Is Teyler safe?

Pros

Cons

Is Teyler Safe or a Scam?

Introduction

Teyler is a newly established forex broker that has entered the trading market in 2023, positioning itself as a platform for high-net-worth individuals seeking to trade in various financial instruments, including forex, futures, and indices. With a minimum deposit requirement of $50,000, Teyler aims to attract serious investors looking for significant trading opportunities. However, the rise of online trading has also led to an increase in fraudulent schemes, making it crucial for traders to carefully evaluate the legitimacy and safety of brokers before committing their funds. This article aims to provide a comprehensive analysis of Teyler's credibility by investigating its regulatory status, company background, trading conditions, and customer experiences.

To ensure a thorough evaluation, this article utilizes a combination of qualitative and quantitative research methods, including reviews from reputable financial websites, user testimonials, and an examination of regulatory databases. By focusing on key indicators of broker reliability, this article will help determine whether Teyler is a safe option for traders or if it poses potential risks.

Regulation and Legitimacy

Regulatory oversight is a critical factor in assessing the safety of any trading platform. A regulated broker is typically subject to strict compliance measures that protect investors and ensure fair trading practices. In the case of Teyler, it claims to be regulated by the National Futures Association (NFA) in the United States. However, upon further investigation, it appears that Teyler is not a member of the NFA, and its license number is marked as unauthorized. This lack of legitimate regulatory oversight raises significant concerns about the broker's credibility.

Regulatory Information Table

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0560215 | United States | Unauthorized |

The absence of regulation from a reputable authority like the NFA indicates that Teyler operates without the necessary safeguards that protect traders. This lack of oversight can expose clients to various risks, including potential fraud and mismanagement of funds. Given that Teyler is a newly established broker, its unregulated status should serve as a red flag for potential investors.

Company Background Investigation

Teyler Limited, the entity behind the trading platform, was incorporated in November 2023 in the United Kingdom. However, a search of the UK Companies House reveals no registration information for Teyler, suggesting that the company may not be operating legally. The companys website lacks transparency regarding its ownership structure, and there is limited information available on its management team. This lack of transparency can be concerning for potential clients, as it raises questions about the broker's legitimacy and accountability.

Furthermore, the company's brief history and recent establishment may indicate a lack of experience in the financial markets. A well-established broker typically has a proven track record, while new entrants may not have the necessary expertise to manage client funds effectively. The absence of clear information about the companys ownership and management further underscores the need for caution when considering whether Teyler is safe for trading.

Trading Conditions Analysis

The trading conditions offered by Teyler are another critical aspect to evaluate. The broker provides access to over 50 forex currency pairs, futures, and indices, which may seem appealing to traders looking for diverse trading options. However, the high minimum deposit requirement of $50,000 is a significant barrier for many potential investors, especially those who are just starting out in forex trading.

Trading Costs Comparison Table

| Cost Type | Teyler | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | Not disclosed | Varies widely |

| Overnight Interest Range | Not disclosed | 0.5% - 2.0% |

The lack of transparency regarding commissions and overnight interest rates is concerning. Traders should be aware of all potential fees before opening an account, as undisclosed costs can significantly impact profitability. Furthermore, the absence of educational resources and support for novice traders may leave them vulnerable to making uninformed trading decisions.

Customer Funds Security

When assessing whether Teyler is safe, it is essential to consider the security measures in place for protecting customer funds. According to the information available, Teyler does not provide clear details about its fund segregation practices or investor protection policies. This lack of transparency can be alarming, as secure brokers typically offer guarantees that client funds are held in separate accounts, minimizing the risk of loss.

Moreover, there are no indications that Teyler has implemented negative balance protection policies, which protect clients from losing more than their initial investment. The absence of these safety measures raises questions about the broker's commitment to safeguarding client assets. Additionally, any historical issues regarding fund security or disputes have not been disclosed, further complicating the assessment of Teyler's reliability.

Customer Experience and Complaints

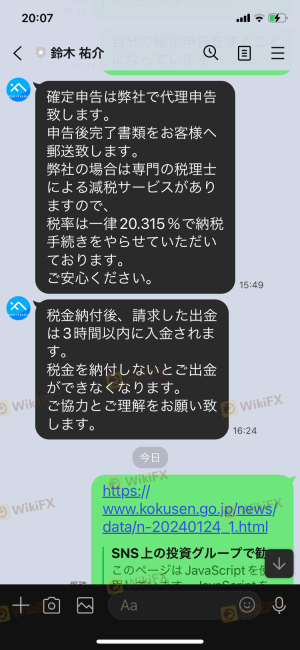

Customer feedback is a vital component in evaluating the overall experience with a broker. Unfortunately, reviews of Teyler are largely negative, with numerous users reporting issues related to fund withdrawals and customer support. Common complaints include difficulty in accessing funds, lack of timely responses from customer service, and the inability to recover deposited amounts.

Complaints Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Transparency Concerns | High | None |

A notable case involved a user who deposited a significant amount and later faced difficulties when attempting to withdraw their funds. The user reported being asked to pay additional fees before their withdrawal could be processed, a common tactic used by fraudulent brokers. Such experiences highlight the potential risks involved in trading with Teyler and indicate that the broker may not prioritize customer care.

Platform and Trade Execution

The trading platform offered by Teyler is another aspect that deserves attention. While the broker claims to provide a user-friendly interface with support for various devices, the overall performance and stability of the platform remain unclear. Reports of slippage and order rejections have surfaced, which can be detrimental to traders, particularly in fast-moving markets.

Moreover, any signs of platform manipulation or irregularities in trade execution should be scrutinized. If traders experience frequent slippage or are unable to execute trades at desired prices, it raises concerns about the broker's integrity. A reliable trading platform should ensure that orders are executed promptly and accurately, providing traders with a fair trading environment.

Risk Assessment

Using Teyler for trading presents several risks that potential clients should consider. The lack of regulation, unclear fee structures, and negative customer feedback collectively contribute to a high-risk profile for this broker.

Risk Rating Card

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Financial Transparency | High | Lack of clear information on fees and policies. |

| Customer Support | Medium | Poor response quality raises concerns about reliability. |

To mitigate these risks, traders should conduct thorough research before engaging with Teyler. It is advisable to start with a demo account or to trade with minimal amounts until more information about the broker's practices is confirmed. Additionally, utilizing brokers with established reputations and regulatory oversight can provide a safer trading experience.

Conclusion and Recommendations

In conclusion, the evidence suggests that Teyler exhibits several characteristics that warrant caution. The absence of regulatory oversight, coupled with negative customer feedback and a lack of transparency, raises significant concerns about the broker's legitimacy. Therefore, it is reasonable to conclude that Teyler may not be a safe option for traders, particularly those who are inexperienced or looking to invest significant amounts of capital.

For traders seeking reliable alternatives, it is recommended to consider brokers that are well-regulated and have a proven track record of customer satisfaction. Platforms such as IG, OANDA, or Forex.com are known for their regulatory compliance and commitment to client safety. Ultimately, traders should prioritize safety and transparency when choosing a broker, ensuring that they protect their investments in the ever-evolving forex market.

Is Teyler a scam, or is it legit?

The latest exposure and evaluation content of Teyler brokers.

Teyler Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Teyler latest industry rating score is 1.36, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.36 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.