Is TNFX safe?

Business

License

Is TNFX Safe or a Scam?

Introduction

TNFX is an online forex broker that has gained attention in the trading community since its establishment in 2019. Positioned as a broker catering primarily to individual and corporate clients, TNFX offers a range of trading instruments, including forex pairs, commodities, and indices. However, the need for traders to exercise caution when selecting a forex broker cannot be overstated. The forex market is rife with potential pitfalls, and the choice of broker can significantly impact a trader's success and safety. In this article, we will conduct a thorough investigation into TNFX, evaluating its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk profile. Our analysis is based on a combination of qualitative insights and quantitative data sourced from various reputable financial websites and user reviews.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety and reliability. TNFX claims to be regulated by the Seychelles Financial Services Authority (FSA), which is considered an offshore regulatory body. While this provides some level of oversight, it is essential to recognize that the FSA does not impose the same stringent requirements as more reputable regulators like the FCA in the UK or ASIC in Australia.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | SD133 | Seychelles | Regulated |

The quality of regulation plays a significant role in ensuring that brokers operate transparently and adhere to industry standards. Although TNFX is compliant with the FSA's requirements, the lack of a robust regulatory framework raises concerns about the protection of client funds and the broker's accountability. Historical compliance records indicate that while TNFX has not faced severe regulatory sanctions, its offshore status inherently carries risks. Therefore, traders must carefully consider the implications of trading with a broker that operates under a less stringent regulatory environment, as this could affect their overall trading experience and safety.

Company Background Investigation

Founded in 2019, TNFX operates under the parent company TNFX Ltd, which is registered in Seychelles. The company has positioned itself as an ECN broker, claiming to provide direct market access and competitive trading conditions. However, the ownership structure and management team behind TNFX remain somewhat opaque, which can be a red flag for potential clients.

The management team consists of individuals with varying degrees of experience in the financial sector, but details about their professional backgrounds are limited. This lack of transparency regarding the company's leadership raises questions about the broker's commitment to ethical practices and customer service. Furthermore, the company's historical performance in the market has not been extensively documented, making it difficult for potential clients to gauge its reliability based on past experiences.

Trading Conditions Analysis

When evaluating a forex broker, one of the most critical aspects to consider is the trading conditions it offers. TNFX provides several account types, including standard, cent, fix, zero, and VIP accounts, each with its own set of features and fee structures. The overall cost structure is essential for traders, as it directly impacts profitability.

| Fee Type | TNFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.3 pips | From 1.0 pips |

| Commission Model | $5 per lot (Zero Account) | Varies widely |

| Overnight Interest Range | Varies | Typically disclosed |

TNFX's spreads start from 1.3 pips for standard accounts, which is slightly above the industry average. This could be a disadvantage for traders looking for competitive pricing. Additionally, the commission structure, particularly for the zero account, may not be appealing to all traders, especially those who are cost-sensitive. The lack of transparency regarding overnight interest rates and other potential fees also raises concerns about the broker's commitment to clear communication with its clients.

Client Fund Security

The security of client funds is paramount when assessing a broker's trustworthiness. TNFX claims to implement several measures to protect clients' funds, including segregated accounts and negative balance protection. However, the effectiveness of these measures is contingent upon the broker's regulatory framework and operational practices.

Traders should be aware that TNFX does not participate in any compensation schemes that would protect clients in the event of insolvency. This absence of additional safeguards could leave traders vulnerable, especially in a market environment characterized by volatility and uncertainty. Furthermore, there have been reports of withdrawal issues from clients, which raises significant concerns about the broker's ability to honor withdrawal requests promptly and efficiently.

Customer Experience and Complaints

Examining customer feedback is crucial for understanding a broker's reputation and reliability. TNFX has received a mixed bag of reviews, with some users praising its customer service and trading conditions, while others have reported significant issues, particularly regarding withdrawals.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Management Issues | Medium | Fair |

Common complaints include difficulties in withdrawing funds and slow customer service responses. For instance, one user reported a lengthy delay in receiving their withdrawal, leading to frustration and distrust in the broker's operations. Another trader mentioned that while the platform was user-friendly, the lack of transparency regarding fees and withdrawal processes was concerning. These issues highlight the importance of evaluating a broker's customer service responsiveness and the overall client experience.

Platform and Trade Execution

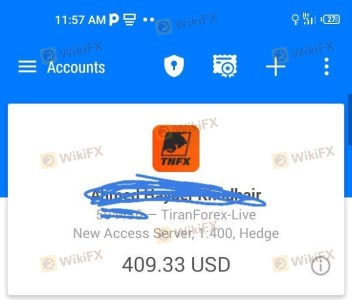

The trading platform is another critical factor in assessing a broker's reliability. TNFX offers the widely-used MetaTrader 4 and MetaTrader 5 platforms, which are known for their robust features and user-friendly interfaces. However, the overall performance, stability, and execution quality of TNFX's platform are vital in determining whether traders can execute their strategies effectively.

Traders have reported varying experiences with order execution, with some noting occasional slippage and delays. While TNFX promotes its platform as efficient, any signs of manipulation or poor execution could lead to significant losses for traders. Therefore, it is essential for potential clients to consider these factors when evaluating whether to trade with TNFX.

Risk Assessment

The overall risk of trading with TNFX should be carefully considered, especially given its offshore regulatory status and mixed customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack oversight. |

| Withdrawal Risk | High | Reports of delayed withdrawals raise concerns. |

| Transparency Risk | Medium | Limited information on fees and operations. |

Traders should approach TNFX with caution, particularly if they are risk-averse or new to forex trading. It is advisable to conduct thorough research and consider alternative options with stronger regulatory oversight and better customer reviews.

Conclusion and Recommendations

In conclusion, while TNFX presents itself as a legitimate forex broker, there are significant concerns regarding its regulatory status, customer fund security, and overall reliability. The lack of stringent oversight and mixed customer feedback suggest that trading with TNFX may pose considerable risks.

For traders seeking a reliable broker, it may be prudent to consider alternatives that are well-regulated by reputable authorities, such as FCA or ASIC licensed brokers. These brokers typically offer better protection for client funds, clearer fee structures, and a more transparent trading environment. Ultimately, traders should prioritize safety and reliability when selecting a broker, and exercise caution when dealing with entities like TNFX.

Is TNFX a scam, or is it legit?

The latest exposure and evaluation content of TNFX brokers.

TNFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TNFX latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.