Is BMF safe?

Pros

Cons

Is BMF Safe or Scam?

Introduction

BMF, a name that has surfaced in discussions surrounding forex trading, positions itself as a broker offering various trading services. However, the forex market is rife with opportunities and risks, making it crucial for traders to conduct thorough evaluations of brokers before committing their funds. The necessity for scrutiny arises from the potential for fraud and mismanagement that can lead to significant financial losses. In this article, we will investigate whether BMF is a safe trading platform or a potential scam. Our analysis will encompass regulatory status, company background, trading conditions, customer experiences, and overall risk assessment, drawing on recent data and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. A regulated broker is typically subject to strict oversight, which helps ensure the protection of client funds and adherence to fair trading practices. Unfortunately, BMF does not appear to be regulated by any reputable financial authority. This lack of oversight raises significant concerns about the safety of funds deposited with them.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulatory oversight by top-tier authorities such as the FCA (UK), ASIC (Australia), or SEC (USA) indicates that BMF operates in a high-risk environment. Without regulation, there are no guarantees regarding the safety of client funds, and the potential for fraudulent activities increases. Furthermore, brokers that are unregulated often lack the necessary transparency and accountability that regulated firms must adhere to. This situation raises a red flag for potential investors, urging them to consider alternative, regulated options to ensure their financial safety.

Company Background Investigation

BMF's company history and ownership structure are essential components of evaluating its credibility. Unfortunately, information regarding the company's establishment, management team, and operational history is sparse. The lack of transparency in these areas can be indicative of deeper issues. Reliable brokers typically provide comprehensive information about their management teams and corporate structure, allowing potential clients to assess their expertise and reliability.

Moreover, the absence of verifiable details surrounding BMF's management raises concerns about the company's commitment to ethical practices. A reputable broker will usually disclose its leadership teams qualifications and industry experience, which fosters trust among clients. Without such information, it becomes challenging for potential investors to gauge the reliability of BMF, reinforcing the notion that traders should exercise caution when considering this broker.

Trading Conditions Analysis

Understanding a broker's trading conditions is crucial for any trader. BMF claims to offer competitive trading conditions, yet the lack of transparency regarding fees and spreads is concerning. Traders must be aware of how fees are structured, as hidden costs can significantly impact profitability.

| Fee Type | BMF | Industry Average |

|---|---|---|

| Spread on Major Pairs | Unspecified | 1.0 - 2.0 pips |

| Commission Model | Unspecified | Varies widely |

| Overnight Interest Range | Unspecified | 0.5% - 2.0% |

The absence of clear information on spreads, commission structures, and overnight interest rates raises questions about the overall cost of trading with BMF. Traders should be wary of brokers that do not provide detailed information on these aspects, as it could lead to unexpected charges that diminish trading profits. Therefore, potential clients should seek brokers with transparent fee structures and competitive trading conditions to avoid unnecessary financial burdens.

Customer Funds Security

The safety of customer funds is paramount in the forex trading industry. Brokers must implement robust security measures to protect client assets. Unfortunately, BMF's approach to fund security is unclear. There is no information available on whether client funds are held in segregated accounts or if investor protection measures are in place.

Segregated accounts are crucial as they separate client funds from the broker's operational funds, providing an additional layer of security. Additionally, investor protection schemes can offer compensation in case the broker becomes insolvent. The absence of these safeguards raises significant concerns about the safety of funds deposited with BMF.

Furthermore, any historical issues related to fund security or client complaints regarding withdrawals can further tarnish a broker's reputation. Given the lack of information on these critical aspects, traders should approach BMF with caution and consider alternative brokers that prioritize fund security and transparency.

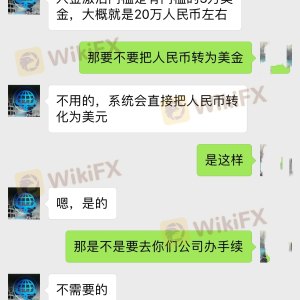

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews and testimonials from actual users can provide insight into the overall trading experience. Unfortunately, the feedback surrounding BMF is predominantly negative. Many users report difficulties in withdrawing funds, lack of responsive customer support, and issues related to unexpected fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Fee Transparency | High | Poor |

Common complaints include the inability to withdraw funds, which is a significant red flag for any broker. Reports of unresponsive customer service further exacerbate the situation, as traders often rely on timely support for resolving issues. These patterns of complaints suggest that BMF may not prioritize customer satisfaction, which is essential for a trustworthy trading environment.

Additionally, anecdotal evidence from users indicates that BMF may employ tactics to delay withdrawals, raising suspicions about the broker's integrity. As such, potential clients should be cautious and consider the experiences of others before deciding to engage with BMF.

Platform and Trade Execution

The performance of the trading platform is another critical factor in evaluating a broker's reliability. Traders require a stable and efficient platform to execute trades effectively. However, there is limited information available regarding BMF's platform performance, stability, and user experience.

Key aspects to consider include order execution quality, slippage rates, and any indications of market manipulation. A reliable broker should provide a seamless trading experience, with minimal delays in order execution. Unfortunately, without concrete data on BMF's platform performance, potential clients may find it challenging to assess the broker's reliability in this regard.

Risk Assessment

Using BMF as a trading broker presents several risks that traders should be aware of. The lack of regulation, transparency, and negative user feedback collectively contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated, no oversight. |

| Financial Risk | High | Unclear fee structures and safety. |

| Operational Risk | Medium | Poor customer service and support. |

To mitigate these risks, traders should consider the following recommendations:

- Research Alternatives: Seek regulated brokers with transparent practices and positive user feedback.

- Start Small: If considering BMF, begin with a minimal investment to assess the platform's reliability.

- Monitor Withdrawals: Be cautious when attempting to withdraw funds, and document all communications with the broker.

Conclusion and Recommendations

In conclusion, the evidence suggests that BMF raises significant concerns regarding its safety and reliability. The absence of regulatory oversight, negative customer feedback, and unclear trading conditions indicate that traders should approach this broker with caution. While there may be opportunities within the forex market, it is essential to prioritize safety and transparency.

For traders seeking reliable alternatives, consider brokers regulated by top-tier authorities, such as the FCA or ASIC, which offer robust investor protection and transparent practices. Overall, the consensus is clear: BMF is not a safe choice for trading, and potential users should exercise extreme caution.

Is BMF a scam, or is it legit?

The latest exposure and evaluation content of BMF brokers.

BMF Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BMF latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.