Tnfx 2025 Review: Everything You Need to Know

Executive Summary

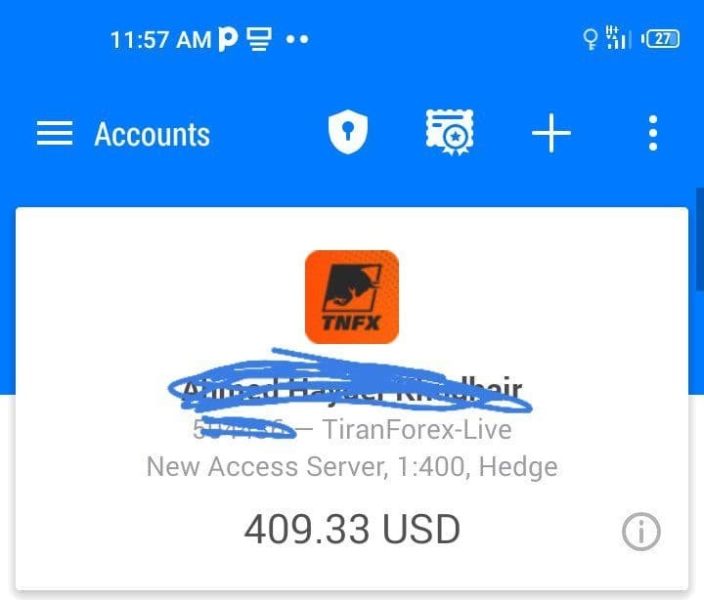

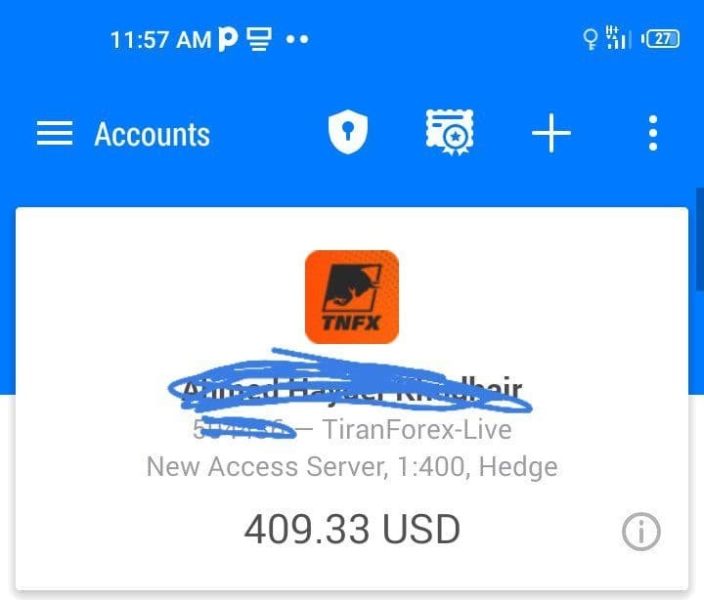

TNFX is an offshore forex broker that started in 2019. It works as a multi-asset trading platform that gives access to many financial tools like forex, precious metals, and stocks. Based on user feedback we found, this Tnfx review shows mixed results for how well the broker performs in the competitive forex market.

The broker runs as a company registered in Seychelles. It provides trading services across multiple types of assets including forex pairs, precious metals, energy commodities, and international stocks from US, EU, and Hong Kong markets. While TNFX says it offers a complete trading solution, user experiences are very different across various review platforms.

Key features include multi-asset trading abilities and customer support services that have gotten some good feedback on certain platforms. However, overall user happiness seems to be below what most people expect in this industry, with various concerns about service quality and how open they are about their operations. The broker's offshore regulatory status needs careful thought by potential clients, especially those who want stronger regulatory protection.

TNFX mainly targets traders who want diverse investment opportunities across global markets. The mixed user feedback suggests potential clients should do careful research before choosing this platform.

Important Disclaimer

This review uses publicly available information and user feedback collected from various sources as of 2025. TNFX operates as an offshore broker registered in Seychelles, which may have different regulatory standards compared to brokers licensed in major financial areas such as the UK, US, or Australia.

Potential clients should know that offshore regulatory frameworks may offer different levels of investor protection compared to tier-1 regulatory areas. The information in this review reflects the current available data and may change as the broker updates its services and regulatory status.

Rating Framework

Broker Overview

TNFX entered the forex brokerage market in 2019 as a Seychelles-registered offshore broker. It positioned itself to serve international clients seeking access to global financial markets. The company operates under an offshore regulatory framework, which allows it to offer services to a broader international clientele while keeping operational costs lower compared to brokers in heavily regulated areas.

The broker's business model focuses on providing multi-asset trading opportunities. This enables clients to spread their portfolios across various financial instruments. TNFX emphasizes its commitment to serving global traders through its international registration structure, though specific details about its operational infrastructure and management team remain limited in publicly available sources.

Based on available information, TNFX offers trading access to major asset classes including foreign exchange pairs, precious metals such as gold and silver, energy commodities, and international equity markets. The broker provides access to stocks from major markets including the United States, European Union, and Hong Kong, allowing traders to build geographically spread portfolios. However, detailed information about trading platforms, account structures, and specific service offerings remains limited in available documentation.

Regulatory Status: TNFX operates under Seychelles registration, working as an offshore broker. Specific regulatory license numbers and oversight details are not clearly specified in available sources.

Deposit and Withdrawal Methods: Available sources do not provide detailed information about supported payment methods, processing times, or minimum/maximum transaction limits.

Minimum Deposit Requirements: Specific minimum deposit amounts for different account types are not detailed in current available information.

Bonus and Promotions: No specific promotional offers or bonus programs are mentioned in available sources.

Trading Assets: TNFX provides access to multiple asset classes including forex currency pairs, precious metals, energy commodities, US stocks, EU stocks, Hong Kong stocks, and various market indices. This multi-asset approach allows traders to spread risk across different markets and instruments.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not fully available in current sources. This Tnfx review cannot provide specific cost comparisons without access to detailed fee schedules.

Leverage Ratios: Specific leverage offerings for different asset classes and account types are not detailed in available information.

Trading Platforms: Information about supported trading platforms, whether proprietary or third-party solutions like MetaTrader, is not specified in current sources.

Geographic Restrictions: Specific country restrictions or regulatory limitations are not clearly outlined in available documentation.

Customer Support Languages: While the broker appears to serve international clients, specific language support details are not fully listed.

Account Conditions Analysis

The account conditions offered by TNFX remain largely unclear based on available public information. This Tnfx review finds that specific details about account types, their respective features, and minimum deposit requirements are not fully documented in accessible sources. The lack of clear account information raises concerns about the broker's commitment to client education and informed decision-making.

Without clear information about different account tiers, their respective benefits, and associated costs, potential clients cannot effectively judge whether TNFX's offerings match their trading needs and capital requirements. The absence of detailed account specifications also makes it difficult to compare TNFX with other brokers in the market.

The account opening process details, verification requirements, and timeline for account activation are not specified in available sources. This lack of clear information may create uncertainty for potential clients regarding what to expect during the onboarding process. Additionally, information about special account features such as Islamic accounts, managed accounts, or institutional services is not available in current documentation.

TNFX's trading tools and resources appear limited based on available information. While the broker offers access to multiple asset classes, detailed information about analytical tools, charting capabilities, and research resources is not fully available in public sources.

The absence of detailed information about educational resources represents a significant gap in the broker's service offering. Modern traders typically expect access to market analysis, educational webinars, trading guides, and economic calendars to support their trading decisions. Without clear documentation of such resources, TNFX may be at a disadvantage compared to brokers that focus on trader education and support.

Information about automated trading support, expert advisors, or algorithmic trading capabilities is not specified in available sources. This lack of clarity regarding advanced trading tools may limit the broker's appeal to sophisticated traders who rely on automated strategies or require advanced analytical capabilities.

The availability of mobile trading applications, their features, and compatibility across different devices is not detailed in current sources. In today's trading environment, strong mobile trading capabilities are essential for active traders who need market access while away from their primary trading stations.

Customer Service and Support Analysis

Customer service represents one area where TNFX has received some positive feedback, according to available user testimonials. Some users have reported satisfactory experiences with the broker's support team, noting detailed explanations and responsive assistance. However, the overall customer service picture remains mixed based on available feedback.

The specific communication channels available for customer support, including phone, email, live chat, or ticket systems, are not fully detailed in available sources. Response time expectations and service availability hours also lack clear documentation, which could create uncertainty for clients needing assistance.

Language support capabilities are not clearly specified, though the broker's international positioning suggests multilingual support may be available. However, without specific information about supported languages and regional support teams, clients cannot be certain about receiving assistance in their preferred language.

The quality of support provided appears to vary based on different user experiences, with some clients reporting positive interactions while others may have different experiences. This inconsistency in service quality perception suggests potential areas for improvement in standardizing customer support procedures and training.

Trading Experience Analysis

The trading experience offered by TNFX lacks detailed documentation in available sources, making it difficult to assess platform stability, execution quality, and overall trading environment. Without specific information about trading platforms used, order execution speeds, or slippage rates, this Tnfx review cannot provide detailed insights into the actual trading experience.

Platform reliability and uptime statistics are not available in current sources, which are crucial factors for active traders who require consistent market access. The absence of technical performance data makes it challenging for potential clients to evaluate whether TNFX can meet their trading requirements, particularly during high-volatility market conditions.

Information about order types supported, risk management tools, and advanced trading features is not fully available. Modern traders typically expect access to various order types, stop-loss capabilities, and risk management tools to effectively manage their positions and protect their capital.

Mobile trading capabilities and cross-platform synchronization details are not specified in available sources. The quality of mobile applications and their feature completeness compared to desktop platforms remains unclear, which could impact traders who rely heavily on mobile trading functionality.

Trust and Reliability Analysis

TNFX's trust and reliability profile presents several areas of concern based on available information. The broker's offshore regulatory status in Seychelles, while legal, may offer different levels of investor protection compared to brokers regulated by tier-1 financial authorities such as the FCA, ASIC, or CySEC.

The lack of detailed information about client fund segregation, deposit insurance, or investor compensation schemes raises questions about financial security measures. Reputable brokers typically provide clear information about how client funds are protected and what recourse is available in case of operational difficulties.

Company transparency appears limited, with minimal publicly available information about the management team, operational history, or corporate structure. This lack of transparency can make it difficult for clients to assess the broker's stability and long-term viability in the competitive forex market.

The absence of detailed regulatory compliance information, audit reports, or third-party certifications further contributes to uncertainty about the broker's operational standards and commitment to regulatory best practices. Without such documentation, clients cannot fully evaluate the broker's adherence to industry standards and regulatory requirements.

User Experience Analysis

User experience with TNFX appears to be mixed based on available feedback from various sources. While some users have reported positive experiences, particularly regarding customer support interactions, the overall user satisfaction picture is not consistently positive across all review platforms and user testimonials.

The registration and account verification process details are not fully documented, which could create uncertainty for new users about what to expect during onboarding. Clear communication about required documentation, verification timelines, and account activation procedures is essential for positive user experiences.

Website usability and interface design quality cannot be thoroughly assessed based on available information. Modern traders expect intuitive, responsive web interfaces that provide easy access to account management, trading platforms, and support resources. Without detailed user interface reviews, it's difficult to evaluate TNFX's digital experience quality.

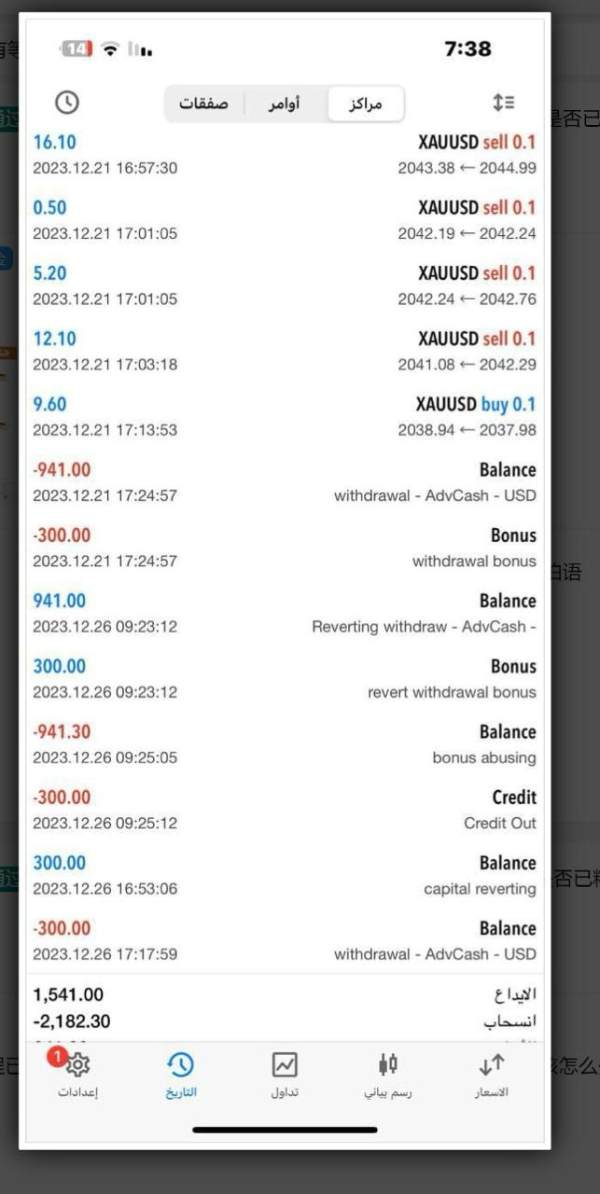

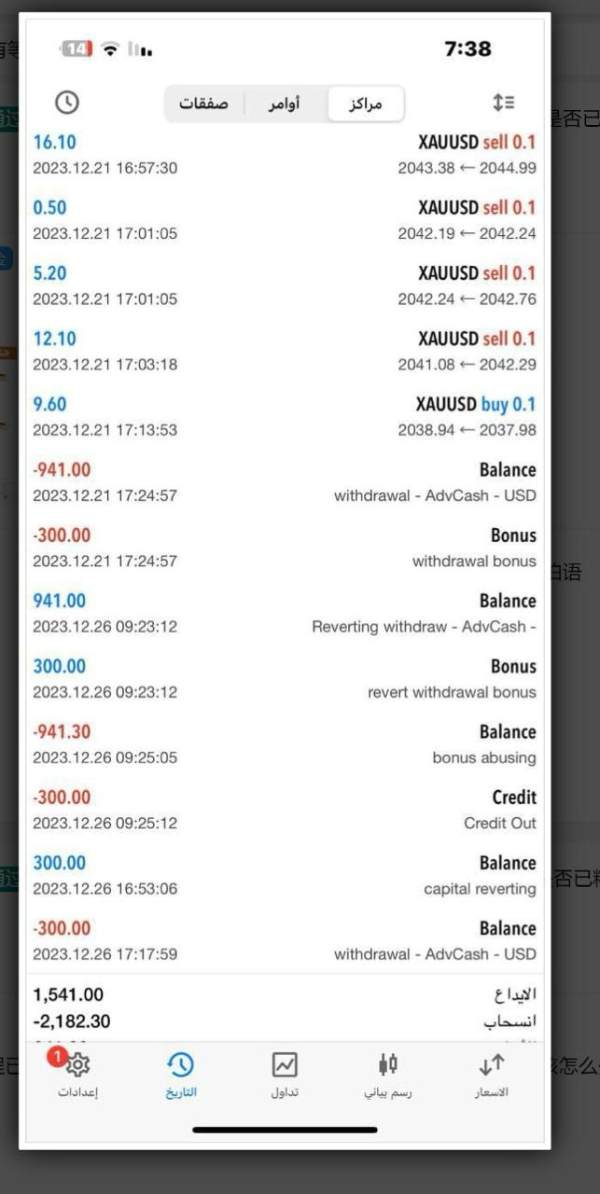

Deposit and withdrawal experiences, including processing times, fees, and available methods, lack detailed documentation in available sources. These operational aspects significantly impact overall user satisfaction, as efficient fund management is crucial for trader confidence and operational convenience.

Conclusion

TNFX presents a mixed picture in the competitive forex brokerage landscape. While the broker offers multi-asset trading capabilities and has received some positive feedback regarding customer support, significant information gaps and offshore regulatory status raise important considerations for potential clients.

The broker may be suitable for traders seeking diversified asset access and who are comfortable with offshore regulatory frameworks. However, the lack of detailed information about account conditions, trading costs, and platform specifications makes it difficult to recommend TNFX without reservations.

Key advantages include multi-asset trading opportunities and reported positive customer service experiences. However, significant disadvantages include limited transparency, offshore regulatory status, and insufficient publicly available information about critical trading conditions and costs. Potential clients should conduct thorough due diligence and consider their risk tolerance before choosing TNFX as their trading partner.