making caution necessary.

Professional depth vs. beginner-friendliness.

- Platform Diversity

- Trade Principal relies on the MT4 platform, which is familiar to many traders. However, the platform's limitations must be acknowledged.

- Quality of Tools and Resources

- Basic tools are available, including live charts and calculators, yet these tools fall short of what experienced traders would require to perform in-depth analysis.

- Platform Experience Summary

- Users have noted challenges with platform stability and execution. Complaints such as slippage and order rejections have surfaced.

User Experience Analysis

Quality over quantity.

- User Interface and Navigation

- Initial impressions of the interface may be positive, but numerous complaints about responsiveness indicate a lack of attention to user needs.

- Feedback Summary

- User sentiment has skewed negative overall. Consistent poor experiences with customer support compromise overall satisfaction.

Customer Support Analysis

Expectations vs. reality.

- Accessibility and Responsiveness

- Several users report that support desks are not adequately staffed or responsive, further aggravating user frustrations.

- Customer Feedback on Experience

- “The support team never answers my queries.” Such statements are not uncommon and raise serious concerns about service reliability.

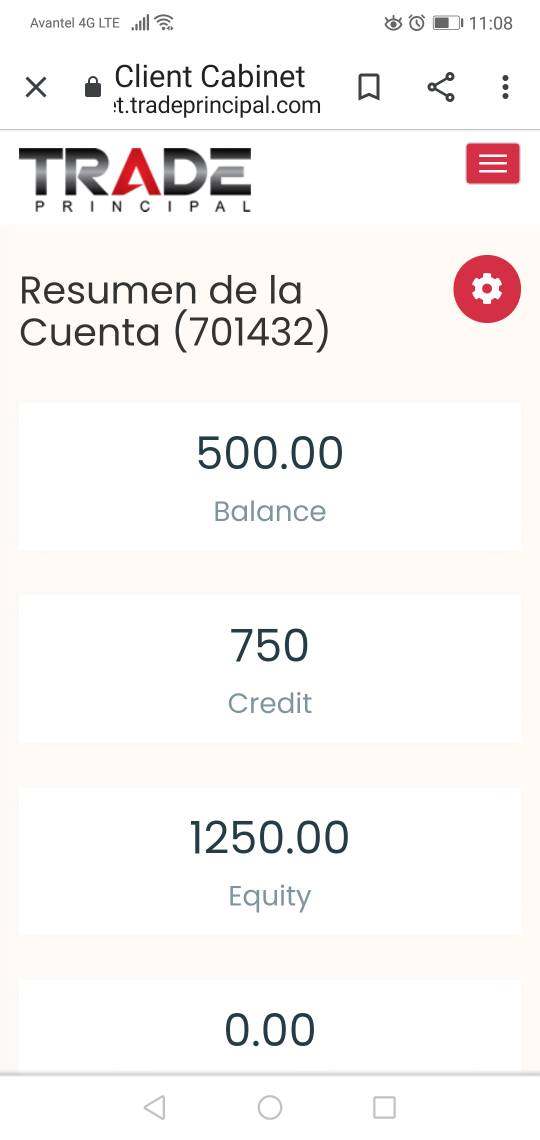

Account Conditions Analysis

Navigating the complexities.

- Account Types Breakdown

- The delineation between account levels (Bronze, Silver, and Gold) lacks competitive advantages, leaving clients wondering why so often they must invest more without gaining tangible benefits.

- Minimum Deposit Concerns

- The minimum required deposit of $1,000 discourages smaller investors, raising questions about accessibility for novice traders seeking a more gentle entry into trading.

Conclusion

In conclusion, the analysis of Trade Principal reveals a broker with significant risks, particularly in trustworthiness, user support, and withdrawal policies. For novice traders seeking to enter the trading world, caution is paramount. Given the companys unregulated status and mountain of complaints, potential investors are advised to consider alternatives that provide regulatory oversight and a clear, trustworthy framework for trading. As the financial landscape continues to evolve, prioritizing safety and transparency should remain at the forefront of any trading endeavor.

It is advisable for traders to explore options with proven regulatory frameworks such as FCA or ASIC. Always prioritize due diligence to protect your investments in an unpredictable trading environment.