Is KuFin safe?

Pros

Cons

Is Kufin Safe or a Scam?

Introduction

Kufin is an online forex broker that has emerged in the trading space, offering various financial instruments including currencies, stocks, and commodities. Established in 2021 and headquartered in the United Kingdom, Kufin aims to attract traders with competitive spreads and a user-friendly trading platform. However, the rapid growth of online trading has also led to an increase in fraudulent brokers, making it essential for traders to conduct thorough evaluations before committing their funds. In this article, we will investigate whether Kufin is safe or a scam, utilizing a comprehensive assessment framework that includes regulatory compliance, company background, trading conditions, and customer feedback.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its trustworthiness. A regulated broker is subject to strict oversight, ensuring that it adheres to industry standards and protects client funds. Unfortunately, Kufin is not regulated by any top-tier financial authority, raising significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Kufin does not have to comply with the stringent rules set by reputable financial authorities such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. This lack of oversight can lead to potentially harmful practices, including unfair trading conditions and inadequate fund protection. Historical compliance issues are also a concern, as unregulated brokers have often been linked to scams and fraudulent activities. Therefore, it is prudent for traders to exercise caution when considering Kufin as a trading option.

Company Background Investigation

Kufin was founded in 2021, positioning itself as a new entrant in the competitive forex trading market. While the company claims to offer a diverse range of trading options, the lack of a robust history raises questions about its operational integrity. The ownership structure of Kufin is somewhat opaque, with limited information available regarding its founders and key executives.

The management teams background is crucial in assessing the broker's reliability. A strong management team with extensive experience in financial markets is often indicative of a trustworthy broker. However, Kufin does not provide sufficient details about its leadership, which diminishes transparency and raises red flags for potential investors.

In terms of information disclosure, Kufins website lacks comprehensive details about its operations, trading policies, and risk disclosures. This opacity can be a warning sign, as reputable brokers typically offer clear and accessible information to their clients. Overall, the combination of a short operational history and insufficient transparency makes it difficult to confidently assert that Kufin is safe for trading.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. Kufin presents itself as a competitive broker, but the absence of regulatory oversight casts doubt on the fairness of its trading conditions. The broker claims to offer variable spreads and a range of trading instruments, but potential traders should be aware of any hidden costs associated with trading.

| Fee Type | Kufin | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1-2 pips | 1-1.5 pips |

| Commission Structure | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

The potential for high overnight interest rates is particularly concerning, as this can significantly impact trading profitability. Additionally, the lack of clarity regarding the commission structure raises questions about the overall cost of trading with Kufin. Traders should be wary of brokers that do not provide transparent fee structures, as this can lead to unexpected charges and reduced returns on investment.

Client Funds Security

Client funds' safety is paramount when choosing a forex broker. Kufin's lack of regulatory oversight means it does not have to adhere to industry-standard practices for fund protection. This absence of regulation raises concerns about whether client funds are held in segregated accounts and whether there are any investor protection measures in place.

Kufin has not publicly disclosed its policies regarding fund segregation, negative balance protection, or any investor compensation schemes. Without these essential protections, traders face significant risks, including the potential loss of their entire investment. Historical issues related to fund security have been reported with unregulated brokers, further emphasizing the need for caution.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's reliability. Reviews of Kufin reveal a mix of experiences, with some users reporting positive trading conditions while others express concerns about withdrawal difficulties and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or No Response |

| Poor Customer Support | Medium | Inconsistent Replies |

Common complaints include difficulty withdrawing funds and unresponsive customer service. Such issues are often indicative of deeper operational problems and can lead to significant frustration for traders. One notable case involved a trader who reported being unable to withdraw funds after a significant profit, raising alarms about the broker's practices. These complaints suggest that potential traders should be cautious when dealing with Kufin.

Platform and Trade Execution

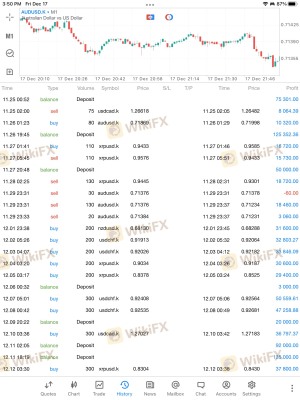

The trading platform is a critical component of the trading experience. Kufin claims to offer a user-friendly interface with advanced trading tools, but the performance and reliability of the platform are crucial for successful trading. Traders need assurance that their orders will be executed promptly and accurately.

Concerns have been raised about order execution quality, including instances of slippage and order rejections. Such issues can severely impact trading outcomes, especially in volatile market conditions. Additionally, any signs of platform manipulation, such as artificially widening spreads or delaying order executions, should be taken seriously.

Risk Assessment

Using Kufin as a trading platform carries inherent risks due to its unregulated status and mixed customer feedback.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of fund protection measures |

| Customer Service Risk | Medium | Complaints regarding responsiveness |

To mitigate these risks, traders are advised to conduct thorough research, start with a small investment, and maintain a cautious approach when trading with Kufin. Additionally, seeking out regulated alternatives can provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Kufin presents significant risks for potential traders. Its lack of regulation, opaque company background, questionable trading conditions, and mixed customer feedback raise serious concerns about its safety and reliability.

Traders should be particularly wary of the potential for withdrawal issues and inadequate customer support. For those seeking a more secure trading experience, it is advisable to consider regulated alternatives that offer transparent operations and robust fund protection. Some reputable brokers include those regulated by the FCA or ASIC, which provide a safer environment for trading.

Ultimately, the decision to trade with Kufin should be made with caution, as the potential for loss is heightened in an unregulated trading environment.

Is KuFin a scam, or is it legit?

The latest exposure and evaluation content of KuFin brokers.

KuFin Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KuFin latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.